Insights & Observations

Economic, Public Policy, and Fed Developments

- Even without an election, today’s macro environment would be interesting. Markets are focused on labor weakness and have broadly moved on from inflation concerns. What makes this fascinating , however, is that we think markets have it backward.

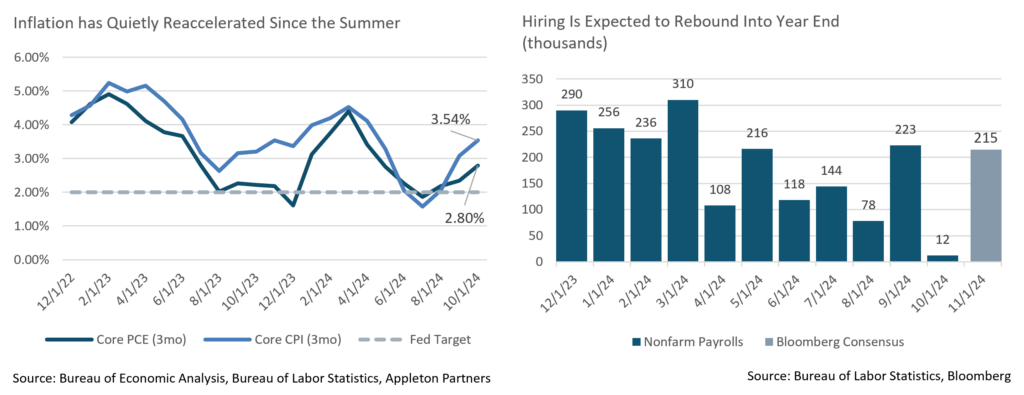

- Inflation has accelerated since the summer. October’s CPI was in line with consensus, but this was the third straight +0.3% Core CPI monthly print, and markets expect a fourth in December. On a three-month annualized basis, this equates to +3.5% Core inflation, too high for the Fed’s comfort. Core PCE bottomed out over the summer and has been running at +0.3% as well, with the three-month annualized rate a better, but still too high, +2.8%.

- Meanwhile, October’s abysmal jobs report, with only 12k new jobs, was impacted by two hurricanes, a major strike, and a lot of election-related deferred hiring. We expect a rebound in hiring in the coming months. Economists do, too, with the Bloomberg consensus for the report due out on the 6th calling for a robust 215k new jobs. Nonetheless, the market remains convinced hiring is worrisomely tepid.

- If we even get consensus employment and inflation reports in December, the case for the Fed to cut short term rates is less compelling, and we think a skip in December is more likely than the 75% probability implied by the futures markets. We’re also looking for a sizable upward revision in the 2026-27, and possibly long run, neutral rates in the December “dot plot,” with a median in the 3.5-4% range plausible; futures market pricing suggests the market wouldn’t be unduly startled by this large a move (the September dot plot had a 2.9% long run neutral).

- Turning to the election, former President Trump will return to Washington in January with narrow House and Senate majorities. As in 2016, there is considerable uncertainty as to which of his campaign talking points will become policy; however, here are some broad observations. With Congress reportedly already working on a budget including a ten-year extension of the Tax Cuts and Jobs Act, this will be an early legislative priority. Passage via reconciliation will be necessary given narrow majorities; and, thus, cuts will mostly be “funded” and will not substantially increase the deficit. Tax cuts should boost growth, although another four years of inaction on persistent deficits was a concern before the election, and this budget will likely do nothing to address this issue.

- Tariffs were another focal point of Trump’s campaign. The consensus is that they are a negotiating tool, which is probably true in the case of China. Nonetheless, Trump has argued his 10-20% tariff proposals on all imports are both good for growth (most economists disagree) and necessary to pay for tax cuts (probably true, as they will have to pass via reconciliation), so action here is very likely.

- Immigration policy is also an under-appreciated risk, as the roughly 3 million migrant workers who came to America in the last few years contributed to unexpectedly robust growth during a period of falling inflation and labor market normalization. While mass deportations would be difficult and expensive, though not impossible, a reduction in new immigration would tighten labor markets, and at the margin, both this and tariffs are likely to be inflationary.

- On the whole, we expect higher growth but also the potential for higher inflation. With this in mind, we are widening our fair value range for the 10Yr UST, raising the top end 25bps to 4.75% while leaving the bottom unchanged at 4.00%.

From the Trading Desk

Municipal Markets

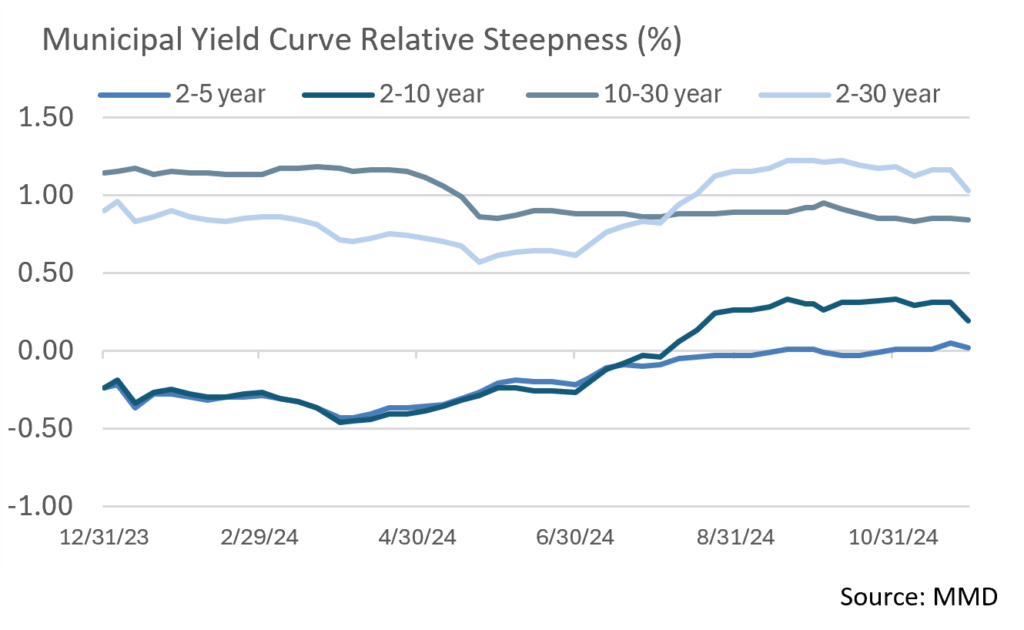

- The AAA municipal yield curve moved in a bull flattener last month, meaning that yields on the longer end of the curve pushed lower by more than shorter maturities. This type of market action favors longer exposure relative to shorter positioning and hinders the curve normalization that had begun following a historic inversion.

- According to MMD, the spread between 2s and 10s began November at 33bps before closing at 19bps. The front end of the municipal yield curve continues to mimic Treasuries and remains inverted, with 1 and 2-year AAAs still outyielding intermediate issues out to nine years on the municipal curve.

- Variable Rate Demand Notes (VRDNs) yields remain volatile and are subject to technical factors associated with new issuance volume and the level of demand for longer fixed coupon securities. Volatility is expected to continue into the New Year, with yields trending lower as buyers look to be fully invested in the face of limited new supply.

- The 10Yr Muni/UST ratio moved lower over November, beginning the month at almost 69% before finishing at 66.7% by month’s end. We expect ratios to stay in this range or slightly lower due to limited December municipal supply and high levels of demand.

- December issuance is expected to be modest even though YTD levels are running 35% above 2023. Bond Buyer’s 30-day visible supply expectation is now just over $14 billion, with the majority scheduled to come to market this week. The FOMC release on December 18th and the following holiday week will put a damper on new offerings. Accordingly, we are looking closely at this week’s deals and actively looking for value in the secondary market.

Corporate Markets

- The US Investment Grade Corporate Bond primary market remained robust in November, with $96.7 billion issued, beating consensus estimates of $70 billion. This was the 9th month this year where actual issuance has exceeded consensus by $25 billion or more, and full-year volume is 27% higher than last year.

- December, generally a quiet month, is expected to produce about $40 billion of new debt, most of which will come to market during the first two weeks. Financials are leading the way with $90 billion issued so far during Q4, new supply that compares to only $45 billion over the same period last year. As the year draws towards a close, conditions remain favorable for issuers with UST yields falling, tight credit spreads, and high investor demand.

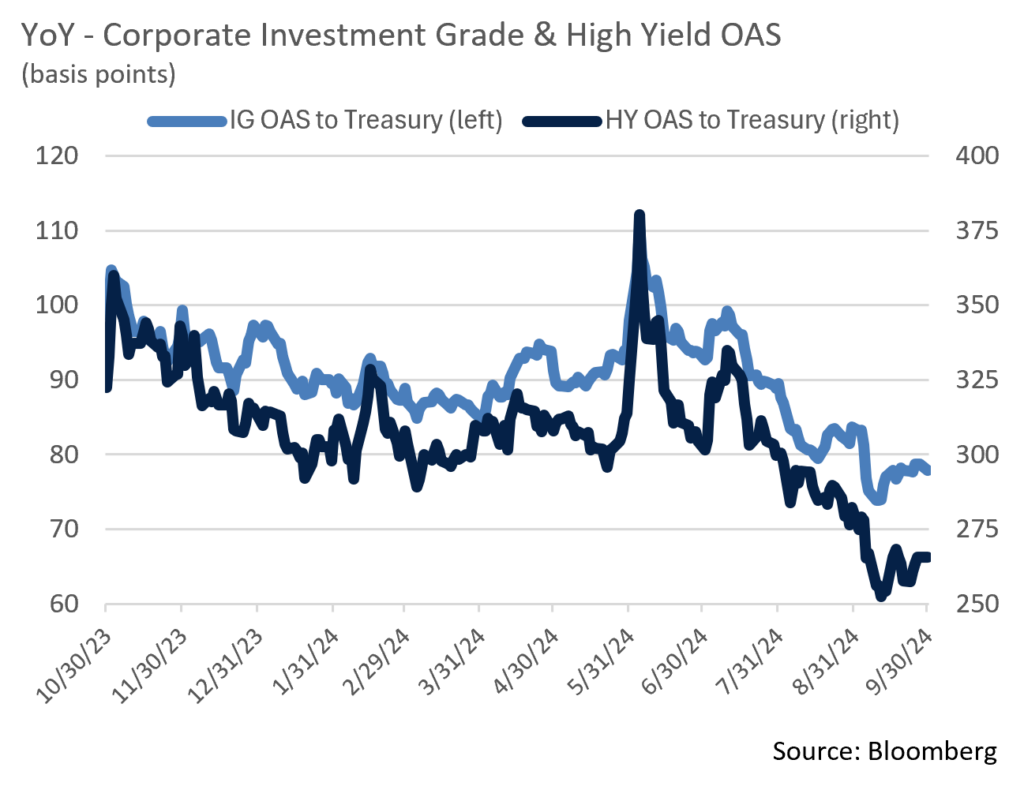

- Strong credit appetite is reflected in OAS on the Bloomberg US Corporate Index averaging only 90bps this year, with a low of 74bps set on November 11th and a high on August 5th of 111bps. Aside from the very short-lived high in August, credit spreads had fluctuated within a relatively tight 20bps range until a downward move began in mid-September that culminated in the 74bps low a week after the Presidential election. We do not anticipate spreads moving meaningfully in either direction over the remaining days of 2024 and expect investor demand for high quality bonds and overall sentiment to remain strong into the New Year.

- November’s +1.34% total return on the Bloomberg US Corporate Investment Grade Index marked the 7th month of positive returns in 2024. Falling UST yields accounted for most of that figure, although tighter credit spreads have produced positive excess returns over USTs (+0.49% in November and +2.52% YTD).

- With credit risk being rewarded, lower quality bonds fared best on the month, as did the Utility and Industrial sectors. US Corporate High Yield also continues to perform well as yield-hungry investors flock to that market. With spreads at near all-time lows, our focus remains on higher quality issues as we feel the risk-reward dynamic is more favorable than going down in credit.

Public Sector Watch

NY Governor Hochul Pursues Congestion Pricing to Fund MTA Capital Plan

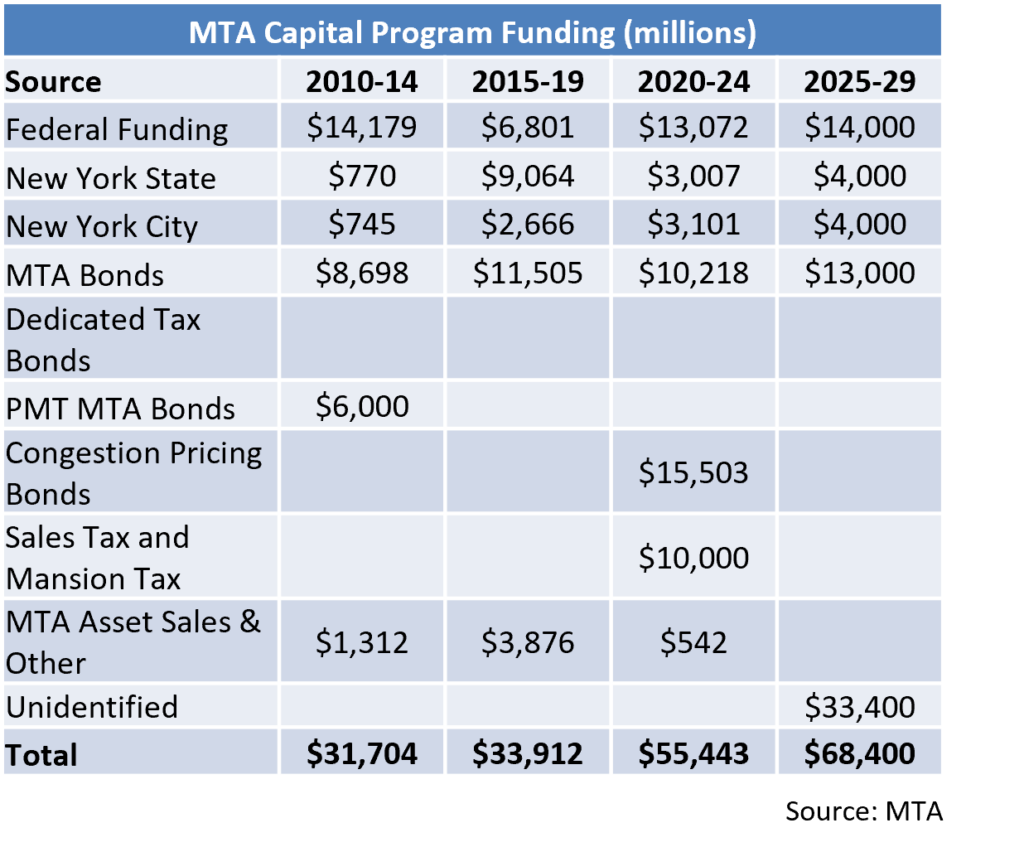

- Shortly after the election, Governor Kathy Hochul announced a plan to revive congestion pricing in Manhattan’s Central Business District. The plan aims to implement a $9 toll ($2.25 during overnight periods) starting in January 2025 and running through 2027, before increasing it to $12 in 2028 and $15 in 2031.

- The $9 toll on passenger cars is the lowest charge the MTA could assess without initiating another environmental review as tolls must raise $1 billion annually per the environmental study. Trucks are tolled at a higher rate and there is no pricing reduction for low-income individuals.

- The approval process typically takes 60 days and must receive an okay from The MTA Board, the Federal Highway Administration, and the NY State Department of Transportation. The first step was recently completed with the MTA board voting to pass the congestion pricing plan in mid-November. The board will now initiate a public education period in which the MTA will message the upcoming unpausing of congestion pricing while working to gain approval at the State and Federal levels.

- The timing of this 60-day process is crucial as Donald Trump has been very vocal about opposing congestion pricing, vowing to quickly remove it upon entering office. However, experts say if the Federal Highway Administration and NY DOT approve it, Trump would have a hard time repealing the tolls, which explains the Hochul Administration’s urgency. The Governor also faces opposition from neighboring NJ Governor Phil Murphy, among others.

- The MTA plans to fund $15 billion of capital projects from congestion pricing to bring the system back into a state of “good repair”. Although capital projects were halted in June, MTA CEO Janno Lieber has emphasized that after the Board’s November vote they were immediately resumed.

- Credit impact on MTA fare revenue-based debt is limited as the system’s five-year capital plan did not remove congestion pricing revenues from their most recent capital plan. Although the capital improvement projects tied to congestion pricing revenue were uncommitted during the pause, they will seamlessly reimplement new projects into their budget if congestion pricing is approved at the state and federal level. We continue to assign MTA’s Transportation Revenue Bonds an A-/stable credit rating and outlook.

An Update on Chicago’s Credit Outlook:

- After years of stable operations supported by record federal support, budgetary stress and political brinkmanship have returned to the City of Chicago.

- In an effort to balance a $980 million+ deficit in FY25, Mayor Johnson went against his campaign promise and proposed a $300 million property tax increase, which was quickly unanimously rejected by the City Council.

- In the absence of a property tax increase, several other proposed one-time revenue sources would help balance the FY25 budget, although structural balance likely will not be achieved.

- Looking ahead, the City is projecting deficits of $1.1 billion and $1.3 billion in FY26 and FY27 respectively, further demonstrating the need for significant recurring future revenues as further expenditure cuts are unlikely to come about.

- Chicago also remains pressured by a very large and growing pension burden, with recent sizable contributions falling below the actuarially determined requirements.

- These ongoing budget challenges are largely driven by an inability or unwillingness to achieve new ongoing revenue sources and/or cost controls that would structurally balance operations. We anticipate that the City’s credit profile will remain strained for some time, with future downgrades a very real possibility. As a result, the City of Chicago continues to be “not approved” at Appleton.

Composite Portfolio Positioning (As of 11/30/24)

Strategy Overview

Duration Exposure (as of 11/30/24)

The composites used to calculate strategy characteristics (“Characteristic Composites”) are subsets of the account groups used to calculate strategy performance (“Performance Composites”). Characteristic Composites excludes any account in the Performance Composite where cash exceeds 10% of the portfolio. Therefore, Characteristic Composites can be a smaller subset of accounts than Performance Composites. Inclusion of the additional accounts in the Characteristic Composites would likely alter the characteristics displayed above by the excess cash. Please contact us if you would like to see characteristics of Appleton’s Performance Composites.

Yield is a moment-in-time statistical metric for fixed income securities that helps investors determine the value of a security, portfolio or composite. YTW and YTM assume that the investor holds the bond to its call date or maturity. YTW and YTM are two of many factors that ultimately determine the rate of return of a bond or portfolio. Other factors include re-investment rate, whether the bond is held to maturity and whether the entity actually makes the coupon payments. Current Yield strictly measures a bond or portfolio’s cash flows and has no bearing on performance. For calculation purposes, Appleton uses an assumed cash yield which is updated on the last day of each quarter to match that of the Schwab Municipal Money Fund.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Not all products listed are available on every platform and certain strategies may not be available to all investors. Financial professionals should contact their home offices. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments and insurance products are not FDIC or any other government agency insured, are not bank guaranteed, and may lose value.