Insights and Observations

Economic, Public Policy, and Fed Developments

- As was widely expected, Chairman Powell laid the groundwork for a July rate cut in his remarks after June’s Fed meeting, stressing the commitment to sustain the economic expansion while reiterating that persistent below-target inflation, even transitory, could lower long-term inflation expectations. An “insurance cut” of 25 basis points at July’s meeting is now priced by futures markets. A stronger than anticipated early July jobs report somewhat tempered rate cut expectations, although we still expect the Fed to respond to a persistent inflation undershoot.

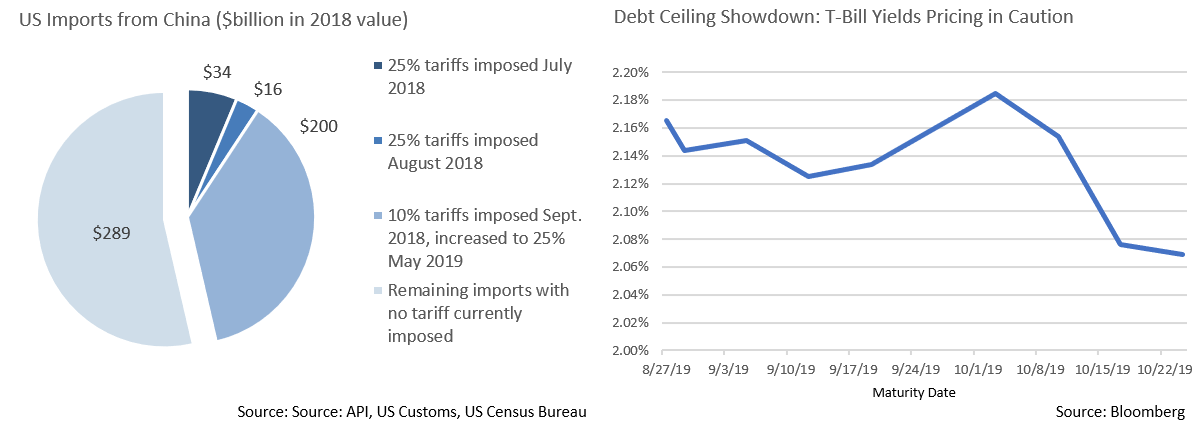

- The US budget deficit widened to $739 billion in the first 8 months of the fiscal year, a 39% increase from the prior year, after 2.3% revenue growth failed to keep pace with a 9.3% rise in spending. The CBO now projects the federal government will hit the debt ceiling in late September or early October. After the government shutdown at the start of the year, we expect an equally bruising partisan fight. The markets appear to agree; recently Treasury Bills due on October 3rd, roughly the date we hit the ceiling, were issued at a premium to maturities immediately before or after, suggesting bidders were uneasy over possible settlement delays. While an actual default is unlikely, the risks of political brinksmanship compromising business confidence and rattling markets is very real.

- Trade tensions cooled in late June when, after a month of fiery rhetoric, Presidents Trump and Xi agreed to a new tariff “truce”. Trump hinted he may lift Huawei’s blacklist status, a major concession criticized by congressional foes and allies alike, while China agreed to step up purchases of American farm goods. While we welcome the reduction in hostilities, no detail or deadline for talks was provided and existing tariffs remain in place. Overall, we believe this latest trade war development still leaves the US worse off than where we were in December, time of the last truce.

- There is also growing evidence the trade war is having an economic impact. US manufacturing confidence remains stronger than most of the world, but both continue to weaken and global confidence indices are now in contraction. Additionally, as we forecast last month, exports and imports dropped sharply in April after that month’s activity was front-loaded in March in advance of tariff increases. This is a primary reason why we expect Q2 GDP to significantly drop from Q1.

- And while some commentators downplay the impact of already imposed tariffs, we feel they are wrong to do so. In 2018, total imports from China were $539 billion. $250 billion in goods have been subjected to new tariffs, while Trump has threatened tariffs on the remaining $300 billion. If implemented, essentially all Chinese imports would be subject to a 25% tariff, for total duties of $135 billion. This comes to about 0.7% of GDP, or roughly a fourth of last quarter’s annualized growth rate, a significant impact at a time when we already expect GDP growth to decelerate. As it stands, tariffs on $250 billion in goods currently in place cost $63 billion, or roughly 0.3%.

- On a happier note, while May retail sales of 0.5% missed expectations of 0.6%, this was a solid number that followed upward March and April revisions, 1.6% to 1.8% in the former and a whopping -0.2% to +0.3% in April. We were watching closely for improvement in recently poor retail sales data, concerning at a time of growing inventory levels and tariff-related pressures, and May’s release delivered. While there is plenty of evidence of weakness elsewhere, a retail turnaround is welcome, as we consider this a precondition for the US economy to continue to avoid recession.

From the Trading Desk

Municipal Markets

- The first half of 2019 closed much as it began, with very high demand for municipals coupled with constrained supply. Net retail fund inflows reached $45.7 billion YTD as of early July, the best start to a year since the data began being tracked in 1992. Playing into a widespread belief that rates are staying low and may be trending lower, Long Term funds have received the lion’s share of fund inflows, $26.4 billion YTD, while Intermediate funds took in $15.8 billion.

- On the supply side, Q2 issuance of $88.7 billion slowed 11% relative to the same period of 2018. We do not see supply dynamics changing significantly anytime soon, as weekly issuance over the remainder of 2019 would have to average $6.8 billion just to meet last year’s total of $338 billion. New money issuance is down 3.6% vs. 2018. Furthermore, JP Morgan modified its expected 2019 target for net negative issuance to -$78 billion from -$63 billion. New deals remain oversubscribed and we see tight market conditions remaining in place.

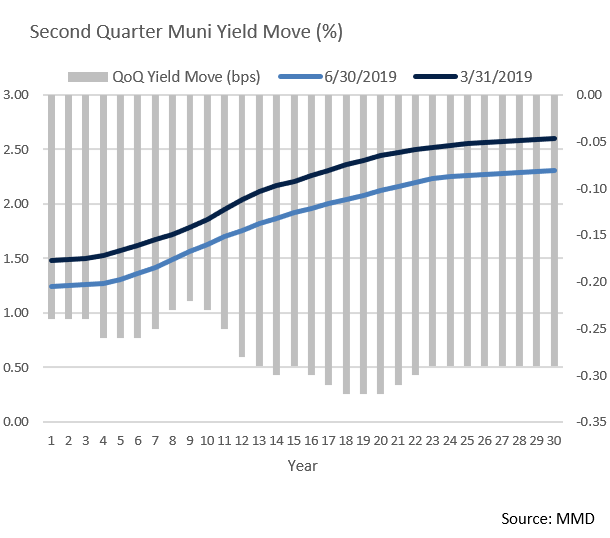

- Municipal yields ground lower across the curve at the end of June with munis following the lead of Treasuries. 2-year muni yields fell 24 bps over the course of Q2; 5-years (26 bps), 10-years (23 bps) and 30-years (29 bps) followed suit.

- Despite strong performance, municipals underperformed Treasuries during Q2, with the 10-year AAA muni/UST ratio increasing from 77.2% to 81.5% at the end of June, up from early May’s low of 70.9%. With technicals extremely strong and an interest rate cut of 0.25% expected at July’s Fed meeting, we anticipate 10-year ratios in the 78-82% range for the foreseeable future.

- Lastly, the muni curve steepened a bit in June as short rates dropped after flattening during Q1. 2-10s ended Q2 with a 38 bps spread, up from a low of 22 bps in mid-May. We have lowered our trading range for the 10Yr UST to 1.70% – 2.20% with a bias towards the lower end and see an accommodative Fed leading to further modest curve steepening. With a lid on interest rates, we are maintaining Intermediate portfolio duration at 4.60-4.70 years.

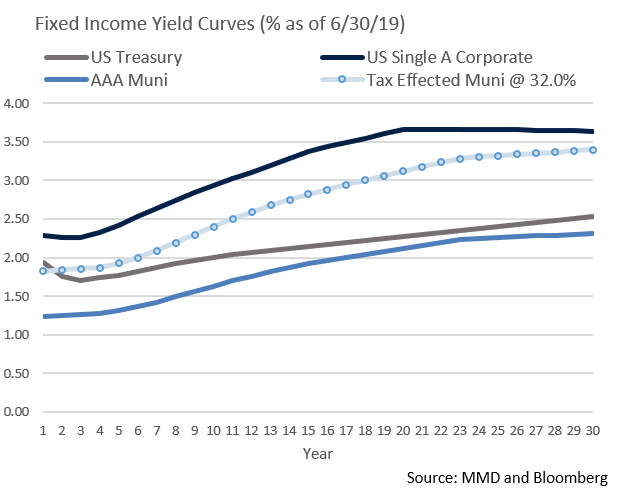

Taxable Markets

- In today’s yield compressed environment, shorter-dated IG corporate bonds may offer an attractive after-tax yield alternative to similar maturity municipal bonds. Several factors (very strong retail demand, favorable technicals, and a positive credit environment) have created conditions in which high quality muni yields have remained tight for a prolonged period. The 10Yr MMD Municipal curve was yielding only 1.60% at the end of June, while that same 10Yr maturity on the A-rated corporate curve yielded 2.93%. The tax effected 1.60% muni bond (@32%) translates to 2.40%, 53 bps less than the A rated corporate bond. For those able to accept modestly greater credit risk, adding crossover IG corporate bond exposure to a core muni account can be additive, especially for investors in mid-tier tax brackets.

Public Sector Watch

Credit Comments

An Impetus for Municipal Credit Quality Improvement?

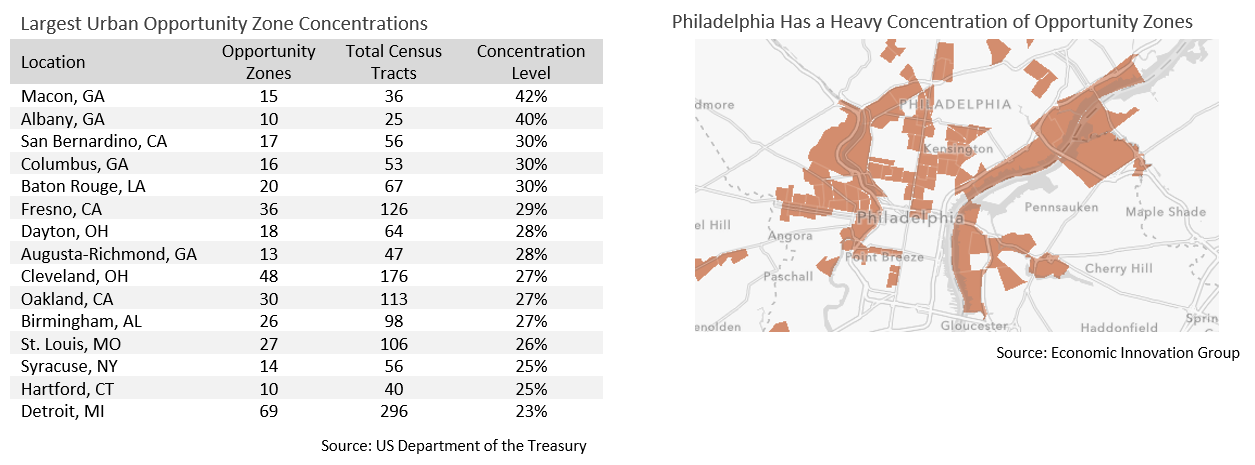

- Although there has been considerable focus on tax-incented Opportunity Zone capital investment into property and businesses through private Funds, we believe this Federal program can also have a positive impact on the broader municipal bond market.

- Increased capital investment within targeted census tracts, of which there are 8,700 spanning 3,500 cities and towns, has the potential to facilitate economic development, growing tax bases, and healthier revenue streams. Selectivity is critical, as we feel jurisdictions with a large number and high concentration of Opportunity Zones are best positioned to benefit.

- To bring potential benefits to our clients, Appleton recently created Municipal Opportunity Zone Credit, a liquid, investment grade tax-exempt separate account strategy. Security selection leverages our longstanding proprietary credit research, as we look for issuers that are both creditworthy and possess Opportunity Zone-driven credit catalyst potential.

The National Pension Picture Brightens

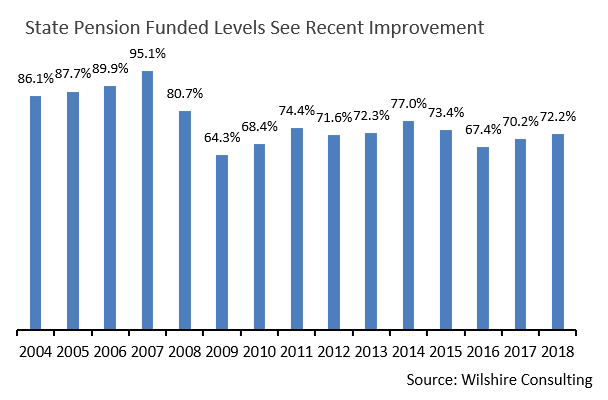

- State pension funded ratios continue to see positive trends but remain below pre-recession levels. According to Wilshire Consulting, aggregate state pension funded ratios increased to 72.2% as of June 30, 2018, up from 70.2% in 2017 and 67.4% in 2016. However, funded levels remain below a pre-recession average of 95.1% in 2007.

- What are the risks to the municipal market? In a worse-case scenario, pension costs overwhelm other expenses and impacted municipalities are forced to choose between its employees and pensioners, and bondholders. Fortunately, most municipalities are not in this position and the few that have experienced bankruptcies were also impacted by steep declines in the local housing market, poor financial management, elevated bond debt, or multi-decade declines in demographics.

- Legal protections vary greatly and must be considered in assessing pension risks. For example, Illinois has basically no flexibility to reform benefits, while recent cases in Houston and Dallas demonstrated how Texas’s constitution offers a much greater legal ability to incorporate benefit reforms than most other states.

- Investment assumptions can also vary considerably, thereby producing a much different fiscal picture than funding levels might suggest. Two plans with similar funded levels may have significantly different discount rates (6.0% vs. 8.0%).

- Pension risks are highly relevant to Appleton’s credit analysis, but only tell part of the story. Poorly funded pensions are a long-term challenge, although most states and local governments have the resources and financial flexibility to manage their liabilities. A bond issuer’s ability and commitment to meet the full actuarially determined pension funding requirement over a long-term horizon is one of several fiscal and management characteristics we assess in evaluating credits.

Strategy Overview

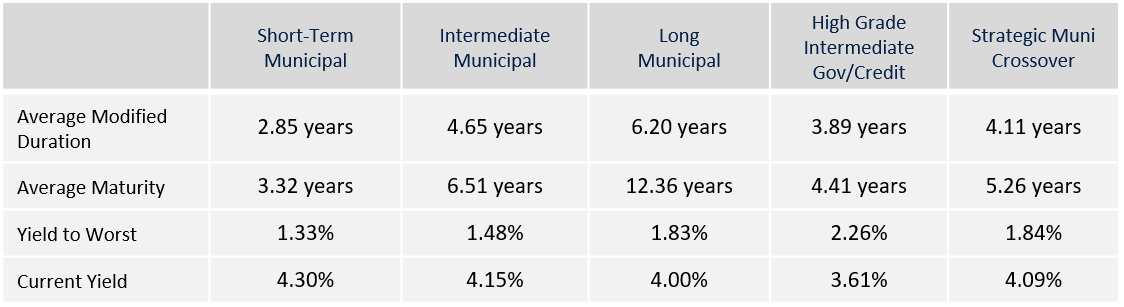

Portfolio Positioning as of 6/30/19

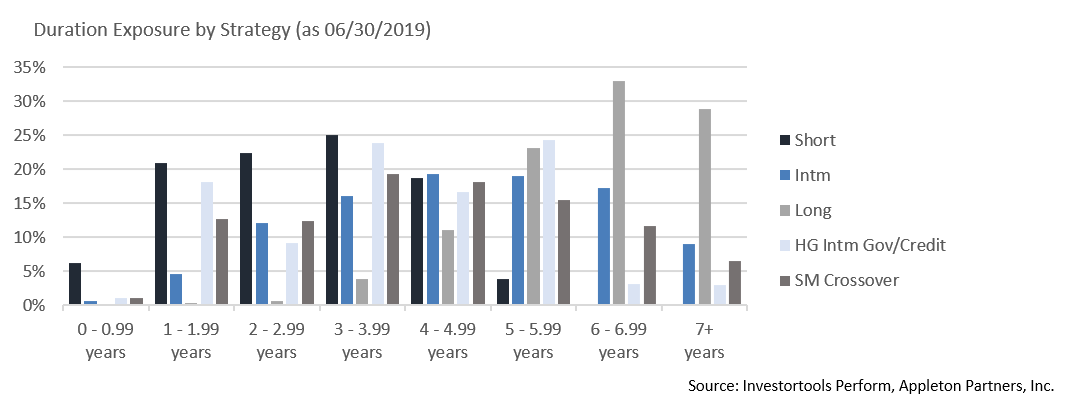

Duration Exposure by Strategy as of 6/30/19

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.