Insights and Observations

Economic, Public Policy, and Fed Developments

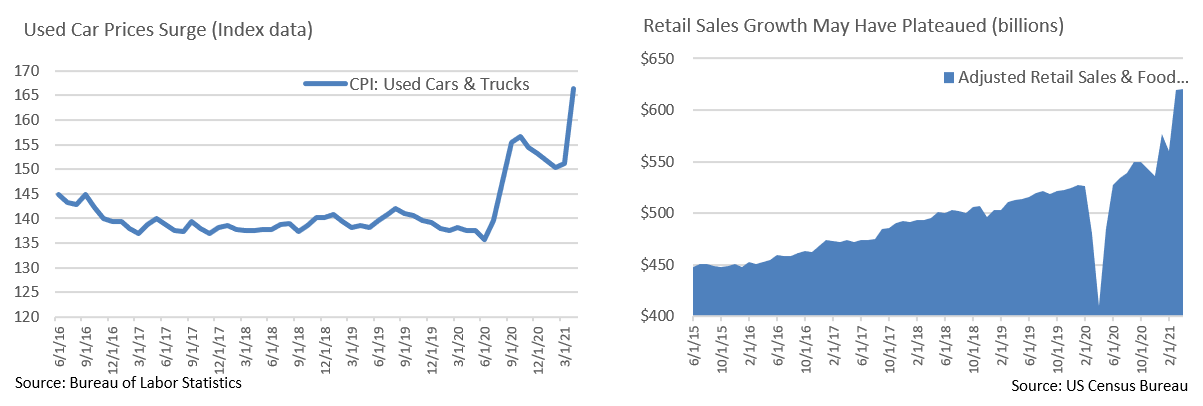

- The long-awaited “transitory” inflation spike arrived in a big way in April (data reported in May), with headline and core CPI handily beating expectations at 0.8% and 0.9% respectively, bringing core to 3.0% YoY. Meanwhile PPI doubled monthly expectations of 0.3%, coming in at +0.6%. Some of this is “reflation” more than true inflation – airfare and hotel prices, for example, made sizable contributions, yet are merely returning to pre-pandemic levels. However, supply chain bottlenecks are also pushing prices up. The impact of microchip shortages on car production is well known – used car prices have surged nearly 20% from the end of 2019. Chinese crackdown on commodities speculation will also likely take some pressure off commodity prices. The Fed – and we at Appleton – still believe the uptick in inflation will be transitory, but it will not fully pass until global supply chain pressures ease.

- Consumer demand may also be plateauing. April’s retail sales were flat vs 1% expectations. While it was on the back of a prior period revision from 9.8% to 10.7% and the nominal level was essentially as forecast, meteoric post-pandemic sales growth seems to be slowing. Meanwhile, a sharp -13.1% drop in personal income was entirely driven by a fall in transfer payments as stimulus payments ended. This should dampen consumers’ heightened ability to spend in coming months. Demand appears to still be strong, but it should soon fall from current stratospheric levels.

- The state of the US workforce remains challenging to read. Weekly unemployment claims have trended down for the last several months, although 406k reported on May 22 was still well above historical norms. However, declines in continuing claims have largely been offset by increases in pandemic emergency unemployment coverage, suggesting that people are dropping off unemployment not because they have found new jobs, but because they had shifted to emergency benefits after conventional unemployment benefits expired. In an economy where labor is in high demand, there is growing evidence of bifurcation and long-term unemployed workers struggling to find work.

- The April unemployment report did little to clarify the labor picture, either. The report missed badly, with 266k new jobs reported vs. expectations of one million. Below the surface the picture was more nuanced; leisure and hospitality employment growth was decent, with 366k new jobs created. There was also a pronounced drop in those reporting they were unable to work or had lost hours due to the pandemic, from 11.4M to 9.4M. Widespread underemployment, with employers cutting hours rather than positions, muted last year’s job losses, but this could also be hindering job gains as the recovery unfolds. All in, the employment report was probably not as dire as the headline number suggests and may be ripe for revision anyway.

- Despite protestations that it was “too early to be thinking about thinking about tapering,” the Fed surprised market participants when their minutes from the April 27-28th meeting revealed that they had been doing just that. The Fed opened with an internal report on market expectations concerning the rate of tapering. The timeline revealed an announcement is not likely before January 2022, tapering beginning in March and ending in December, and initial rate hikes unlikely before September 2023. Several meeting participants indicated that if economic data continues to come in stronger than expected, they may need to discuss preparing the market for an earlier taper. While yields initially spiked on the news, they quickly traded back down. The release went on to indicate that any deviation from market expectations was, at present, not appropriate, and would need to be clearly communicated well in advance. Still, a close reading of Fed minutes and statements in coming months will be important to see if the minority view that earlier moves may be needed gathers support.

From the Trading Desk

Municipal Markets

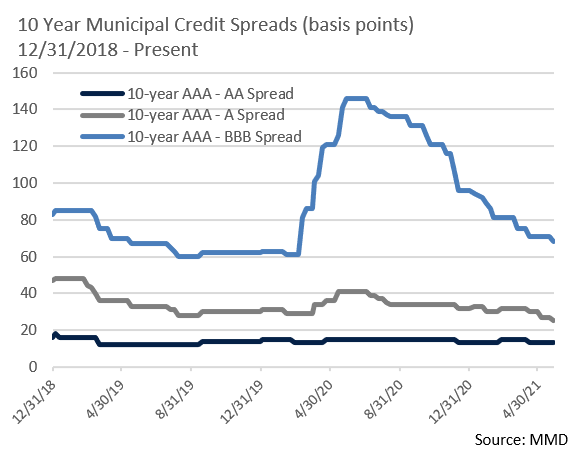

- Despite intramonth volatility, the 2Yr and 10Yr AAA municipal curve returned at month’s end to the same place it began May, with the 2Yr at 10 bps and the 10Yr at 99 bps. What remains noteworthy is relative value within the intermediate portions of the curve, as 89 bps of spread between 2Yr and 10Yr maturities offers an integral component of total return as bonds “roll down the curve”.

- Retail demand for municipal bonds remains a constant as evidenced by mutual fund inflows. YTD net inflows have reached $48B, already more than half of 2019’s “normalized” full year inflows of $93.6B. Consistency of demand is evidenced by 34 consecutive weeks of positive net inflows dating back to October 2020. The Biden Administration’s policy agenda is likely to intensify demand for tax-advantaged investments, and with credit quality strengthening for the most part, we anticipate a sustained strong bid for municipal securities.

- Municipal demand is also evident when looking at compression across the credit curve. State of Illinois GO bonds maturing in 10 years are now the tightest they have been since the 2008-’09 financial crisis. While, in this example, some spread compression can be attributed to credit improvement and extensive Federal support over the course of the pandemic, much of the move has also been driven by investor demand for yield. Anecdotally, we continue to see credit spread tightening and are actively looking for issuers and structures offering incremental relative value while avoiding taking on inadequately compensated credit risk.

Corporate Bond Markets

- Investment grade corporate credit spreads traded narrowly for most of May with very little movement and well contained volatility. This was followed by a month-end rally that drove spreads to 14-year lows. The 84 bps OAS on the Bloomberg Barclays Corporate Bond Index is at a level not seen since January 2007. It is worth emphasizing that the 10Yr UST was trading at 4.80% at that time, as opposed to 1.60% as we write. Historically speaking, these are not the lowest IG spreads on record. That honor belongs to the first half of 1997 when IG corporate spreads fell to a mid-50 bps range. What this indicates to us is that investor demand and credit confidence matter most, and corporate OAS can be driven quite low during very different yield environments.

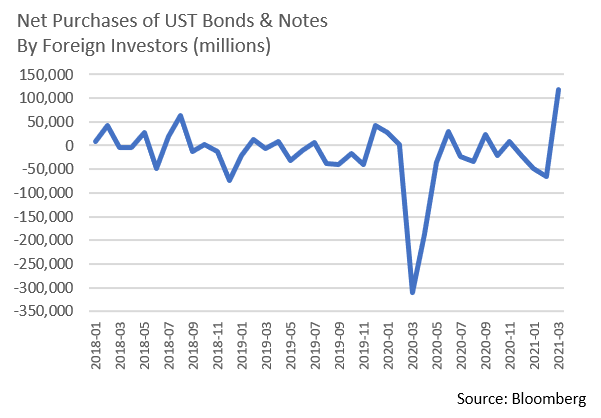

- Demand for Investment Grade credit continues to be exceptionally strong with a noticeable uptick in foreign buying across the US fixed income markets. According to the Treasury International Capital System (TIC), which is on a 2-month lag, net purchases of USTs by foreigners reached $118.9B in March vs. net outflows of $65.5B in February. Total net corporate bonds purchased rose to $43.1B in March, up from $14.5B the month prior. The combination of incrementally higher nominal yields, strong US credit conditions, and favorable hedge adjusted yields have all fueled growing non-US buying demand.

- Historically low borrowing costs have also helped corporate issuance remain solid. Although the $136B in new issuance in May was lower than expected, the overall tone allowed issuers to pay minimal to zero concessions relative to outstanding debt. That is also evident within the lowest tiers of the Investment Grade credit spectrum as the BBB ratings category makes up almost 52% of the overall market. Compression between BBB and Single A credit spreads is getting narrower and consolidation in the BBB ratings bucket is apparent.

Public Sector Watch

Credit Comments

Reversal of Fortune: States Now Reporting Large Surpluses

- What a difference a year makes. Almost exactly a year ago, California Governor Newsom was warning that the State faced dire budgetary consequences due to the COVID-19 pandemic, with a $54B deficit anticipated. Fast forward to this budget season, and the Governor is now touting a $75B surplus (although others “conservatively” peg the surplus closer to $38B). This remarkable fiscal reversal has largely been driven by a successful transition to work-from-home among wealthy households, strong investment markets, and massive amounts of federal aid.

- California is hardly alone:

- Texas is now expecting a $725M surplus vs. a $1B deficit projected just four months ago.

- Michigan has revised its revenue projections up $3.5B, 7.1% above previous estimates.

- Illinois, the only state to borrow from the Fed’s Municipal Liquidity Facility, plans to repay $2B of that loan earlier than scheduled.

- Connecticut, a state that was projecting a $2.1B deficit as of August 2020, now expects to add $1.4B to its reserves. Their rainy-day fund balance is expected to reach $4.5B, a very healthy 22% of expenses.

- New Jersey was expecting a deficit of $4.3B but is now budgeting for a $6.3B surplus as sales tax collections and real estate sales fees are running far ahead of prior projections.

- These and other budget headlines point to a powerful tailwind for municipal credit conditions. Amid these many near-term positives, we will be carefully monitoring how state and local governments utilize their newfound wealth and are hoping to see longer-term impact.

- In our view, sustained credit quality enhancement is often evidenced by positive economic development initiatives, rebuilt reserves, structurally balanced budgets, and improvement in long-term liability funding levels associated with employee health care and retiree benefits.

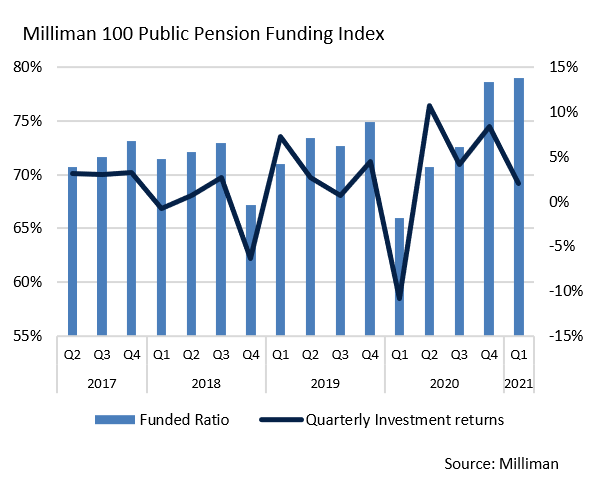

Pension Funding Boosted by Market Strength

- Q1 ‘21 marked the fifth consecutive quarter of improving pension funded ratios according to the Milliman Public Pension Funding Index (PPFI) report, which covers the 100 largest US public pension funds. The funded ratio climbed 0.5% quarter-over-quarter to 79%; the highest ratio recorded since Milliman began tracking the index. The net pension liability decreased by $12B to $1.166 trillion.

- Funded ratios have been bolstered by surprisingly strong investment returns since Q1 ’20, a time period that saw the funded ratio drop to 66%. Despite modest Q1 ‘21 returns of +1.95%, the average annualized return for the 12 months ended 3/31/21 was +27.37%.

- Wilshire Consulting reported similar results, estimating an aggregate state pension plans’ funded ratio of 81.3%, the highest level since Wilshire began quarterly reporting.

- Many of the largest public pension funds reflect this trend, as illustrated by New York State’s $254.8B retirement system, the third-largest U.S public pension fund, returning a record +33.6% for the fiscal year ended 3/31/21.

- Although impressive investment returns have alleviated some near-term funding pressures, not all pension problems have been solved. One must not forget that total pension liabilities have also been growing, albeit at a slower pace. According to the Milliman PPFI, total liabilities reached an estimated $5.56 trillion at the end of Q1 ‘21, up from $5.51 trillion in 4Q ‘20. If investment returns soften, or states begin to ease contributions, these positive trends could reverse. Appleton will continue to monitor each individual issuer’s pension situation as part of our credit due diligence process.

Strategy Overview

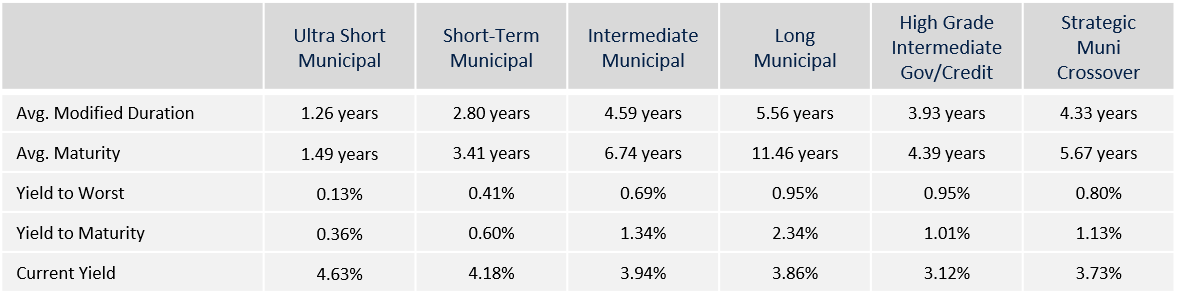

Composite Portfolio Positioning as of 5/31/21

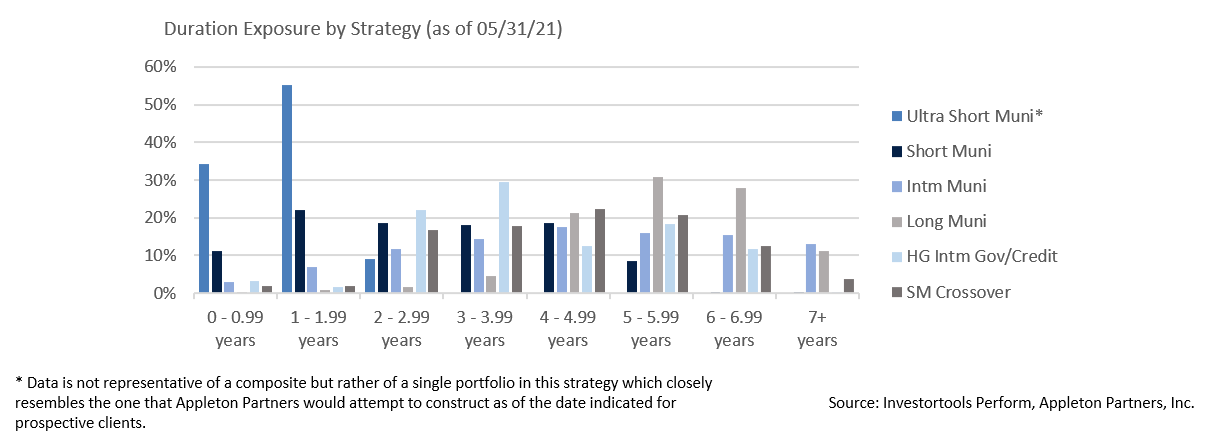

Duration Exposure by Strategy as of 5/31/21

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.