Insights and Observations

Economic, Public Policy, and Fed Developments

- As we write, the House has passed President Biden’s $1.9 trillion stimulus bill, which the Senate is expected to take up this week. The bill will not be exactly as initially proposed – a $15 minimum wage increase fell afoul of reconciliation rules and has been removed – although the proposal has emerged largely (and somewhat surprisingly) intact. Further income limits on $1,400 stimulus checks have been implemented and a decrease in supplemental unemployment benefits from $400 to $300 is expected. Passage appears likely although it will be a test of the Democrats’ narrow control of both houses of Congress. Democrats hope to sign a bill into law before expiration of unemployment benefits on March 14th.

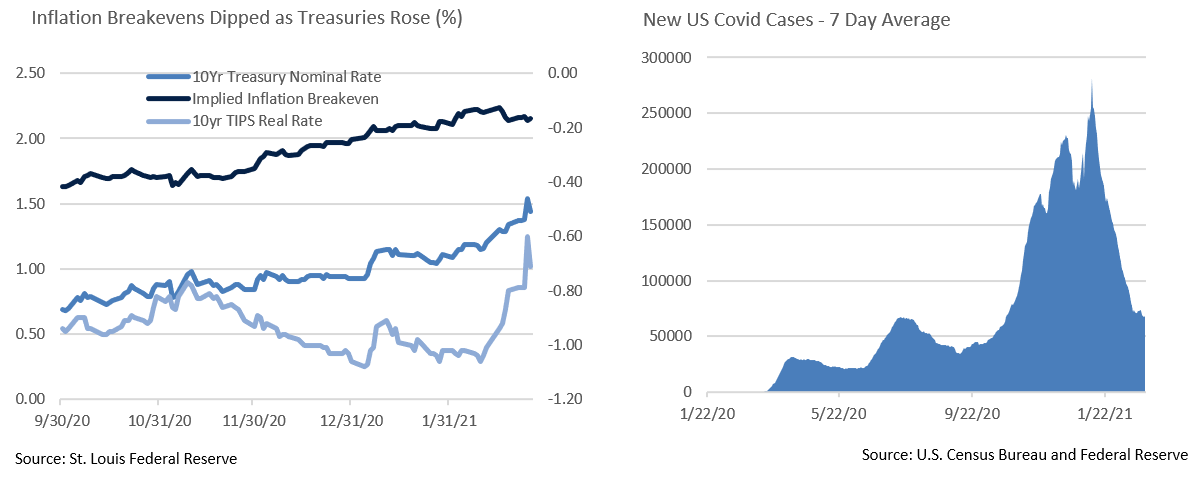

- Partly in response to the growing likelihood of a larger-than-expected stimulus bill, as well as a pronounced decline in COVID-19 cases and rising vaccination rates, Treasuries sold off in late February. The 10Yr briefly broke 1.60% before settling into a 1.40% range at month’s end. While the prevailing narrative is that the surge in yields is being driven by inflation fears, there is little current evidence of inflation, and the 10Yr TIPS breakeven rate, a measure of market inflation expectations, actually began dropping right around the time Treasury yields spiked. An increase in real rates from deeply negative levels appears to be a major factor, and some yield normalization is a sign of a healthier economy. While YoY comparisons will likely introduce noise in coming months, CPI also surprised to the downside in February.

- The labor market was even weaker than it appeared over the winter. January payroll numbers came in at only 49k new jobs added, while December and November were revised down by a combined 159k. However, there is encouraging evidence of improvement in weekly initial unemployment claims. Although still elevated, they continued trending down in February, in line with COVID-19 case counts. FDA approval of Johnson & Johnson’s single-shot vaccine and an aggressive US vaccination push offers considerable cause to hope for further job market gains. A concern lies in the potential for heavy temporary job losses in the retail, leisure, and hospitality sectors to become permanent if business failures exceed consensus expectations.

- An economic bright spot has been retail sales which surged 5.4% in January. Seasonal adjustments are complicated during a period where holiday shopping was anything but normal, but the simplest explanation may be the most accurate – stimulus checks delivered at the end of December likely were spent, not saved (there was no increase in the Fed’s Demand Deposit totals). This should be modestly additive to 1Q GDP.

- President Biden is rumored to be considering two names for the Fed Board of Governors – Michigan State Economics Professor Lisa Cook, and Howard University Professor William Spriggs. Cook earned degrees in Physics and Philosophy before completing a PhD in Economics from UC Berkeley and would bring a strong technical background to the Fed. Spriggs was an economist under the Clinton and Obama administrations, and with the AFL-CIO. Both have worked extensively on the impact of racism on economic outcomes, and we feel they would each be well qualified to join the Fed, if nominated.

From the Trading Desk

Municipal Markets

- After seeing bond yields grind lower and lower for an extended period, municipals finally reversed course and began to track upward pressure on Treasuries. 10Yr AAA municipals spiked from 0.87% to 1.14% over the last week in February and by 45 bps over the last two weeks.

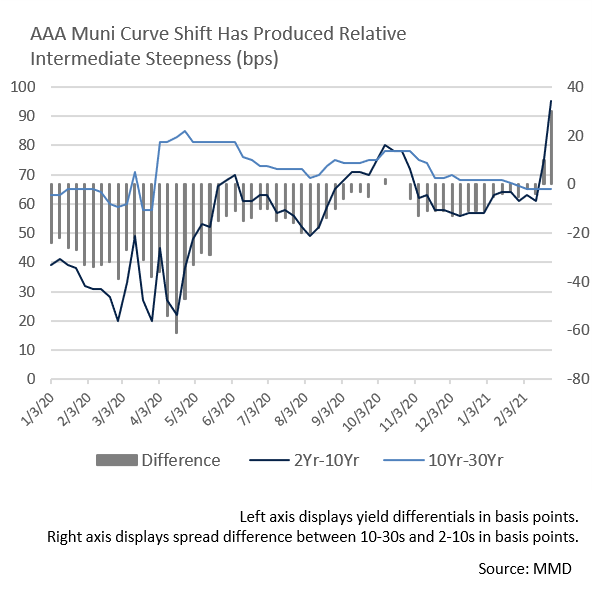

- Curve steepening has been most visible among intermediate maturities, as the short end is still anchored by the Fed and 10-30Yr yield differentials have largely remained flat. By contrast, 2-10Yr AAA muni spreads increased 20 bps to 95 bps last week. We will gladly take advantage of an ability to add incremental yield when extending portfolios and find the 6 to 10-Yr maturity range to be an attractive position on the curve. Financial advisors and investors are grappling with the prospects of future inflation and upward rate pressure. It is our belief, as outlined in a newly published white paper, that active managers have considerable advantages relative to passive strategies during times of cyclical change.

- Market technical factors remain solid despite a recent pop in UST yields. Municipal supply is still modest with about $11.2 billion expected to come to market over the first week of March according to Ipreo, only $7 billion of which is tax-exempt. Municipal fund net inflows continue to be positive, although last week’s $38 million was the lowest recorded since September 2020. YTD net fund flows are +$26 billion.

Corporate Bond Markets

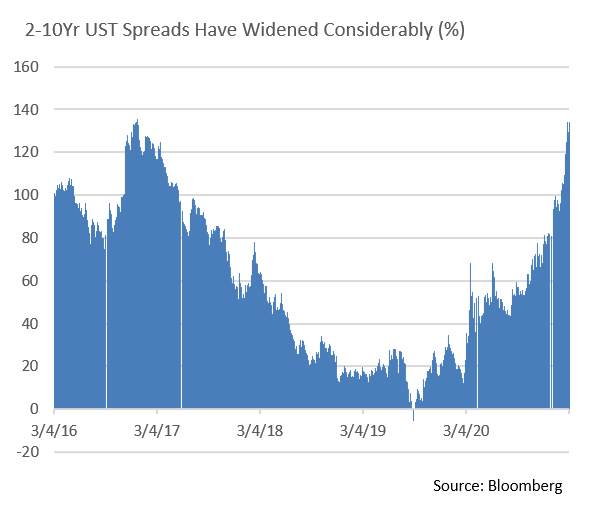

- Curve steepening was evident over the first two months of the year. A sizeable move up in rates during February drove 10Yr UST yields from 1.07% to 1.41%. This reflected concern over inflation prospects, as well as an increase in real rates in response to heavy Treasury issuance and an anticipation of accelerating growth. The spread between 2-10Yr USTs at the end of the month reached 127 bps, a level not seen since mid-March 2017.

- Amid the UST sell-off, the Investment Grade Corporate market remained healthy with credit spreads intact. In fact, spreads are tighter now than at year-end 2020 and taking on credit exposure has generally been additive to performance. The Bloomberg Barclays IG Corporate Index has tightened from 96 bps at the start of the year to 90 bps, a healthy market indicator. Most spread tightening has been at the front of the curve; longer spreads are little changed and have tended to move more closely with Treasuries.

- Despite reasonably strong January and February issuance ($265.2B vs $220.4B over the same period of 2020), we expect to see supportive technical factors continue in 2021. The market expects negative net issuance over the full year after a very heavy 2020 calendar left corporations well capitalized. We remain positive on high quality corporate credit and are seeking to capitalize on the incremental yield offered by a bear steepening yield curve.

Public Sector Watch

Credit Comments

Winter Freeze In Texas Impacts Residents and Energy Suppliers

- As in all such situations, we first acknowledge the tragic loss of life and recognize the severe personal and economic disruptions that have occurred. Our comments below solely relate to credit implications.

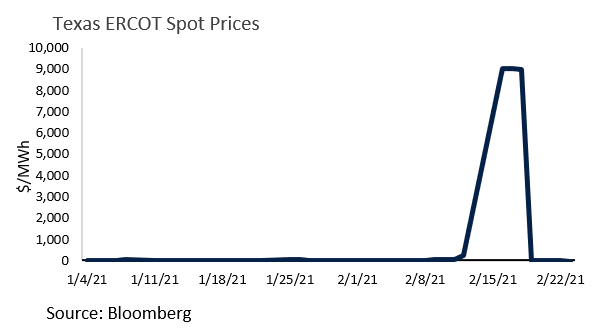

- Texas faced extreme winter weather and historically low temperatures during the week of February 14th, causing demand for electricity and gas to soar and disruptions in energy delivery throughout the service area of the Electric Reliability Council of Texas (ERCOT), the State’s grid operator.

- Energy providers that could not meet the requirements of their supply contracts at pre-negotiated prices were obliged to buy in the open market. As a result, spot prices rose to as high as $9,000/MWh and spot gas increased to over $200/MMBtu, compared to prices earlier this year of $20/MWH and $3MMBtu.

- Near-term challenges exist for some Texas bond issuers and municipal sectors impacted by these developments. However, we expect Appleton held credits to weather this period well, a reflection of our preference for large, well-established issuers.

Municipal Issuer Credit Implications

- State of Texas – The State’s credit should not be materially affected by a loss of economic activity during the rolling blackouts. We believe the impact will be minimal due to the limited time involved and expect FEMA aid will also help in cost recovery. Texas is more insulated from volatility in the energy sector than many presume. Severance taxes represent only 7% of total revenue and they do not fund general operating expenses.

- Local Governments – The impact on cities and towns will also be driven by lost tax revenues during blackout and cold weather periods when economic activity came to a halt. Smaller issuers are likely to be more challenged given their more limited reserve and resource bases. Large cities that benefit from a diverse tax base should be able to adjust budgets as needed. While the slowdown in drilling activity may impact certain energy intensive areas of Texas, we typically avoid municipalities with high reliance on energy and power, as many of them have concentrated tax bases.

- Public Power – The largest and most sustained impact lies in the Public Power sector. Those that distribute power to end-users were forced to pay extremely high prices in the open market and may not be able to pass through costs to customers over the near term. While this has created stresses, Appleton-held public power utilities are supported by substantial access to liquidity. Internal cash reserves and external lines of credit have provided needed resources while utilities work to secure long-term financing. While politically difficult at the moment, these entities benefit from unregulated rate-setting authority and may eventually be able to recover costs. Federal aid is also likely to provide some relief.

- Not all utilities will escape from these events unscathed. Texas’s largest power generation and transmission cooperative, Brazos Electric Power Cooperative, filed for Chapter 11 bankruptcy protection after incurring $2.1B in charges in just one week. This was more than double their entire 2020 power costs. Appleton Partners does not own Brazos Electric debt, nor is this an approved credit. We are monitoring our Texas public power exposure and have not made any changes to our portfolios. Proprietary analysis suggests that our holdings have ample liquidity and the means to cover costs incurred during these difficult times.

Federal Stimulus Should Further Aid States and Municipalities

- The House passed a $1.9 trillion stimulus package during the last week of February, largely keeping intact the proposal laid out by President Biden. The measure now moves to the Senate, where Democrats hope to swiftly incorporate certain changes and get the bill to the President’s desk before emergency provisions expire on March 14th.

- While Senate modifications are expected, we believe direct aid to state and local governments will be retained. The current amount is $350B, more than twice the funding these entities received under the CARES Act.

- Given prior stimulus aid and relatively solid tax revenue, we view additional support provided by the American Rescue Plan as a tailwind for municipal credit fundamentals. Many state and local governments will now have the financial flexibility to restore spending cuts made during the pandemic, as well as support economic recovery initiatives.

Strategy Overview

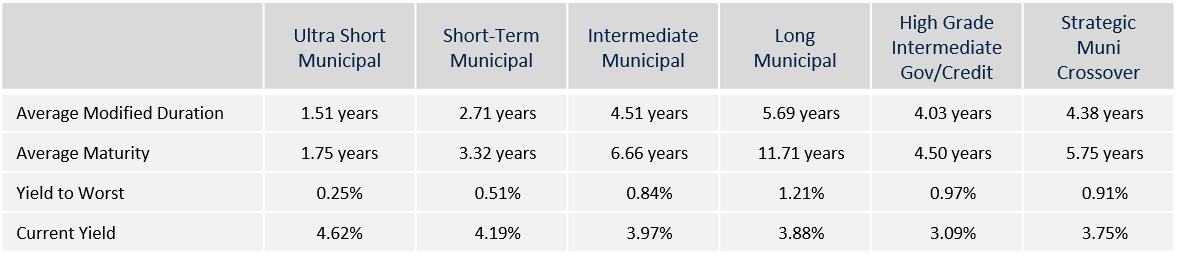

Composite Portfolio Positioning as of 2/28/21

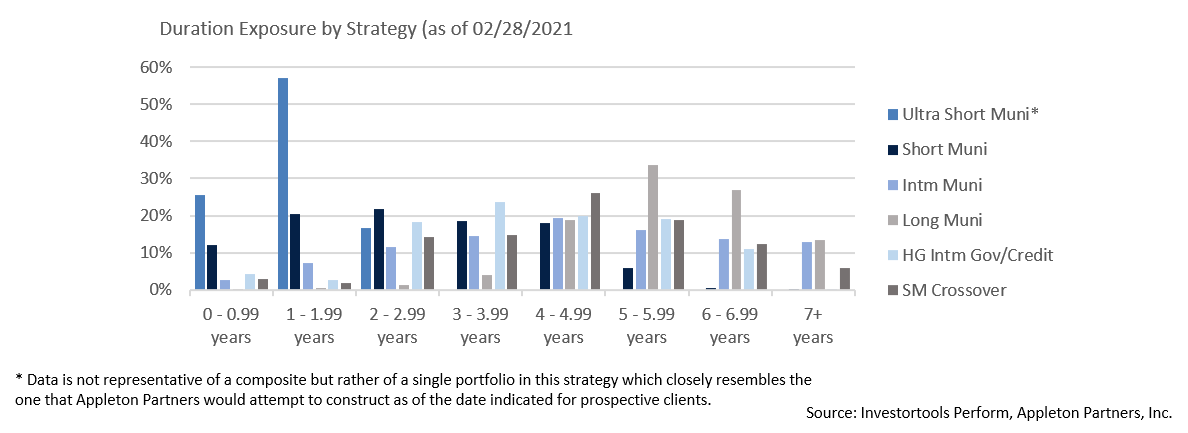

Duration Exposure by Strategy as of 2/28/21

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.