Insights and Observations

Economic, Public Policy, and Fed Developments

- The economic highlight of December was the Federal Reserve bowing to market expectations by updating their “dot plot” to show three rate hikes in 2022, up from an even split at the prior meeting between no hikes and one. In some ways this was unsurprising; in the post-Great Recession era, disagreements between market expectations and the Fed dot plot have been resolved in favor of the market.

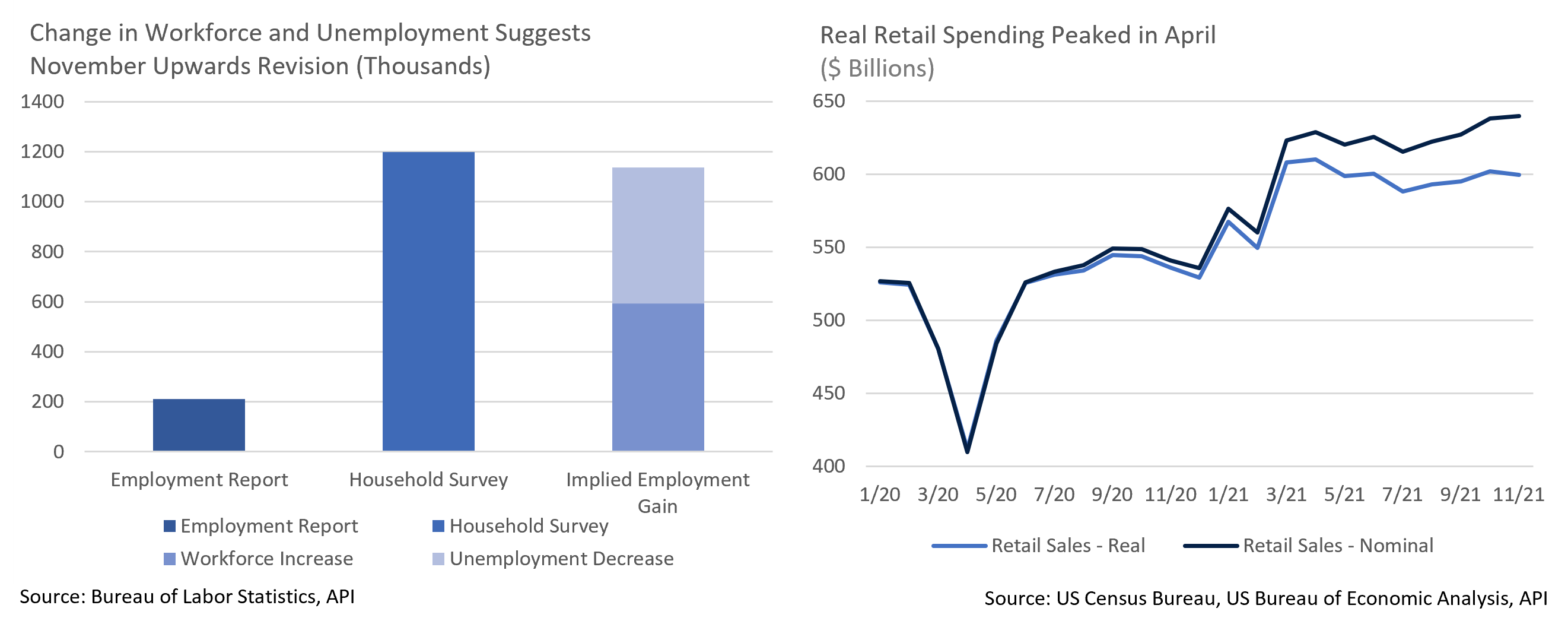

- However, market expectations are still evolving. A particular source of uncertainty lies with the labor market. November’s BLS report of only 210k new jobs has been taken as evidence of a tight labor market. The unofficial “household survey” flagged much higher job growth of 1.2M, whereas the BLS report included a 594k increase in the workforce (those currently employed or unemployed but actively looking) and a 542k decrease in the unemployed (no job but actively looking). This report aligns more with the “household survey” than the “headline” BLS numbers. A sizable upwards revision to November’s report and a strong December jobs number could shake the consensus view that tight labor conditions will drive inflation via wage increase, a dynamic we have yet to see materialize.

- There is encouraging evidence of easing supply bottlenecks as auto production has begun to recover. The Motor Vehicles and Parts industrial production index rose from 85.1 in September to 95.7 in November, the highest reading since January and first back-to-back increase of the year. This suggests chip shortages that have plagued production are starting to abate. Meanwhile, while the headline December ISM Manufacturing report missed, the details were better, with employment indices improving, and prices paid and delivery time indices hitting near term lows, though the survey period was largely pre-omicron wave.

- While retail spending has been strong, in inflation-adjusted terms it has been flat to slightly negative for some time. A further upward revision to October’s already strong reading from 1.7% to 1.8%, and personal spending outstripping personal income by 0.2% in November’s report, offers additional evidence of an unusually front-loaded holiday shopping season. These give us reason to believe strong spending should moderate in coming months, potentially helping to take the edge off inflation readings.

- For now, inflation remains high – both CPI and PPI surprised to the upside in November’s release. It is likely too early to estimate how the latest variant wave will impact future inflation readings, but for now we will be paying close attention to whether the annualized month-over-month trendlines show deceleration or remain elevated, and how core inflation components not highly sensitive to the pandemic, such as shelter costs, are behaving in assessing the 2022 inflation outlook.

- Omicron remains a significant source of short-term uncertainty. The variant is far more contagious than previous iterations, with the US setting a new daily record of more than a million new cases on the 4th. While it appears to be less severe, this is not yet entirely clear. Hospitalizations have not risen as aggressively, though they typically lag new cases and with widespread vaccination and prior infections, breakthrough infections are a much larger proportion of current cases than in waves past and tend to be milder. In any event, we certainly hope the human impact remains low.

From the Trading Desk

Municipal Markets

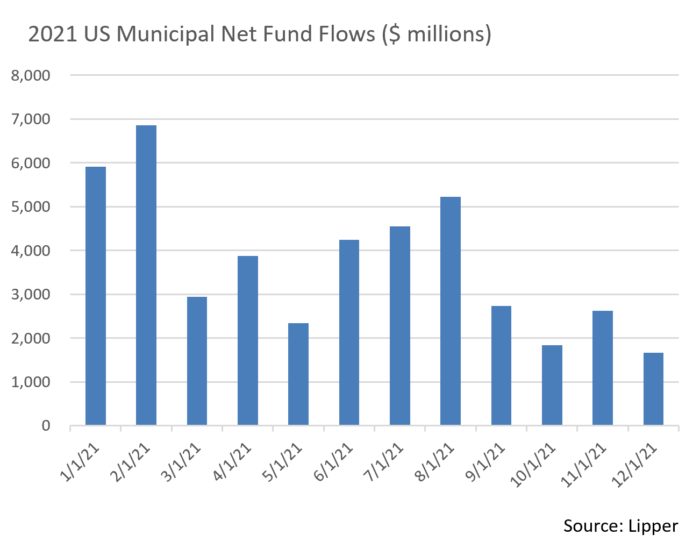

- Over the course of 2021 retail demand for municipals did not relent as evidenced by mutual fund inflows of $101.8 billion. By comparison, total inflows for 2020, a year disrupted by initial pandemic volatility, was about $40 billion. Looking back to 2019, we experienced total inflows of about $94 billion. This year’s relentless demand has been highly supportive of the tax-exempt asset class, constraining municipal yields even in the face of recent UST weakness.

- On the supply side, December issuance was $38.2 billion according to The Bond Buyer, a level above the $34.8 billion brought to market during the same month of 2020. On an annual basis, issuers brought $475 billion of new supply for 2021, slightly below last year’s record issuance of $484 billion. Bond supply remains tight in both the primary and secondary markets.

- The year closed with 10-year AAA muni/UST ratios at just over 68%, roughly in line with the 52-week average, but below longer-term norms. The significant demand noted above is the primary cause of the lower ratio data this year. As emphasized for some time, we see greater relative value in the intermediate portions of the curve with the spread between 2-10s at 0.79% vs. only 0.46% between 10-30s. While the market is currently pricing in 3 Fed rate hikes this year, the short end of the muni curve is remaining stubbornly low.

Corporate Bond Markets

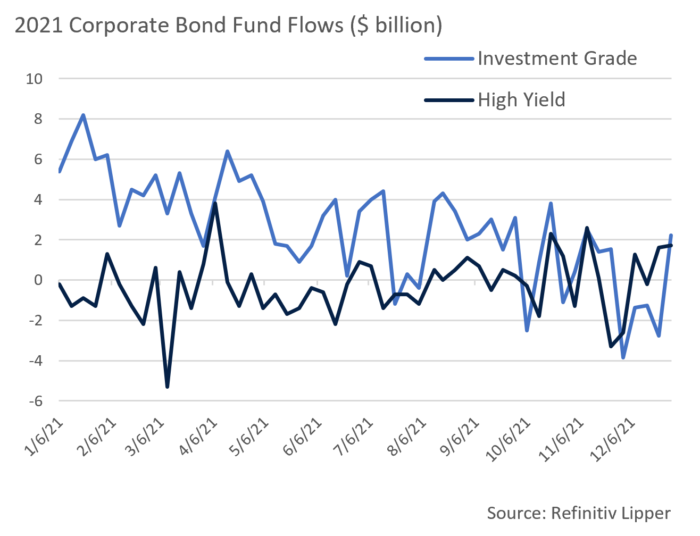

- The last month of 2021 was a roller coaster ride for investment grade credit spreads with buyers reluctant to take on additional credit risk as the year concluded. Market skittishness was influenced by growing anticipation of Federal Reserve policy guidance as the December meeting approached. All ended well though, as the market grew more comfortable with the Fed’s tapering plans and rate expectations and investment grade credit caught a bid with spreads ending the month 8 bps tighter.

- If we widen the lens further, the Bloomberg Barclays IG Corporate Bond Index began 2021 at an OAS of 96 and closed just 4bps tighter at 92 OAS despite trading in a narrower 10 – 15bps range for most of the year. We anticipate slight spread widening in 2022 that is likely to be orderly and range bound.

- Issuers took full advantage of benign market conditions in 2021 with investment grade supply of $1.41 trillion the second largest year on record, trailing only 2020’s mammoth $1.75 trillion. An unexpected rush of new supply during the first two weeks of the month led to a record $61 billion in December issuance, unusual for a typically sluggish month. Primary issuance market conditions continue to be favorable and the appetite for investment grade credit should carry over into 2022. The market has embraced new supply and we expect to see a similar size calendar this year.

- Retail investor sentiment, as measured by investment grade corporate fund flows was mixed to close out the year. In the four weeks preceding the last week in December, funds incurred just over $9 billion of net outflows. This was presumably spurred by the uncertainty around the omicron variant and future Fed policy, which drove modest spread volatility in the first few weeks of the month. This weakness marked the largest stretch of outflows of the year. However, the trend may be short lived as the last week of the month saw $2.22 billion of inflows. Over the course of the year, 44 positive flow weeks far outnumbered the 8 negative ones. The ebb and flow of retail bond funds can be volatile but overall investor appetite for investment grade credit remains solid and should remain that way as we move further into 2022.

Public Sector Watch

Credit Comments

2022 Municipal Sector Outlook

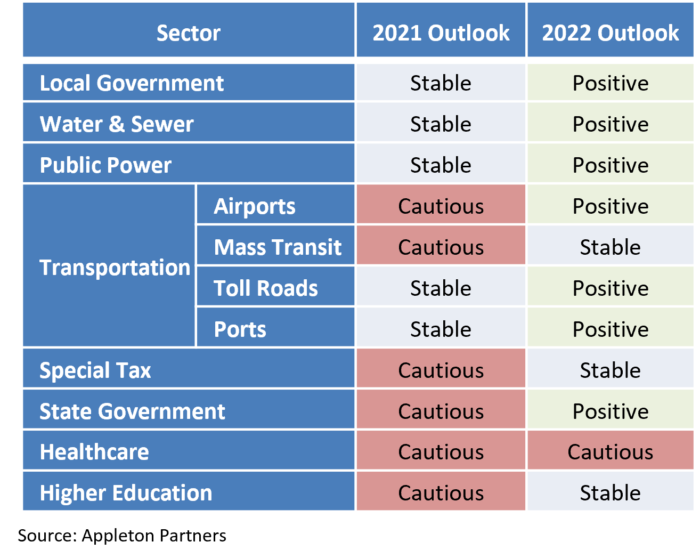

The past year revealed a major shift in sentiment for many sectors of the municipal market. Several contributing factors were evident including economic reopening, increased vaccination rates, and strong consumer spending to name a few. However, arguably the most influential factor has been vast federal aid, as it has paved the way for positive municipal credit trends.

- Over the last two years, municipal sectors have been allocated nearly $1.7 trillion in funds. These resources came through the CARES Act ($347B), the December 2020 Federal Stimulus bill ($157B), the American Rescue Plan Act ($650B), and most recently, the 2021 Infrastructure Bill ($550B of new funding).

- These resources have touched nearly every corner of the municipal market, creating a significant tailwind. This is reflected in our sector outlooks, all of which have improved from the year prior with one exception – Healthcare

A “Positive” 2022 Outlook on Seven Sectors

Four of these sectors exhibit similar credit characteristics given their non-cyclical nature. Our positive outlooks largely reflect considerable financial resiliency throughout the pandemic coupled with a fiscal performance boost driven in large part by federal aid.

- Local Governments – Property taxes are typically a leading revenue source for local governments, and a healthy housing market throughout the pandemic has produced considerable fiscal stability.

- State Governments – States produced strong tax revenue in fiscal 2021, led by a robust housing market, stock market returns, and consumer spending. Average tax revenues have grown by double digits on a YoY basis through November.

- Water & Sewer – Given the essentiality of services and a self-regulated rate setting ability, revenues have largely remained stable, and in general have incurred little to no operational disruptions.

- Public Power – This is a defensive sector with low volatility due to service essentiality. Financial metrics should continue to be favorable with minimal pandemic impact.

Our positive outlook on airports, ports and toll roads are also partially reflective of stimulus funding, although underlying financials within these sectors significantly diverged from pre-pandemic levels.

- Airports – Passenger volumes experienced a slowdown although concerns have been mitigated by many issuers’ strong pre-pandemic credit fundamentals. Ample liquidity and more than adequate debt service have provided a cushion in the face of lagging performance and financial resources have been replenished by federal aid over the past two years. These funds should continue to offset unforeseen COVID-related costs.

- Toll Roads – Work from home and constraints on travel negatively impacted volumes although substantial recovery was evident in fiscal 2021. We expect a sustained resurgence in traffic that brings overall transaction volumes back to prior levels in 2022.

- Ports – Issuers have largely performed exceptionally well throughout the pandemic relative to other revenue-backed sectors. Sustained high levels of demand for goods and increased port activity is expected to bolster revenues.

We Maintain a Cautious Healthcare Sector Outlook

Despite nearly $125B in federal aid, the Healthcare sector continues to face headwinds that will limit financial flexibility. Expense pressure stems from labor shortages impacting wages, and supply chain interruptions that have driven up PPE and drug costs. Concurrently, profitable elective surgeries are being canceled due to labor shortages and growing COVID-19 case counts. Many hospitals will continue to face compressed margins as they combat the pandemic.

Security Selection Remains of Paramount Importance

Overall, the municipal market has demonstrated considerable resiliency the past two years due in part to the essential nature of issuer services. Federal stimulus has reinforced credit quality and remains a driver of our improving outlooks for most sectors. While sector outlooks are a tool that supports fundamental credit analysis, comprehensive assessment of each individual issuer remains essential.

Strategy Overview

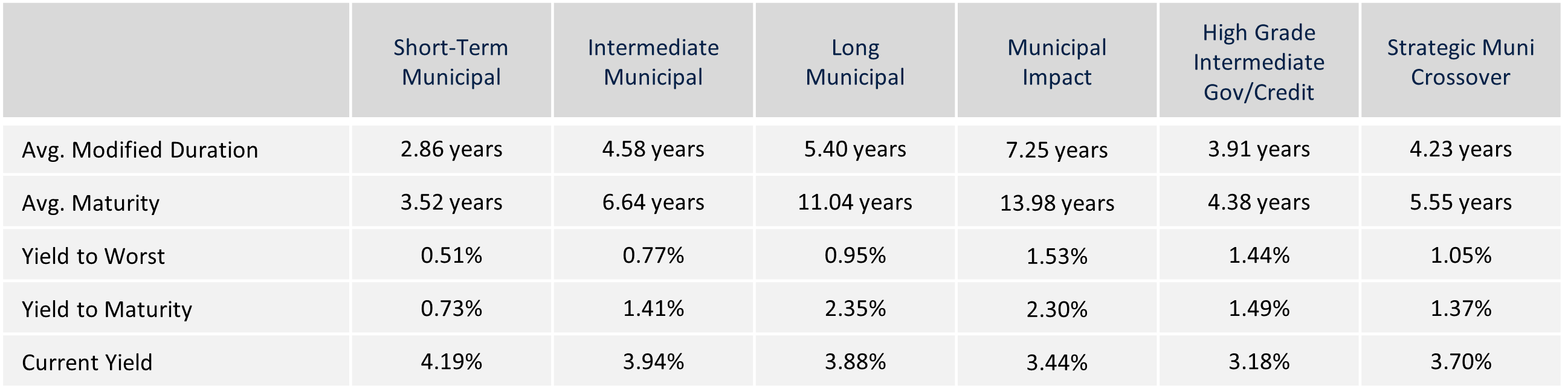

Composite Portfolio Positioning as of 12/31/21

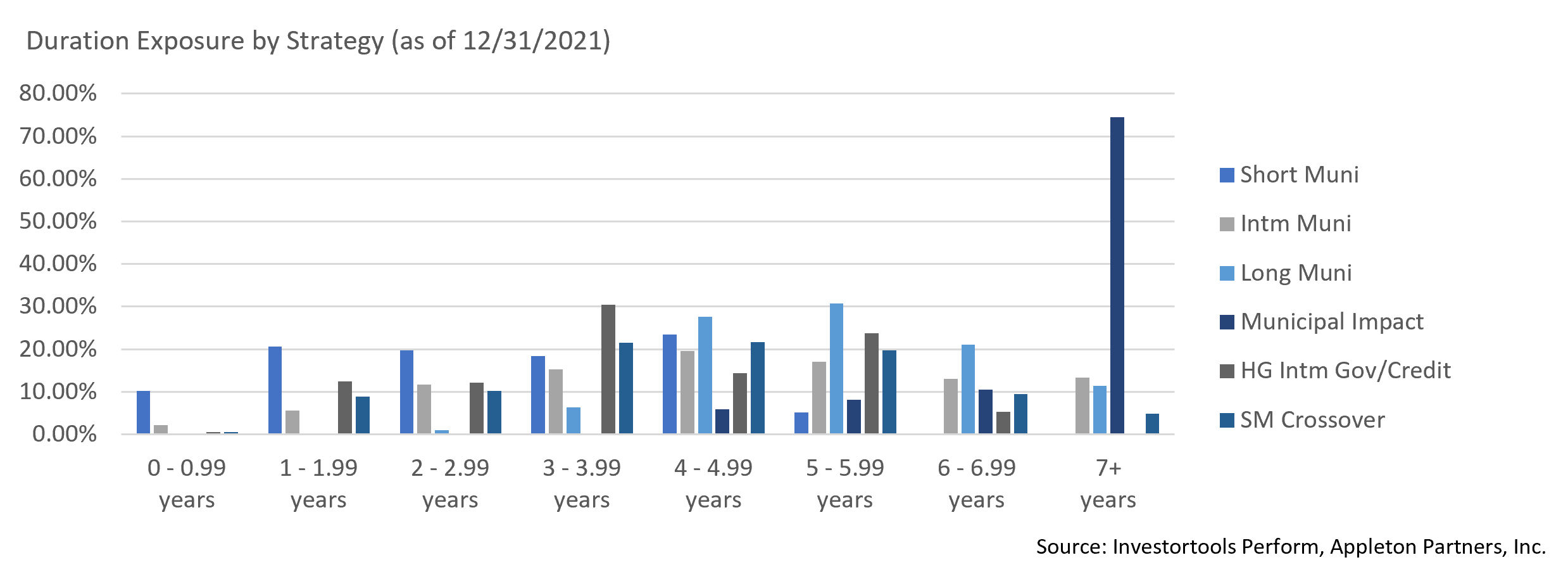

Duration Exposure by Strategy as of 12/31/21

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.