Insights and Observations

Economic, Public Policy, and Fed Developments

- The coronavirus pandemic dominated the news cycle and the markets in April. Risk assets fell into a tailspin as global cases surged to more than 3.5M by the start of May, with nearly a third in the US. The pandemic response continues to be managed locally, as cities and states grapple with the balance between maintaining a functioning economy and protecting their population. States such as Georgia and Florida that have led phased reopening will be closely watched test cases and their experience is likely to influence the pace of national economic recovery.

- Record unemployment claims continue, and while the trend seems to be decelerating, total job losses over the past six weeks reached an estimated 30.3M. While some workers may have replaced jobs or dropped out of the workforce, if all jobs lost were added into the known unemployment rate, it would imply a 24% rate in the 5/8 release. We expect the official number to be slightly lower, although unemployment is now the highest since the Great Depression with roughly one out of five Americans at least temporarily out of work. We expect this will weigh on potential GDP for some time.

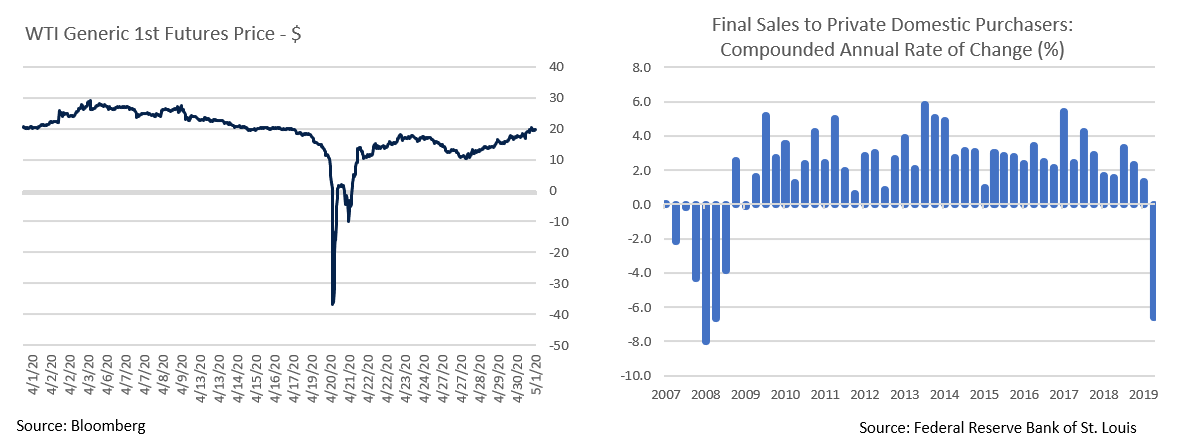

- Turmoil in the oil markets continued in April, as trading in WTI oil futures went negative for the first time on 4/13. Technical factors were largely to blame, as traders holding the active futures contracts expiring on 4/14 and unable to take physical delivery became forced sellers, pushing that contract to a low of negative $37/barrel. Technical turmoil persisted later in the month, although markets eventually calmed and WTI recovered to break $20/barrel at the start of May. Absent the same technical pressures, Brent traded with much less volatility, although the underlying supply and demand fundamentals remain weak for both, yet another disinflationary factor.

- The Q1 GDP came in slightly worse than expected at -4.8%. Final sales to private domestic purchasers, a better indicator of underlying demand, contracted 6.6%, nearly equaling the lows of 2008-09. January and February were strong, however, so this is a mere preview of what lies ahead. Q2 estimates vary widely, but GDP is expected to contract by roughly 33% on an annualized basis, a figure expected to be the largest decline in modern history.

- The Fed’s bond buying tapered significantly over the month, from an early pace of $75B/day down to a projected $8B/day at the start of May. Jerome Powell pledged to keep the benchmark Fed Funds rate near zero until the Fed “is confident that the economy has weathered recent events”. A recent Bloomberg survey of economists indicates most expect the Fed Funds rate to remain at near zero for at least the next three years.

- Additional detail on the Primary and Secondary Market Corporate Credit Facilities and the Municipal Liquidity Facility was also recently published, expanding the number of eligible companies and municipalities. The response to this crisis has been unprecedented, and with the initial phases behind them, the Fed appears to be settling in for the long haul with the intention of aggressively supporting the economy until it is strong enough to sustain a recovery.

From the Trading Desk

Municipal Markets

- As we move further away from the initial shock of COVID-19 stay-at-home orders, the municipal market is beginning to normalize. New issuance was essentially put on hold through mid-April, but the last two weeks of the month each saw over $5B in new issues brought to market. Dealers are generally capital constrained, but the market has been able to absorb the deals with only modest concessions.

- Yields remain volatile as technical factors fluctuate. Municipal fund demand rebounded after experiencing heavy March and early April outflows, as net flows were relatively flat over the second half of the month. The 10Yr AAA yield ranged between 1.10% and 1.90%, ending April at 1.46%. We have seen increased curve steepness, with 2Yr to 10Yr spreads moving from 27 bps at the beginning of the month to 55 bps at month’s end. This can be advantageous as it allows investors to realize incremental value when adding duration.

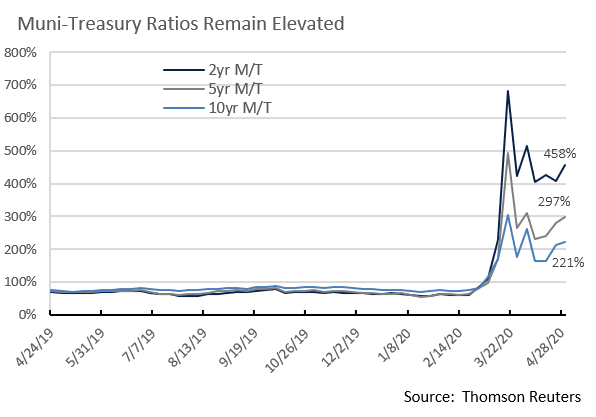

- Sustained economic fears have caused municipals to underperform USTs and ratios remain highly elevated. The 2Yr ratio stood at 458%, the 5Yr ratio was 297%, and the 10Yr 221% as of 5/1, levels that suggest considerable relative value in swapping out USTs for municipals, particularly at shorter maturities.

- Senate Majority Leader McConnell created a flurry of headlines and a stir in the markets by suggesting that he could be in favor of states being allowed to use the bankruptcy code to restructure pension liabilities. Our view is that this was a bargaining tactic as Congress moves to the next phases of stimulus negotiations, not a realistic possibility. State bankruptcy is not currently legally permissible, and any such future consideration would face considerable political, economic and market hurdles.

Corporate Bond Markets

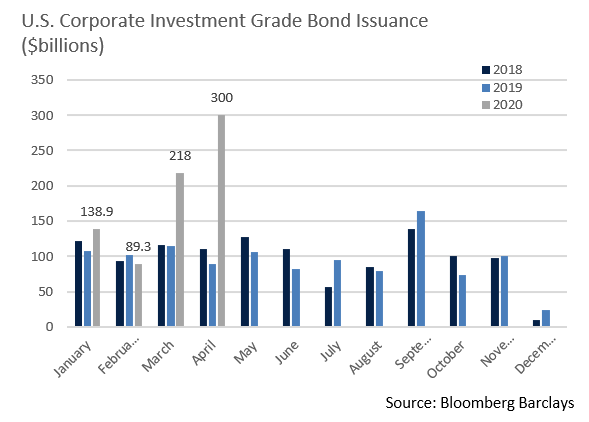

- In a sign of strengthening risk appetite, new issue investment grade corporate bond concessions have fallen significantly since the end of March. Issuers incurred an average cost of 4-5 bps in spread above their current bonds when pricing new debt during 2019, a concession which spiked to roughly 30 bps during March’s market dislocation. Since that time, new issue concessions have dropped to about 14 bps and order books have been upwards of 5 times oversubscribed. Demand from investors has been revitalized, influenced considerably by unprecedented Federal Reserve support. Mutual fund investors have begun to react accordingly, with net IG inflows of $2.25B recorded during the week ended 4/29. This coupled with extremely low UST rates and a flat yield curve have made conditions ripe for issuance.

- April’s $300B of issuance combined with $259B in March have fueled a YTD pace that is 85% above the same period of 2019. Boeing (Baa2/BBB-) brought a $25B 10-year deal in late April, the 6th largest in history, that was initially priced at +525 bps above comparable Treasuries. Strong demand pushed yields tighter and this bellwether deal closed at +450 bps, another indication that market conditions are improving.

- Investment Grade credit spreads tightened by 68 bps during April, while lower-tiered credit tightened by just over 90 bps to 258, down 200 bps from the widest levels seen in March. Single A yields also narrowed 156 bps from March OAS highs. In this environment, value has once again become less readily apparent and we feel credit vigilance is imperative given our reluctance to rely on the Fed’s backstop.

Public Sector Watch

Credit Comments

Fed Support of Municipal Markets Expands

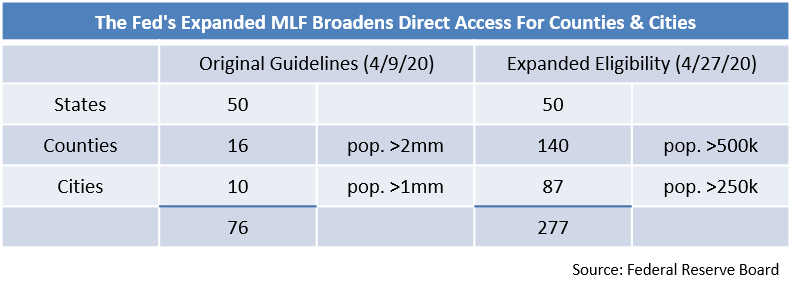

- In the face of growing state and local government liquidity strains, prompted to a large extent by a delay in April income tax payments until 7/15, the Federal Reserve announced the creation of the Municipal Liquidity Facility (MLF) on 4/9. The MLF aims to support short-term lending for municipal issuers with authorization to directly purchase up to $500B of eligible notes.

- Initial eligibility standards permitted all 50 states (plus D.C.), counties with populations of 2 million or more, and cities with populations of 1 million or more to directly access the program. The term sheet also indicated that entities not meeting the population thresholds could still access the program via a state or city “conduit issuer.”

- Two weeks later, after heavy lobbying by local governments, the Fed expanded eligibility to counties with populations of more than 500,000 and cities with at least 250,000 residents. This dramatically expanded the list of eligible entities from 76 to 277. The MLF and other Fed programs favor larger issuers over smaller ones, as the market impact of supporting larger entities is greater and expanding the number of eligible issuers introduces practical limitations. This policy aligns well with Appleton’s preference for large, well-established municipal issuers.

- We believe the MLF program will prove valuable for case specific liquidity purposes, but its very existence will be even more beneficial in terms of overall market stability. The prospects of a Fed cash flow backstop should enhance issuer and investor confidence, thereby boosting credit stability and municipal market trading.

- The MLF represents another example of Federal commitment to the municipal market. We believe another round of stimulus for states and local governments is forthcoming, although it will likely face much more challenging political negotiation than prior programs. At the end of the day, public officials understand that the health of states and local governments is instrumental to economic vitality.

Stress-Testing Offers Credit Confidence

- The $3.8 trillion municipal market is broad and diverse, and certain investment grade sectors currently face greater credit stress than others. Revenue bonds are under the microscope as fee-based revenue derived from airports, toll roads, ports and healthcare facilities has plummeted during the lockdown.

- Our Credit Research team proactively stress-tested individual Appleton revenue bond holdings based on sector-specific factors that we feel are most important to preserving creditworthiness, such as cash flow margin, service breadth, and revenue mix. This scenario analysis collectively points to a broad ability to manage a prolonged economic downturn based on liquidity, budget flexibility and financial resources. There will be difficult budget decisions in the coming weeks and months, but drawing on our conservative approach to credit, we expect all your holdings to remain creditworthy.

Strategy Overview

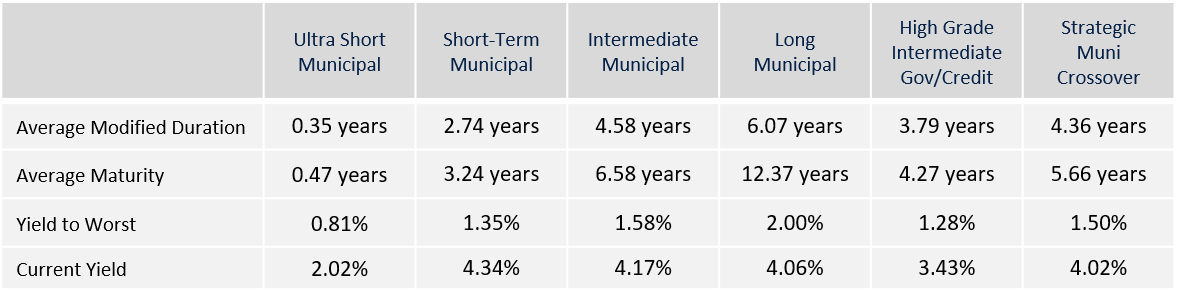

Portfolio Positioning as of 4/30/20

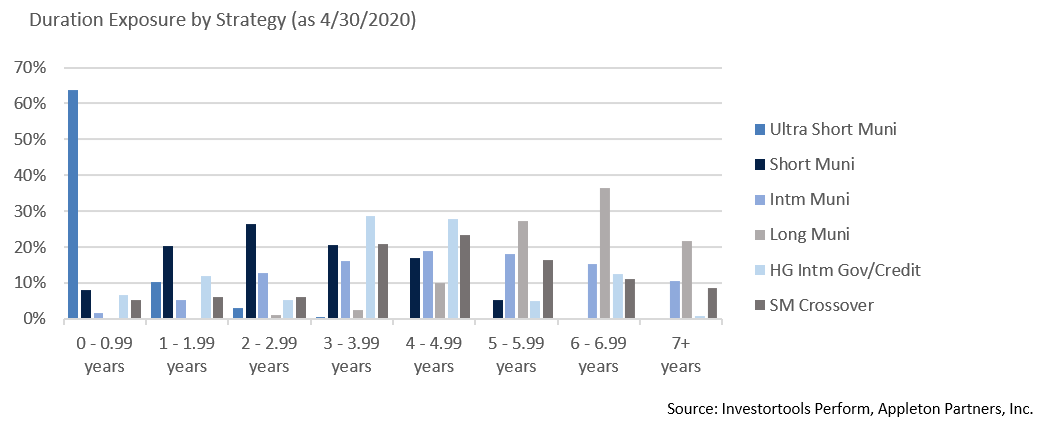

Duration Exposure by Strategy as of 4/30/20

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.