Insights and Observations

Economic, Public Policy, and Fed Developments

- Primarily a regional concern in July, the Delta variant erupted nationally in August to become a legitimate threat to the economic recovery. While thankfully vaccines appear to be holding up and breakthrough cases have mostly been relatively benign, total cases are surging and there is growing evidence that this latest wave is impacting consumer behavior. The University of Michigan Consumer Sentiment Index plummeted at the start of the month, followed by a decline in the Markit PMI Goods and Services indices. The report noted ongoing inflation pressures but attributed the drop to a sharp COVID-related slowdown in consumer activity. Risks have not just been domestic; acute issues in Southeast Asia are worsening microchip shortages. The pandemic has also created fresh logistics challenges by reducing shipping capacity and causing ever-shifting supply chain reroutes. Increasingly, the narrative will need to evolve from “post-pandemic recovery” to maintaining economic growth in the middle of a pandemic, as COVID-19 is far from over.

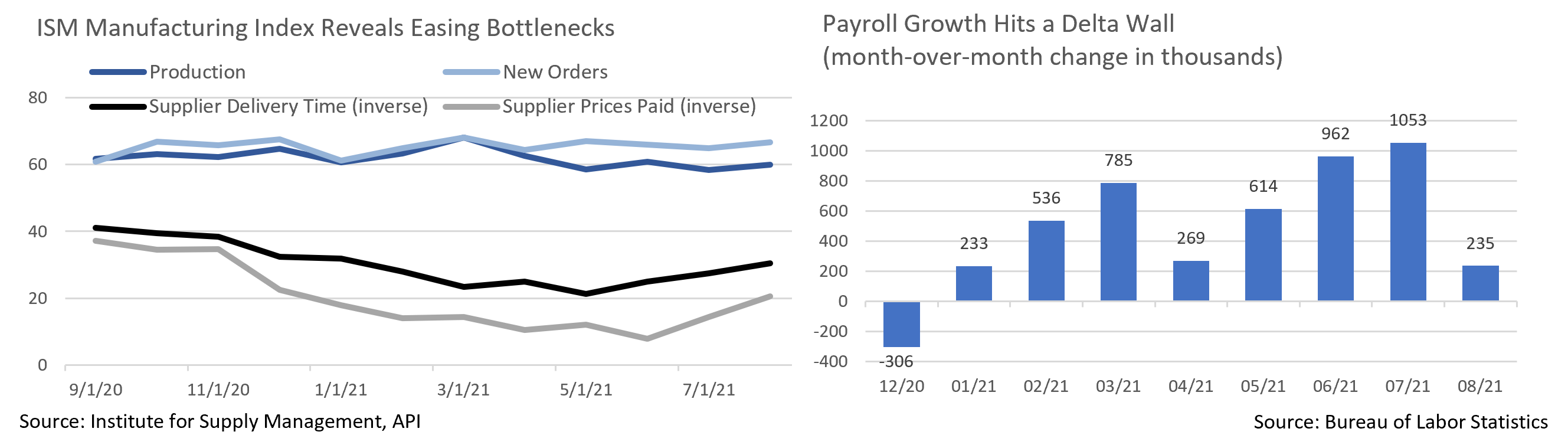

- These strains have also added considerable nuance to the inflation picture. The period of base effects impacting YoY inflation is now behind us, and economic indicators paint a picture of moderating demand that should cause inflation to slow. Retail spending remains high, although it contracted in July (-1.1% vs. expectations of -0.3%) as the impact of stimulus fades. Notably, the survey period was before Delta took hold, so there is a reasonable probability that August’s numbers will moderate further. The ISM Manufacturing Index offered additional clarity, as both production and orders accelerated, suggesting demand remains strong and companies are better able to meet that demand.

- However, the ISM Manufacturing report also noted that labor shortages are creating a drag. The Delta wave will not help here, and indeed August’s Employment Report came in a half million jobs under expectations with weakness concentrated in leisure and hospitality, and 5.6 million Americans unable to work due to the pandemic, up 400k from the prior month. This makes arguments that enhanced pandemic unemployment benefits were keeping Americans off payrolls harder to make. Hiring will remain a challenge without fundamental improvement in the fight against COVID-19. As with economic growth, the inflation discussion increasingly needs to account for the likelihood that the pandemic will exert both inflationary and deflationary pressures as the situation evolves.

- We noted last month that the 67-32 vote to open debate on a $1B “hard” infrastructure bill was an encouraging sign for its passage; the bill ultimately did pass by a slightly wider 69-30 vote, with support from Minority Leader McConnell and 18 other Republicans. The bill includes $550B in new funding, high speed internet access expansion, sizeable roads and bridges outlays, and the largest Amtrak funding since its creation in 1971. Most of this money would be spent over the medium to long term, so there is little risk to the inflation outlook, and we note that most of these “hard” infrastructure projects are badly needed. The $3.5B “human infrastructure” bill’s process began with a party-line Senate vote followed immediately by Senators Manchin and Sinema stating that they couldn’t support the price tag. Given they had just voted to do exactly that, this seems more of a negotiating position than serious resistance, although the Biden Administration has an incredibly narrow path to get a bill moderate enough to pass the Senate yet sufficiently progressive to pass the House.

- Jerome Powell’s speech at Jackson Hole was largely uneventful; his remarks mostly reiterated the Fed’s July meeting statement, although two incremental developments are worth mentioning. First, Powell explicitly included himself within the majority of FOMC participants who believed the Fed had met its “significant progress” test needed to begin tapering. Second, he focused on the disinflationary pressures that have kept inflation below 2% with sub-4% unemployment before the pandemic, noting that “…there is little reason to think that they have suddenly reversed or abated.” Overall, the Fed appears poised to begin tapering at year-end, yet with a very dovish outlook while doing so.

From the Trading Desk

Municipal Markets

- Municipal market conditions remain characterized by intense demand (66 of the past 67 weeks have produced positive net mutual fund flows), modest tax-exempt supply (YTD is running 2% above the trailing 5-year average), and sustained risk appetite (lower quality credits have largely outperformed YTD).

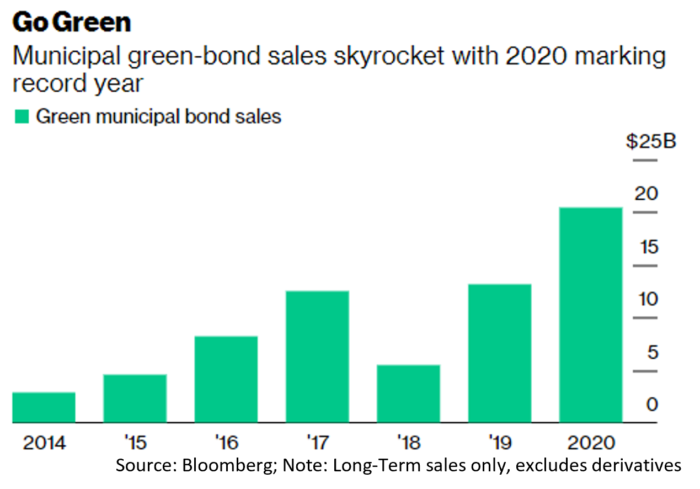

- The explosion of interest in ESG investing has been well chronicled. Although far more prominent amongst corporates, 1,973 US municipal bonds designated as “green” were added to the Climate Bonds Green Bond Database in 2020, and total issuance rose 66% over the prior year. (1) We anticipate a further surge in new tax-exempt green supply in 2021, particularly if Congress approves President Biden’s environmentally conscious infrastructure plan. Analyst estimates for the remainder of the year generally fall in a $30-35B range, a modest yet welcome increase.

- Over recent years, municipal green certified issuance has been led by California and New York, although the Climate Bonds Initiative reports that other large states such as Florida and many municipalities are following suit. Here in our backyard, the City of Boston recently offered green bonds to support energy efficiency and climate resilience projects.

- This niche area of the $4T tax-exempt market remains relatively small and not clearly defined, as far more debt is subjectively viewed as “green” by market participants than the 1% or so officially certified as such. At this stage, many issues are of modest size (typically <$100M) and tend to be somewhat longer in duration, although the market is rapidly evolving. At Appleton, we see growing client demand for customized impact solutions, and are focusing considerable attention on both ESG bond analysis and product innovation.

(1) Climate Bonds Initiative, “North America: State of the Market, 2021”

Corporate Bond Markets

- August is typically a month that rolls on by in the investment grade credit markets with minimal fanfare and this year was no exception. With many market participants out on holiday there was little reason for issuers to come to market. New issuance of just under $90B was mostly brought to market in the first two weeks and was met with solid price action. We expect September to initially ramp up new supply but then taper off as a Federal Reserve meeting later in the month approaches.

- Investment grade credit spreads were unchanged over the month, resting at 87 OAS to USTs. We have nothing exciting to project in that regard over the near-term as we anticipate spreads will remain range bound given resilient credit appetite. Investment grade credit demand remains robust with +$123.1B in net mutual fund flows YTD, including another +$4.3B over the last week in August.

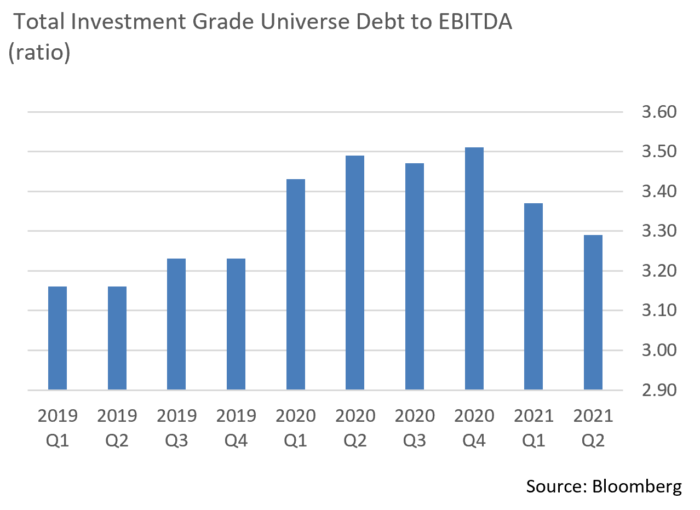

- Over the past several months we have touched on the sustained technical and fundamental strength of the investment grade universe. With earnings reports behind us, these conditions remain intact as the creditworthiness of most corporations is still quite strong. Q2 saw companies report sizable income and revenue increases and the rating agencies have been taking notice with net upgrades to downgrades (as a total of the overall index) positive over the past two quarters.

- Furthermore, median debt leverage ratios have steadily declined. Improvement since the pandemic has been significant as companies have proactively fortified their balance sheets. Bank loan borrowing has also sharply dropped due to the relatively low cost of accessing the public debt markets.

Public Sector Watch

Credit Comments

The American Rescue Plan Act: State Spending Plans Slow to Materialize

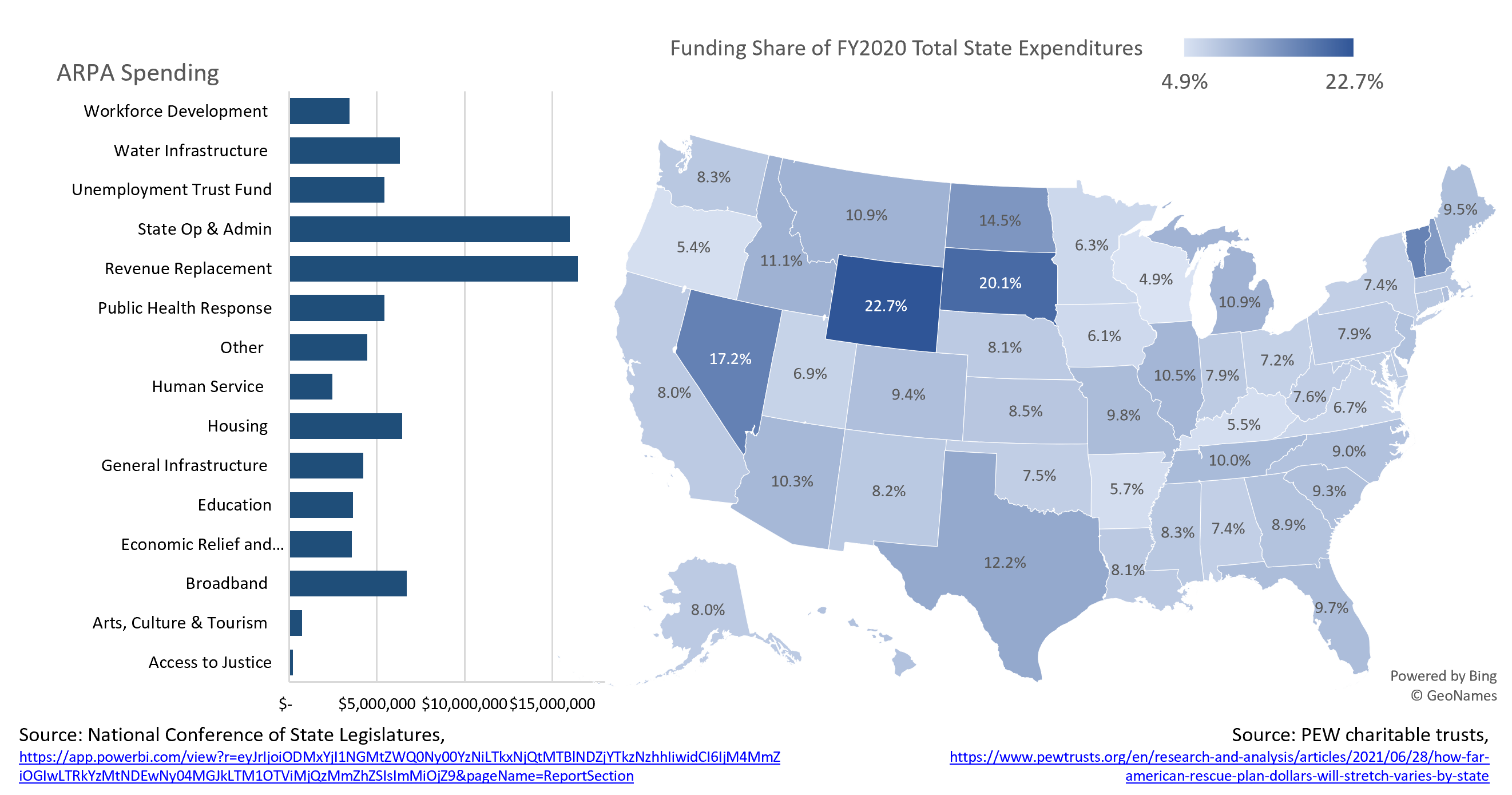

- President Biden signed the $1.9T American Rescue Plan Act (ARPA) in March to aid economic recovery from the COVID-19 pandemic. State governments were among the largest beneficiaries, receiving $195B to be spent through 2026.

- Despite a push for federal aid to offset heavy pandemic related losses, most states have been slow to deploy this federal aid and a dozen have yet to spend any of the funds. Rapidly improving state budgets help explain why, with several states now projecting fiscal year surpluses. Among the 39 states that have so far reported June tax revenue, median YoY collections have increased by 25%.

- The National Conference of State Legislatures’ database breaks down how ARPA funding has been spent. We note that these figures only include money that has been distributed and exclude proposals. To date, $85.5B has been distributed, less than half the amount states were allotted.

- The largest use of funds, $16.5B, is considered “Revenue Replacement”. This accounts for funds departments or agencies spend to backfill revenue losses or to support repayment of loans incurred due to pandemic needs.

- The “Operations and Administrations” category totals $16.0B and includes a $12.5B allocation to New York to cover pandemic costs incurred by the state, although project level uses have yet to be defined.

- New York is hardly the only state to enjoy wide discretion relative to aid. Pennsylvania received $4.6B, of which $3.8B will go to the state’s general fund.

- Colorado gave the governor authority to appropriate $300M to any department for purposes allowable under ARPA.

- California is set to receive the largest amount of federal aid at $27B. Notable anticipated spending includes $7.3B toward offsetting general fund expenditures, $5B for housing assistance programs, and over $4B on broadband.

- Broadband has been a popular use of funds with 15 states collectively planning on allocating $6.7B of anticipated ARPA funds for these purposes.

- Texas is among the states who have yet to receive any federal funds, as Governor Abbott has stated that state funding decisions await a special legislative session later this year.

- Despite the slow roll out of relief funds, there is still plenty of time to make spending decisions. States and cities have until 2024 to commit ARPA money and until 2026 to spend it. The relief program was structured in a manner designed to support governments during the pandemic and for years afterwards, a flexibility that should be beneficial from economic recovery and budgetary standpoints.

Strategy Overview

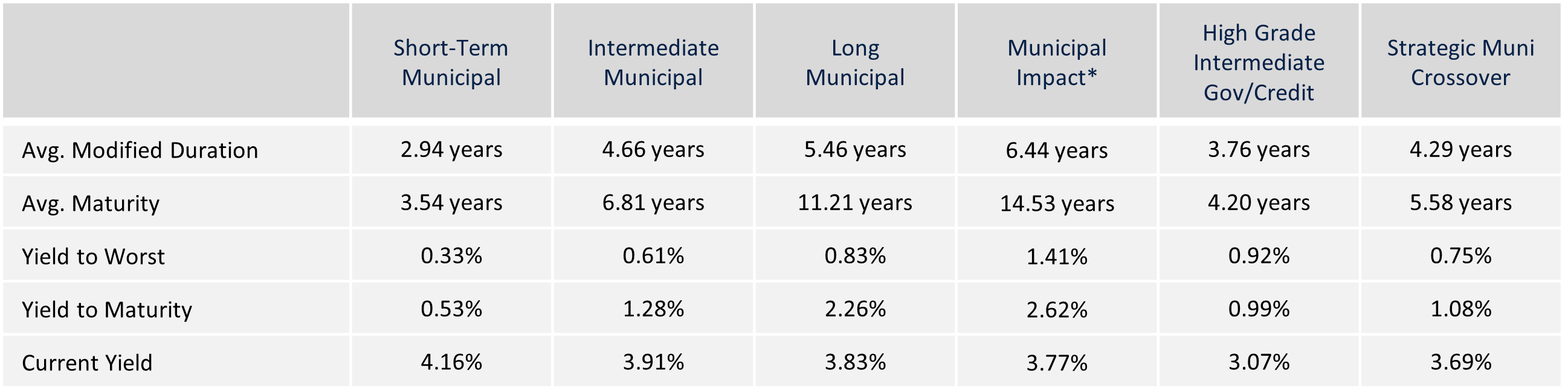

Composite Portfolio Positioning as of 8/31/21

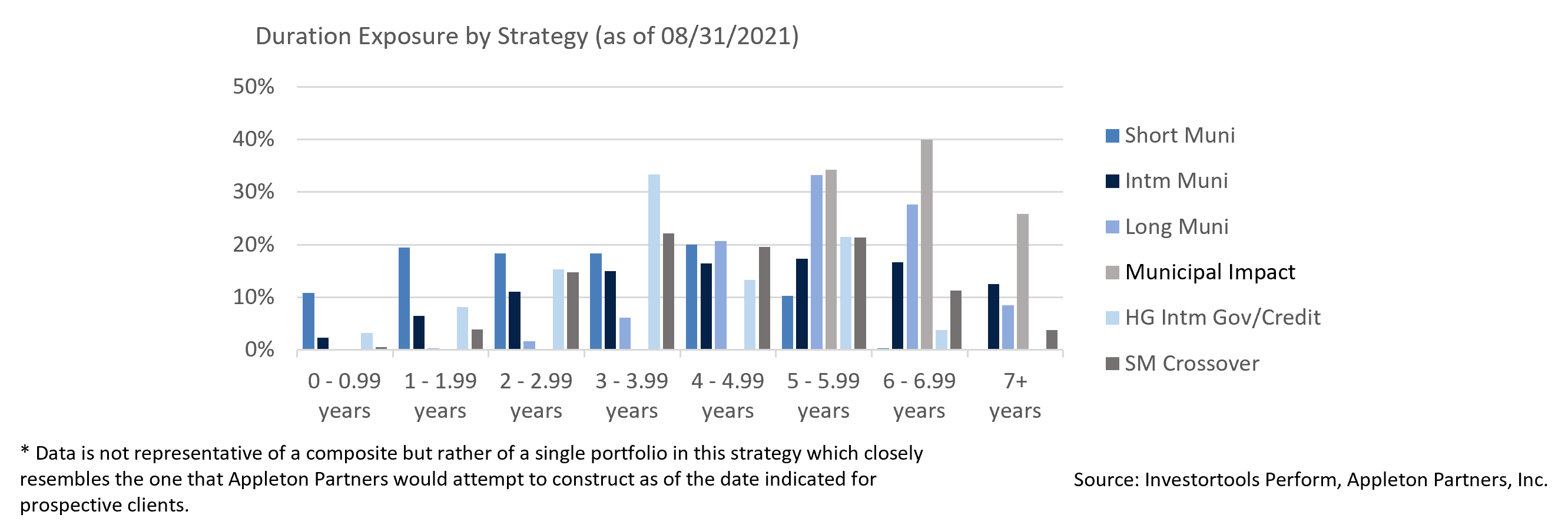

Duration Exposure by Strategy as of 8/31/21

Our Philosophy and Process

- Our objective is to preserve and grow your clients’ capital in a tax efficient manner.

- Dynamic active management and an emphasis on liquidity affords us the flexibility to react to changes in the credit, interest rate and yield curve environments.

- Dissecting the yield curve to target maturity exposure can help us capture value and capitalize on market inefficiencies as rate cycles change.

- Customized separate accounts are structured to meet your clients’ evolving tax, liquidity, risk tolerance and other unique needs.

- Intense credit research is applied within the liquid, high investment grade universe.

- Extensive fundamental, technical and economic analysis is utilized in making investment decisions.