Insights and Observations

Economic, Public Policy, and Fed Developments

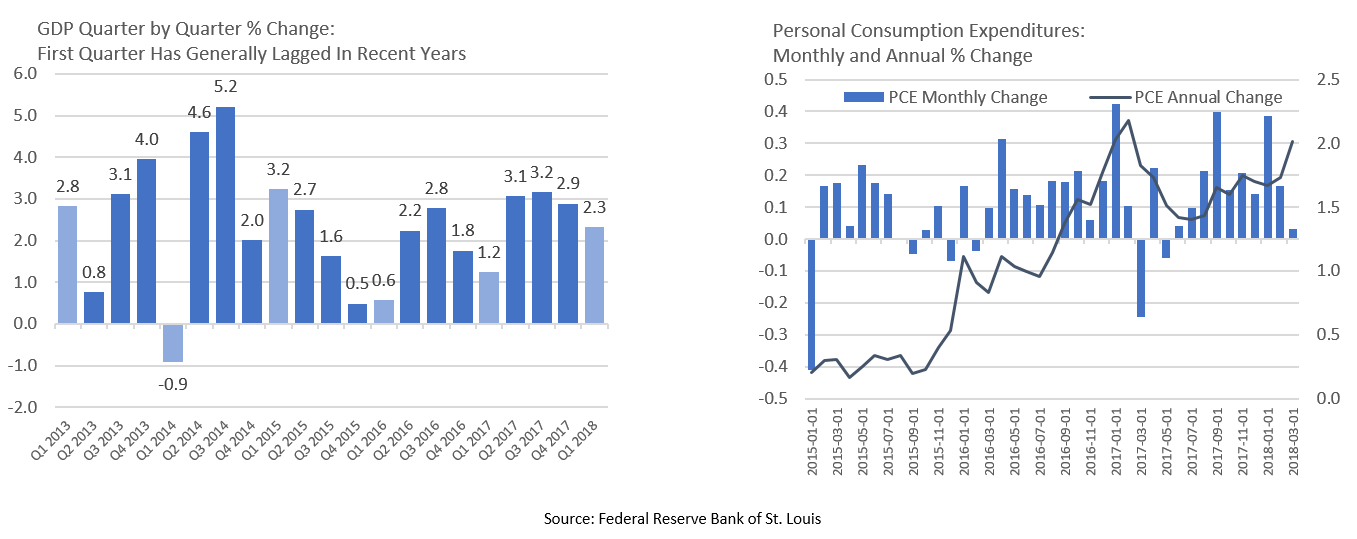

- After an unusually quiet 2017, markets have been on edge thus far in 2018. On the macro front, reading the economic tea leaves and assessing potential Fed response has been challenging. First quarter numbers failed to paint a clear forward picture, with a reported slowdown in GDP growth from Q4’s 2.9% to 2.3%, although the result exceeded Bloomberg’s median estimate of 2.0%.

- Beneath the headlines, solid wage growth of 0.9% belied unexpectedly weak personal consumption growth of 1.1%. Business investment also slowed, albeit to a still strong 6.1%. An inventory buildup from the fourth quarter of 2017 continued to grow. While the slowdown is expected to be temporary, further inventory buildup without a rise in consumption could drag on growth and restrain the pace of Fed rate increases.

- Headline PCE inflation finally reached the Fed’s 2.0% target in the first quarter, with core PCE not far behind at 1.9%. However, the monthly numbers suggest inflation peaked in January before slowing in February and March. The market’s response was quite limited and we do not foresee rapid acceleration.

- Trade policy receded from the headlines in April, although the issue has hardly gone away. Tensions returned on May 3rd as US and China trade negotiations began. While the administration’s last-minute decision to delay the steel and aluminum tariffs set to go into effect on May 1st was encouraging, the Chinese have indicated that Trump’s two chief demands, a reduction in $300B billion in state investment in high technology, and a rapid $100 billion reduction in the trade deficit, are not on the table. The US delegation’s mix of prominent free traders and protectionists adds policy uncertainty. Our expectation is that trade policy will likely create significant continued volatility, although the ultimate economic impact remains highly uncertain.

- April was a busy month on the Fed personnel front. John Williams was formally named the President of the New York Federal Reserve, the branch that oversees FOMC activity. Meanwhile, Richard Clarida and Michelle Bowman were nominated as vice chair and an open governorship spot, respectively. All three are considered establishment picks. Trump has largely stuck to “conventional” picks, naming well-qualified governors with pro-business and deregulatory views. The notable exception is Martin Goodfriend, a QE opponent, frequent Fed critic, and inflation hawk, whose nomination has stalled in the Senate.

- April also saw a substantial shift in FOMC policy expectations. Over the last several meetings the Fed has gradually raised its projected 2020 Fed Funds rate above its current assessment of the long term neutral rate. During the May meeting, language was adopted describing a “symmetrical” inflation target, one with acceptable deviation above and below the stated target. Coupled with meeting the target in March, the implication we envision is a Fed that believes unemployment is below its structural rate, and is prepared to let the economy run hot for the next year or two before eventually needing to tighten to cool economic growth.

- Meanwhile, as expected, the Fed left rates unchanged at their early May meeting. We continue to expect two further increases before year end, one fewer than the Fed’s own expectations.

From the Trading Desk

Municipal Markets

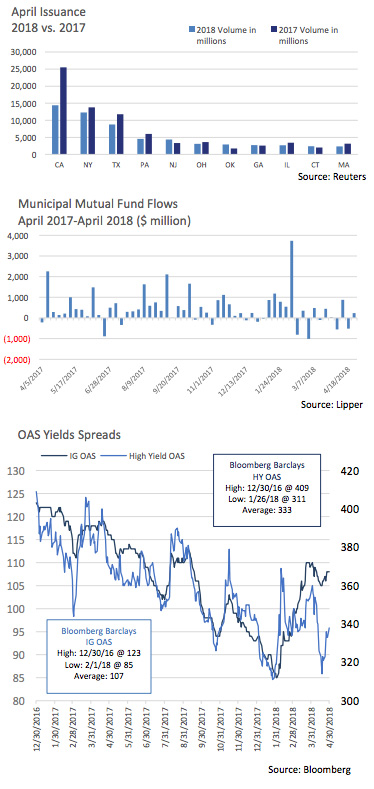

- Municipal issuance is down about 25% on a year-to-date basis compared with 2017. Given these supply limitations, coupled with increased demand due to the loss of the SALT deduction, spreads on bonds from high-tax states have compressed. California saw its new offerings decline by 44% relative to last April. New issuance from other high-tax states such as New York and Massachusetts also declined in April versus the same month last year.

- Further reducing issuance in the tax-exempt space is a sharp increase in taxable municipal refunding deals, as debt offerings of this nature replace tax-exempt supply. The result is a more limited supply of tax-exempt debt.

- The scarcity of available issues meeting our investment criteria is an added challenge for high grade accounts, however, lack of new supply has also been supportive of outstanding bond prices. With this in mind, we have recently been pushing towards the higher end of a typical 60-90 day build-out period for new accounts. This is particularly acute in high-tax states seeing sustained strong demand.

- April tax-exempt mutual fund inflows and outflows essentially cancelled each other out, leaving year-to-date net flows unchanged at +$6.5 billion. In our view, a slowdown in net inflows and recently uncertain sentiment reflects concern about interest rates and more active portfolio reallocation, although reinvestment at higher nominal yields is a positive.

Corporate Markets

- Risk appetite has remained high as the curve flattens, with high yield spreads tightening to levels not seen since early March. The Bloomberg Barclay High Yield Index OAS ended the month at 338 basis points. In the meantime, the spread between the UST 2Yr and the 10Yr contracted, and that part of the curve has gotten much flatter. Often times, as rates rise the preference for risk assets eventually lessens, although this has historically occurred with a size-ablelag and demand for high yield credit has remained robust. As the accompanying chart indicates, Investment Grade Credit spreads have moved more quickly, widening as the yield curve has flattened.

- Given the competition for global capital, the differential between various income producing asset classes can be revealing. The 10Yr and the S&P Dividend yield differential narrowed to 100 basis points towards the end of April with the 10Yr briefly crossing 3%. Declining differentials can prompt investors to gravitate toward bonds in their income-oriented asset allocation. We foresee continued volatility as the Fed assesses economic conditions and monetary policy. Nonetheless, credit quality is strong, demand for credit remains robust, and we anticipate some reallocation effect from investors looking for “risk-efficient” yield options.

Public Sector Watch

Credit Comments

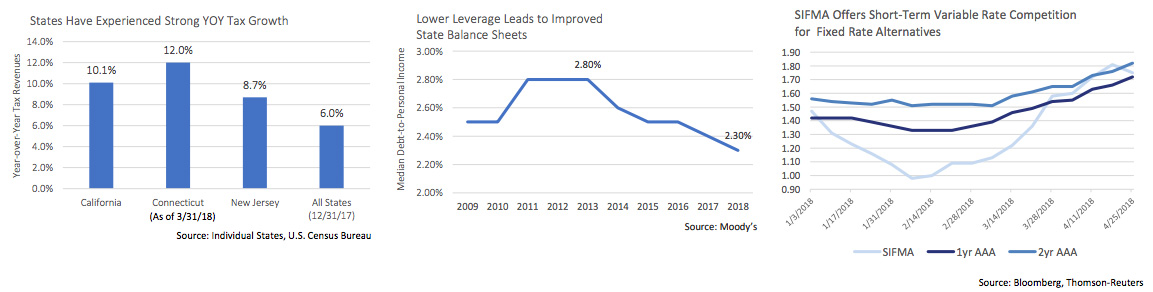

State Revenue Picture Remains Bright

- As most states enter the last few months of their fiscal years, the state revenue picture is looking brighter than in recent years. Strong tax collections in December and January, primarily driven by federal tax law changes, boosted revenues as taxpayers looked to take advantage of expiring deductions. A February through April slowdown was expected, although YTD revenues remain moderately above last year’s pace. “High-tax” states have fared particularly well, including California, New Jersey and Connecticut.

- Per a recent Moody’s report, state balance sheets are strengthening, as average debt has only grown by a very modest 0.8% annually over the last three years.

- An improved revenue environment and lower leverage collectively support what we see as a multi-year improvement in state credit fundamentals. Pockets of weakness exist, thereby requiring thorough credit analysis, although the State sector remains a key allocation in Appleton’s tax-exempt portfolios.

Variable-Rate Issuance May Increase, Keeping Rates Attractive

- Recent increases in the SIFMA index, a proxy for short-term, high quality variable-rate tax-exempt debt, are seasonally driven, as investors often sell liquid paper to meet tax liabilities. However, the drop in the corporate tax rate under federal tax reform may spark additional variable-rate issuance, increasing supply and potentially supporting the relative attractiveness of variable-rate notes (or VRDNs).

- With the corporate tax rate dropping from 35% to 21% under the Tax Cuts and Jobs Act, banks have a lower incentive to hold tax-exempt loans. Municipalities that sold direct loans to banks may be subject to a “gross up” provision, where the cost of borrowing is increased to adjust for the lower tax rate. As a result, municipalities will likely be pushed to consider more cost-effective financing vehicles and VRDNs provide a good alternative.

- Citi Research estimates that banks hold $180 billion in municipal private loans. If 25% of these loans were converted to VRDNs, that would result in $45 billion of new issuance. Compared to approximately $147 billion of outstanding VRDNs, this would present a significant jump in supply. The result should be upward pressure on yields, a trend that should be bolstered over time by a broad increase in nominal short-term rates given anticipated Fed Funds rate increases. In short, tax-exempt VRDNs should continue to present a compelling, high quality short duration opportunity for HNW investors. We wrote about this theme in April in a paper titled, “Optimizing Short-Term Investment Assets.”

Strategy Overview

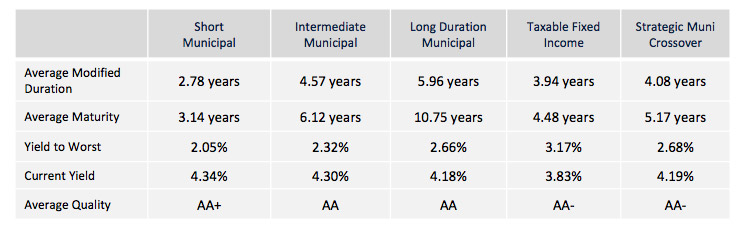

Portfolio Positioning as of 4/30/2018

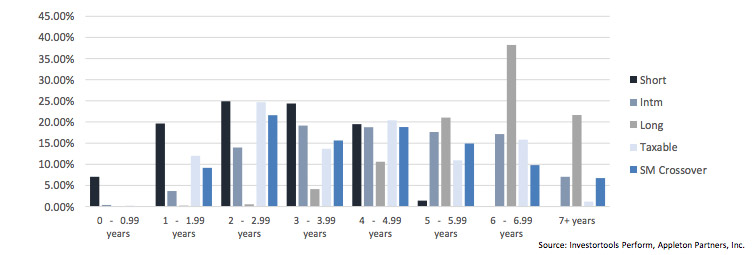

Duration Exposure by Strategy as of 4/30/2018

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making.