Insights and Observations

Economic, Public Policy, and Fed Developments

- Georgia has commanded much political attention in recent days and reports now indicate that the Democrats have narrowly won both Senate run-off elections with control of the upper chamber at stake. While we do not understate the importance of these races, their impact on the Biden agenda may be overstated by the markets and media. The Senate will remain highly dependent on moderate Senators to pass legislation under either party’s control, and concern about a progressive agenda that influenced a recent uptick in Treasury yields is likely unwarranted. The biggest benefit to the Biden agenda of a Democratic Senate will be through operational control of the chamber; the ability to decide what legislation to take up, to form subcommittees, and to weaken the GOP’s ability to use procedural means to block legislation.

- Meanwhile, as Biden’s cabinet picks are being evaluated by the markets, we find the nomination of Pete Buttigieg as Secretary of Transportation especially interesting. Buttigieg’s endorsement of Biden came at a critical juncture, and we feel his nomination increases the likelihood that federal investment in transportation infrastructure will be a priority.

- On a final political note, President Trump has refused to formally concede, and has been fighting a protracted campaign to overturn the results of the presidential election, culminating in violent protests on Capitol Hill prior to Congressional certification of the Electoral College votes. The President’s increasingly defiant actions may introduce short-term volatility over the next two weeks.

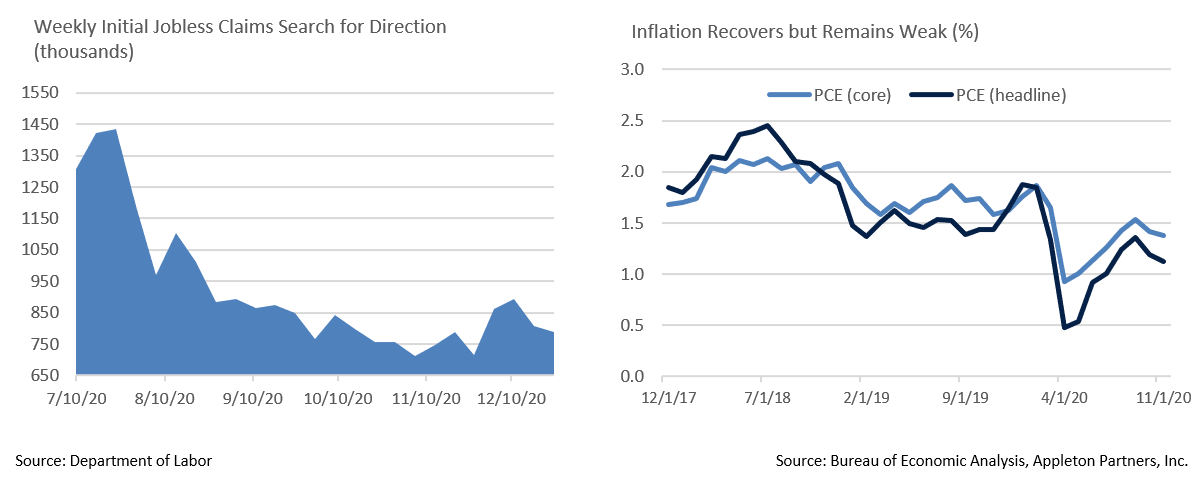

- The employment situation remains murky and recent releases have not been especially promising. A recent rise in new unemployment claims reversed at the end of December, a development that was likely impacted by a state-level crackdown on fraudulent claims and the (brief) expiration of temporary pandemic unemployment benefits in the final week of the month. With COVID-19 cases surging and PUA benefits resuming at the start of January we expect new claims to continue to rise. In any event, claims remain higher than they were in mid-October, when a pronounced downtrend was still in effect, and well above normal non-recessionary levels.

- Meanwhile, personal income and consumption both dropped more than expected in November, another sign of economic weakness. Income came in at -1.1%, below expectations of -0.3%, while consumption missed expectations of -0.2%, at -0.4%, driven in part by the start of a gradual phase-out of pandemic benefits and uncertainty over the fate of the second stimulus bill. The PCE deflator, the Fed’s preferred measure of inflation, came in flat at both headline and core, bringing YoY headline to +1.1% and core to +1.4%. Despite concern over unprecedented monetary stimulus, evidence of inflation remains scarce even as demand for pandemic-impacted goods has accelerated. Durable goods orders have recently been a bright spot, although services spending slipped for the first time since April as case counts rose and weather cooled.

- Jerome Powell used his final press conference of the year to reiterate that short term rates would remain at zero for quite some time while continuing asset purchases, despite today’s negative real rates well into the recovery. We expect the Fed to remain accommodative for a long time to come, and to clearly telegraph any change in monetary policy well in advance of acting. This policy stance should be highly supportive of markets as we begin 2021.

From the Trading Desk

Municipal Markets

- Robust demand for municipals remains intact with mutual funds gathering another $20 billion of net flows in Q4, bringing 2020’s total to $39.7 billion despite almost $47 billion of outflows during a 5-week period in April and May. We expect positive fund flows to continue in January.

- As 2020 drew to a close the municipal curve flattened somewhat with 10-year AAA yields falling 16 bps over the quarter. Buyers have been willing to go a bit further out on the curve and inventory remains limited. This caused a reduction in the 2-10Yr AAA municipal spread from 74 bps on 9/30 to only 57 bps at year-end. Several municipal strategists are predicting increased supply in 2021 based on an expectation that governments will borrow sizeable sums to help with pandemic related challenges.

- Taxable municipals ended a strong year on a high note with 2020 doubling the prior year’s issuance at $145.2 billion. Taxable supply should remain healthy absent a significant uptick in yields or a reversal of the restriction on tax-exempt refinancing. Crossover and other flexible municipal portfolios can selectively find after-tax incremental value in taxable municipals, although a good deal of that supply is slightly longer than the Intermediate buying range.

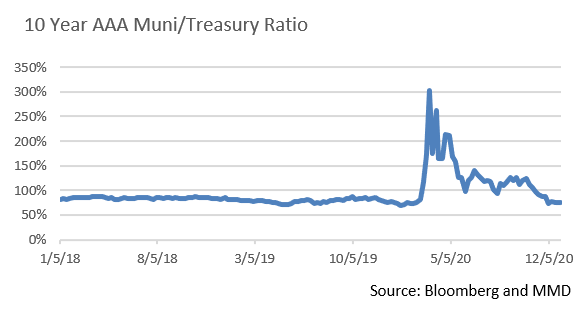

- A more favorable forward economic outlook pushed UST yields higher with the 10Yr ending December at 0.93%, triggering a decline in the 10Yr AAA muni/UST ratio to 77.2% after beginning Q4 at 112.8%. This represents a return to long term average ranges prior to pandemic induced spikes earlier in 2020. Our current trading expectation is 0.80 – 1.25% on the 10Yr UST, and with ratios below their long-term average of 86%, we are duration neutral versus the benchmark on our Intermediate Municipal portfolio at about 4.60 years. As 2021 begins, the high-grade municipal curve remains steepest in the 6 to 10-year range, thus making it an attractive portion of the curve.

Corporate Bond Markets

- Sustaining recent momentum, new debt hitting the IG Corporate market during the typically slow month of December came in at $38 billion, beating estimates of $25-30 billion. This brought the YTD total to just shy of $1.75 trillion, the largest annual total in history. Extremely low interest rates and tight credit spreads continue to make it advantageous for corporate issuers to come to market. Borrowers capitalized on this favorable environment throughout the second half of the year by raising cash and enhancing liquidity amid highly uncertain economic times. Market consensus calls for 2021 issuance to normalize towards about $1.1 trillion.

- An improving macroeconomic backdrop in 2021 should strengthen corporate fundamentals and we anticipate demand for IG credit to remain strong. After a volatile year in which balance sheet fortification was the norm, the prospects for M&A activity to pick up substantially in 2021 are good, although we do not see this significantly impacting the higher quality credits we favor.

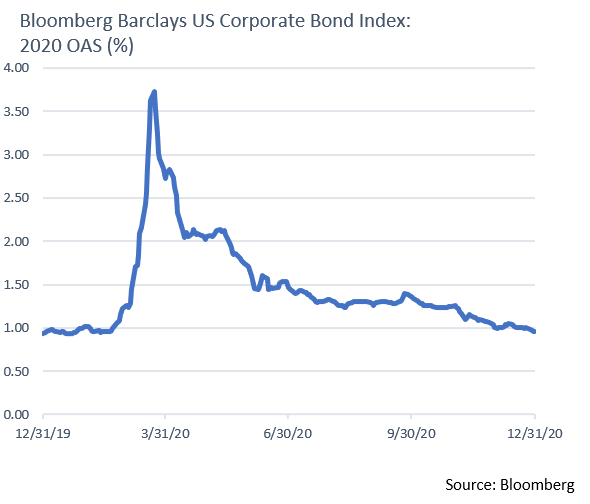

- Modest credit spread tightening in December represented a continuation of a trend that began in March with the Federal Reserve’s move to backstop then turbulent credit markets. Amazingly, December’s 5 basis point move from an OAS of 101 to 96 left IG Corporate spreads just 2 bps above the 93 level seen at the end of 2019, pandemic and recession notwithstanding.

- With very low short-term rates expected through 2022 we anticipate spreads remaining range bound for a sustained time. Global rates also remain repressed, and in some cases negative, leaving foreign investment in place as a favorable technical factor in US IG markets.

Public Sector Watch

Credit Comments

2021 Sector Outlook

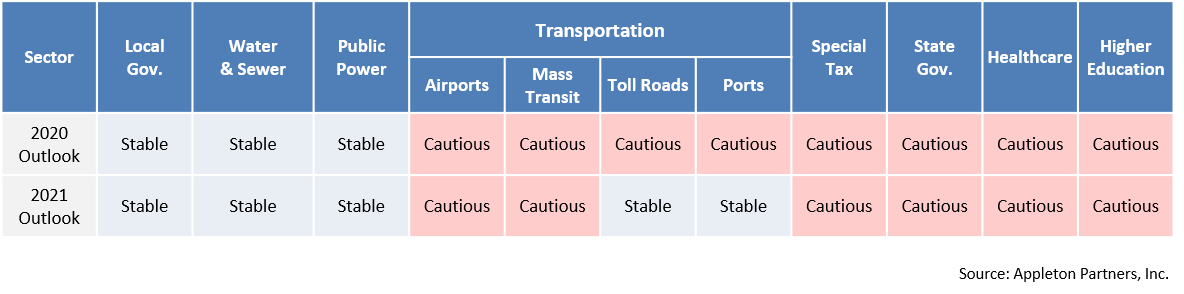

- Our municipal sector credit outlook remains largely unchanged from the start of the pandemic with a few exceptions. The positive impact of ongoing vaccine distribution is tempered by nagging budget challenges and an anticipated lag in state and local revenue recovery relative to the broader economy.

- Slower than anticipated vaccine rollout paired with rising virus cases has forced cities and towns to reimpose economically restrictive travel, restaurant, and retail constraints, and in some cases, shelter in place orders. Municipal sectors tied to these areas of the economy will likely lack the tailwinds needed to positively shift credit sentiment. As we have long emphasized, credit differentiation at the sector and bond issuer level remains warranted.

- Our outlook has improved for two transportation subsectors – Toll Roads and Ports. The change in sentiment is due to their unique performance profile during the pandemic. Toll roads benefited from changes in consumption of goods and travel patterns due to safety concerns. Port container traffic should accelerate based on pent up demand caused by 2020 supply chain disruption paired with strong consumer spending.

- We are maintaining stable credit outlooks on predominately non-cyclical sectors, including local governments, water and sewer, and public power. Our credit team remains highly selective in these areas with a high-quality bias emphasizing issuer size and scale, fiscal flexibility, and service essentiality, among other credit attributes.

Impact of the Stimulus Package

- The most recent stimulus package provided no direct aid to state and local governments, although many other tax-exempt sectors were allocated funds and several provisions will indirectly benefit municipalities. We view this legislation as a credit positive.

- State & Locals – tax refund checks, $300/week enhanced unemployment benefits, and $325 billion in small business aid will positively impact consumption and consumer savings, which in turn should bolster tax revenue. Tax revenue data over the past eight months supports this view and we expect the trend to continue.

- $69 billion in aid to cover vaccine distribution and administration, testing and contact tracing will help offset costs assumed by state and local governments. The ability to use CARES Act grants was also extended by one year to December 31, 2021, creating additional budget flexibility.

- Public Transportation – $15 billion in new federal support includes $4 billion for the nation’s largest public transit agency, the New York Metro Transportation Authority (NY MTA). Despite ongoing budget pressures, these funds will reduce the need for the NY MTA and other systems to undertake even deeper service cuts and more extensive near-term borrowing.

- Highways – Toll roads have bounced back more quickly than other transportation infrastructure, momentum that should be enhanced by $10 billion in new federal aid. These funds will help bridge revenue projections that remain 10-20% below 2019 levels.

- Airports – Airports received $2 billion, funds that offer short-term relief until enplanements recover, although most large airports maintain significant liquidity reserves. An additional $15 billion was provided to airlines, supporting airports’ primary revenue generator.

- Education – K-12 schools will receive $54 billion and Higher Education $20 billion to help offset increased health safety expenses and revenue losses.

Strategy Overview

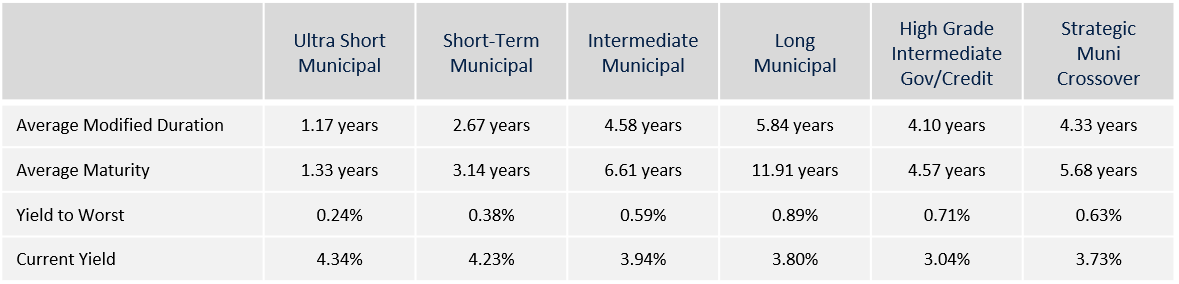

Composite Portfolio Positioning as of 12/31/20

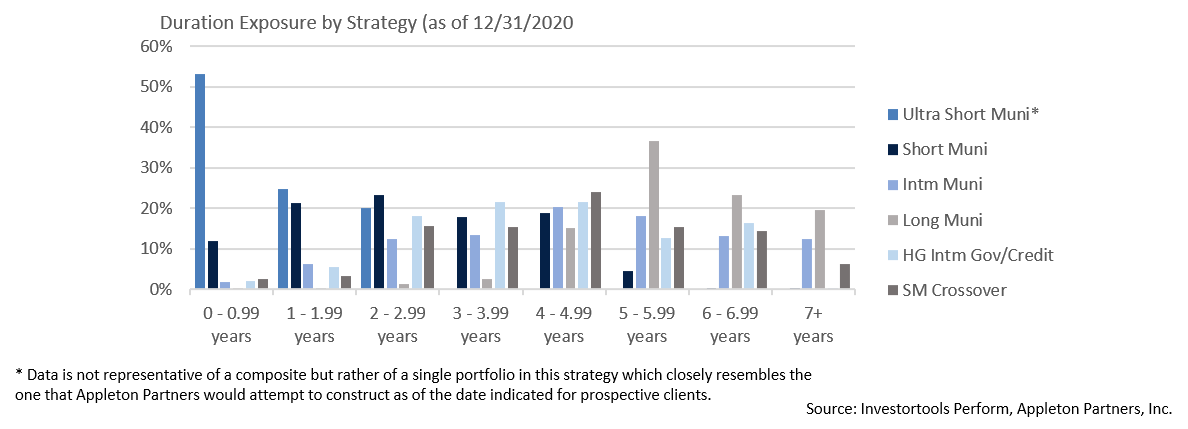

Duration Exposure by Strategy as of 12/31/20

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.