Insights and Observations

Economic, Public Policy, and Fed Developments

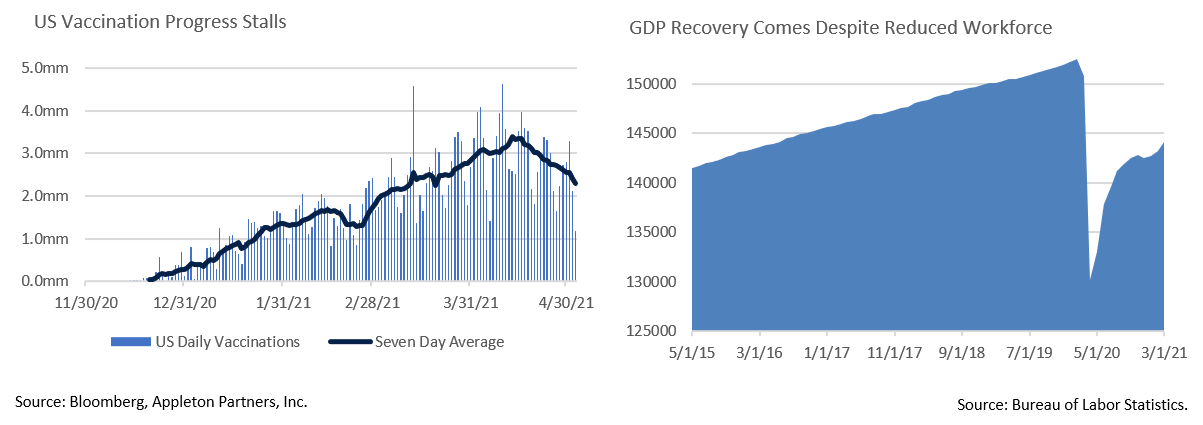

- Growing strength in both the labor market and consumer spending was confirmed with the release of the first Q1 GDP estimate. While the headline number of +6.4% represented a modest miss vs. expectations of 6.7%, the underlying data was incredibly strong. Notably, absent a drawdown of inventories detracting 2.64%, growth would have been closer to +9.3%. Final Sales to Private Domestic Purchasers, a good indicator of underlying consumer demand, rose a whopping 10.6%. While this expansion was fueled by rapid progress against the COVID-19 pandemic and federal stimulus payments, inventory depletion coupled with the lingering effects of the second stimulus check should also support Q2 growth. US GDP now sits only 0.87% below its pre-recession high and is higher YoY.

- The remarkable recovery has a dark side; although the labor market is recovering, 8.5 million fewer Americans are employed than were before the pandemic hit. While achieving YoY output growth is a positive milestone, the fact that this occurred with a sizable reduction in workforce adds weight to the argument that technology and automation is driving pandemic recovery. These developments risk accelerating secular trends that have hurt labor, and while the Services sector provides opportunity for further growth, it is hard to argue that some of these job losses will not be permanent.

- Inflation-related releases revealed a widely expected pickup in inflation, with the PCE deflator rising from +1.3% to +2.3% in the initial Q1 report, and headline CPI increasing to +2.6% YoY. Core was more muted at +1.6%. Caution is warranted when interpreting inflation numbers; YoY comparisons now introduce a powerful “base effect” that skews current numbers higher given the prior year’s depressed levels. Federal stimulus payments are also temporarily boosting demand. If the economy takes longer than expected to return to full employment, as we are afraid may be the case, out-of-work Americans will weigh on aggregate demand. After a mid-month peak, the relative stability of the UST curve speaks to the market’s growing comfort with the inflation outlook.

- Another potential worrisome sign is that the nation’s vaccination effort, which has shattered all expectations coming into the year, is stalling. The 7-day average daily vaccination rate peaked in mid-April at around 3.4M doses and has since fallen by more than a 1M doses per day. This is occurring with not quite half the country having received one dose, and less than 30% fully vaccinated. There is evidence of vaccine hesitancy amongst several demographic groups, and many infectious disease professionals are concerned that the vaccination effort may fail to achieve herd immunity. A strong economic recovery is in part predicated on receding pandemic restrictions and perceived risks. The US may still be fighting pockets of infection with localized economic limitations for some time, a prospect that is not embedded in most economic forecasts.

- Asset class implications of President Biden’s “American Families” infrastructure plan are discussed elsewhere in this piece. Suffice to say, the White House has taken a very expansive interpretation of infrastructure. The plan would represent the largest reshaping of the role of government in American life since at least the Reagan Administration, and while the current proposal is an opening in a much larger negotiation, the Biden Administration did a much better job than we or many others expected in getting the American Rescue Plan passed at desired spending levels. There is a very narrow window through Congress to pass this bill, and many details are likely to change, but it is premature to assume the final bill will be significantly reduced or substantially altered. From a macro perspective, the size and scope of federal spending will need to be factored into full year 2021 and 2022 economic expectations.

From the Trading Desk

Municipal Markets

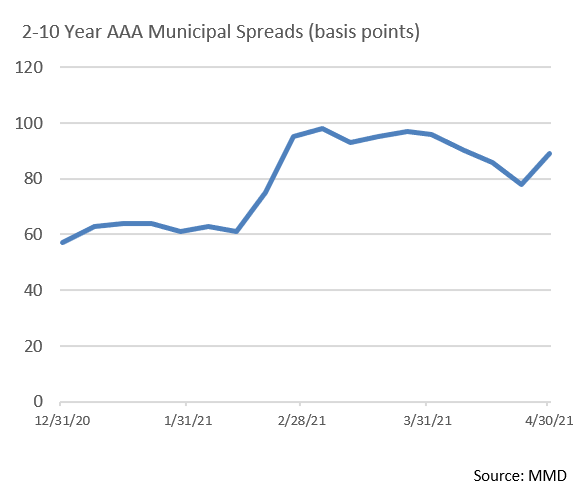

- The municipal curve ground lower once again in April with 10Yr AAA yields starting at 1.11% and ending at 0.99%. This move offers more evidence of investor appetite for municipals, especially given the prospects for higher upper income tax rates. While the curve flattened by 7bps over the month to 89bps, it remains significantly steeper than the 57-bps level at which we began 2021. We continue to find more attractive relative value in the 6 to 9-year range given compressed shorter maturity yields and a relatively flat long end.

- April muni issuance increased by about 6% vs. the same month of last year. 2021 YTD issuance is 12.6% higher than 2020, according to The Bond Buyer. Many commentators are predicting significantly higher issuance this year than last year, which would require an acceleration in new supply over the remainder of the year. Tax-exempt advanced refundings were eliminated by the 2017 Tax Reform; if they were to be reinstated it would provide a boost to tax-exempt supply. Additionally, an infrastructure package would also likely increase municipal supply. With no lack of buyers, issuance should be well received in the marketplace.

Corporate Bond Markets

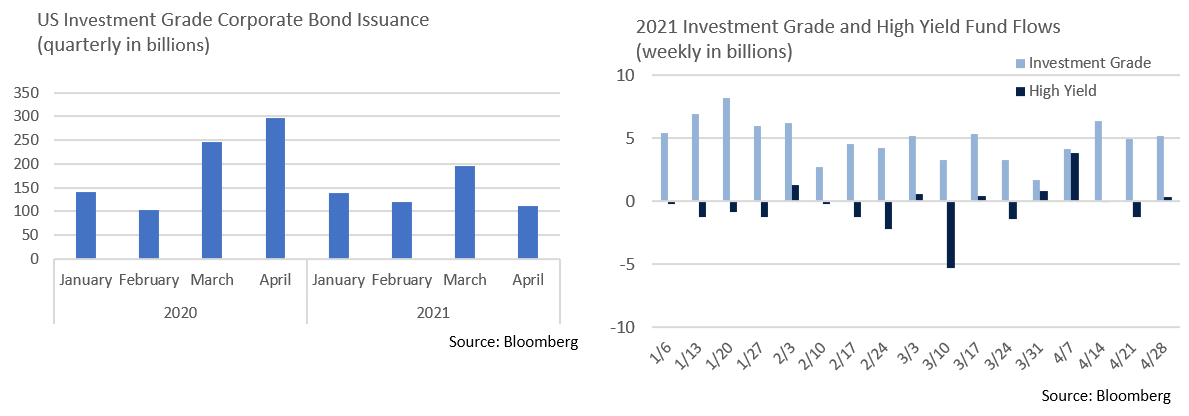

- After a quiet end to the month, $110.8 billion of IG corporate issuance in April easily beat estimates of $95 billion. That brought YTD issuance to $547 billion, down 23% on a YoY basis vs. extraordinarily high levels of a year ago. April’s new issuance was led by Financials, with jumbo deals from B of A, JPM Chase, Morgan Stanley, Goldman Sachs, and Citigroup accounting for $72 billion of the $110.8 billion in new funding. Just over $73 billion in IG corporate maturities are coming due in the finance sector, and April’s issuance surge may be preemptive funding of upcoming maturities given the risk of rising debt costs.

- Spread volatility was muted with spreads trading in a very tight band of about 4 bps. The Bloomberg Barclays US Corporate Index closed the month at an OAS of 88, 2 bps tighter than at the end of Q1. Energy and Transportation (just over 10% of the index) have tightened the most YTD (-20 bps and -17 bps respectively. This reflects rising economic optimism after difficult 2020 sector conditions. Financials, 30.5% of the index, saw only a modest 4 bps spread contraction.

- A positive credit tone and solid earnings releases support a favorable economic reopening narrative. Better-than-expected GDP growth of +6.7% (QoQ annualized) did little to move credit market spreads. We believe economic confidence is already priced into the IG Corporate markets and anticipate spreads will remain range bound over the near term.

- Broadly speaking, demand for taxable fixed income remains extremely strong. Lipper Inc. reported $217.6 billion of net new flows into taxable bond mutual funds YTD through 5/3. Economic momentum and investor enthusiasm should keep the IG Corporate bid strong for some time.

Public Sector Watch

Credit Comments

The American Jobs and Families Plan

President Biden’s American Rescue Plan injected $1.9 trillion of funding into the economy earlier this year, providing a large boost to several sectors of the municipal market. The White House is now proposing a new two-part bill comprised of the American Jobs Plan, a bill aimed at improving the nation’s infrastructure and shifting toward a greener energy, and the American Families Plan, a bill aimed at fostering a robust and more equitable economic recovery.

The American Jobs Plan proposes to spend $2 trillion with an emphasis on enhancements to infrastructure such as roads, bridges, broadband, and schools.

- $135 billion would support modernizing 20,000 miles of highways, roads, and main streets. The plan prioritizes fixing the most economically significant bridges and repairing the worst 10,000 smaller bridges.

- Federal funding for public transit would nearly double with $165 billion expected to be deployed towards modernization of new and existing infrastructure.

- $25 billion would be allocated to airports and $17 billion to inland waterways, ports, and ferries.

- Water systems would receive $111 billion as a means of rebuilding our nation’s water infrastructure. All lead pipes and service lines would be replaced.

- $100 billion would be used to build new public schools and upgrade existing buildings through improved ventilation systems and technology.

The American Families Plan would make an additional $1.8 trillion investment in education, childcare, and paid family leave.

Biden’s $4 trillion proposals face considerable opposition and negotiations are underway that could lead to significant changes. While the end-product of these massive initiatives is uncertain, substantial federal infrastructure investment in our communities is a strong positive for a municipal market already bolstered by the American Rescue Plan. Sectors such as Transportation, Airports, Education, and Water & Sewer are likely to be the biggest beneficiaries.

Changing Population Patterns Impact Federal Aid

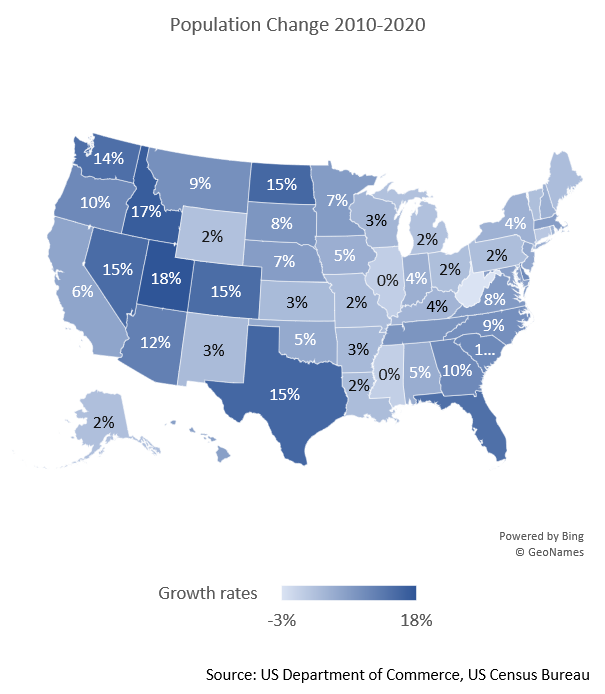

- The Census Bureau’s 2020 survey data confirmed strong population growth in the South and West with the Northeast and Midwest lagging. The impact will be most directly felt through Congressional redistricting and funding formulas that influence Federal aid to the States.

- TX will gain two Congressional seats, while NC, FL, CO, MT, and OR are all adding one. This came at the expense of NY, MI, PA, OH, IL WV, and CA which all lost one seat. These changes in representation could shift the political makeup of Congress, as well as fostering renewed redistricting battles in the coming months.

- Population also affects the amount of federal funding received by each state, impacting public schools, infrastructure, higher education, and many other public goods. Relative to the economy, population changes can influence housing demand and assessed values, sales taxes, and rates of business incorporation, among other factors.

- Given the wide-ranging influence that population trends can have, tracking these changes and incorporating implications into our credit analysis remains part of our research process.

Strategy Overview

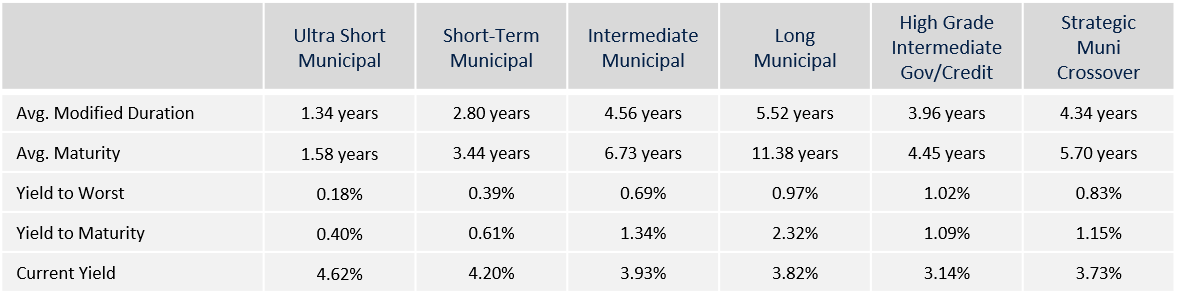

Composite Portfolio Positioning as of 4/30/21

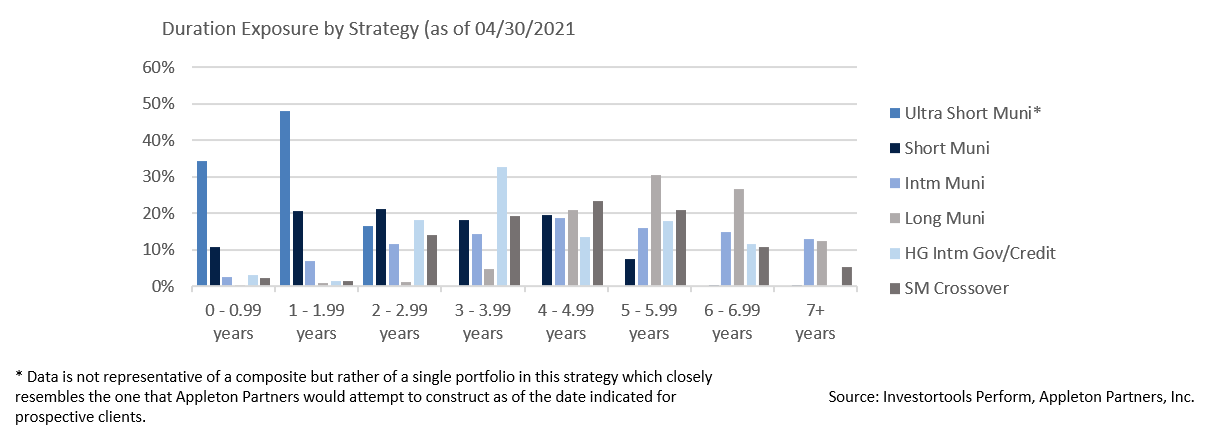

Duration Exposure by Strategy as of 4/30/21

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.