Insights and Observations

Economic, Public Policy, and Fed Developments

- Trade concerns dominated August, as the run-up to the G7 meeting saw the sharpest increase in tariffs and currency devaluation to date. At the summit, Trump tried to soothe markets with claims that China had resumed high-level contact, something insiders on both sides questioned. This rapid escalation rattled the equity markets, sent the 30Yr Treasury to all-time-lows, and inverted the 2-10Yr curve for the first time since the Great Recession. These latest tariffs should impact consumers more directly than past rounds; according to the AP, consumer goods under tariff jumped from 29% to 69% on 9/1. While there is now talk of an October summit in Washington, we see no obvious reason for either side to make needed concessions and believe the odds of resolution remain remote.

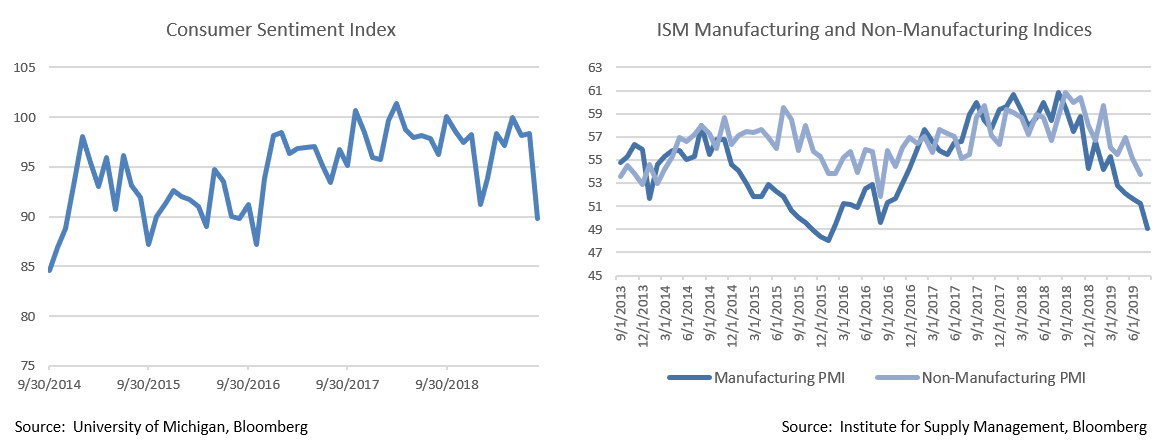

- There is growing evidence that this conflict is beginning to weigh on consumers. The University of Michigan Consumer Sentiment Index declined sharply in August, dropping from 98.4 to 89.9. A third of respondents made unprompted reference to tariffs, and those who did had markedly weaker outlooks than those who did not. Encouragingly, consumers have so far remained resilient, with retail sales (+0.7%) exceeding expectations once again in July. Increases were broad-based; 10 of 13 categories showed growth, led by a 2.8% increase in “non-store-sellers,” a group including online sales. This was a good report after a period of strong, if volatile, sales.

- President Trump seized the Fed’s Jackson Hole symposium as an opportunity to escalate attacks on the Fed, demanding a 100 basis point Fed Funds cut before the meetings began. Meanwhile, former Fed Chairman Bill Dudley penned an op-ed arguing that if further rate cuts make a continuation of the trade war more likely, the Fed’s mandate might be best served by not cutting, denying the President further cover from the economic side effects of his war. With pressure on its independence coming from both sides, the Fed is being forced to walk an increasingly fine line to remain above the political fray, thereby complicating policymaking.

- Brexit continues to evolve at a furious pace, as on 9/3 Prime Minister Johnson lost his parliamentary majority before the opposition passed a bill barring the UK from leaving on 10/31 without a deal. Johnson claims this move weakens the UK’s bargaining position and is now calling for fresh elections before the Brexit deadline. We expect Brexit to remain a source of considerable economic uncertainty in September and potentially October, as the market assesses the likelihood and cost of a no-deal Brexit.

- The non-partisan CBO revised their budgetary forecasts in August and now expects the annual US deficit to breach $1 trillion in 2020 and remain above that level thereafter. US debt held by the public is expected to reach 100% of GDP within a decade, a level traditionally associated with overly indebted economies. Furthermore, the latter phases of an economic expansion are typically periods in which debt/GDP contracts, not expands.

- While the US has remained a bright spot in a slowing global economy, the most recent ISM surveys now also show weakness. The ISM Service Index dropped 5.1 points to 53.7 in July, the weakest reading in two years, while the August ISM manufacturing survey unexpectedly fell to 49.1. Services represent more than two-thirds of the US economy and remain in expansion, but the rate of growth is slowing, and manufacturing has begun to contract, mirroring the slowdown the rest of the world has experienced for some time now.

From the Trading Desk

Municipal Markets

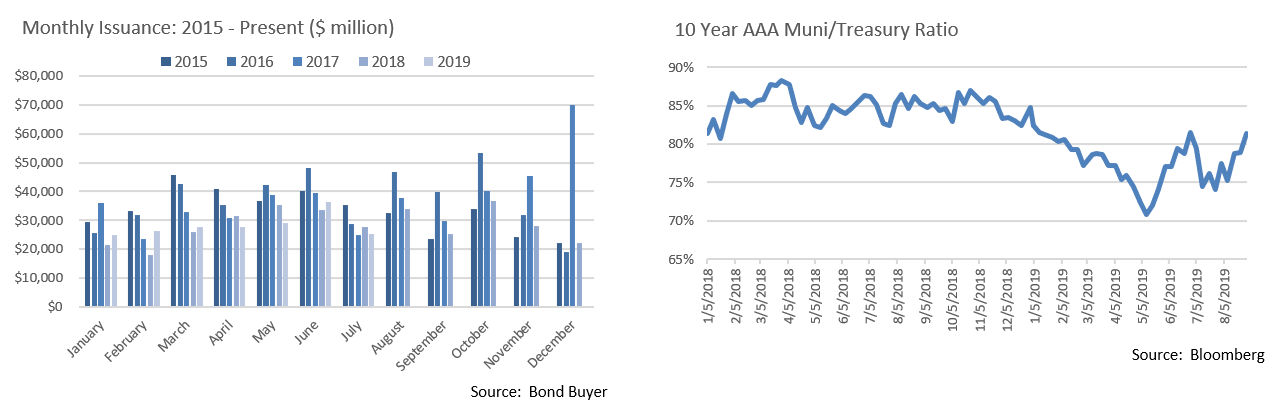

- Low interest rates contributed to a surge in August municipal issuance of $38.53 billion, the highest monthly level since December 2017, and an increase of 13% relative to the same period of last year. About a third of August’s issuance was in the form of refundings, as issuers took advantage of the rate environment. Technicals are still favorable, with issuance flat vs. 2018 prior to August’s spike, while demand remains extremely high. As expected, the market digested recently increased issuance well.

- While the municipal curve’s movements generally correlate with those of Treasuries, it is still very much subject to its own supply/demand dynamics. The easiest way to look at the relationship between the two is through the muni/Treasury yield ratio. Over the past 2 months, AAA 10-year municipals have become somewhat cheaper with respect to the same maturity Treasuries, as the muni/Treasury yield ratio has increased to 81.33% in the face of plummeting Treasury yields. As we’ve previously noted, the ratio had been as low as 70.85% in May.

- Retail continues to drive the municipal market and YTD net positive mutual flows have reached $62.7 billion. However, growth in foreign ownership over recent years has also been noteworthy. According to Federal Reserve data, non-US buyers hold more than $100 billion of municipal securities, much of it in taxable issues. This is double the level of a decade ago, a trend influenced by nearly $17 trillion in negative yielding sovereign debt and an accompanying desire among foreign investors for income and credit stability.

Taxable Markets

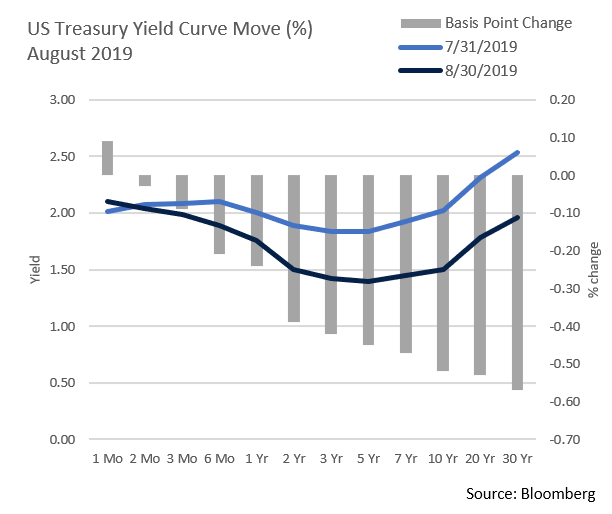

- The month of August was one for the investment grade record books as returns from the asset class were, yet again, strong. The Bloomberg Barclays U.S. Corporate Bond Index returned 3.14% and the longer version of the Index (Bloomberg Barclays U.S. Long Corporate) returned 5.86%. A sharp rally in Treasuries saw the 10Yr fall a whopping 51 basis points during the month to 1.50%. This drove overall IG sector returns as much of the broader non-Treasury asset class weakened modestly, with spreads widening by 12 basis points. Nonetheless, IG spreads in aggregate are 37 basis points tighter on the year.

- Amid recession fears, the long bond’s rally was even more pronounced with 30Yr Treasury yields falling 57 basis points to an all-time low of 1.96% at month’s end. Looking back at the beginning of a decades-long bull market, the 30Yr highwater yield was 15.19% on 9/30/81. With a large majority of positive global rates coming from the US, demand for US IG corporates, Treasuries and municipals should remain strong. There are simply not many other places to go for positive income from high quality credits.

Public Sector Watch

Credit Comments

Moody’s Public Finance Default Report Released in August Revealed Several Points Worth Noting

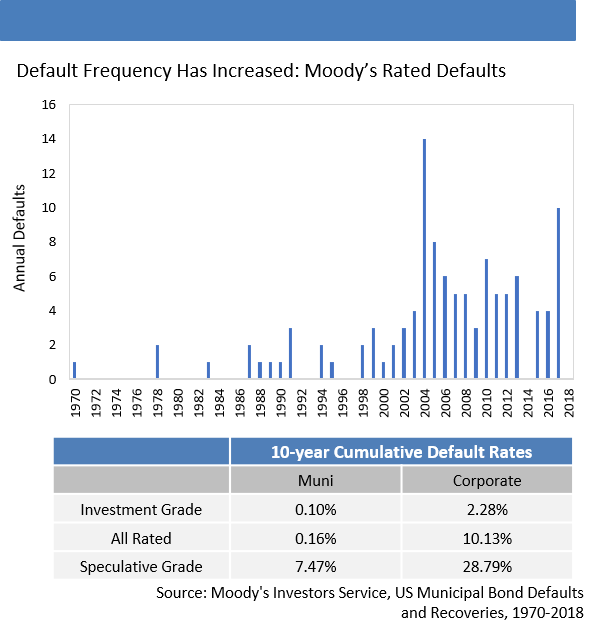

- Fundamentals matter – Reflective of recent defaults and court rulings (Puerto Rico Highways), credit fundamentals, not security provisions, remain the driver of default risk. Security structure influences post-default recovery, but it does not fully insulate bonds from default or impairment.

- Municipal default rates have accelerated since the Financial Crisis, reinforcing the need for issuer due diligence. Of the 113 rated defaults since 1970, 55 have occurred since 2007. The cumulative five-year municipal default rate since 2009 of 0.16% compares to 0.09% for the period 1970 through 2018.

- However, municipal defaults remain rare. The ten-year cumulative default rate for municipal bonds in Moody’s portfolio is 0.16% compared to 10.13% for corporate issuers. Focusing on just the investment grade space, municipal default rates drop lower to 0.10%, highlighting the historically stable nature of the sector.

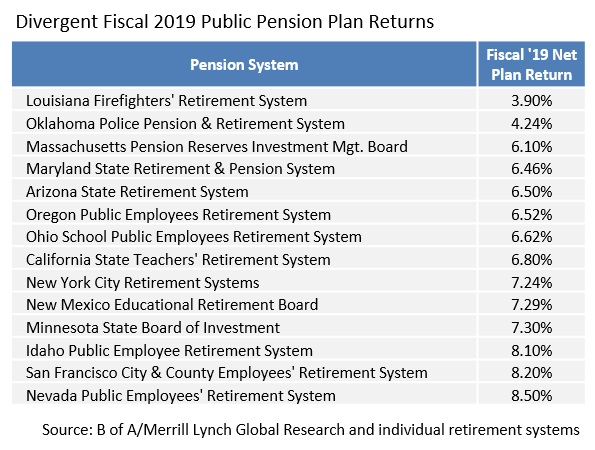

Lackluster Public Finance Investment Performance

- Investment performance remains a key variable as municipal pension plan and endowment returns can indirectly impact operating budgets and balance sheets. Recently reported data indicates that investments largely underperformed expectations for the fiscal year ended 6/30, creating a potential need for additional plan contributions, expense reductions or new revenue sources.

- According to the Wilshire Trust Universe Comparison Service, public pension plans >$1 billion earned a median return of 6.8% in fiscal 2019, below the median long-term target of 7.25%. University and non-profit endowments with > $500 million earned a median 5.3%, their lowest return since 2015.

- The inherent variability of investment performance speaks to the importance of assessing bond issuers’ revenue base and management acumen. We look to invest in obligors able to manage modest plan underperformance without overly straining budgets and balance sheets.

Opioid-Related Settlements Are Likely to Have a Muted Public Finance Impact

- The market rewarded Johnson & Johnson’s shares after an Oklahoma judge ordered the company to pay far less than some investors expected in the first trial by a state seeking compensation for the public-health crisis spawned by opioid painkillers. Oklahoma sought as much as $17.5 billion in reimbursement for tax dollars spent battling addiction and overdoses. However, the court ordered Johnson & Johnson to only pay $572 million, pouring cold water on hopes that the State would see a much larger one-time fiscal boost.

- Other states are pursuing similar cases, although we feel the ultimate outcomes are likely to have a minimal credit quality impact. Not only was the initial and potentially precedent setting Oklahoma verdict (which may be appealed) much less than some had hoped, the judge ruled that proceeds should be directed towards opioid mitigation programs, thereby reducing the likely impact on state general or unreserved funds. This contrasts with the master tobacco settlement which imposed no restrictions on proceeds and became somewhat of a windfall for many states and local governments.

Strategy Overview

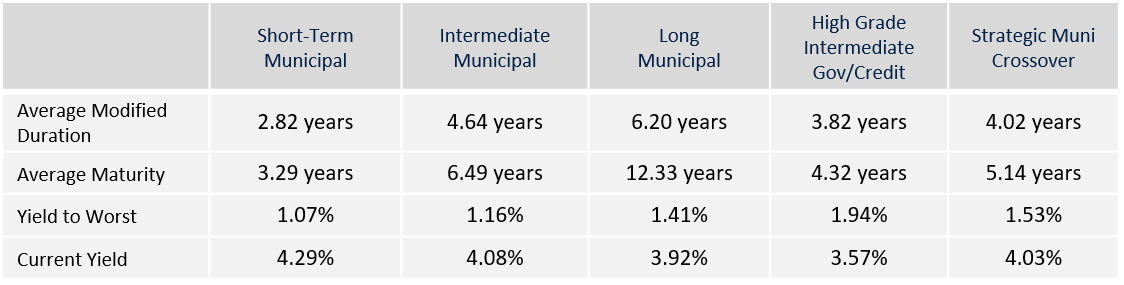

Portfolio Positioning as of 8/30/19

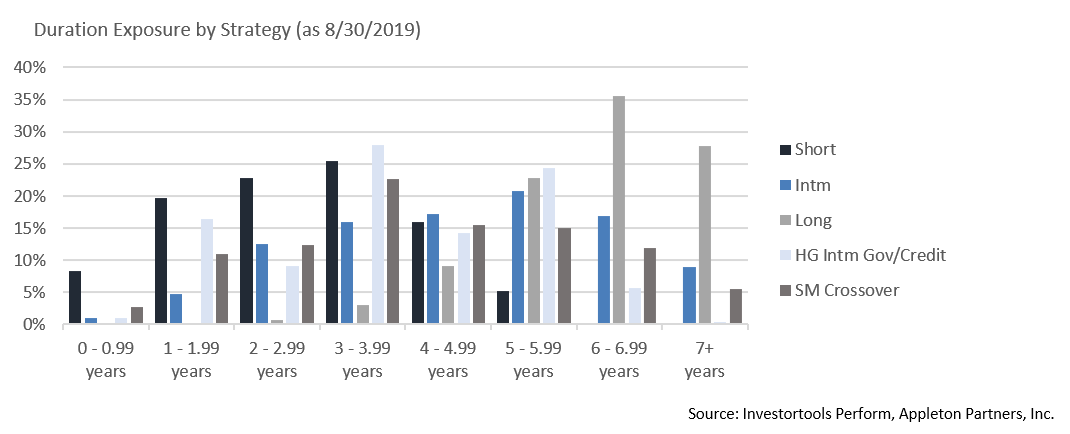

Duration Exposure by Strategy as of 8/30/19

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.