Insights and Observations

Economic, Public Policy, and Fed Developments

- The most impactful development in a busy month of macro news came at the end when, after a strong CPI report roiled the markets, Fed Chairman Powell indicated in Congressional testimony that he no longer expected inflation to be transitory. Powell stated “…we’ve seen the factors that are causing higher inflation to be more persistent,” and that it would likely be appropriate to speed the pace of asset purchasing tapering. We agree, as “transitory” inflation was predicated on an end to the pandemic that has not yet occurred. However, we believe Powell’s remarks are likely being misread by a market that quickly began pricing in faster Fed Funds rate increases.

- First, Powell has pointedly refused to link the end of tapering with the start of interest rate increases. Second, while noting inflation had spread, he was careful to emphasize that “pandemic-related factors”, not an overheated economy, are behind more persistent price pressures and that raising rates will not defeat COVID-19. Both the Fed and market forecasters also agree that absent external shocks inflation should slow in coming months. The market may be basing rate expectations on today’s inflation levels rather than post-taper. While some FOMC members are open to 2022 rate hikes, we feel rate increases are not yet likely.

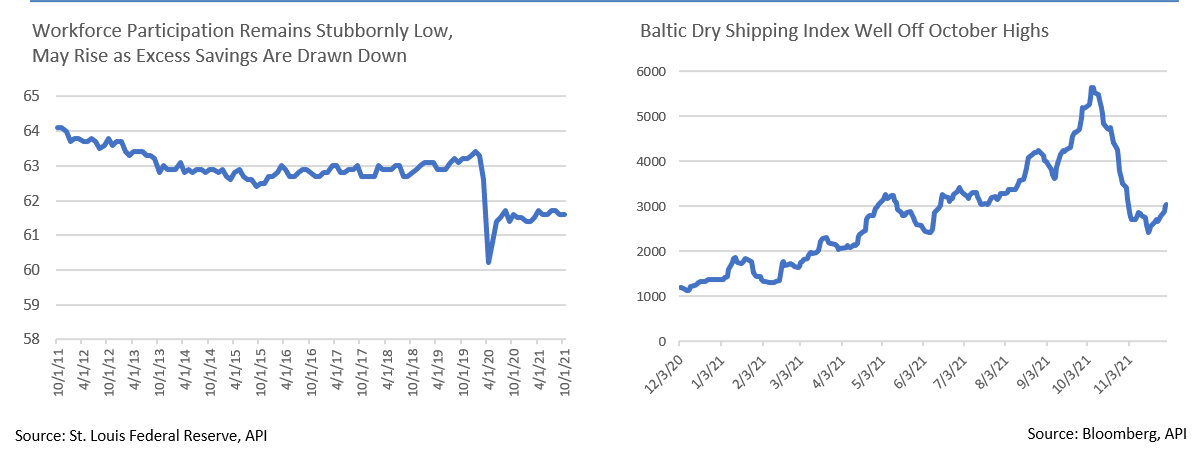

- Market-based metrics continue to support the argument that we are likely past “peak inflation,” and pandemic supply chain issues are easing. The Baltic Dry shipping index has fallen by nearly half since early October and appears to be stabilizing, easing one source of price pressure. Industrial production now exceeds pre-pandemic levels and, due to capacity utilization that still falls 3.2% below normal levels, there will be further production gains as bottlenecks ease. Retail sales remain strong in nominal terms but are close to flat in real terms. This is despite a holiday season pushed forward to allow for shipping delays, suggesting demand may not be able to drive inflation much further. And finally, in an unprecedented move, the Biden Administration approved the release of oil from the US Strategic Reserves in concert with China, Japan, India, South Korea and the U.K., a policy response that should ease energy prices.

- A new wrinkle for the global recovery lies in the Omicron variant, whose discovery roiled global markets on Black Friday. It is too early to say how severe this variant will be and what sort of impact it will have on public health and the markets, but the development is concerning and bears monitoring

- An unemployment claims report of 194k on November 20th was the lowest since 1969 and spooked markets already wary of tight labor conditions. The reality may be more complex; Moody’s and Bloomberg separately estimated pandemic-era excess savings of roughly $2.6 billion, assets primarily held by the least wealthy 80% of US households. Bloomberg concluded that these excess savings may allow many US workers to remain out of the workforce through year-end, but after that time more will be pulled back into the workforce. If so, labor participation should begin improving in coming months. Already, there are encouraging signs in the household survey, where the number of Americans reporting they were unable to work due to the pandemic fell substantially in October, from 5.0 to 3.8 million.

- We welcome Chairman Powell’s re-nomination and believe he will easily be reconfirmed. Beyond his excellent track record over the last four years, it was also a symbolic and intentional move to shore up the Fed’s independence by returning to the tradition of the President appointing a Fed Chairman of the opposing party that had long been the norm before the Trump Administration.

From the Trading Desk

Municipal Markets

- Demand continues to bolster the municipal market as we move towards the end of the year. The short end of the curve has been anchored for over a month, although intermediate maturities have recently demonstrated strength and incremental performance. The spread between AAA 2 and 10-year maturities narrowed in November to 79 bps but remains steeper than at the start of the year.

- Mutual fund flows have been consistently positive throughout the year, although there are signs that relentless demand is slowing. The highest weekly inflow in November was $2.6 billion, while the last week of the month totaled only $160 million. For the full year, inflows of almost $97 billion have helped keep yields at compressed levels. Looking into 2022, we expect retail demand to remain robust, a dynamic influenced by a sustained desire for tax-advantaged income and strong credit conditions.

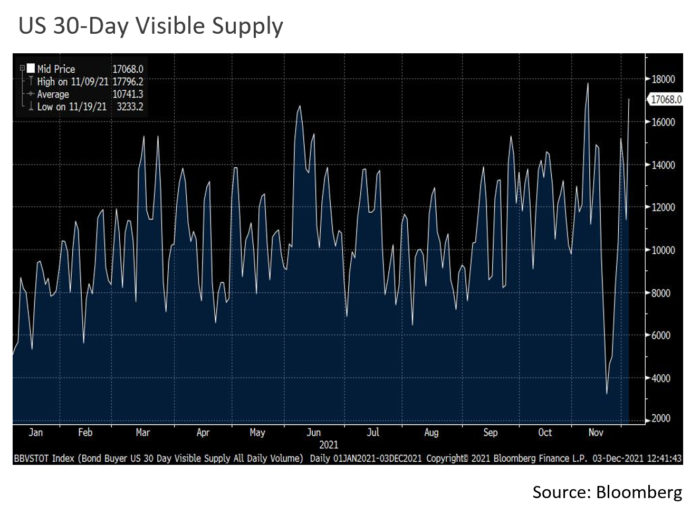

- The Thanksgiving lull helped produce a thin new issue market. Looking forward, 30-day visible supply of $17 billion is well above the YTD average of just under $11 billion and reflects issuers looking to get deals done before year-end. We welcome new supply as greater deal flow can be helpful in positioning portfolios ahead of the new year.

Corporate Bond Markets

- After yields fell at the start of November on Powell’s dovish press conference and a surprise decision not to hike by the Bank of England, the Treasury curve began to behave as if it wanted a reason to rise yet was not particularly concerned what that rationale might be. Yields first began to drift up after a surprisingly hot CPI report and continued after Powell was renominated, the latter based largely on concerns he would be less accommodative than Lael Brainard might have been.

- The tide quickly changed as Black Friday news of the newly discovered Omicron variant crushed Treasury bears. The 10Yr fell 13bps from its mid-month high, and the spread between 2s and 10s flattened 12bps. While it seems the default price action here would be a move to higher rates, we believe this flight to quality will hold at least until more is known about the latest variant, and the near-term probability leans towards lower, not higher, rates.

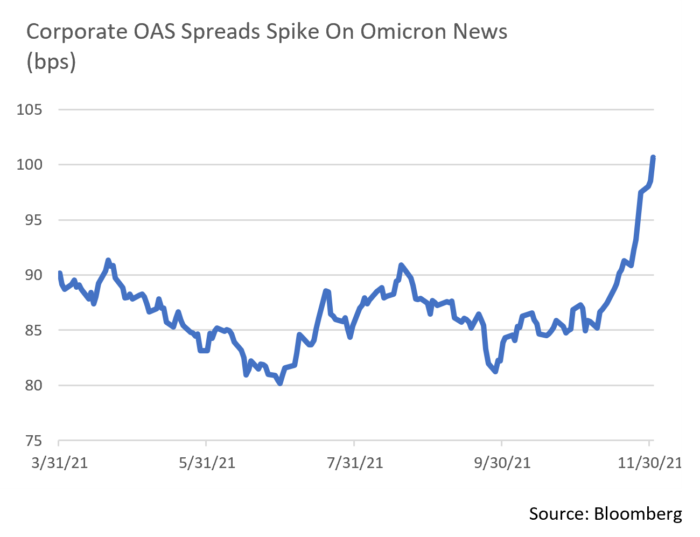

- The Omicron variant also broke spreads out of a tight ~10bps trading range. While a pre-Thanksgiving rush of issuance had softened the market and led to a modest backup in spreads, this was mostly evident in new issue concessions widening a little and deals modestly less oversubscribed than recent norms. On Black Friday, virus fears hit a thin half-day session and pushed spreads to their widest levels since early spring. The selloff continued into the start of December, with the Bloomberg Barclays US Corporate Index OAS rising to its highest level since this time last year. Despite currently high volatility, spreads remain reasonably tight and have remained remarkably resilient throughout 2021.

- With issuers able to borrow at historically low costs, 2021 is already the second largest year on record for IG corporate issuance, behind only 2020’s pandemic fueled borrowing spree. With a good number of companies deferring late November issuance until the markets settle, the all-time December record of $57 billion set in 2014 could be in play. Coming off a strong year, 2022 IG issuance forecasts have generally called for a slight pullback, but it is worth remembering that 2021 was not supposed to be a heavy year of issuance either following 2020. Current trends may still have room to run, and we are not concerned about the market’s ability to digest new supply.

Public Sector Watch

Credit Comments

Infrastructure Investment and Jobs Act

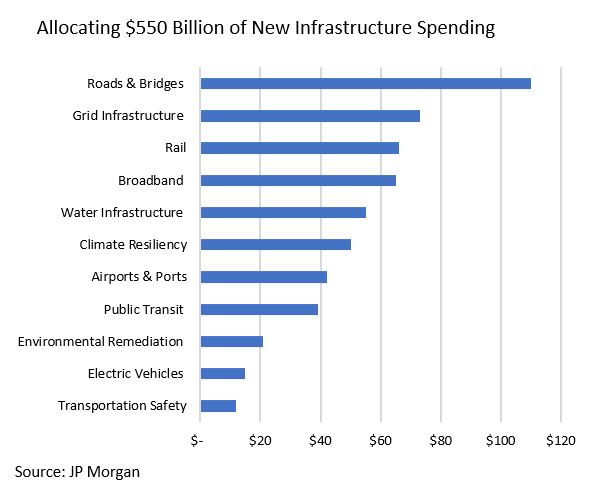

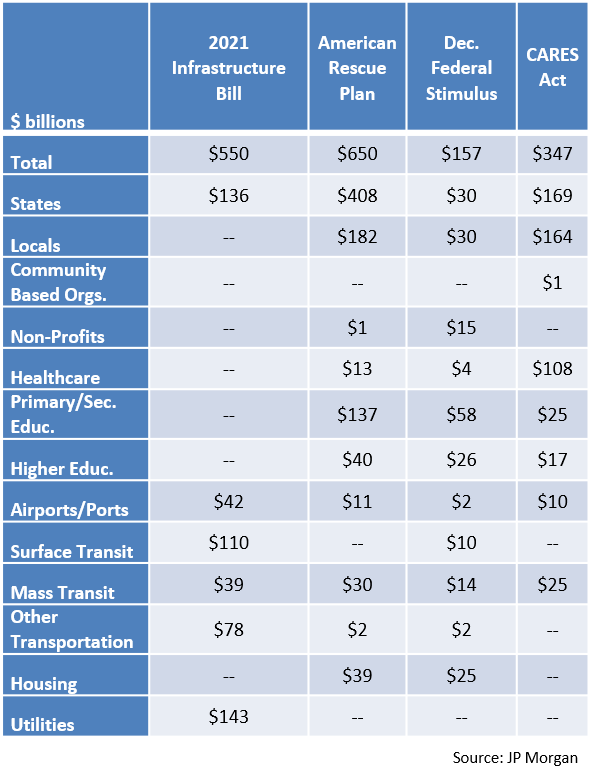

- On November 15th, President Biden signed into law a bipartisan infrastructure bill providing $1.2 trillion of spending over the next five years. The bill includes $550 billion of new investments, with funding to be distributed to state and local governments which will subsequently determine project plans. The remainder reflects prior federal commitments.

- As with other federal support over the past two years, The Infrastructure Investment and Jobs Act (IIJA) provides a sizeable boost to several sectors of the municipal market. However, an important distinction is that IIJA is neither a stimulus bill nor a response to economic crisis. IIJA addresses the longer-term need to rebuild aging infrastructure. According to the most recent report by the American Society of Civil Engineers, the US faces a $2.59 trillion shortfall in infrastructure needs.

- The bill is vast and touches nearly every sector of infrastructure including transportation, water, energy, broadband and more. Importantly, the funds will be distributed through 2026, providing multi-year support for municipalities relative to their capital planning and budgeting process.

- Federal funding is likely to encourage state and local governments to expand existing infrastructure plans, as issuers are being afforded valuable flexibility in the use of funds and will also now be able to more confidently draw upon debt financing to cover capital costs. Some issuers were waiting for details of the infrastructure package to be finalized, and with it now having been signed into law they should gain confidence initiating and financing long-term projects. Although we do not expect a wave of new issuance, we view the passage of IIJA as a positive for near-term municipal supply.

A Windfall of Federal Funding Bolsters Tax-Exempt Issuers

- As emphasized in past commentary, federal support for the municipal market has been remarkable, with $1.7 trillion allocated across four major programs in the last 20 months alone. From a credit perspective, this has provided a strong tailwind for tax-exempt issuers and the policy response has served to reinforce the essentiality of state and local governments across the country.

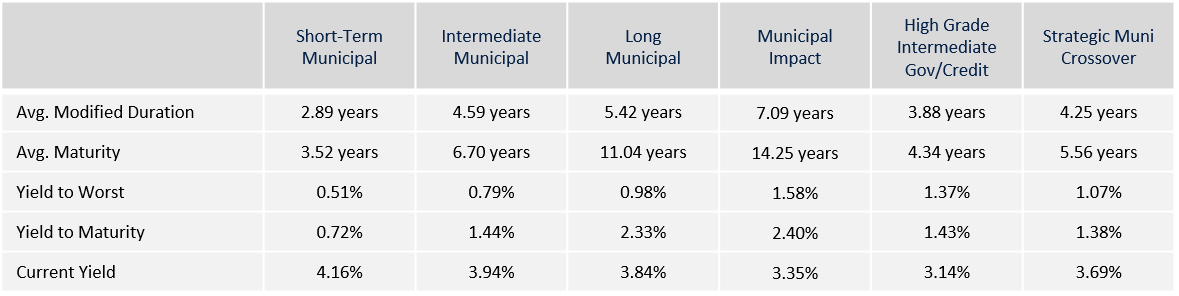

Strategy Overview

Composite Portfolio Positioning as of 11/30/21

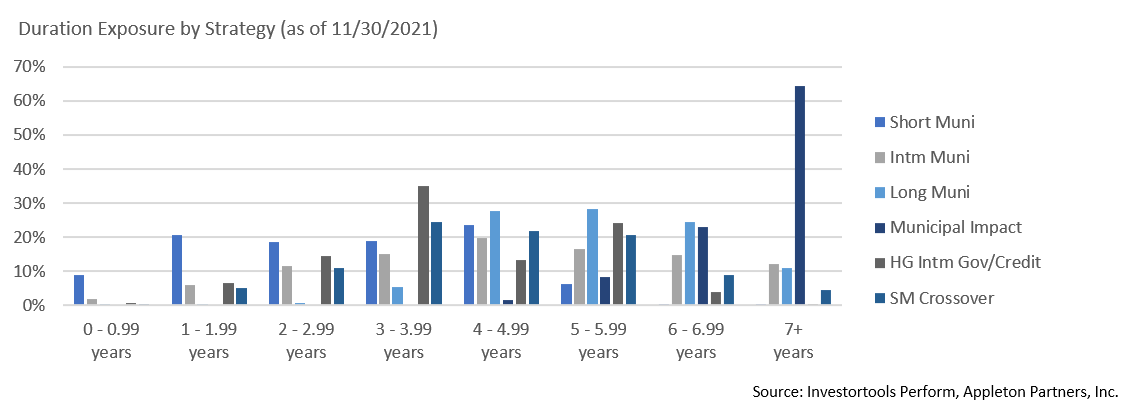

Duration Exposure by Strategy as of 11/30/21

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.