Insights and Observations

Economic, Public Policy, and Fed Developments

- As expected, the Federal Reserve raised the Fed Funds Rate to a range of 2-2.25% in September and dropped “accommodative” from their assessment of monetary policy. The Fed’s “dot plot” shows 12 of the 16 officials favor a fourth hike in 2018, and the median projection is for a further three in 2019. This would bring the Fed Funds Rate to a range of 3-3.35%, slightly above the Fed’s long-range projection of 3.0%. The odds of a fourth hike in December implied by futures markets now stand at about 71.5%, up from roughly a coin flip at the start of the month.

- That said, while the market has priced in a December hike, the inflation picture cooled slightly in September. Headline CPI declined from 2.9% to 2.7%, while core fell from 2.4% to 2.2%. Meanwhile, the core PCE deflator, the Fed’s preferred inflation measure, came in flat in August, missing expectations for modest 0.1% monthly growth. While year-over-year inflation remains at 2.0%, that rate may start to trend downwards as more robust growth at the start of the trailing year period begins to drop out. If this were to happen, we believe the Fed will struggle to raise the Fed Funds Rate the anticipated three times in 2019.

- On September 19th Trump announced the nomination of former Fed economist Nellie Liang to the Federal Reserve board. This is somewhat of a surprising choice; Liang was the former head of the Division of Financial Stability and has been a staunch defender of both Dodd Frank and the Fed’s response to the Great Recession. She is also a registered Democrat. Ms. Liang is an excellent, highly qualified pick; our only concern with her selection is that it furthers the tension between Trump’s public criticism of Fed policy, and his nomination of moderates who are likely to continue those policies. We see this dynamic as raising the risk of a destabilizing showdown should the economy begin to falter.

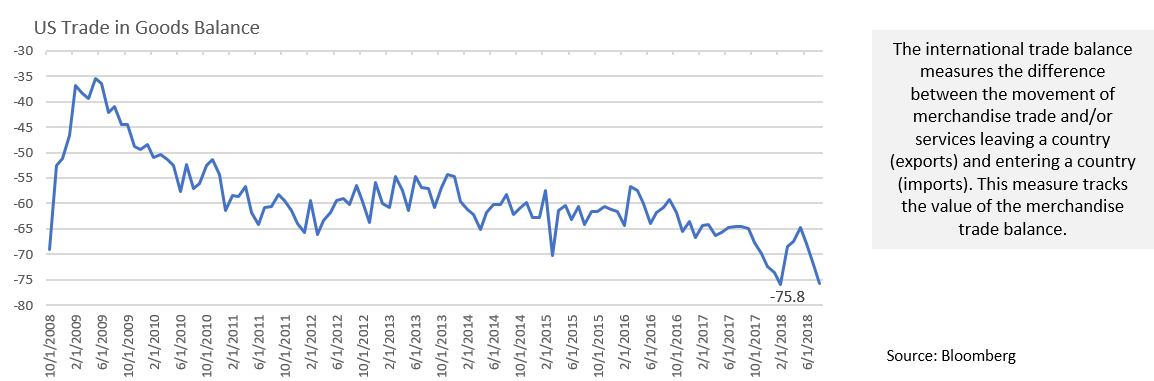

- As usual, it was also a big month for trade news. Despite the Trump Administration’s prediction that Chinese negotiations would take a back seat to negotiations with Canada, Chinese trade tensions dominated September. After two weeks of delay, Trump announced tariffs on $200B in goods on the 24th, initially at 10% but stepping up to 25% on January 1st. China responded with $60B in tariffs of their own, as well as cancelling planned trade talks, indicating they would not resume so long as the US continued to threaten further tariffs. The delayed step-up in the latest round of tariffs appears to be a tacit acknowledgement that the tariffs are beginning to effect US consumers, and the step-up pushes the impact past the holiday shopping season. A widening trade deficit to near-record highs in August provides further evidence that retaliatory tariffs may be impacting the balance of trade and leaves us more confident in our view that GDP growth will slow in Q3.

- Meanwhile, after a month of little incremental news, the Trump administration announced a renegotiated NAFTA, named the United States Mexico Canada Agreement (USMCA), on the 30th. Markets rallied on the news, less because of actual changes to the trade pact than in relief that the risk of the US terminating NAFTA was taken off the table. The new agreement now heads to Congress for a vote, although one is not likely until early 2019.

From the Trading Desk

Municipal Markets

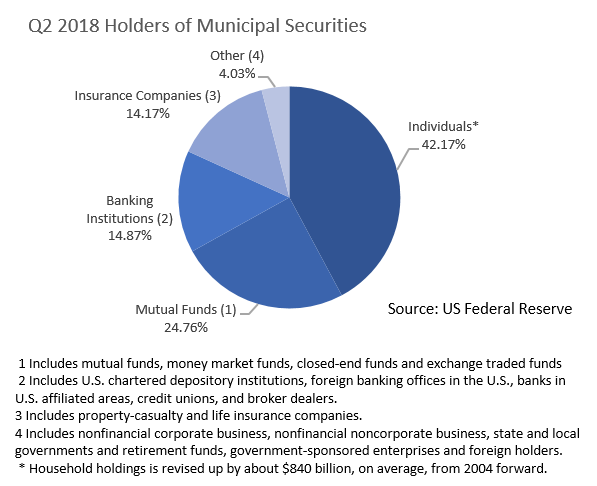

- A long era of accommodative monetary policy, favorable credit conditions, and a thirst for tax-advantaged income have driven yields in the tax-exempt high yield market to record low levels. In fact, the Barclays High Yield Municipal Bond Index yield to worst of 4.74% recorded on 8/31/18 represents the lowest level since the Index’s 1/1/95 inception. The extent to which muni high yield spreads have compressed relative to the investment grade market is also noteworthy. The accompanying chart details the spread between the Barclays Municipal High Yield and Investment Grade indices measured on a yield to worst basis. August ended with a paltry spread of 2.06%, the lowest relative risk premium since 11/30/07, prior to the onset of the Great Recession, a time that also reflected widespread use of 3rd party bond insurance guarantees, a credit backstop that has since largely dissipated.

- In our view, today’s tight high yield spreads introduce a relative value consideration, as advisors and investors assess the adequacy of tax-exempt high yield risk premiums. While nominal tax equivalent high yield coupons may still appear attractive, an extended “risk-on” environment has given investors an opportunity to consider the merits of reallocating a portion of their portfolio into more liquid, higher grade tax-exempt exposure.

Taxable Markets

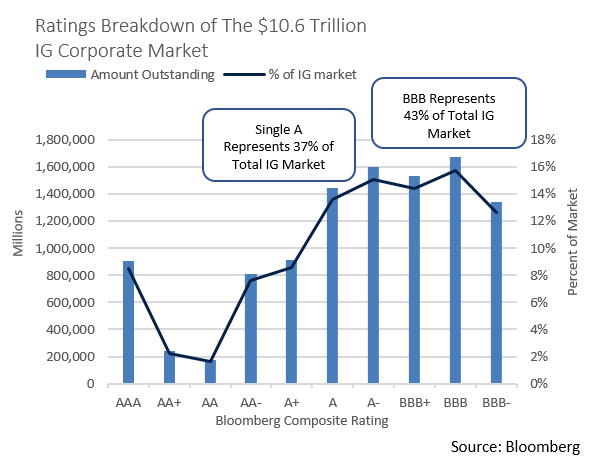

- A sea of red ink at the Federal level is exacerbating US Treasury yield curve fears. As we move into the second half of 2018, the level of outstanding marketable US Treasury debt has climbed to a record level of $15.566 trillion, more than $1 trillion greater than the Treasury had outstanding as recently as the end of 2017. The year-to-date 2018 increase is roughly equal to recession easing issuance during all of 2011. The additional debt is in part needed to offset revenue lost by the Trump tax cut package. An additional $500 billion is expected to be raised by the end of 2018.

- Treasury issuance has been focused on the shorter end of the curve, with the heaviest distribution out to five years. Funding the Treasury’s needs will continue to put pressure on rates at the front end of the yield curve, contributing to the flattening that has given market watchers so much consternation. This supply dynamic is compounded by the Fed’s ongoing efforts to normalize monetary policy, in part by steadily nudging up short-term rates. The market has long demonstrated a willingness and ability to accommodate US debt needs, although the longer term funding cost is something that must be closely watched.

Public Sector Watch

Credit Comments

- Early returns for some of the country’s largest public pensions are running ahead of assumptions through the fiscal year ended June 30th, narrowing the gap between assets and promised future benefits. The California Public Employees Retirement System (CalPERS) announced an 8.6% return for fiscal 2018, besting the plan’s 7.0% target and boosting the funded ratio from 68% to 71%. The second largest U.S. pension plan, California State Teachers Retirement System (CalSTRS), posted a healthy 9.0% return over the same period. Investment returns remain an important ingredient in stabilizing pension fund health. As participating governments struggle to make necessary contributions, investment performance can provide temporary relief. Our tax-exempt research focuses on identifying issuers with adequate current pension funding, and a strong commitment and ability to meet the future benefits promised to retirees.

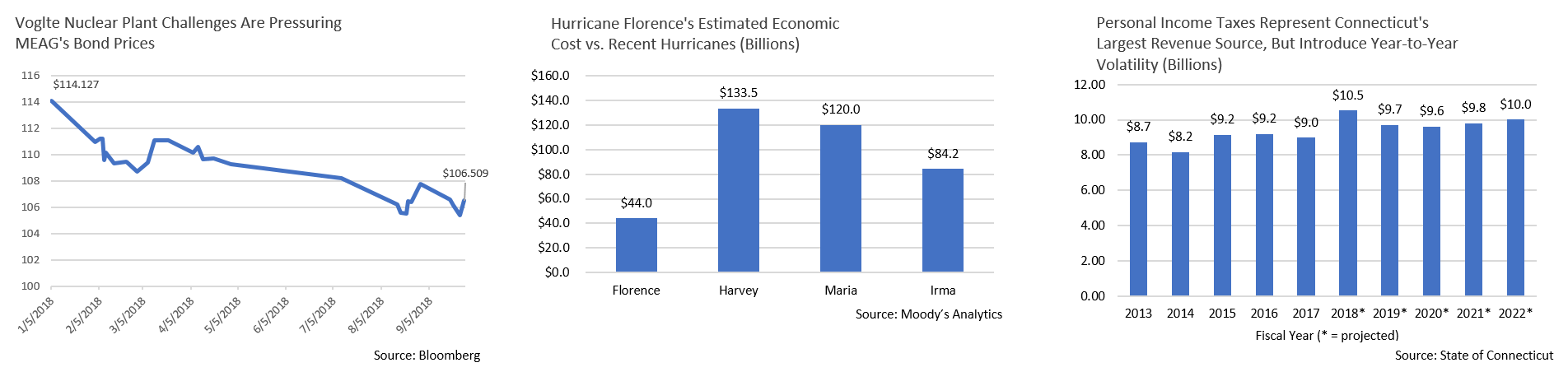

- Connecticut, Maryland, New Jersey and New York sued the Trump Administration over the $10,000 state and local tax deduction cap, implemented as part of the 2018 Tax Cuts and Jobs Act. The States argue the measure unfairly targets traditionally Democrat-led states and “hobbles their sovereign authority to make policy decisions without federal interference.” Successful invalidation of the deduction cap through the courts appears unlikely. Attempts to circumvent the SALT deduction cap through charitable donations or employer-paid payroll tax have also stalled. The state and local governments most impacted by tax reform may ultimately need to adjust their taxing mechanisms, as current tax policy could be constrained by pressure brought to bear by the impact of recent Federal tax reform. These are developments we feel require sustained research scrutiny.

- California’s Supreme Court ruled that Proposition 9, a proposed measure to split the state into three distinct governments, will not be on the November ballot as it could cause serious harm and disruption to the State’s ability to provide essential services. Billionaire Tim Draper sponsored the bill, arguing that California’s distinct regional cultures, prosperity and political bents would benefit from being separated into Northern California, California and Southern California. Even if voters had approved the measure, it would have required State ratification and an act of Congress. However short-lived, Proposition 9 highlights the potential impact of voter-driven ballot measures on state budgets and governance.

Strategy Overview

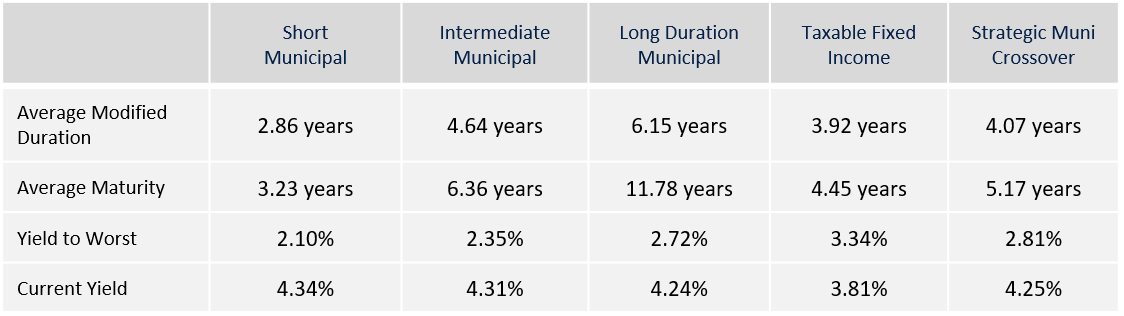

Portfolio Positioning as of 9/30/2018

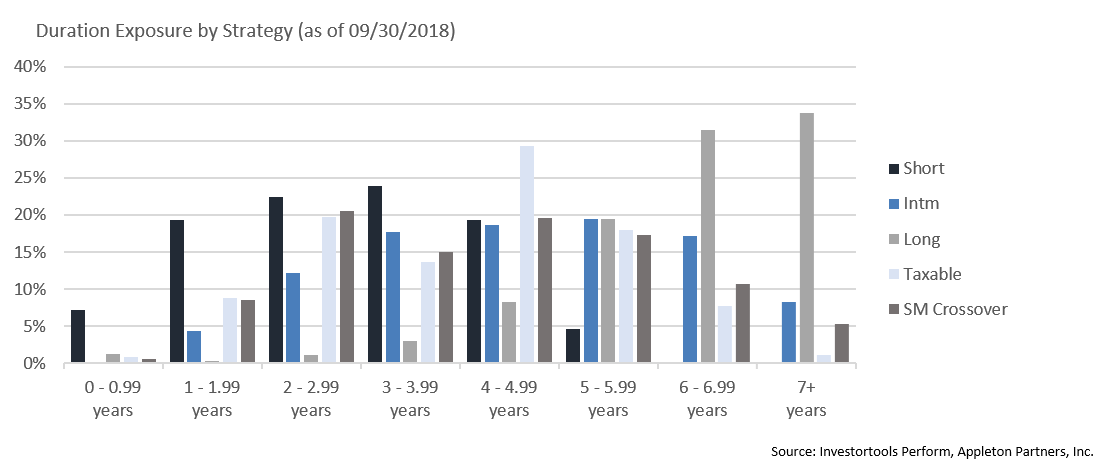

Duration Exposure by Strategy as of 9/30/2018

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.