Insights and Observations

Economic, Public Policy, and Fed Developments

- Two November inflation reports shifted market expectations concerning Federal Reserve policy and the market is now pricing a “pivot.” We think this is wrong, for two reasons.

- First, an expected decrease in the pace of tightening to 50bps is not new; it has been telegraphed by the Fed for months and market expectations have not shifted materially from a deceleration to 50bps in December and 25bps by March. Recent Fed commentary (notably Chairman Powell’s Q&A after the last meeting) has shifted the focus from the pace of tightening, to how high they will ultimately hike and how long we should expect rates to stay there. In our view, Powell has implied that the market’s expectations on both fronts were too conservative.

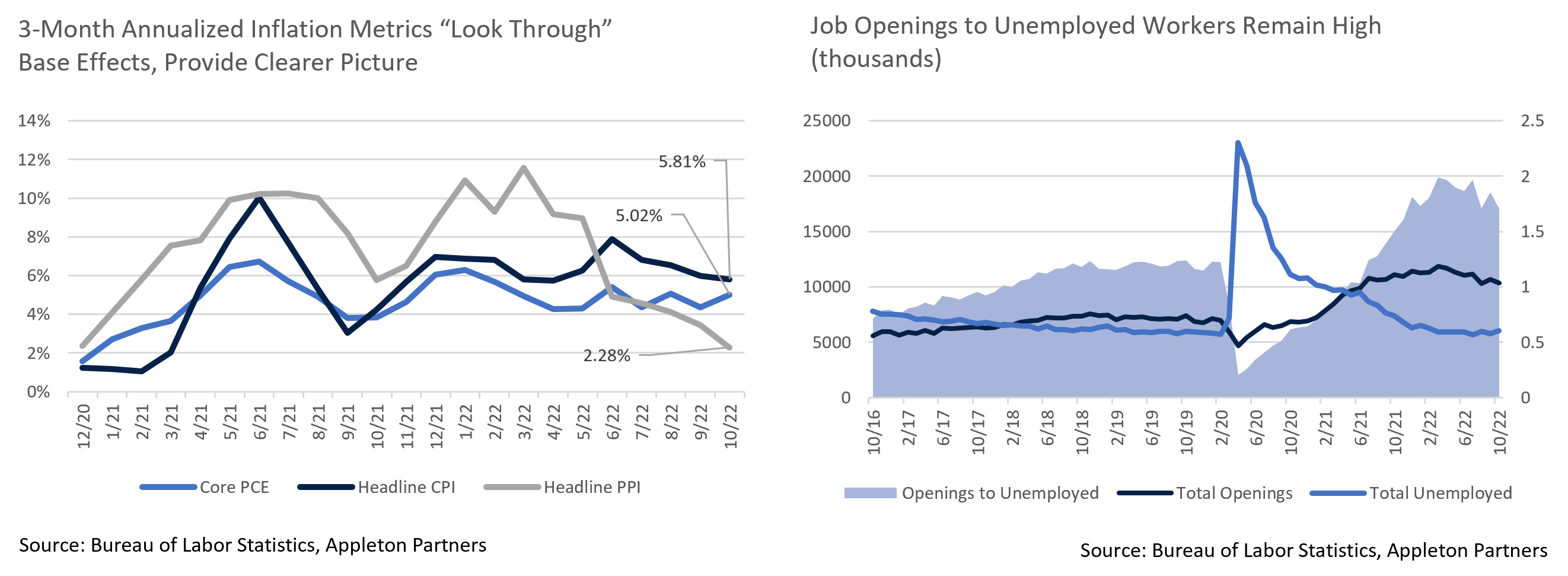

- Second, while pivot talk was fueled by CPI and PPI falling more than expected in October, annual improvements were driven by base effects. Although the monthly CPI change stayed the same at +0.4%, the annual rate of inflation dropped from +8.2% to +7.7% due to the anniversary of higher levels of inflation a year ago rolling off. The same applies to headline PPI which held steady at +0.2% month-over-month but dropped on an annual basis from +8.4% to +8.0%. Base effects were a big story last year when they were pushing inflation up, yet they are getting surprisingly little attention now. As before, we suggest looking at annualized 3-month rates to “look through” base effect noise, and this suggests consumer inflation remains fairly stable at +5-6%. By this measure, interest rates are not yet restrictive.

- The Fed is very likely to hike 50bps in December as they have made this policy course quite clear. However, when the Fed publishes their new “dot plot” in December, we expect it to show a terminal rate several hikes above the 4.75-5% range currently priced in, and for the first cut to not occur as early as fall 2023, as traders currently expect. This may lead to some repricing in the equity and bond markets, both of which have rallied on hopes for a slowing and then more rapid reversal of the Fed Funds rate path.

- Tightening does not yet appear to have discouraged the consumer as both retail sales and personal consumption expenditures have been much stronger than expected. On one hand, this is a positive for growth and increases the odds of a “soft landing,” but it complicates the Fed’s work as demand needs to weaken to adjust to supply shocks. Bloomberg estimates consumers still hold $1.2T in excess savings, and that it will take 12 months to spend down at current rates. Consumer spending will likely need to further soften before inflation can significantly fall, and this may take time.

- The labor market also remains robust. JOLTS data suggest job openings are starting to decline relative to job seekers, from nearly 2.0 openings per unemployed to 1.7 in October, though these are still very elevated rates. The November jobs report also came in unexpectedly strong at 263k vs. expectations of 200k, closely in line with the last three reports. With wages cheap relative to other production imports and many employers still short-staffed from the pandemic, hiring may continue for a time even as the economy slows. Labor market reports like these make it difficult for the Fed to conclude their policy tightening work is done.

- On the other hand, ISM manufacturing fell into contraction for the first time since May 2020, on the third straight deceleration in new orders. Inventories fell at their slowest rate since April 2020, which is concerning for retailers already worried about high inventories. We will be monitoring this economic indicator as the Fed balances data inputs in planning monetary policy.

From the Trading Desk

Municipal Markets

- After posting negative returns for most of 2022, November was a strong month for municipals as yields receded amid growing speculation that an earlier than once anticipated Fed pivot might be forthcoming. The Bloomberg Barclays Municipal Managed Money Intermediate Index rose 4.32%, narrowing YTD declines to -7.72%.

- AAA Municipal/UST ratios declined considerably in November as the tax-exempt market rallied, with 2 and 10-year ratios of 63% and 78% respectively falling from 72% and 85% recorded at the end of October.

- Although less compelling relative valuation may cause some municipal buyers to pull back a bit, we see technical factors remaining strong which should bolster near-term performance. Yield levels are still far more attractive than has been the case over the past few years, supply remains tight, and December 1st and January 1st interest payments are approaching.

- A more positive tax-exempt market backdrop should be supportive of a recovery in retail demand in the months ahead. Lipper Inc. reports YTD net mutual fund flows of -$112 billion and a 4-week average of -$2 billion. Despite these outflows, sentiment is improving, and this should continue given demand for tax-advantaged income coupled with more attractive yields.

- As year-end approaches, tax loss harvesting is an important consideration. Very modest supply is complicating matters with Bond Buyer reporting that November issuance fell short of $20 billion for the first time since 1999. As a result, secondary trading, which has been averaging about $12 billion per day, and daily bid wanted lists averaging $1.6 billion in November (+23% above the 2022 monthly average), are demanding our traders’ attention.

Corporate Bond Markets

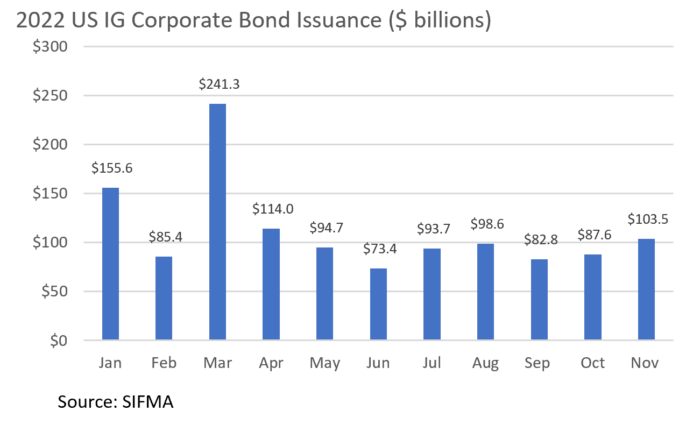

- November’s monthly Investment Grade Corporate supply was projected to be in a $75 billion range, but two solid weeks to close the month enabled the total to reach $101.9 billion. Despite beating expectations, 2022 issuance is now expected to only reach $1.250 trillion, which would be the lightest volume of new supply in three years. The persistence of spread/rate volatility, a rapid rise in US Treasury yields, and lack of risk-taking conviction have been the main inhibitors to new debt offerings. December is undoubtably going to be a very light month in the primary market and we expect similar primary market volumes to linger into 2023. New issue supply constraints are likely to have a positive effect on spreads for some time.

- Option adjusted spreads on the Bloomberg Barclays Corporate Bond Index moved steadily tighter on the month, driven in large part by a credit backdrop calmed by signs of reduced inflationary pressures. The Index OAS touched lows not seen since the beginning of June and hit 130 bps on 11/23/22. The Fed Chairman’s speech at the end of the month was perceived to be somewhat dovish by many and this coupled with strong payroll numbers drove spreads wider to 133 bps. Still, this proved to be the best performing month of the year for IG credit as returns on the above referenced index of +5.18% were the best since April 2020. Should inflationary pressures stabilize on a sustained basis and begin to wane, a Federal Reserve pause in early 2023 is likely, and we would expect that to help keep spreads reasonably tight over the balance of next year.

- Investment grade corporate bond funds continue to lose assets as -$6.9 billion of net outflows were recorded in November. This brings the YTD net fund outflow total to -$125.7 billion. Typically, IG credit markets gain a more solid foundation over the course of the month, but investors have not seen it that way this year. Fund outflows reflect market sentiment which has been shaky for some time, yet November’s more positive tone should help investors gain greater conviction.

Public Sector Watch

Credit Comments

Healthcare Sector Credit Caution is Warranted

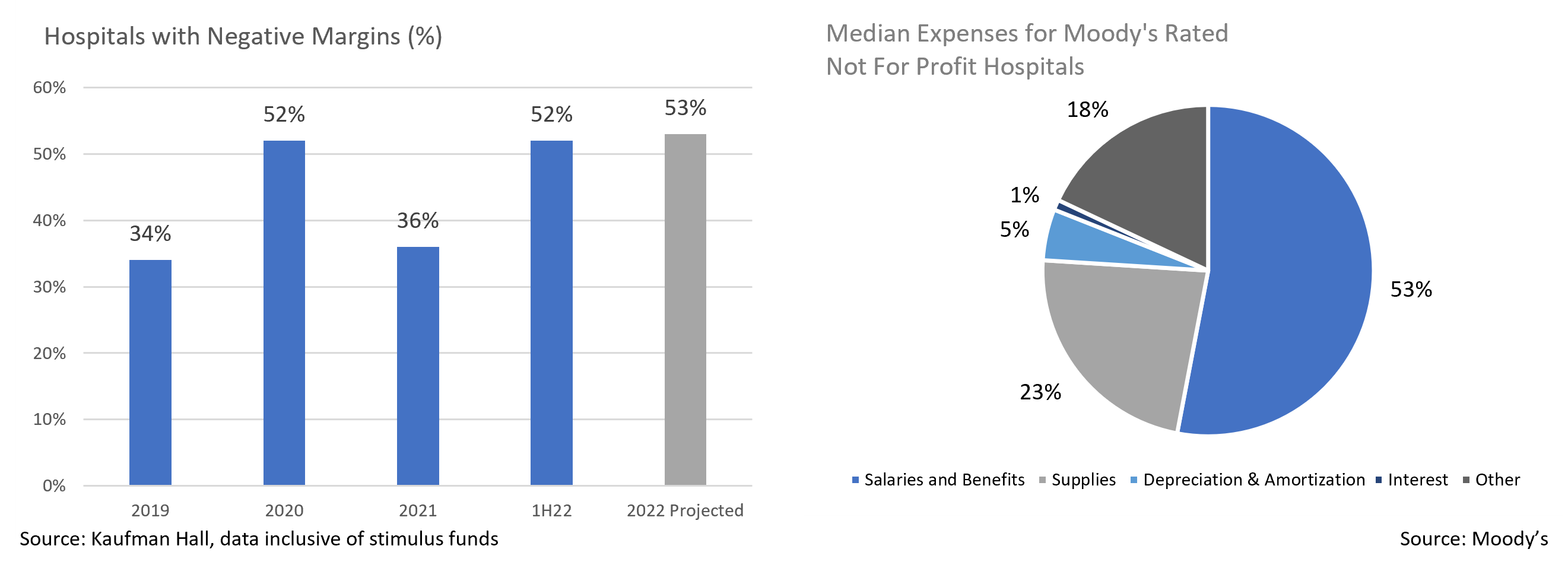

- The healthcare sector has faced challenges since the onset of the pandemic in 2020, including considerable pressure on staffing and supplies. Along with these persistent concerns, healthcare systems have been dealing with revenue declines and a lack of further stimulus funding, leading to another year of weak operating performance and compressed margins.

- Inflation has impacted nearly every corner of the economy and has been one of the main contributors to the difficulties health care systems face.

- Expenses are projected to increase by $135 billion over 2021 levels, $86 billion of which is derived from labor, while non-labor expenses are projected to increase by $49 billion, per Kaufman Hall.

- Labor costs pressures reflect both employed labor (+$57 billion YoY) and temporary, non-staff workers (+$29 billion YoY). In response, many hospitals are emphasizing tight contract worker expense control including the creation of internal agency pools that are on call to support core staff. Hospitals have also increased employee pay and benefits to maintain staffing levels and incentivize long-term labor force stability.

- Non-labor expense growth is primarily driven by supplies and purchased services which increased by $11 billion and $7 billion respectively. All expense categories are projected to end 2022 roughly 25% above pre-pandemic levels.

- Smaller hospitals have been more adversely impacted by expense pressures, a distinction that we consider when reviewing issuer credit. Many cannot keep up with the compensation and benefit packages offered by larger providers. Non-labor expenses also do not benefit nearly as much from economies of scale or the ability to move supplies among several hospitals operating within the same system.

- Inflation has also impacted hospital revenues with many yet to consistently meet pre-pandemic volumes. Hospitals face increased price sensitivity as patients defer high-priced elective medical procedures given cost of living expense constraints.

- Challenges that hospitals must address arising from the shift to ambulatory sites from inpatient admissions are also exacerbated by rising costs. While consumers have shown a preference for outpatient facilities in recent years, insurers have also been directing patients to these less expensive settings. Many larger systems have acquired and grown ambulatory and urgent care centers to partially offset revenues directed away from inpatient settings, allowing these bigger institutions to typically fare better than smaller competitors without such resources.

- Although hospitals have been coping with pressure since the beginning of the pandemic, 2022 has been a particularly challenging year with both revenues and expenses feeling inflationary impact and lingering Covid-19 effects. Most healthcare systems have already employed traditional cost cutting measures, which means management will need to get more creative with their financial management strategies going forward. Further compounding the problem is the absence of federal aid, which has cushioned healthcare systems over the past two years.

- Optimistic projections indicate profit margins will be down 37% vs. pre-pandemic levels, and 53% of hospitals will incur negative 2022 profit margins according to Kaufman Hall.

- Appleton’s credit research team is carefully monitoring how individual hospitals are responding to ongoing financial difficulties and we maintain a clear preference for larger hospital systems with the resources and management strength needed to weather the storm.

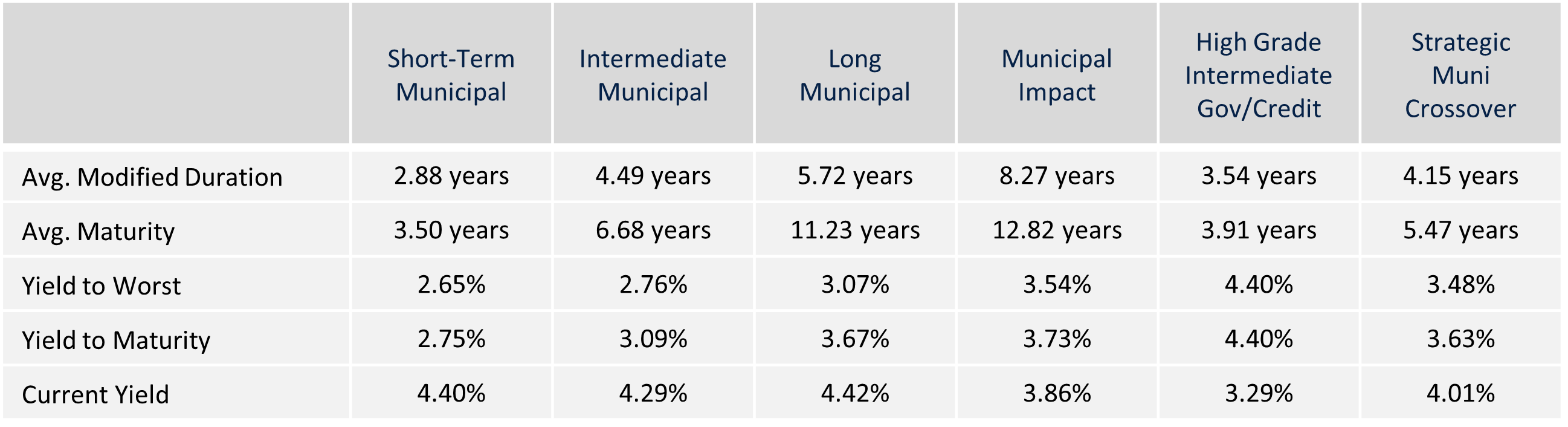

Strategy Overview

Composite Portfolio Positioning as of 11/30/2022

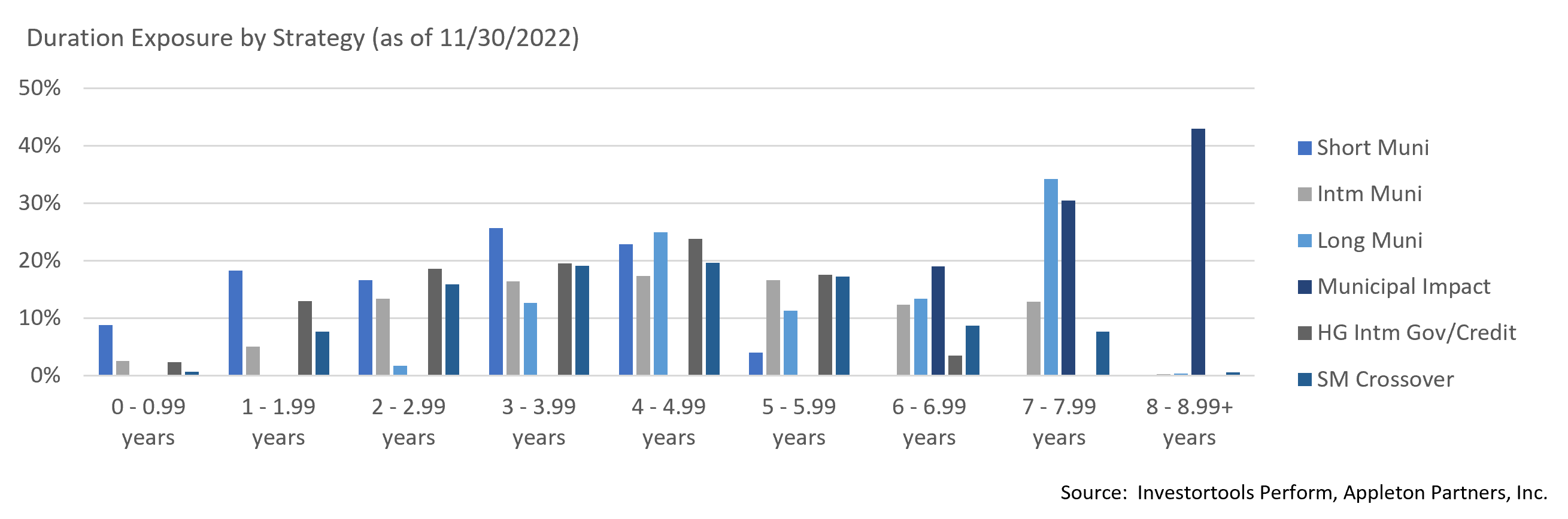

Duration Exposure as of 11/30/2022

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.