Insights and Observations

Economic, Public Policy, and Fed Developments

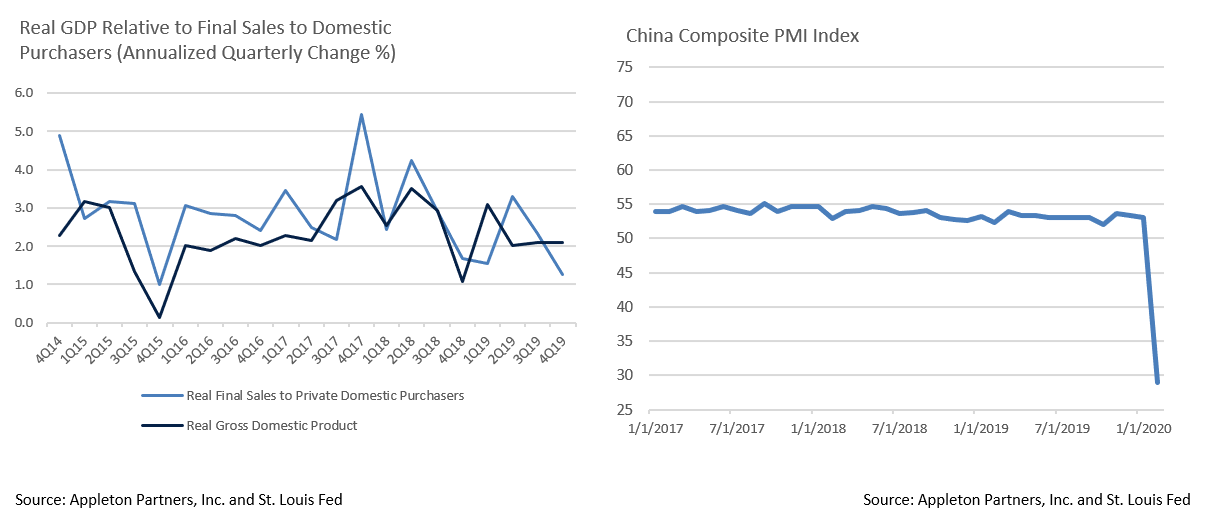

- Coronavirus fears began permeating the market in earnest in February, as reports of European supply chain disruption caused investor skittishness early in the month. Fear came to a head over the weekend of February 22nd, however, when a sudden uptick of cases in Italy, South Korea, and Iran compromised hopes for Chinese containment. Equities skidded into correction over the following week while Treasuries set record lows, with the 10Yr Treasury touching 0.909% midday on March 3rd before closing at 1.00%. Abysmal Chinese PMIs (the composite dropped to 28.9), the lowest on record (readings below 50 indicate contraction) provided compelling evidence of economic pain. This points to a profoundly negative impact on business supply chains and consumer demand due to necessary virus containment measures.

- This comes at a challenging time for the US economy, as evidence suggests consumer demand had already begun to lag before Coronavirus gripped the markets. Retail sales weakness continues, and while technically the headline 0.3% met expectations, the control group (a component of GDP) was flat, with December revised down three tenths to 0.2% and November revised down a tenth to -0.2%.

- Meanwhile, the PCE deflator, an important personal consumption indicator, dropped from an already sluggish 1.3% to 1.2%. Should Q1 consumption fall significantly it would be off an already weakening base, leading to a critical forward-looking question of whether Coronavirus fears are merely delaying economic activity or displacing it entirely. The bond market is pointing to the latter, while equity bulls are counting on the former.

- The Fed responded to the sharp repricing of Coronavirus risk on March 3rd with an unusual between-meeting 50 basis point rate cut, the first time they had adjusted rate policy between meetings since the Financial Crisis in 2008. This failed to sooth the markets, and further rate action is likely. Futures markets quickly priced in most of an additional rate cut at March’s meeting.

- In other Fed news, Trump Fed nominee Judy Shelton testified to the Senate Banking Committee on the 13th. A highly partisan pick, Shelton was a Trump campaign advisor who has advocated for a return to a gold standard, and for the Fed slashing rates to weaken the dollar and discourage banks from depositing money at the Federal Reserve. Her testimony met bipartisan resistance, and Shelton’s nomination may ultimately be pulled. That would likely be well received by markets given the uncertainty her views introduce. If seated, she could become Trump’s pick to replace Jerome Powell at the end of his term.

From the Trading Desk

Municipal Markets

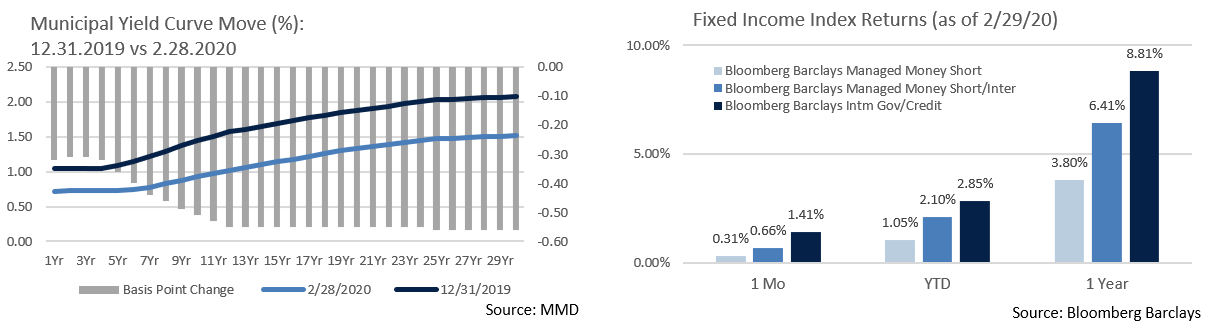

- The municipal curve is pushing lower and flatter on the heels of a pronounced Coronavirus influenced flight to quality trade. Over the month of February, 2-year AAA municipal yields fell by 10 basis points and 10-year AAA by 21 basis points. The 2-10-year spread ended the month at only 21 basis points versus 36 basis points at year-end 2019.

- Despite these low yields, which we discussed in “Operating in A Low Yield Environment,” mutual fund investors continue to see the value of municipals as a source of portfolio stability and tax-advantaged income. Tax-exempt funds have enjoyed another $23.6 billion in net new flows YTD in 2020, reaching 60 consecutive weeks of positive net inflows.

- Given this favorable backdrop, municipal performance has remained very strong. The Bloomberg Barclays Managed Money Short/Intermediate Index has returned 2.10% YTD through February.

- Taxable issuance has also been a major story, accounting for about 35% of total municipal issuance for the year. This is roughly 320% higher than the same period of 2019. Generally, the increase in taxable issuance reduces the supply of traditional tax-exempt offerings, a dynamic supportive of tax-exempt municipals. With yields driving lower, we anticipate additional large taxable issuance levels over the near-term, another positive technical factor.

Taxable Markets

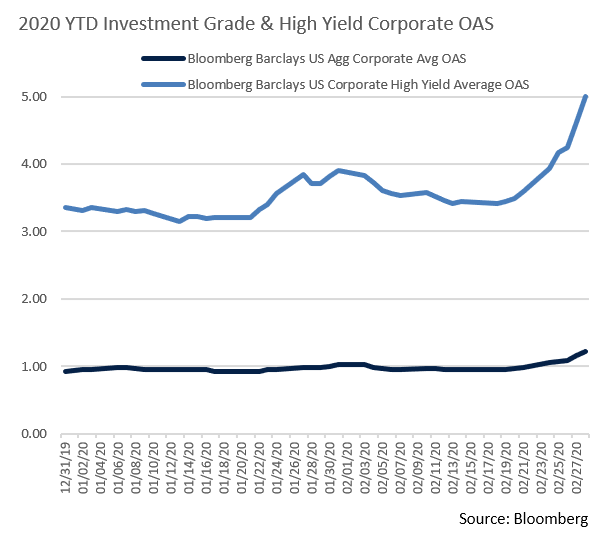

- Corporate issuance closed January up 26% YoY and remained strong into February before extreme market volatility forced issuers to the sidelines. No deals came to market during the last week of February. The $86.67 billion of supply from earlier in the month reduced 2020 YoY volume by 8%. This has left pent up demand and issuers are standing by waiting for stability to return to the markets. Once a sense of normalcy returns, we expect as much as $50 billion of new issuance. Buyers are ready and we anticipate these offerings will be well received, thereby keeping a lid on corporates spreads.

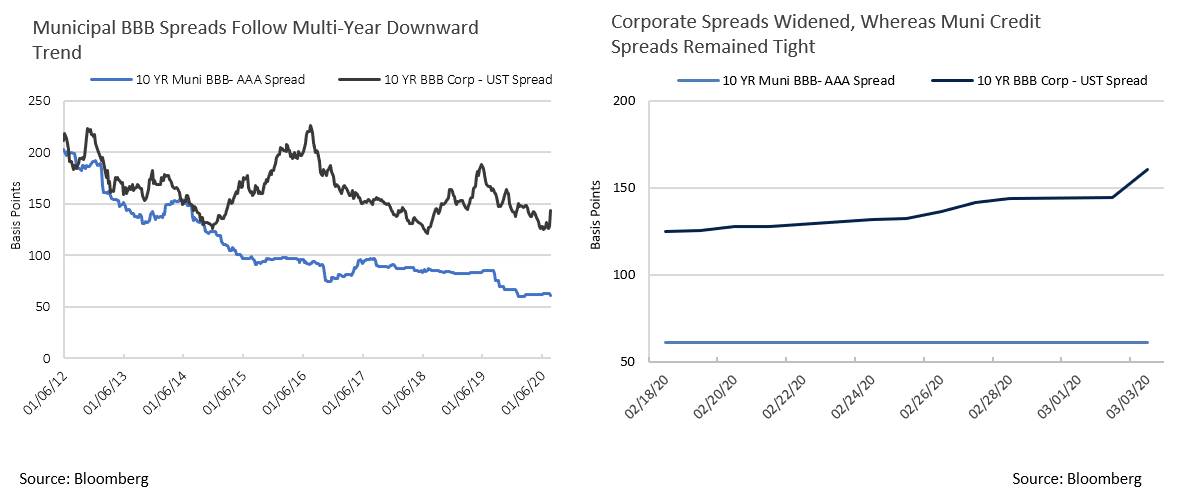

- Investment grade issues tightened through most of the month until the Coronavirus sell-off drove spreads in the other direction. Spreads ended the month at the widest levels since September of 2019, and the 8 basis points (7.4%) of widening from February 27-28 was the largest one day jump since the Financial Crisis. Notably, the stronger the credit quality the better pricing fared, as flight to quality moves tend to hit lower quality issues with far more vigor. High Yield option-adjusted spreads rose over the last week of February from 331 to 500 basis points, while CCC-rated corporate spreads (a quality rating we do not hold) exceeded 1,000 basis points over US Treasuries for the first time since August 2016. This market action speaks to our focus on more resilient, high quality, liquid corporate bonds.

Public Sector Watch

Credit Comments

Coronavirus Impact – A Deeper Dive

Last month we took a high-level look at potential municipal credit impact should the effect of the Coronavirus significantly worsen. We now are sharing additional thoughts concerning sectors and credits that may have heightened exposure. Given a multi-year compression in credit spreads and the lack of reaction in the tax-exempt market last week, we believe the margin of safety priced into lower-rated and non-rated municipal entities is generally slim and may be insufficient given the Coronavirus’s potential economic disruption. In any environment, these areas of the market lie outside of our typical buying preferences, but may still be illustrative of credit trends.

Airlines – Leisure and business travel will be one of the first activities curtailed amid a widespread outbreak of the virus. United Airlines, American Airlines and Delta all have high yield municipal debt outstanding. Although their direct exposure to China is less than 7% of capacity according to Barclays, domestic and international travel outside of the highest impact regions will also be impacted. Despite savings from falling oil prices, lower utilization should weigh heavily on revenues and potentially credit quality.

Senior Living – The data points to higher mortality rates among seniors infected by the Coronavirus. In fact, the first US deaths reported were residents from the same nursing home in Kirkland, WA. Senior living facilities are vulnerable to health outbreaks of this nature due to their demographics, often pre-existing fragile health of their residents, residents living in proximity of each other, and the negative impact a wave of deaths can create in terms of attracting new residents.

Higher Education – Certain institutions that historically benefited from high international student populations (China in particular) may experience a drop in Fall 2020 enrollment. Depending on the length of the outbreak and severity of travel bans, some international students may not attend in the Fall, leaving universities to scramble to cover lost tuition revenue.

Convention Centers & Hotels – Similar to airlines, convention centers and hotels would be negatively impacted should business and leisure travel be curtailed for a sustained time period. Municipal bonds that financed these properties are often backed by hotel taxes, rental car fees, or other local taxes. These economically sensitive revenues would likely decline, thereby pressuring credit quality.

Project Financing – Lower yields and reduced tax-exempt supply has provided a tailwind for speculative municipal projects financed in the tax-exempt markets over the past few years. Many of these enterprises require two-to-three years of construction and ramp-up prior to generating adequate revenue coverage. If economic activity were to seriously contract, even for a short period, projects that are incomplete or not at full utilization may struggle to meet debt costs, necessitating restructuring.

Strategy Overview

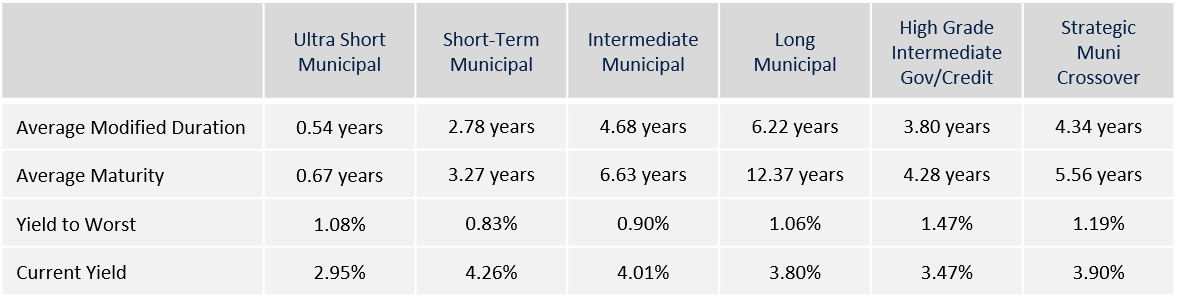

Portfolio Positioning as of 2/29/20

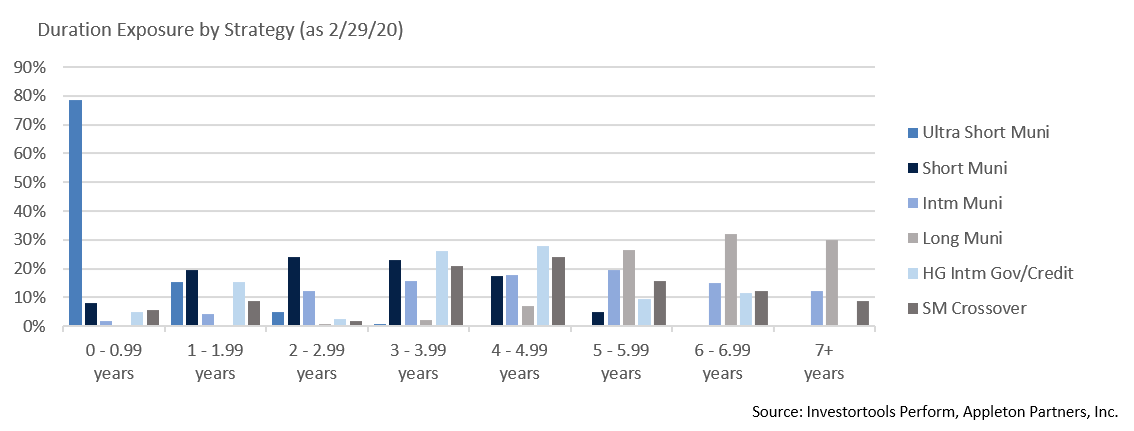

Duration Exposure by Strategy as of 2/29/20

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.