Insights and Observations

Economic, Public Policy, and Fed Developments

- After 35 days, the longest government shutdown in US history ended on January 25th. Facing attrition within his own party, and after an air traffic controller shortage briefly led to a ground halt at LaGuardia Airport, the President signed a 3-week continuing resolution. This resolution did not include wall funding, but appropriated $5.7 billion for border security measures, including modernizing ports of entry and additional immigration justices. Trump left the door open to shutting the government down again or declaring a national emergency on February 15th when the continuing resolution expires, but he will be working from a considerably reduced bargaining position. Polls revealed he was losing in the court of public opinion, leaving Congressional Republicans with little appetite for a second shutdown. The CBO estimates the protracted battle has already reduced Q1 ‘19 growth by 0.4% due to lost wages and delays in government activity.

- Fed Chairman Jerome Powell’s gradual effort to walk back market-rattling comments from the December FOMC meeting culminated in the January 30th meeting. Noting that “we don’t have a strong prior – we’re not making a judgement,” Powell stressed the importance of inflation to the Fed’s decision making, reiterated that their inflation target is symmetrical, and notably made no mention of the dot plot or prospects for two hikes in 2019. This was broadly interpreted as a commitment to pause interest rate hikes. We would argue this isn’t entirely accurate; instead, Powell has abandoned a preset rate path and committed to be data-dependent. We view this as positive and do not feel that the current inflation picture dictates further rate hikes. Should that change, investors ought not rule out Fed activity later in the year.

- Trade negotiations continue, with Chinese negotiators reportedly offering to increase purchases from the US to close the trade deficit by 2024; US negotiators are allegedly holding out for 2021. This may be difficult in practice, as the primary driver of the trade deficit is US demand for Chinese goods and increased Chinese purchases from the US would require corresponding cuts from other countries. Complicating the picture, the US filed charges against Huawei, a large Chinese telecommunications equipment and consumer electronics manufacturer, on January 28th, alleging theft of trade secrets and violation of Iranian sanctions. Trade negotiations are delicate and progress on intellectual property law has been difficult. Nonetheless, we believe the market would embrace even a somewhat superficial deal, as it would reduce the risk of tariff escalation and provide forward business clarity. The trade war appears to be weighing on corporate earnings – Apple, Caterpillar, and Nvidia all cut guidance in January citing Chinese weakness.

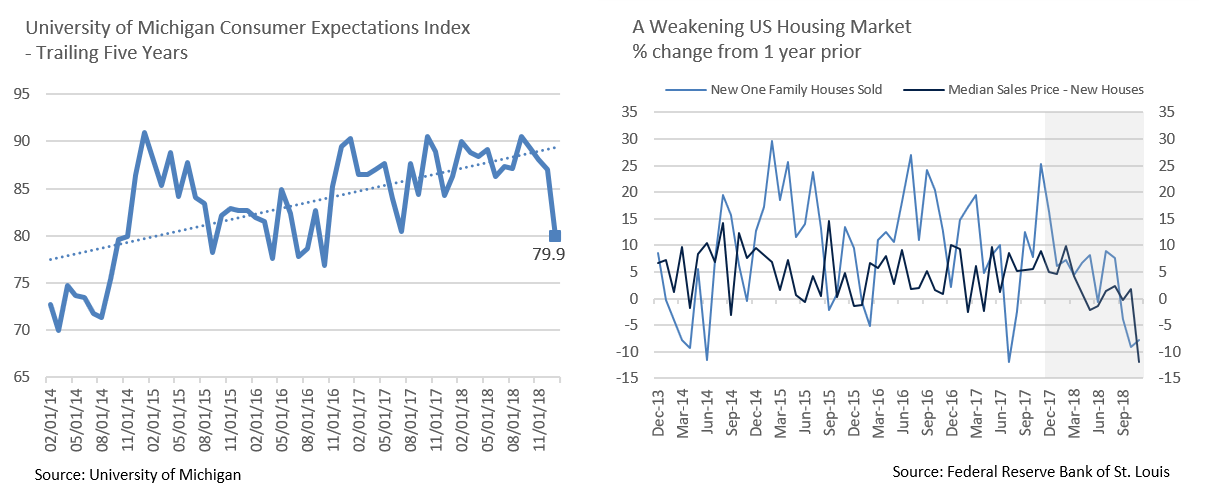

- While most economic indicators remain robust, a few suggested economic softening in January. The housing market may be showing signs of topping; new single-family sales crested in May, and median selling prices have begun to fall. Finally, the University of Michigan Consumer Expectations index dropped to the lowest level since October 2016. The timing of the release suggests the government shutdown may have impacted the reading, and December’s equity market sell-off also likely weighed on the indicator. We anticipate a rebound in February consumer confidence, assuming a second shutdown does not occur.

From the Trading Desk

Municipal Markets

- Market technicals remain favorable, with January’s issuance of $22.34 billion lower than expected, and up only slightly from a weak first month of the prior year according to Thomson Reuters. New money volume of $16.05 billion fell 6.8% vs. the same period of 2018. Issuance should pick up as the year progresses, with analysts looking for roughly 10% growth relative to 2018’s level of $338.9 billion. Demand has been supported by a bounce back in mutual fund flows which turned positive over the last two weeks of 2018 and remained strong in January with $3.99 billion of net inflows.

- Our tax-exempt portfolios have had a longstanding preference for premium bonds, an element of our investment process that reflects several objectives. Premium bonds have a lower sensitivity to changes in interest rates than par or discounted bonds due to their higher current income, which moderates a bond’s duration. Cash flow from premium bonds creates an enhanced ability to reinvest at higher rates should interest rates rise. Premium callable bonds also offer greater protection against extension risk, as higher coupons generate a cushion to absorb yield increases before a bond trades to maturity, which can add unwanted duration. Sheltering clients from the “market discount”, or De Minimus Tax, is another reason we prefer bonds trading above par.

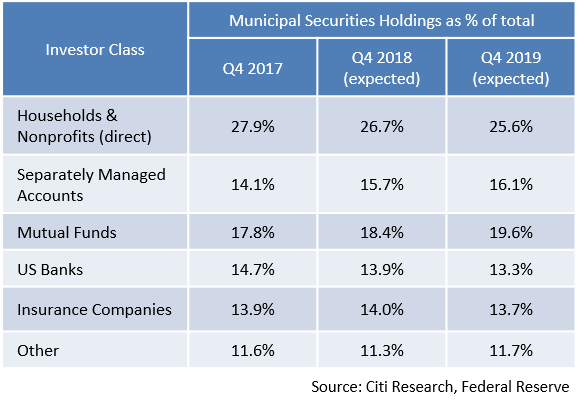

- Although the Federal Reserve estimates that the $3.77 trillion municipal securities market will end 2018 having declined by 1% relative to 2017 and should remain flat in 2019 ($3.75 trillion projected), the market’s ownership structure is evolving. Banks and P&C insurance companies are reducing their municipal holdings due to 2017’s corporate tax reduction, although demand is growing through separately managed accounts and mutual funds.

Taxable Markets

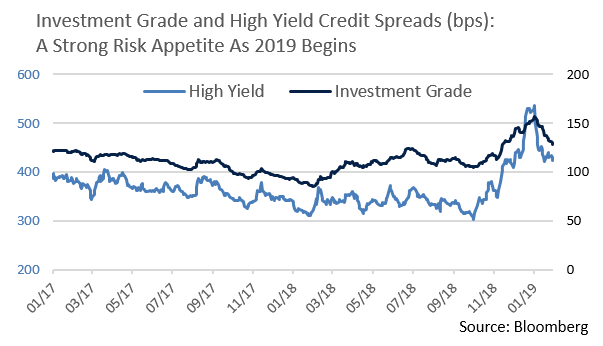

- Q4’s negative corporate credit sentiment turned sharply positive in January with the Investment Grade and High Yield markets enjoying one of their best months in several years as spreads tightened by 35 and 103 basis points, respectively. Economic slowdown fears abated, fostering strong market demand. Corporate bond issuance of $125 billion was up 45% in 2018 from the prior year’s $86 billion as issuers took advantage of generally favorable market conditions.

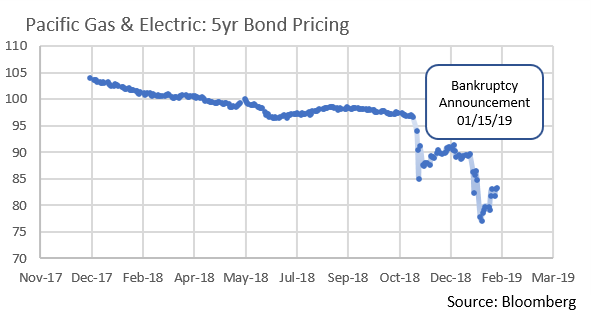

- The biggest corporate news was Public Gas & Electric (PG&E), the nation’s largest utility, filing for Chapter 11 bankruptcy on January 29th, a fallout from California’s catastrophic wildfires. With more than $50 billion in liabilities and facing onerous legal claims, PG&E’s fate will impact many stakeholders, including equity and bond owners, and municipal entities with electric grid and other service relationships with PG&E. PG&E has $22 billion in outstanding debt, including $920 million of municipal obligations. PG&E bond prices have been volatile and should remain so until the extent of the utility’s liabilities, and the path this complex bankruptcy takes, becomes clearer. Appleton Partners does not own PG&E debt in any client accounts. PG&E’s travails have largely been viewed as idiosyncratic and have yet to impact corporate risk appetite.

Public Sector Watch

Credit Comments

- Broadly speaking, municipal credit quality remains strong, although slowing growth is creating modest headwinds. Combined state and local tax revenue grew 4.6% in Q3, a solid pace that we expect to decelerate when Q4 figures are published and as we move forward in Q1 ’19. Trade uncertainty, a sluggish housing market, and weakness in oil prices (which more recently appear to be stabilizing close to many energy intensive states’ budget assumptions) have held back revenue growth.

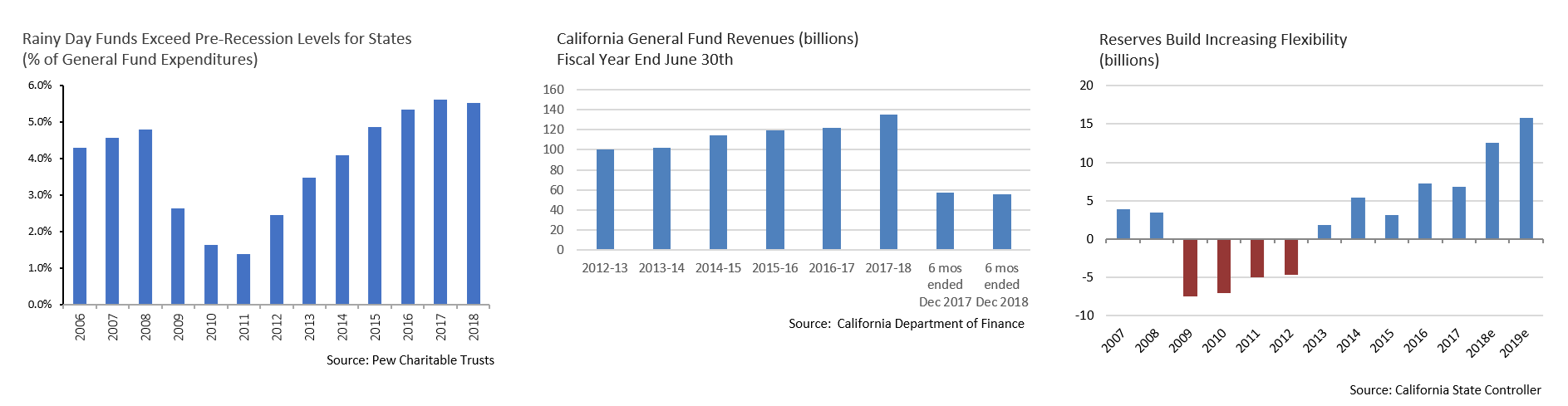

- Nonetheless, state balance sheets have strengthened in recent years. Median rainy day funds are expected to reach 6.2% of expenditures in 2019, up considerably from 1.9% in 2011. Across the tax-exempt spectrum our security selection remains focused on larger, well-established issuers characterized by broad and diverse economies or services, access to diverse revenue sources, and prudent long-term liability management.

- The onset of a new administration in the credit-challenged State of Illinois has created some fiscal optimism as it could help break long-running, fiscally damaging political stalemate. However, we remain on the sidelines and do not own Illinois GOs. J.B. Pritzker (D) was elected governor and now enjoys a Democratic super-majority in the legislature. A proposed move from a flat 4.95% income tax rate to a progressive structure may generate greater tax revenue, but cannot be implemented until 2020/2021 due to amendment provisions. A constitutional amendment that would loosen pension protection rules has also been floated, although we are skeptical of its prospects given the strength of the state’s unions and political dynamics. While we hope to see political will facilitate sustained fiscal progress, we are not purchasing State of Illinois debt obligations at this time.

- We discussed California’s pending leadership transition in June 2018 (“California: Credit Reflections as a New Era Approaches”) and it is now upon us with Governor Newsom releasing his first budget proposal. The $209 billion spending plan reflects fiscal restraint with 3% projected revenue growth down from close to 4% in 2018, but also includes an expansion of funding into several “one time” programs that could introduce recurring obligations. This bears close attention. We applaud Governor Brown’s prior intention to direct an additional $3.5 billion into the State’s reserve fund on top of the required $1.5 billion, and the fund should meet or exceed its 10% of revenue goal by FY 2019. State reserves are still growing, positioning California well for the next downturn. While healthy, FY ‘18-19 YTD revenues of $55.6 billion were 4.4% lower than budgeted projections, as personal, sales and corporate taxes all lagged expectations given a sharp decline in December. In all likelihood, this reflected lagging taxpayer filings that should more or less catch up in January.

Strategy Overview

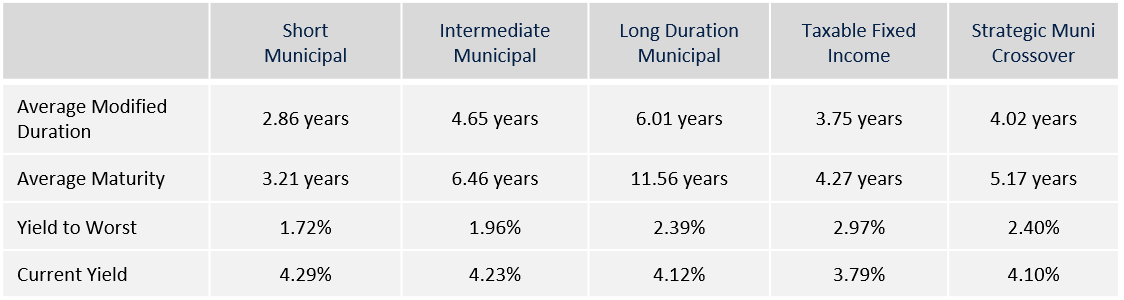

Portfolio Positioning as of 1/31/2019

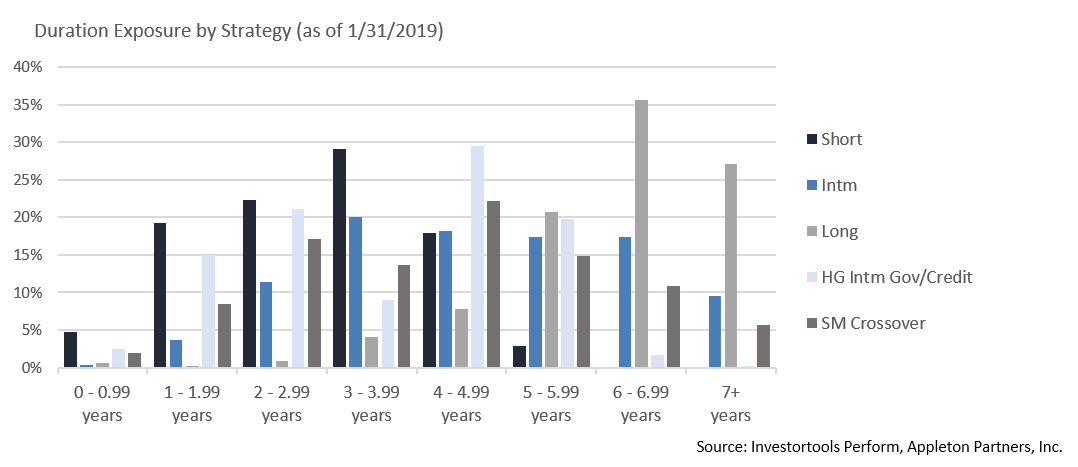

Duration Exposure by Strategy as of 1/31/2019

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.