Insights and Observations

Economic, Public Policy, and Fed Developments

- The US pandemic inflation debate has shifted from whether the Fed was right to expect transitory inflation, to what the Fed’s response to more persistent inflation will be as the reopening is delayed. The Fed met expectations on November 3rd by announcing tapering of asset purchases, leaving the timing of the initial Fed Funds rate hike as the remaining variable. While most market forecasts have generally pulled a hike forward to 2022, we believe the market may be getting ahead of itself, in part because it is unclear whether a rate hike would actually lower inflation.

- The Fed Funds Rate offers a means of tightening credit conditions when an overheating economy is running close to potential GDP and is still unable to keep up with demand. By increasing borrowing costs, demand can be slowed and rebalanced to output, cooling inflation. While “this time it’s different” arguments ought to be taken with a grain of salt, two current factors warrant consideration. First, the economy does not seem to be running anywhere near potential GDP. Output has barely returned to late 2019 levels and is plagued by short-term constraints. Second, after a protracted period of unprecedented US household savings, consumer spending is almost certainly being fueled by ready access to cash and not credit. We believe raising rates would be akin to pushing on a string and expect the Fed to focus on resetting expectations back to 2023.

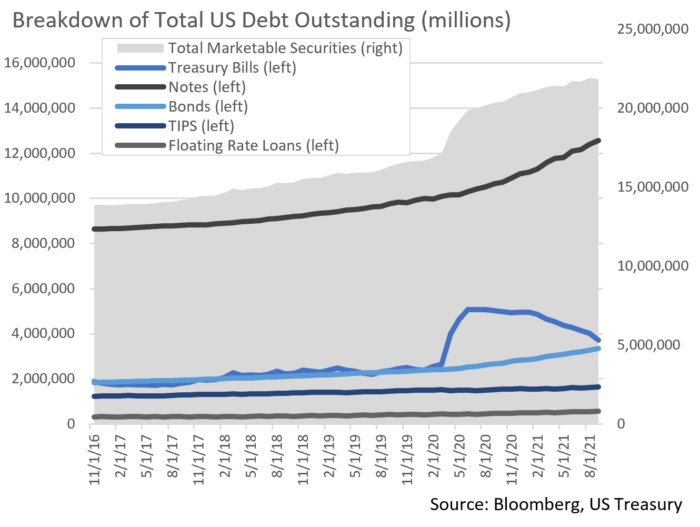

- Although the prospect of Fed tapering while longer dated interest rates are rising makes some uneasy, we feel these concerns are misplaced. First, tapering of asset purchases still provides monetary stimulus, just at a slower pace. Second, Treasury issuance is expected to fall by an estimated $1 trillion over the next four quarters while the Fed tapers due to a shrinking budget deficit. And third, we believe changes in longer rates were driven by the Build Back Better Act, the Biden Administration’s massive “human infrastructure” plan, which in recent days has shrunk in size considerably. While as investors we would welcome higher rates and a steeper curve, rates are unlikely to rise materially in the near term.

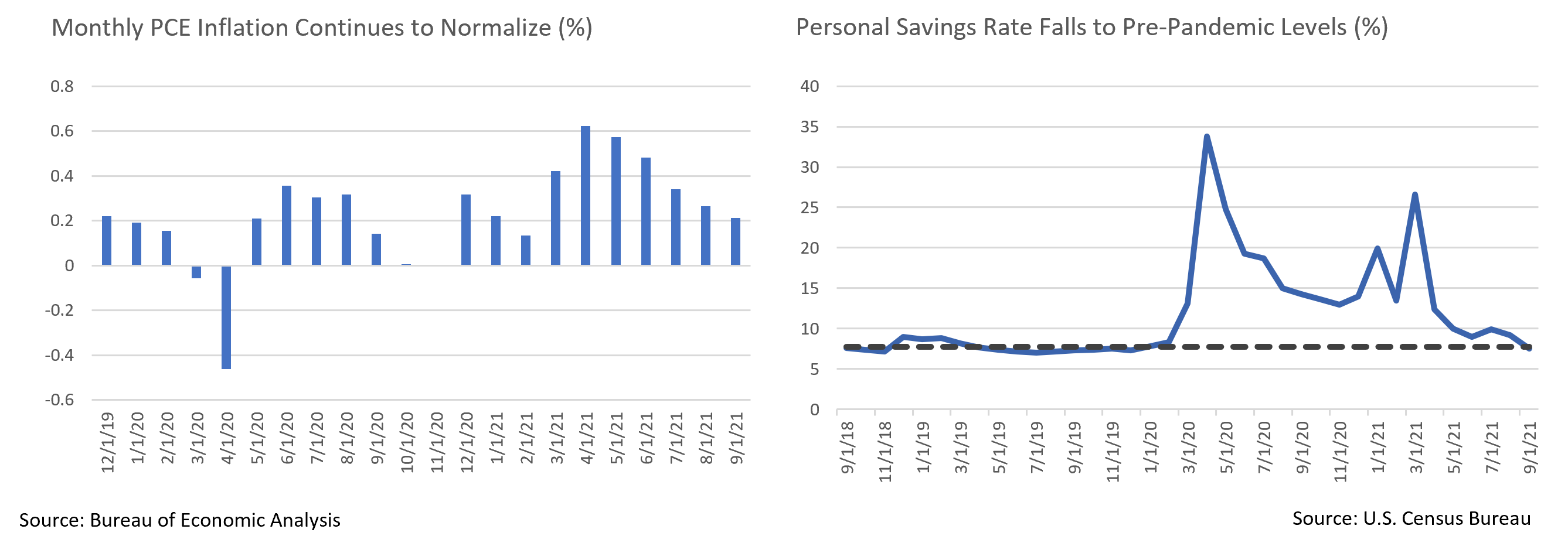

- Trailing monthly CPI and PCE inflation numbers continue to be eye-popping, and we expect pockets of inflation to persist as the COVID-19 situation evolves. However, inflation is slowing – while higher shelter-related weightings have added volatility to CPI, monthly PCE readings are falling and have returned to more normalized levels. September’s 0.21% monthly core PCE rate, annualized, is +2.56%, squarely within the Fed’s target range.

- September’s labor report produced a sizeable headline miss, although October’s pending report offers reasons for optimism. While we remain skeptical that enhanced unemployment is to blame for the decline in the labor participation rate, the US savings rate reverting to pre-pandemic norms may provide gradual pressure for workers to rejoin the workforce. The approval of COVID-19 vaccines for 5- to 11-year-old children may also help. And, while the 192k jobs created in September badly missed expectations, a supplemental household survey reported job growth slightly ahead of expectations. With seasonal factors related to earlier-than-normal education hiring also adding noise, September’s report could be setting up either an upward revision or an unexpectedly strong October report.

- Q3 GDP missed a “whisper number” of +5.7% and a Bloomberg median estimate of +2.6%, coming in at +2.0%. The details were bleak; a supply-driven decline in motor vehicle sales stripped 2.39 points off the headline number, and Final Sales to Domestic Purchasers, in normal times a good measure of core demand, was an anemic +1.0%. A positive contribution from Change in Private Inventories of 2.07 points was related to inventories being spent down at a slower rate, rather than stabilizing. Growth will remain hampered until further progress is made against COVID-19 globally.

From the Trading Desk

Municipal Markets

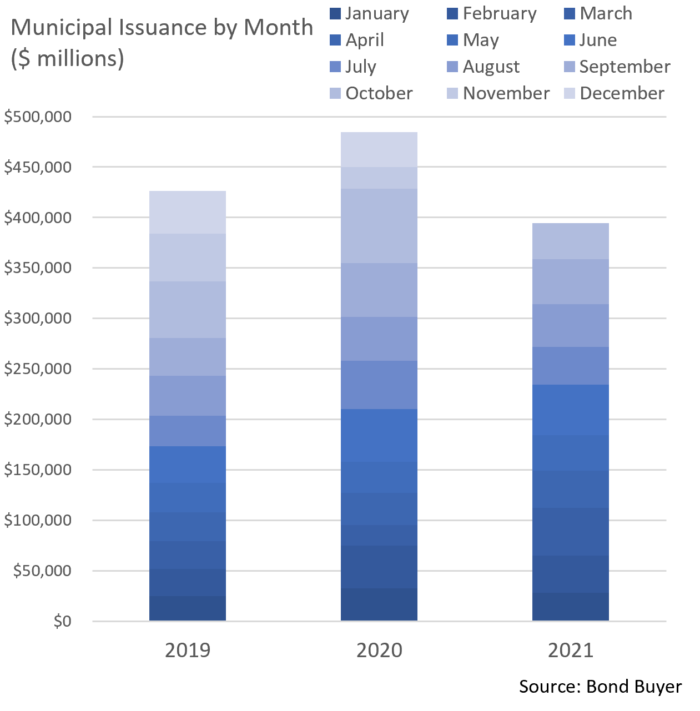

- It bears repeating that the municipal market’s supply and demand dynamics remain very favorable for bondholders. YTD new issuance currently sits at 92% of the same period of 2020, while prevailing estimates for 2021 total issuance will likely need to be revised downward. As for demand, mutual fund flows, a measure of retail buying strength, are up over $91 billion YTD. Despite recent moderation, 75 of 76 weeks have seen net fund inflows.

- As investors seek to put new money to work, high grade new issue names continue to be oversubscribed. This remains a challenge and we are actively working our dealer network to source attractive bonds in both the primary and secondary markets.

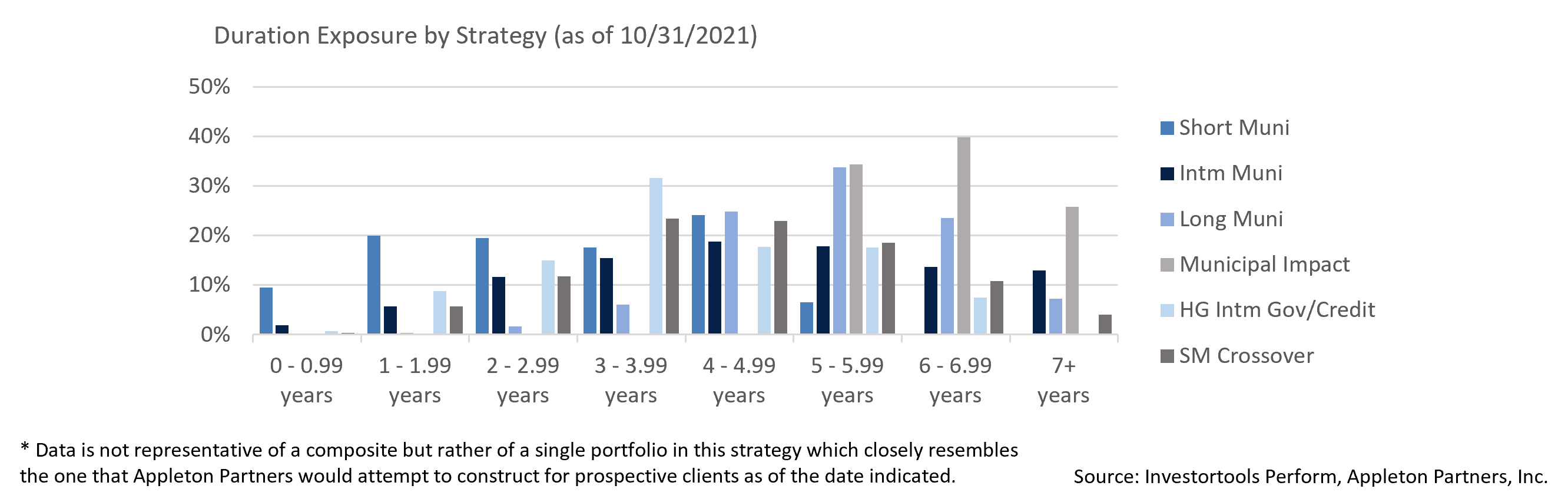

- Municipal yields edged higher over the month, following a corresponding move in Treasuries. While we could see some volatility through the end of the year, demand for municipals should keep yield moves muted. The spread on the AAA MMD curve between 2 and 10 years ended October at 96 bps, a level that benefits buyers who are selling shorter on the curve to buy longer dated issues. Our emphasis is on the 5 to 9-year part of the curve as it offers the greatest relative value given the increase in steepness vs. earlier this year. Over the course of 2021, a bear steepening trend has driven 10Yr yields up 50 bps, while the short end of the curve has only increased about 11 bps.

Corporate Bond Markets

- The investment grade credit market remained quite stable even as UST volatility ramped up over the course of the month. A good deal of that volatility was driven by Fed policy uncertainty, most notably the timing of tapering and possible future rate hikes.

- Investment grade credit spreads have rested in a very narrow range between YTD wide and tight levels. October began at 84 bps, before closing the month at 87 bps. The year began at 96 bps, with a YTD high of 100 bps reached on March 9th. Credit spreads are firmly anchored, and we feel they will trade in this band for the remainder of the year given corporate balance sheet strength and sustained investor demand.

- High grade supply surged in October as $120.2 billion of investment grade credit issuance set a monthly record. The market had no issues digesting the influx of new deals, although signs of investor fatigue are beginning to show. Order books were noticeably less heavily subscribed for most deals this month despite prices holding up well.

- We have also recently seen a reduction in refinancing as short UST rates tick higher and the need to do so diminishes. November and December tend to be quiet months and our expectations are for issuance to remain close to historical averages.

- A lot of attention was paid to the much-anticipated November 3rd announcement that Fed asset purchase tapering will begin later this month, a process that is likely to end by mid-2022. No mention of rate hike timing was given in the release or the press conference that followed.

- Coincidentally, the US Treasury also recently announced that it will cut back on long-term debt sales as borrowing needs begin to slow along with reduced pandemic relief funding. The largest reductions in auction sizes will be in 7 and 20Yr maturities, which are falling by $3 and $4 billion respectively. Further reductions across all maturities will be revisited on a quarterly basis. These developments are bullish for USTs and leave room for excess capacity of non-coupon bearing Bills going forward as Congress revisits the debt ceiling.

Public Sector Watch

Credit Comments

University Endowments Bolstered by Surging Investment Returns

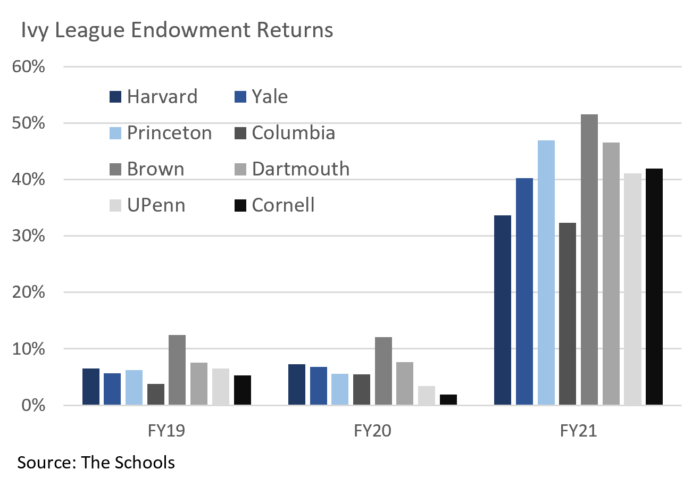

Endowments have recently enjoyed some of their largest investment gains in decades, fueled by the soaring 2021 stock market and robust venture capital and private equity returns. Large gains come after years of mediocre performance and at a time when tuition has lagged given the pandemic’s impact on enrollment.

Undergraduate enrollment in the Fall of 2021 dropped 3.2% from the previous year, as higher-education struggles with residual pandemic impact and falling birth rates. The number of undergraduate students has declined 6.5% since 2019, although an institution’s selectivity is an important variable. As selectivity decreases enrollment declines increase, as evidenced by a 4.3% gain among the most selective colleges since Fall 2019 vs. a 14.1% decline among community colleges.

While revenue losses related to enrollment declines vary considerably, a surge in recent endowment returns have largely made up for this impact.

Endowment gains in 2021 have been bolstered by sizeable investments in alternative assets such as private equity and venture capital. These alternative assets had performed relatively poorly over the last decade, factoring into endowments only posting an average annualized gain of +7.5% over the 10 years through June 30th, whereas the S&P 500 rose +14.8%.

While most endowments have performed very well of late, outsized gains have primarily been concentrated among large endowments with greater exposure to venture capital. Endowments managing over $1 billion had an average venture allocation of 11%, as compared to only 5% for those managing $501 million to $1 billion. Consequently, the median return for all endowments was +33.3% in fiscal 2021, while endowments with assets of over $1 billion enjoyed median performance of +36%.

Ivy League funds, all of which have above $1B in assets posted exceptional returns. Brown has outpaced peers for the past three years and in fiscal 2021 reported a robust +51.5% return. Private equity accounts for 39% of assets at last report. Comparatively, Harvard has somewhat less private equity exposure and posted a more modest +33.6% return.

Appleton continues to prefer Higher-Ed institutions with strong, secure competitive position and solid financial profiles. The ability of larger institutions to maintain enrollment during the pandemic supports this view, as do outsize endowment returns many enjoyed.

State & Local Governments Increase Pension Risk

State and local government pensions have recently followed endowments by increasing their allocations to alternative assets in an effort to bridge large asset-liability gaps. State and local governments have historically sought to fund pension obligations through taxes and budget decisions, although this has often proved to be politically difficult.

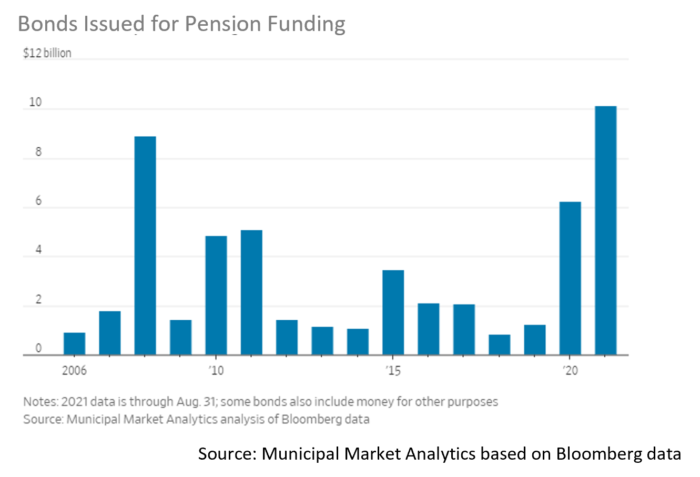

Many cities and towns have increased credit exposure by borrowing to help fund their pension liabilities. In fact, state and local governments borrowed about $10 billion YTD through August for this purpose, more than in any of the previous 15 calendar years. The number of borrowers has also increased to 72 from a 15-year average of 25. Pension obligation bonds are essentially a bet that there will be a positive spread between investment returns on bond proceeds relative to interest costs. While this has recently been the case, such funding strategies can be risky as future underperforming returns could leave borrowers with greater costs.

Despite the boon created by recent investment performance, many state and local pensions still have a long way to go in addressing their pension obligations. Appleton continues to monitor each issuer’s situation and considers pension stability and funding strategy important elements of our credit analysis.

Strategy Overview

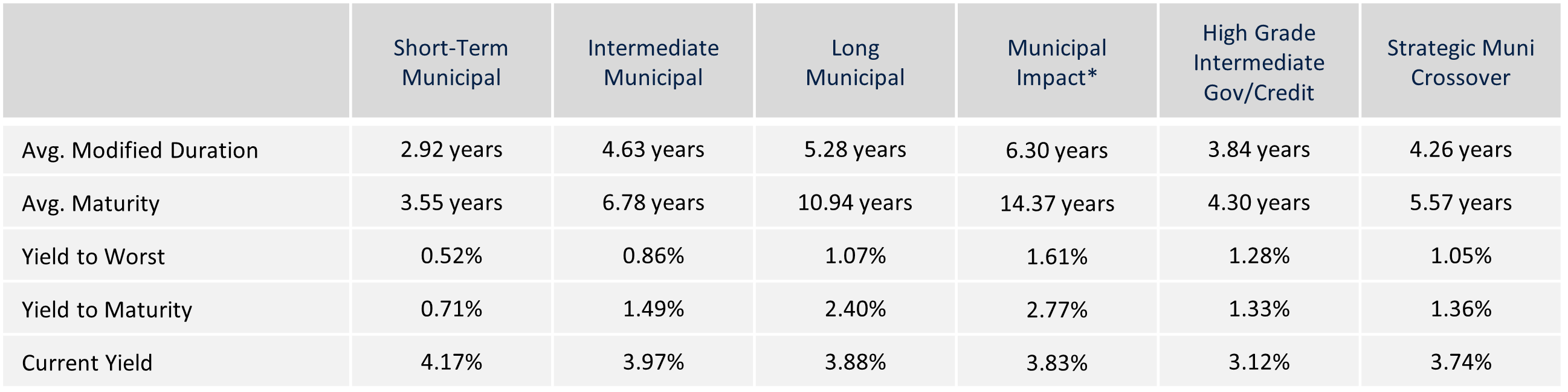

Composite Portfolio Positioning as of 10/31/21

Duration Exposure by Strategy as of 10/31/21

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.