Insights and Observations

Economic, Public Policy, and Fed Developments

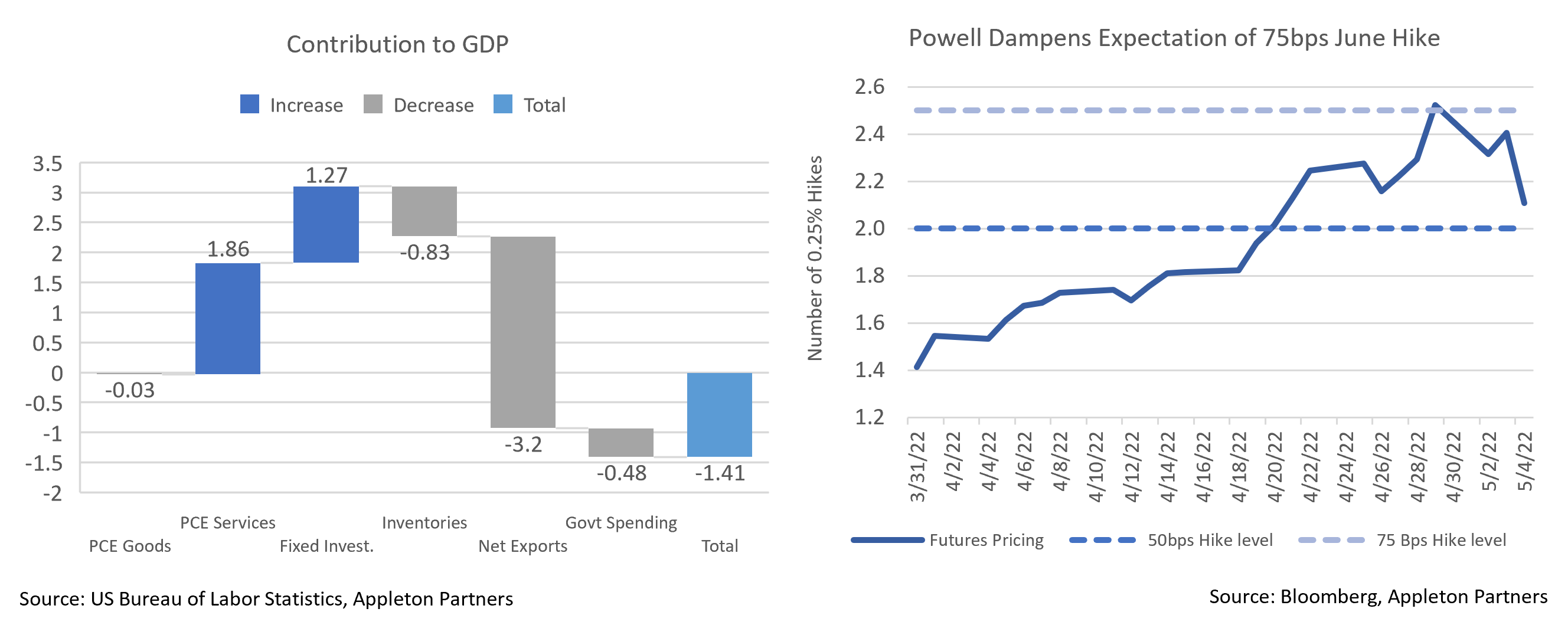

- The Q1 GDP report released at the end of April shocked markets expecting a slowdown to +1.0% by contracting 1.4%. While the headline figure sparked talk of recession, the details of the GDP report were somewhat stronger. With the US recovery outpacing the rest of the world and domestic demand stronger than foreign, a record trade deficit detracted 3.2% from growth, while a buildup in Q4 inventories essentially moved 0.84% of growth from Q1 into the prior quarter. Final sales to domestic purchasers, a good proxy for underlying demand, strengthened from +1.0% to +2.6%, suggesting the economy continues ticking along, and we do not expect this to be the first quarter of a recession.

- That said, inflation is clearly weighing on consumers. Inflation-adjusted income dropped 2% in the GDP report, the fourth consecutive quarterly decrease, and consumer spending came in at the lower range of projections at +2.7%. The personal savings rate also dropped from 7.7% to 6.6%, and consumer use of revolving credit facilities rose at an annualized +20.7% rate, as consumers deferred saving and turned to credit cards to support current consumption. Accordingly, March’s retail sales report missed, +0.5% vs. expectations of +0.6%. We do not expect Q2 to show a further GDP contraction, but we are concerned about growth prospects in the second half of the year and into 2023 and think the Fed may struggle with its planned pace of hikes.

- While cooling demand would normally take pressure off inflation, the supply picture is worsening as well. China’s “Zero Covid” policy has produced sweeping lockdowns crippling mainland Chinese cities representing more than 40% of the country’s economic output. Chinese manufacturing and nonmanufacturing PMIs fell to the lowest levels in two years, at 47.4 and 41.9 respectively (values below 50 represent contraction). It may take some time for these lockdowns to begin impacting US prices, but some of the recent improvement in chip supply is likely to reverse by the summer.

- Given this backdrop, the Fed’s 50bps short term rate hike announced after Wednesday’s meeting was a foregone conclusion. Instead, the market reaction was primarily driven by changes in outlook. The pace of quantitative tightening outlined by the Fed was slower than expected, starting at a runoff cap of $30 billion a month, and rising to $60 billion after three months. Participants had instead expected increases every month. Taken with the Treasury’s earlier announcement of cuts in its quarterly debt sale, the third consecutive quarterly decrease, the market will have to a smaller supply of Treasuries to absorb later in the year than had been expected.

- Chairman Powell used his press conference to downplay the possibility of a 75bps hike at the next meeting in June, one market participants had increasingly begun to contemplate in recent weeks, noting inflation was being driven by supply shocks and the Fed’s policy tools were demand-oriented. After several consecutive FOMC meetings where the Fed surprised to the hawkish side, this may be the beginning of a more dovish tilt as the Fed becomes concerned with growth. Treasury yields fell after the meeting, particularly at the front of the curve.

- The May 6th jobs report also bears watching. Weekly new unemployment claims data bounced off recent lows but are continuing to trend downwards, implying a tight labor force. A strong BLS employment report, particularly with an uptick in the participation rate, would be an encouraging sign, suggesting workers are returning to the workforce.

From the Trading Desk

Municipal Markets

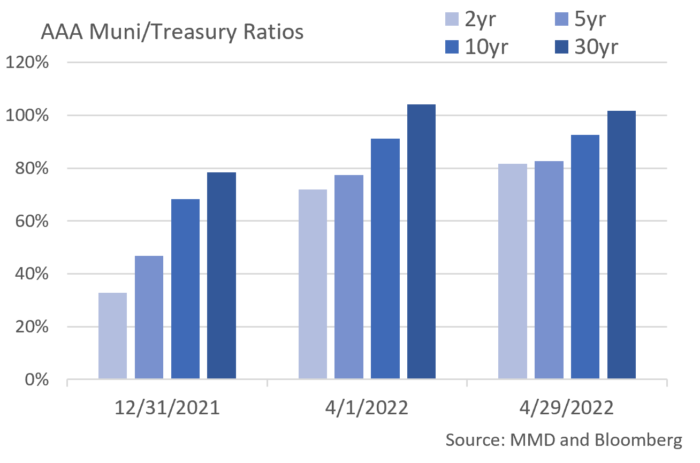

- A sharp rise in municipal yields continued in April with the 10Yr AAA curve ending the month at 2.72% and the 2Yr reaching 2.22%. The market clearly has its focus set on inflation and the magnitude of forthcoming Fed Fund rate hikes, an environment that has impacted YTD performance across most asset classes.

- The upside of this yield movement lies not only in higher income streams available on reinvested or newly deployed cash, but also in gaining the curve steepness that increases the value of incremental duration. To that point, the spread between AAA 2s and 10s is now a healthier 50bps.

- Rising interest rates and a substantial increase in equity market volatility have influenced municipal credit spreads which had been very tight for almost two years. AAA-A spreads ended April at 43 bps after spending most of 2021 in a 20-30bps range. Widening spreads means investors are now being paid more for the same risk profile, assuming all else remains equal.

- Assets have been flowing out of municipal mutual funds over the course of 2022, a major reversal from 2021 but one that is not terribly surprising given recent downside volatility. Over the last 16 weeks municipal funds have incurred net outflows of over $41 billion, selling pressure that is helping to push rates higher.

- As we discussed in recent commentary, we now see significant value in high quality municipals on an absolute basis and relative to Treasuries. The 10-year AAA to UST ratio began May at 92% as compared to a 52-week average just shy of 73%. Security selection is always paramount, although recent repricing has created considerable values across the municipal curve.

Corporate Bond Markets

- It is hardly news that yields across the fixed income landscape have moved sharply higher as the Fed scrambles to contain inflation. April’s trading saw the 2Yr UST yield rise from 2.33% to 2.71% while the 30Yr increased from 2.44% to 2.96%. In the face of this move, the VIX Volatility Index spiked to the low 30s, the highest recordings since early 2021.

- Investment Grade credit spreads had been on a sustained tightening trajectory at the beginning of April although that quickly shifted into a 4-week widening trend. OAS on the Bloomberg Barclays US Corporate Bond Index rose 20bps to 135 OAS over the course of the month. On a YTD basis, IG spreads are off by roughly 43bps. Early May OAS spreads of 145 appear to us to be fair value after accounting for economic conditions, corporate fundamentals, and valuations. IG credit spreads should remain range bound as we push through Q2.

- Although very lumpy, the primary market has tracked last year’s issuance pace. In the face of considerable volatility, the $580 billion brought to market YTD is just slightly lower than the same period in 2021. How we got there appears quite different though as turbulent markets have sidelined some issuers. The cost of issuing bonds and required concessions has steadily climbed over the course of the year, particularly for lower tier investment grade names. We expect this dynamic to persist over coming months as issuers will be nimble in their approach to the primary markets, thereby reducing new issue supply among names we like.

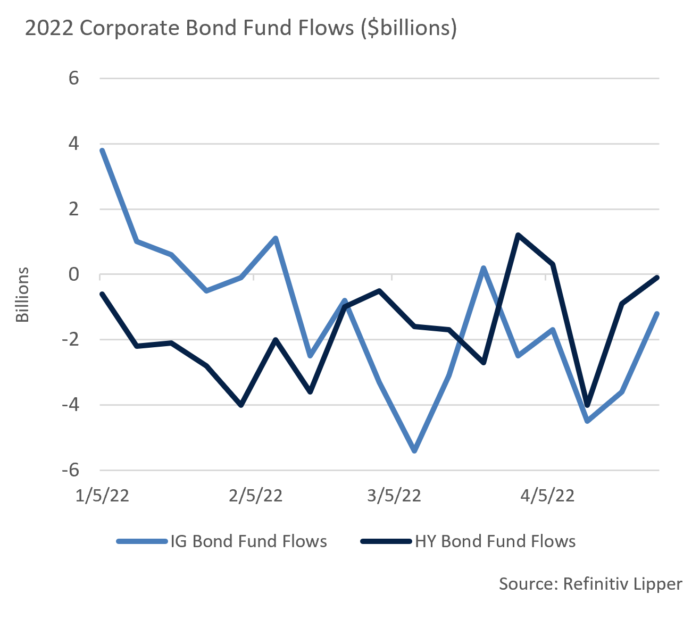

- Another indicator of shaky retail sentiment lies with corporate bond mutual fund flows. So far in 2022, IG bond funds have incurred $22.4 billion of net outflows, a sharp change from $83.5 billion in net inflows over the same period of 2021. While not a leading indicator of market sentiment, we are paying close attention as flows can impact secondary and primary market conditions.

Public Sector Watch

Credit Comments

The State of Florida Targets Disney

- Reedy Creek Improvement District (“Reedy Creek”) was established in 1967 to give The Walt Disney Co. broad control in and around their theme parks. At that time, Orange and Osceola Counties could not afford to fund necessary infrastructure for the theme park’s development. The improvement district allowed Disney to take over said development along with the responsibility to provide power, water, road construction and maintenance, and fire protection services. As part of the arrangement Disney benefits from foregoing the need for local government approval for construction projects.

- The district currently includes 25,000+ acres encompassing four theme parks, two water parks, 175 lane miles of roadways, 67 miles of waterways, and the cities of Bay Lake and Lake Buena Vista.

- Although the surrounding region has benefitted from Disney related tourism and associated economic development, the district has recently come under scrutiny from Governor DeSantis, largely as a fallout of Disney’s criticism of unrelated and politically sensitive Florida legislation.

- DeSantis recently signed into law a bill passed by the Florida House and Senate that would eliminate the special district effective June 2023. Republican lawmakers have promised to work through the legal and financial implications of eliminating Reedy Creek over the coming year, having yet been unable to offer specifics. It is notable that the law allows for the districts to be reestablished in the future, thereby affording lawmakers an easy exit should the costs prove unwieldly or public opinion shift.

Potential Outcomes for Local Municipal Bond Issuers:

- Here are three ways this situation may play out: Reedy Creek is eliminated in June 2023; the legislature changes course and/or Disney wins upcoming legal challenges and Reedy Creek remains intact; or the district’s powers will be pared back, with Reedy Creek maintaining its taxing power but losing certain other privileges.

- Eliminating Reedy Creek would produce considerable financial implications for Disney, Orange County, and the State of Florida. Disney would be impaired through slower development since they would no longer be able to independently authorize capital plans, although the company would receive at least $160 million of tax breaks since they would no longer pay the Reedy Creek tax.

- Orange County (and Osceola County to a lesser extent) would face the greatest burdens. Taxpayers of these counties would be responsible for not only servicing Reedy Creek’s $1 billion in outstanding debt, but also the obligation to maintain the roadways, water and wastewater systems, and fire and safety costs previously borne by Disney. Preliminary estimates suggest Orange County would need to raise property taxes by 20-25% to cover annual costs alone, with greater sums required for future development and maintenance.

- The State of Florida faces a lesser burden although reduced investment by Disney would affect economic activity. The fallout of this bill should its stated intention become closer to being realized could reduce the desire of companies to invest there given that the State’s largest employer would have been punished for political reasons. Even if the district is not eliminated, this soft cost could linger for some time.

Possible Bondholder Outcomes

- We expect Reedy Creek to remain in place to some degree, either by the legislature changing course or Disney prevailing in a lawsuit. The fiscal realities associated with following through on an elimination of the district are onerous.

- That said, if the district were eliminated, $1 billion of outstanding Reedy Creek bonds would become an obligation of AAA-rated Orange County, a tax-exempt issuer to which we currently have no exposure.

- As this situation plays out, we expect minimal impact on Reedy Creek debt, with any rating agency actions made in the interim likely amended once this uncertainty passes, with no risk to the timely payment of debt service when due. Ultimately, we do not see any meaningful risk to Appleton’s bond holdings or the municipal market at large.

Strategy Overview

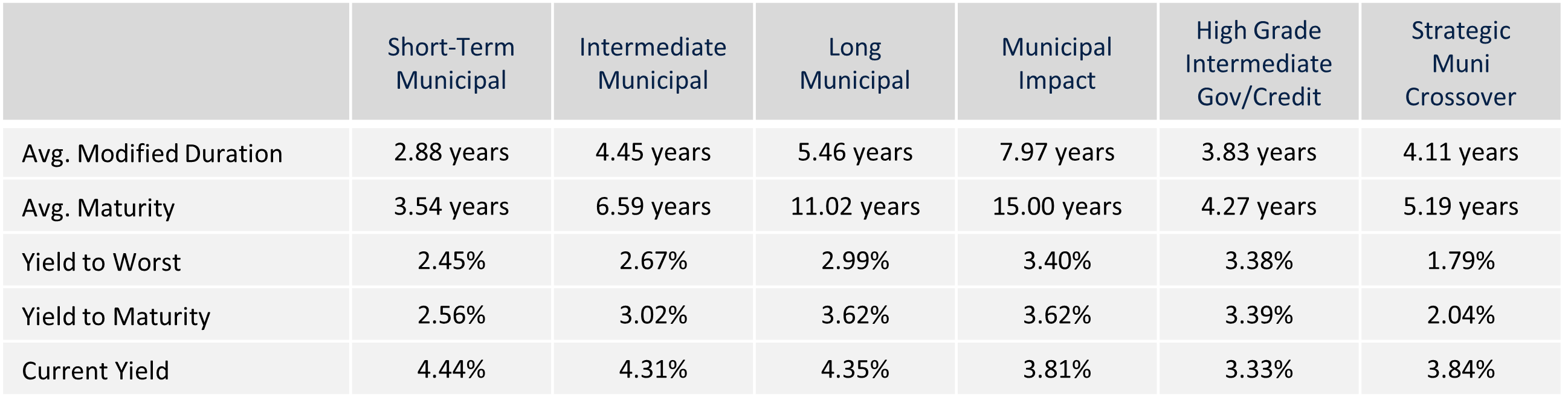

Composite Portfolio Positioning as of 4/30/22

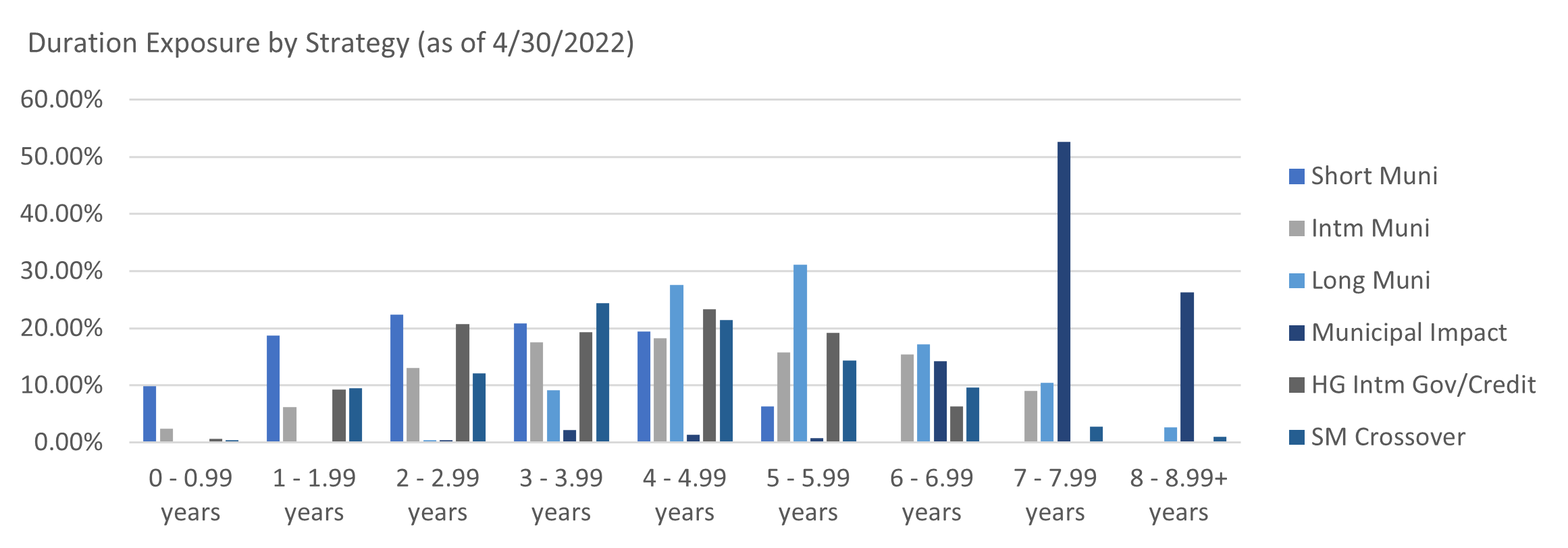

Duration Exposure by Strategy as of 4/30/22

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.