Insights and Observations

Economic, Public Policy, and Fed Developments

- Economic indicators were largely encouraging during May. A worrying buildup in inventory and slowdown in personal consumption noted in our last monthly was tempered in the second GDP revision. While headline growth dropped a tenth of a point, the data revealed solid downward revisions in inventories and upward adjustment in final sales. Business fixed investment also strengthened. Taken together, many of the economic headwinds have weakened and a rebound in Q2 GDP appears more likely than it did a month ago.

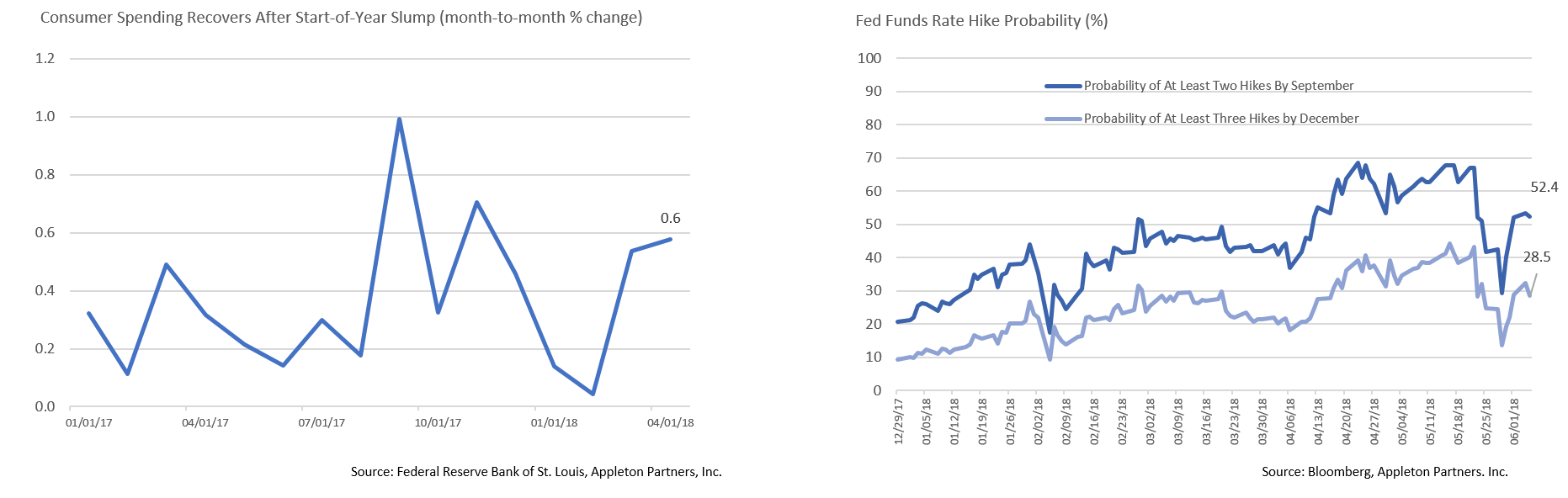

- April consumer spending numbers released at the end of May rose 0.6% month-over-month, two tenths higher than forecast, while May’s employment report showed broad-based sector strength, with unemployment tying a 48-year low at 3.8%. Given this positive backdrop, it was somewhat surprising to see wage growth remain muted at 2.7%. Headline and core PMI inflation both fell short of market expectations in April as well, and headline PCE growth held at 2.0% in May.

- The market is closely monitoring the Fed’s reaction to this atypical combination of low inflation, low unemployment, and high labor demand, and the Fed minutes released on May 23rd indicate a greater concern about inflation missing on the downside than exceeding the 2% target over the short run. The committee believes the current FOMC rate is “close to neutral”, and while a Fed Funds hike this month remains very likely, it will be difficult to maintain a steady pace of hikes much longer without evidence of wage growth or inflation.

- Geopolitical risk continues to threaten global risk appetite. Turkey faces a growing currency crisis after President Erdogan threatened the central bank’s independence, the alliance between Italy’s populist Five Star Movement and far right League failed to form a government after the Italian president rejected a euro-skeptic finance minister, the US pulled out of the Iranian nuclear deal, and a US summit with North Korea was cancelled only to now be back on. It would be a lot to digest, even if it weren’t for trade policy.

- After a month of relative calm following Treasury Secretary Mnuchin’s announcement that proposed tariffs would be put on hold, trade tensions escalated at month’s end. The Trump Administration unexpectedly reversed course and implemented broad steel and aluminum tariffs, while also indicating that $50B of proposed Chinese import tariffs would be in place within a month. Reaction from China, Canada, Mexico, the EU, and Japan, as well as US business and many Congressional allies and foes, was swift and fierce. The prospect of damaging trade conflict remains a serious threat, especially as slowing ex-US growth already risks curtailing overseas demand for US goods and services.

From the Trading Desk

Municipal Markets

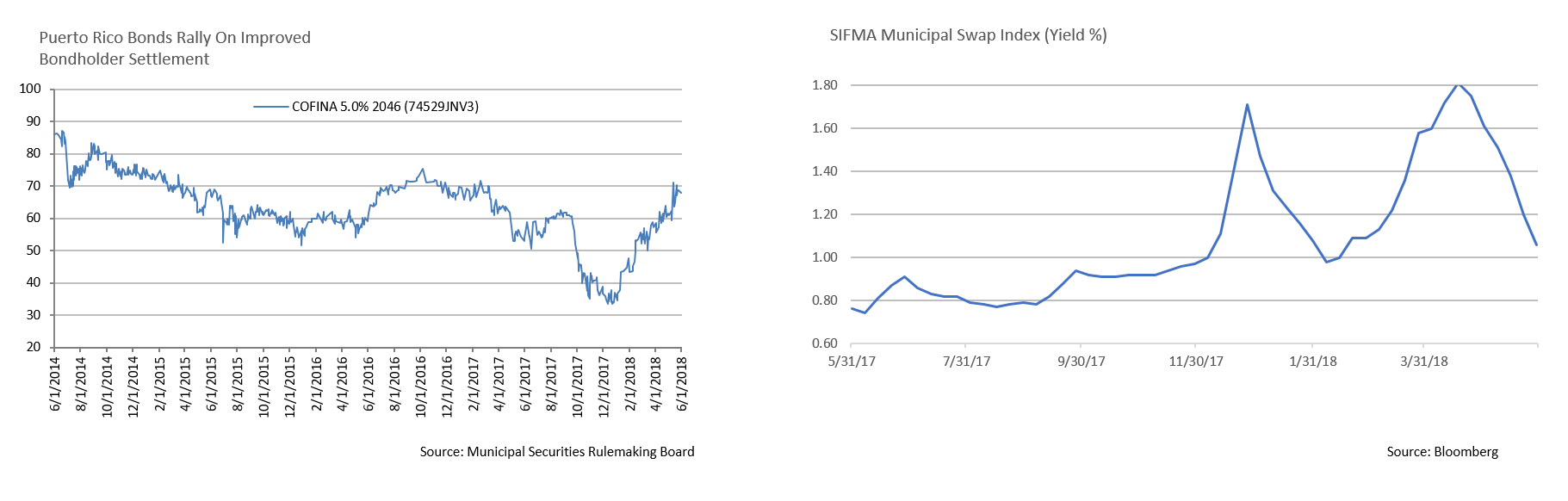

- Puerto Rico’s bonds rallied in May as dueling bondholders reached a compromise, temporarily firming up tax-exempt market sentiment. Unfortunately, we see this as an isolated, short-lived positive. A group of GO bondholders, COFINA bondholders, and bond insurers announced a settlement that may resolve a key dispute at the heart of Puerto Rico’s debt restructuring. The parties agreed to take haircuts ranging from 6% to 68% depending on the underlying claim and create a new security that would potentially allow Puerto Rico to reenter the capital markets years down the road. Puerto Rico bonds rallied following the announcement. However, both the Puerto Rico government and the federal oversight board opposed the plan, claiming debt reduction was insufficient and future obligations unsustainable. We continue to avoid Puerto Rican debt and believe a long-term resolution to the Island’s immense financial challenges remains years away.

- While market participants were positioning themselves for higher rates, the extremely short end of the municipal curve has recently had other ideas. The SIFMA Municipal Swap Index, which tracks the yield of seven-day variable rate securities, dropped during May from 1.66% to 1.06%, curtailing the return of a high quality, tax-exempt cash alternative. Although the prior higher yields were boosted by April tax payments, the dramatic decline has been largely technical, a function of strong inflows into longer term municipal funds combined with limited new issue supply. Should the new issue market pick up, we expect to see SIFMA rates stabilize and ultimately increase. In our view, the current SIFMA/1 month Treasury bill ratio of 61% is unlikely to persist.

Taxable Markets

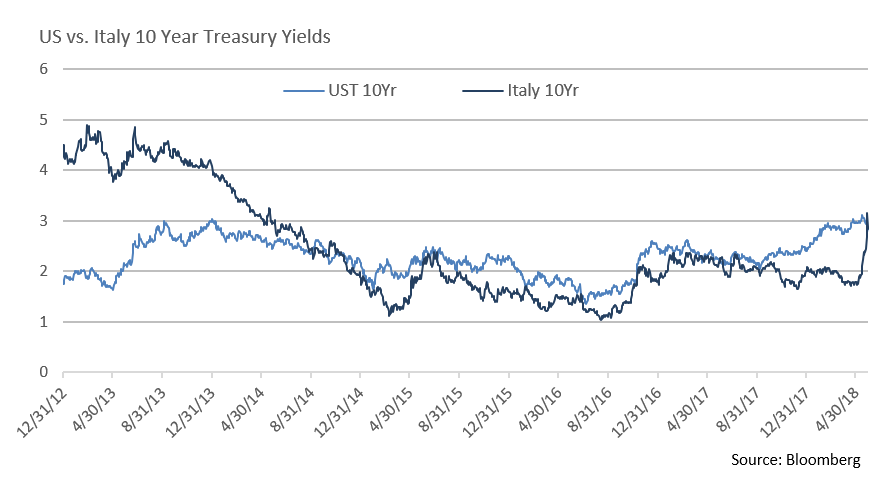

- This past October the European Central Bank (ECB) decided to continue its asset purchase program of Italian debt well into 2018, thereby pushing Italian bond yields well below 2.00% and prompting a yield bifurcation with US Treasuries, which moved higher over subsequent months. This trend ended abruptly on May 29th when the Italian 10Yr suddenly spiked 45 basis points to 3.15% on fears that the country’s political turmoil would impact its financial system. This prompted a “risk-off” trade, sending US Treasury rates sharply lower. In fact, the single day 15 basis point drop in the UST 10Yr represented the second largest one day yield decline in 50 years. The UST remains a risk-off investment of choice, intrinsically connecting the US taxable markets to global economic and geopolitical events in a manner we believe investors cannot afford to ignore.

Public Sector Watch

Credit Comments

- The IRS and the Treasury Department recently threw cold water on states looking to aid residents impacted by the new tax law’s $10,000 limitation on state and local tax deductions. The IRS notice said the new federal regulations will “assist taxpayers in understanding the relationship between the federal charitable contribution deduction and the new statutory limitation on the deduction for state and local tax payments.” A public warning by the IRS and Treasury, regardless if new rules are adopted or not, most likely puts an end to most, if not all, of the workaround plans. In the nearterm, the credit impact to “high-tax” states and local governments should be muted, although the ability over a longer period to increase taxes could be compromised. High investor demand for in-state paper, as experienced throughout the first five months of 2018, should remain given the lack of alternative tax minimization options.

- Will sports gambling become the state revenue windfall many expect? We tend to doubt it. The US Supreme Court overturned the Professional and Amateur Sports Protection Act on May 14th, striking a law that prevented states from permitting sports betting. The ruling will allow legal sports-books to begin operations nationwide and likely setting off a scramble by operators and states to explore potential opportunities. New Jersey, Connecticut, New York, Pennsylvania, Delaware and Mississippi have already enacted legislation with the expectation that the Act would be overturned. Other states are also expected to move quickly. While expanded sports betting will likely lead to higher gambling taxes and fees for state and local governments, we caution that the ultimate impact will likely be more moderate than many expect. Cross-state border competition along with ongoing black-market operations represent factors that will likely prevent legalized sports betting from becoming the budget panacea statehouses long to enjoy.

- Colorado’s lawmakers’ last-minute bill to stabilize the State’s pension system highlighted a size-able discrepancy in state-tostate legal flexibility. The bill calls for cuts to retirement benefits and requires increased contributions from both the State and employees. Benefit reforms include raising the retirement age and reducing cost-of-living adjustments. While Colorado’s reforms will likely be challenged, the proposal illuminates clear distinctions between laws and protections from state to state, including the legal ability to make unilateral changes. Assessment of pension and retiree obligations remain an important part of our research process, not only in terms of asset and liability analysis, but also state specific legal and actuarial factors.

Strategy Overview

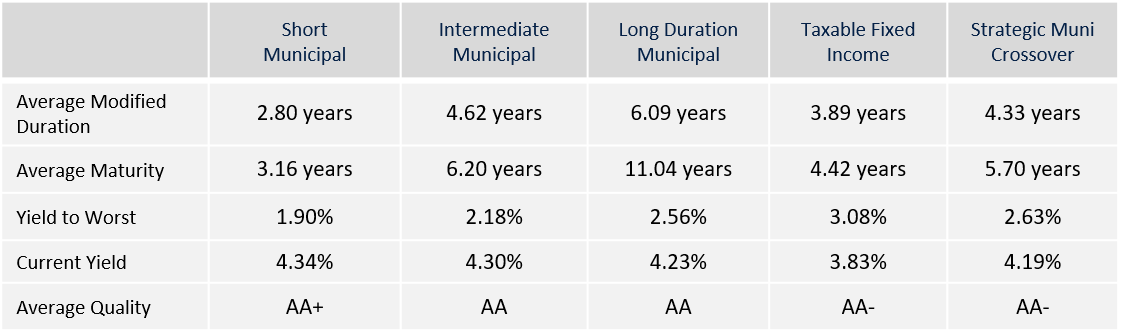

Portfolio Positioning as of 5/31/2018

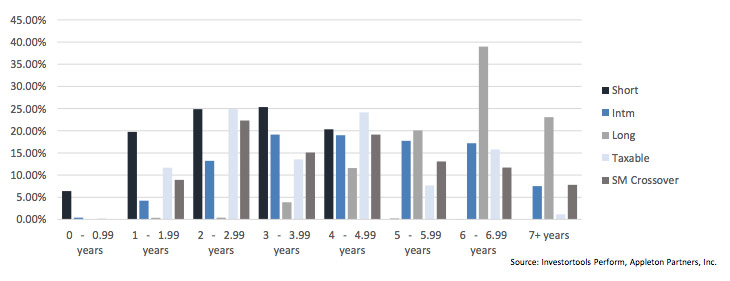

Duration Exposure by Strategy as of 5/31/2018

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.