Insights and Observations

Economic, Public Policy, and Fed Developments

- After President Trump killed an 11th hour short term spending bill passed with bi-partisan support by the Senate based on its failure to increase funding for his border wall, the Federal Government shut down at midnight on December 20th. While initially saying he would be proud to shut down the government over border security, Trump quickly pivoted and blamed Democrats. With Congress unable to pass a bill with Trump’s desired $5.6B for a border wall, and with the President currently refusing to back down, some creativity may be required to pass a spending bill. A potential deal where the Democrats agree to increased border security resources, including creative border barrier funding language, in return for clarity on the legal status of DACA has been hinted at by various parties. Resolution is important to settling highly volatile markets, as the current impasse will shave 0.1% off of GDP every two weeks according to the Council of Economic Advisors, while also dampening appetite for risk assets.

- November’s employment report came in light at 155k vs expectations of 198k, with unemployment unchanged at 3.7%. Average hourly earnings also missed slightly at 0.22% vs. 0.30%. Digging more deeply, with the workweek decreasing by a tenth of a percent, average weekly earnings were up only 0.07%. The Real Earnings Summary report painted a similar picture, with real average hourly earnings up 0.3%, but real average weekly earnings declining 0.1% due to a 0.3% drop in the workweek. While this was a weak report, it was not so weak as to cause fundamental concern that the economy was teetering on recession, and the market took it in stride. We feel similarly and are more concerned about interest rate policy, trade, and other aspects of DC politics than the current state of the US economy.

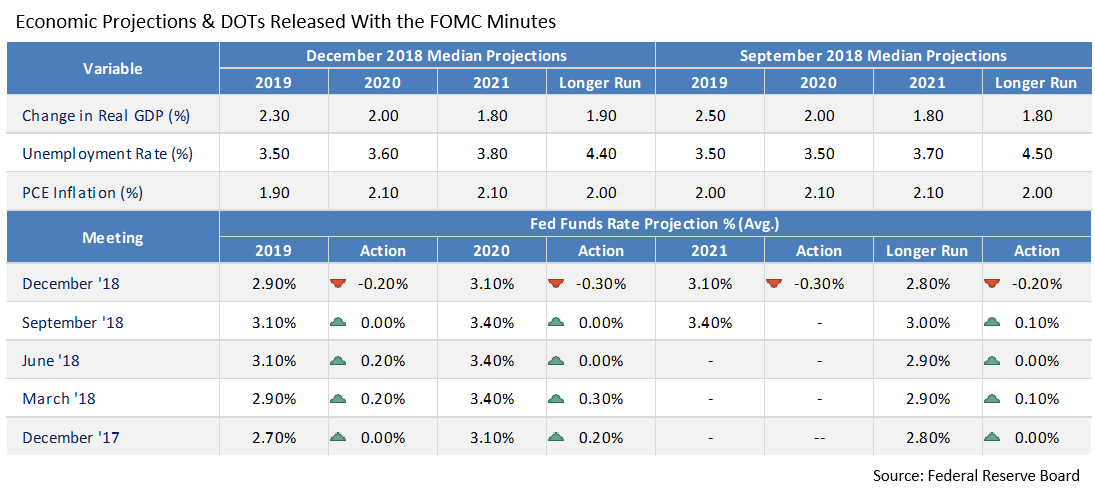

- That said, when the Fed met on December 19th, they raised short term rates a quarter point, but surprised markets by only reducing their “dot plot” from three hikes to two in 2019. While the reduction in forward guidance was reasonably dovish, the market had expected a larger downward revision, or even potentially a full pause. Markets traded off mildly on the news, but the decline gathered steam during the accompanying press conference when Powell implied that the Fed was resisting political pressure from the White House, and was not preoccupied by the equity market reaction. Market participants interpreted this as the end of the “Yellen put” that had seemingly shored up equity markets in recent years, although Powell later emphasized the Fed’s conditions dependent policy flexibility.

- The final Q3 GDP revision saw the growth rate drop one tenth of a point to 3.4%. The drop was primarily driven by a reduction in PCE and exports, partially offset by an increase in private inventory investment. Meanwhile, the PCE deflator rose, as was broadly expected, from 1.8% to 1.9% in November. Personal consumption and consumer confidence numbers were solid, although housing demand and selling prices have continued to weaken somewhat, possibly due to this year’s tax reform. Overall, we see the US economy moderating, weaker global economic conditions, and sub-2% inflation creating a case for either one Fed Fund rate hike in 2019, or perhaps even none.

From the Trading Desk

Municipal Markets

- AAA municipal yields dropped across the curve over the final two months of the year. This was largely a function of dwindling inflation concerns, weakening global economic prospects, and anticipation of a slowing pace and potential magnitude of 2019 Fed Funds rate increases. The futures markets were pricing in only a 10-20% chance for a rate increase at any of the Fed’s 2019 meetings as trading moved into the second week of January.

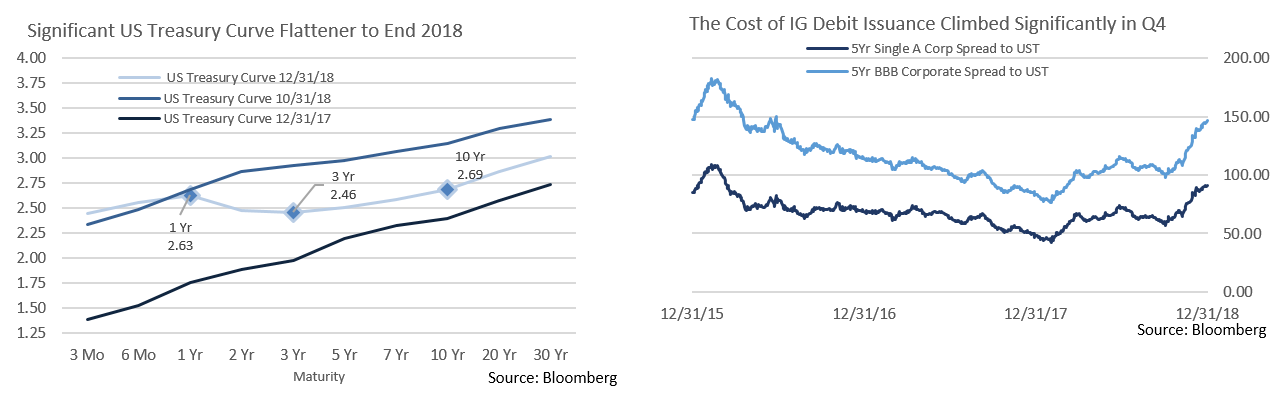

- Municipals took their lead from Treasuries, with the tax-exempt yield curve continuing its flattening trend. Over the month of December 2s-10s dropped from 59 to 50 basis points. As the market gets more comfortable with the idea that the Fed may be on hold, we could see short rates decline, leading to a bit of steepening.

- Although municipal yields were lower across the curve, the drop in the 5 to 12Yr range was largest, causing the 10-year Bloomberg Barclays index to be the strongest performing segment in Q4 at +2.09%. For the year, the 3-year Bloomberg Index outperformed at +1.76% while the Long Bond Bloomberg Index (22+ years) was the worst performing at +0.34%.

- As we look ahead, municipal market conditions appear reasonably favorable. The average expectation of municipal analysts for full year issuance is $370B vs. $338B in 2018. There should be net negative issuance of $70B to support the market according to JP Morgan, down from a $121B net negative total in 2018. To start the year, coupon payments and maturities should double expected January municipal issuance of $21.5B according to Citigroup. Additionally, most strategists believe that mutual fund flows will turn positive in 2019 after sizeable Q4 outflows as investors get a better handle on their tax situation and the benefits municipal securities offer post-2017 tax reform, particularly in high tax states.

Taxable Markets

- A sharp December flight to quality drove the US Treasury yield curve into a rapid Bear Flattener. The very short end remained stable with the 1Yr hovering around 2.63%, although the long end dropped 28 basis points to 3.02%. The bellwether 10Yr dropped 30 basis points to 2.69%, while 2, 5, and 7Yr yields also fell by 30+ basis points, leaving the curve inverted.

- The last time that we had a meaningful US Treasury curve inversion was early 2006 and it lasted through the middle of 2007. Yield curve inversion is a well-chronicled indicator of potential recession, although it has typically occurred with 12-18 months delay. We see the Fed becoming a bigger influence on the curve, and current expectations are they will refrain from 2019 rate hikes.

- Investment Grade corporate issuance was almost nonexistent in December at only $7.95 billion. Several factors contributed, including repatriation rules that have reduced borrowing needs, political headline risks, trade uncertainty, and rising issuance costs.

- In fact, the cost of issuing a 5Yr single A corporate bond rose from 2.68% at the beginning of the year to 3.42%, with 0.44% of this due to spread widening and 0.30% a function of increased 5Yr US Treasury yields.

Public Sector Watch

Credit Comments

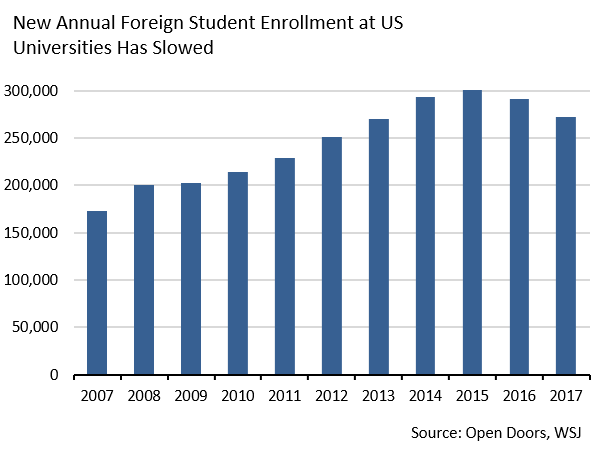

- Lost in the global trade debate is the potential impact to higher education, one of the most vulnerable tax-exempt sectors. Many of these institutions rely heavily on international students, a demographic whose 2017 enrollment declined by 6.6% from the year prior. This is troubling given that international enrollment in undergraduate, graduate and professional programs had been growing steadily, often with full-pay students. Universities that attracted international students often enjoyed rating agency upgrades in recent years. We do not see recent enrollment declines as an aberration and many of these institutions are now facing increased credit risk. Cost, immigration policy, fears of violence, as well as increasingly attractive overseas higher education options are all having an impact. China and India, the largest student exporters to the US, have been particularly effected. Evolving enrollment dynamics highlight the need for diligent analysis in the higher education sector, as yesterday’s trends may not translate into tomorrow’s credit quality.

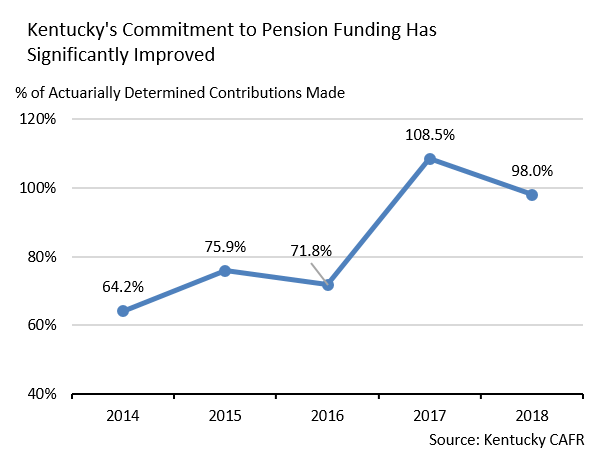

- Kentucky’s Supreme Court struck down pension reform legislation (SB 151) in December that had been passed earlier in the year by the Commonwealth’s legislature. The Supreme Court affirmed a lower court’s ruling that the legislative process was procedurally flawed and thereby unconstitutional. Importantly, neither court determined that the actual reforms – enrolling new hires in a hybrid plan, reducing benefits for future teachers, increasing retirement age for some employees – were unconstitutional. This leaves the door open for the legislature to approve revised pension reform, which they unsuccessfully attempted to do before year end and may do so again as a new session began on January 8th. Kentucky’s pension plans remain one of the weakest funded among US states. However, recent actions to substantially increase contribution levels and enact more appropriate actuarial assumptions, coupled with previously approved reforms, point to stabilization in funding levels and future costs.

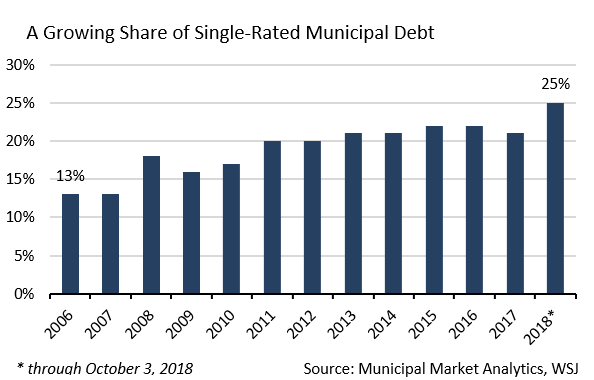

- According to data collected by Municipal Market Analytics, 25% of the par value of debt issued this past year through October had only one major agency credit rating. This accelerates a troubling trend which averaged 21% over the previous five years, but was only 13% as recently as 2007. Many retail investors and advisors rely on 3rd party ratings to ascertain a bond’s credit risk, and lack of multiple objective viewpoints can be problematic. Many issuers attempt to save costs by requesting only one rating, although at times the anticipated alternative rating could be lower, potentially “hiding” risks by limiting ratings. At Appleton, we not only prefer multiple 3rd party ratings, but assign our own ratings as part of our proprietary credit research process.

Strategy Overview

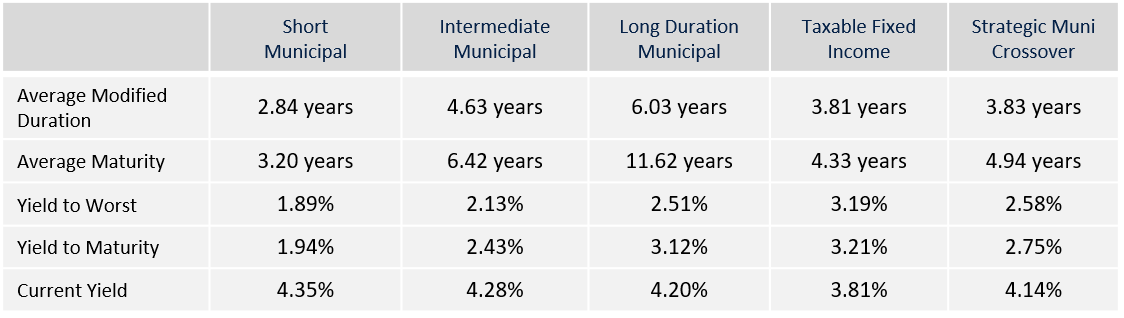

Portfolio Positioning as of 12/31/2018

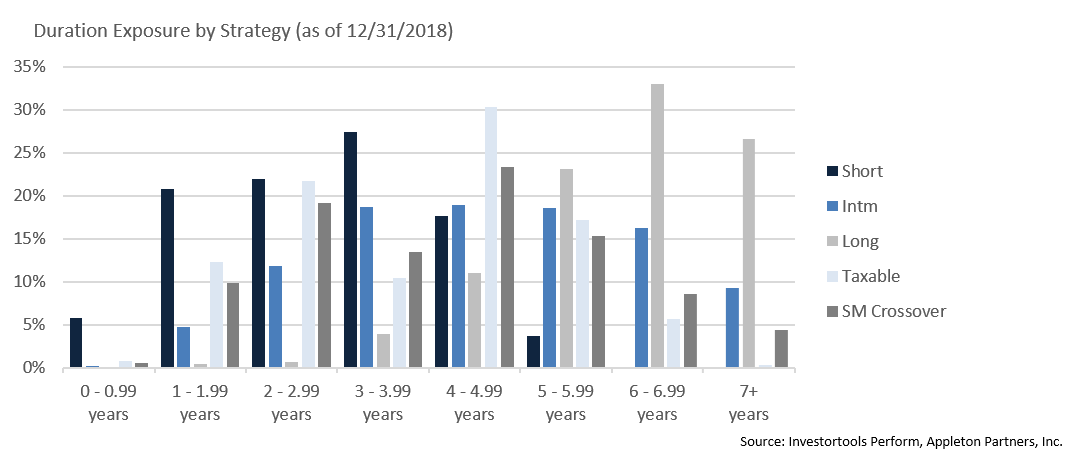

Duration Exposure by Strategy as of 12/31/2018

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.