Insights and Observations

Economic, Public Policy, and Fed Developments

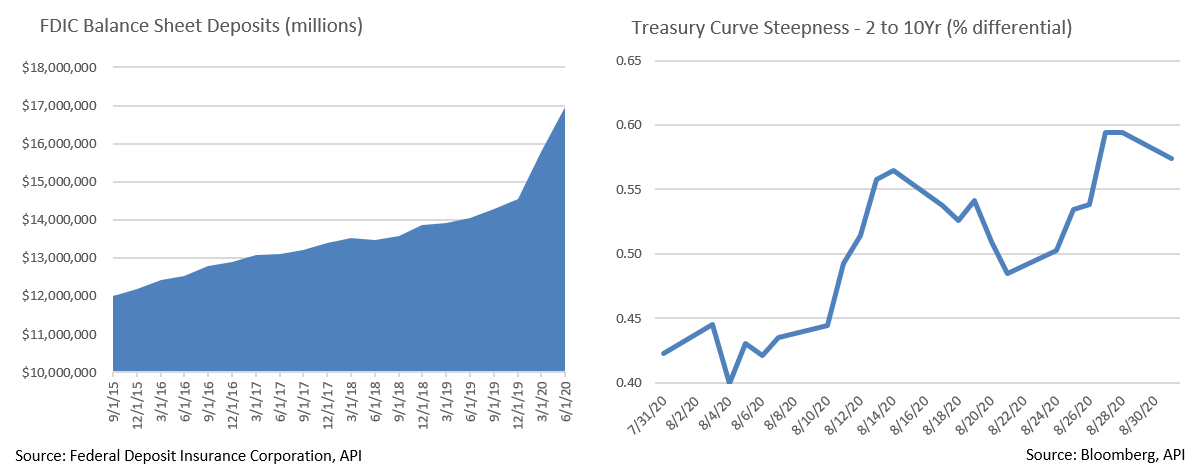

- In a relatively quiet month, Fed Chairman Jerome Powell made the biggest macro news during a virtual Jackson Hole speech. He announced the conclusion of the Fed’s year-long policy review, and the adoption of a 2% average inflation target, indicating that inflation would be allowed to modestly overshoot after a period of failure to meet targets. Powell noted persistent inflation shortfalls led to persistently low rates even during times of expansion, tying the Fed’s hands during contractions. He also discussed the benefits of maximum employment on income inequality. In practice, this solidifies the Fed’s commitment to maintain ultra-low short-term rates for the foreseeable future, and modestly increases inflation expectations. The Treasury curve steepened slightly in response. We expect this shift to eventually lead to higher rates, although not for some time to come.

- The workforce picture remains muddled. The unemployment rate fell in July to 10.2%, beating expectations of 10.6%, and the lingering misclassification issue we have referred to in the past continued to shrink. However, the weekly unemployment reports are still volatile – two consecutive better than expected drops in new unemployment claims stoked the market and brought new claims under a million for the first time since before the pandemic. However, new claims subsequently spiked on 8/20, with 1.106M exceeding the highest estimate in Bloomberg’s survey. The 8/27 claims were in line with expectations although hopes for a much faster-than-expected recovery were dented. Our belief is that the labor market recovery will be slow, and with recent large layoff announcements after the expiration of stimulus funds, notably American Airlines, we worry about a second wave of layoffs.

- Speaking of the stimulus deal, negotiations remain in stalemate, with Congress on break until early September. Major sticking points include liability protection for schools and companies following CDC guidelines on the right, and aid for state and local governments and for the USPS on the left. There is also disagreement on the size of the stimulus bill. Democrats are reportedly open to their version of a “skinny” deal that will buy time until a broader deal after the election, but ultimately, we believe negotiations will be driven by the trajectory of the pandemic and the extent to which improving economic conditions hold. However, consumer confidence fell in August, likely as a biproduct of the collapse in stimulus talks. The current political stalemate comes at a cost.

- The economic picture is not without bright spots, at least. Despite a headline miss, retail sales were surprisingly robust under the surface, with ex-autos and gas surprising to the upside, and with autos being extremely strong in the prior period, timing may have been a factor in the headline miss. Housing has also been a source of strength, as American preferences appear to be shifting from workplace proximity to space in short order. ISM Services also surprised to the upside in August, led by strength in New Orders (61.5 to 67.7) and Production (62.1 to 67.2).

- Finally, while the household savings rate has been unusually high for some time, further evidence of an improvement in consumer balance sheets came in the form of the FDIC quarterly report. Deposits spiked in Q2, up roughly $1.2 trillion, or nearly 21% from a year ago, the highest annual jump in record. The odds of a rapid recovery are low, but consumers are well positioned to weather a sustained slowdown and if the pandemic were to resolve faster than expected there is considerable dry powder to fuel an expansion.

From the Trading Desk

Municipal Markets

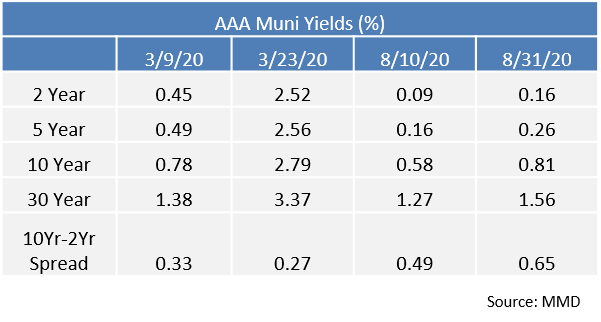

- The municipal market is now six months from March’s COVID-19-induced price lows, a remarkable period in which yields have retraced back to below pre-pandemic lows. The 10Yr AAA MMD hit a high of 2.79% on 3/23 before receding to a new low of 0.58% on 8/10. The same factors have continued to drive market performance – sustained retail demand, paltry alternative yield options, and a robust Federal Reserve backstop.

- Towards the end of August rates drifted slightly higher as a period of seasonal extremes for municipal demand tapered. June to August produced roughly $40 billion of net negative issuance, a trend that is expected to end in September when issuance is likely to increase. This may modestly pressure yields as we move into the fall.

- The 10Yr AAA MMD ended August at 81 basis points. The bid at shorter to intermediate levels has remained stronger than on the longer end and the municipal curve added steepness late in the month. The spread between 2Yr and 10Yr AAA municipals ended August at 65 basis points, affording investors greater relative compensation when adding duration.

- A good part of the volatility six months ago at the onset of the pandemic was driven by mutual fund flows. To illustrate how quickly market conditions changed, during March and early April net outflows from tax-exempt funds exceed $47 billion over a five-week period. This subsequently reversed and fund flows have now been positive for 15 consecutive weeks. YTD tax-exempt fund flows are net positive $14.2 billion despite the five-week period of dramatic outflows earlier in the year.

Corporate Bond Markets

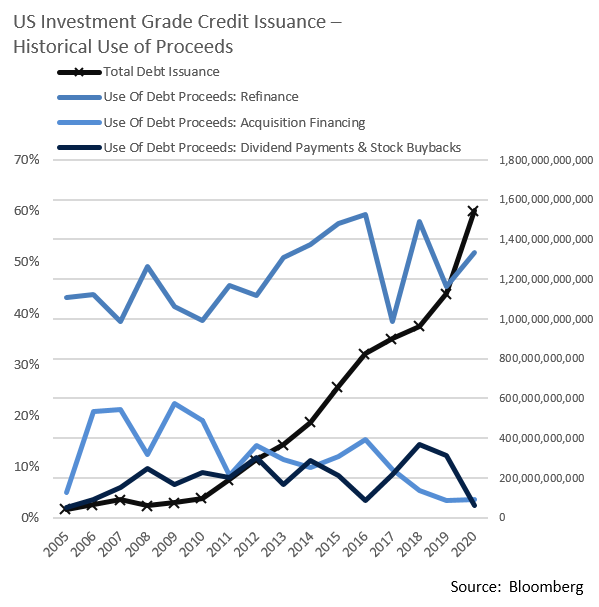

- Investment Grade corporate bond Issuance continues to hit on all cylinders, as $136.3 billion in new debt sales established an August record. That brings the YTD total to $1.377 trillion, 80% above the $764 billion offered at this point last year. A great many issuers continue to utilize proceeds to refinance debt, a positive for credit quality. Over the last 15 years debt refinancing has accounted for an average of 47% of total issuance. So far this year it has accounted for 43%.

- Acquisition financing is another common use of corporate debt proceeds, averaging nearly 20% of issuance over the last 5 years. This year has seen that number drop to just under 5%. Additionally, offering new debt to fund stock buybacks and dividends has accounted for only slightly more than 2% of 2020 issuance.

- September is slated to remain robust with syndicate estimates of around $140 billion. Sustained demand for high grade debt coupled with low rates and tight credit spreads should continue to make refinancing and other debt offerings appealing for corporations.

- Retail continues to be a pillar of support for new bond supply. Last week’s $6 billion of net flows into Investment Grade mutual funds marked the 20th straight week of positive flows. Since the end of March Bloomberg estimates that $87.88 billion has been added to IG corporate mutual funds, a key reason yields have remained compressed.

- The Treasury markets recently experienced a bear steepener, as the 10Yr UST increased 17 basis points in August while the 30Yr spiked 28 basis points. Growth in supply was the biggest contributor, as it has weighed on the long end of the UST curve.

Public Sector Watch

Credit Comments

Rating Actions Spike In 2Q20

- COVID-19’s economic fallout has caused considerable municipal market strain. With revenues down across nearly all sectors, rating agencies have taken notice, with Q2 ’20 downgrades – 81 by Moody’s and 207 by S&P – far outpacing upgrades. This marks an abrupt reversal of prior trends, as upgrades exceeded downgrades in all four quarters of 2019.

- In past recessions rating actions typically lagged economic conditions. During the Great Recession, which began in 2007, downgrades as a percentage of rating actions stayed relatively low until 4Q ‘08 and then remained at higher levels for several years after economic recovery began to materialize. We expect a weaker ratings trend to continue over the next couple of quarters, although primarily in the most heavily impacted sectors such as transportation, higher education and healthcare.

- A proactive approach to credit analysis is important in all conditions, although it is particularly critical during challenging economic times. Appleton relies on proprietary analysis of each issuer’s creditworthiness, seeking to identify risks and possible deterioration in fundamentals well before the ratings agencies act. Our credit quality assessment remains paramount whenever we evaluate the relative value of a municipal bond.

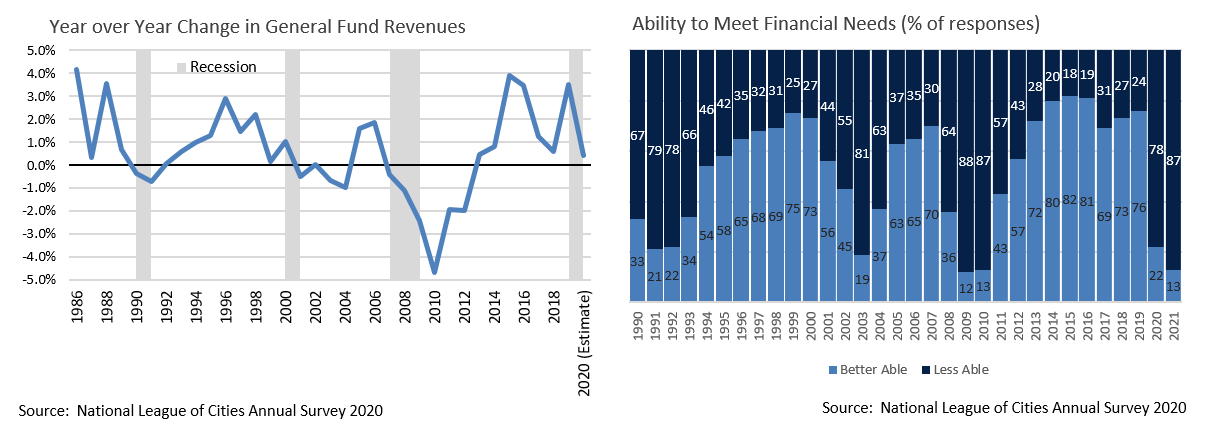

City Managers See Weak Outlook

- The National League of Cities recently conducted their annual survey of local fiscal health and to no one’s surprise responses expressed acute budgetary concerns. FY 2020 revenue growth estimates dropped close to zero (+0.4%), the lowest level since 2012. This factored in large declines in sales taxes (-10.9%) and income taxes (-3.4%). FY 2021 is likely to reveal similarly weak data.

- Forward sentiment is also markedly weaker, as 80% of managers reported being less able to readily meet their anticipated fiscal needs. This contrasts with last year’s survey when only 20% indicated that their city’s fiscal health was expected to weaken.

- Despite these pressing concerns, financial strain does not necessarily indicate credit deterioration. The issuers in which we invest have considerable resources and options at their disposal and we expect these entities to make appropriate fiscal adjustments. It bears emphasizing that, on average, local governments rely on property taxes for 80% of their budgets, a much more stable revenue source than sales or income taxes. Survey respondents indicated that they anticipate property tax revenue to grow 1.9% in FY 2020. While future property tax inflows are expected to decline, there is typically a timing lag that allows financial managers to adjust expenditures.

Hurricane Laura Makes Landfall

- Hurricane Laura made landfall last week in southern Louisiana with wind speeds that reached Category 5 thresholds. Although secondary to the safety of impacted populations, events of this nature often prompt credit quality impact questions. With this in mind, we revisit a past Appleton commentary concerning natural disasters and municipal credit quality.

- Our opinion remains unchanged. Operations are often disrupted in the near term and temporary liquidity challenges are possible. However, strong, stable credits should remain resilient, as budget adjustments are typically supported by state and federal aid.

- Natural disasters amid a pandemic can present heightened challenges for local governments, as increased strain is placed on management teams. Nonetheless, while not immune, the large, well-established issuers we prefer have greater financial and administrative resources to weather unforeseen events.

Strategy Overview

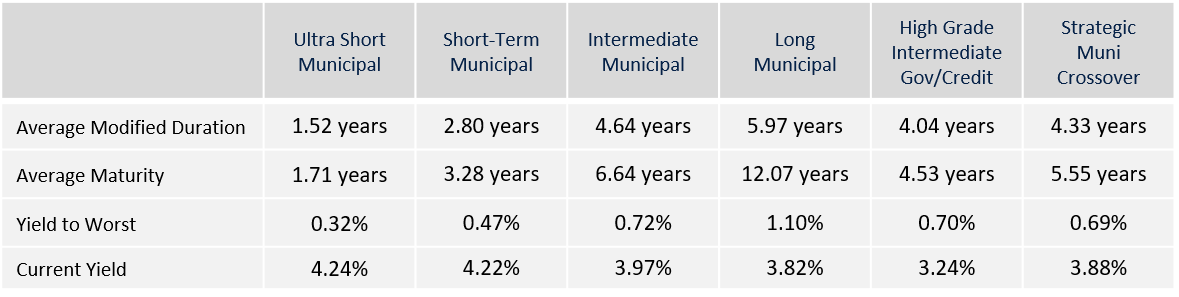

Portfolio Positioning as of 8/31/20

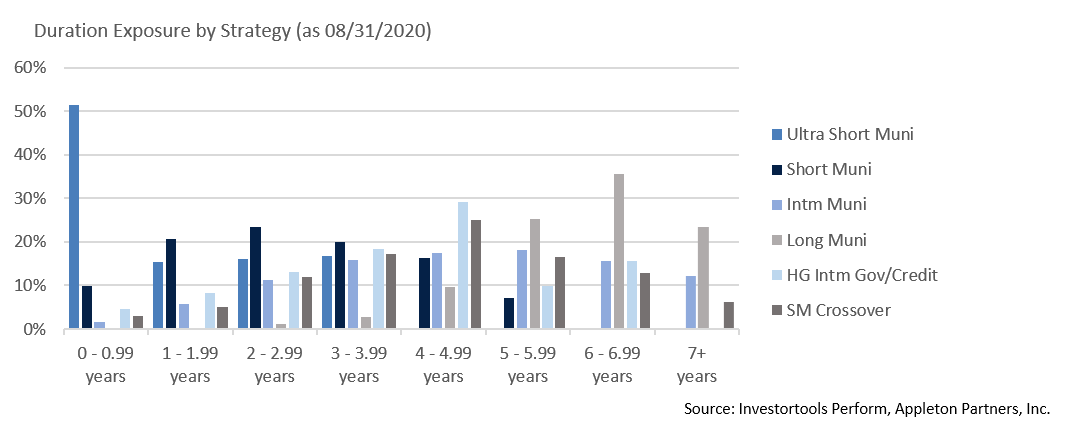

Duration Exposure by Strategy as of 8/31/20

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.