Insights and Observations

Economic, Public Policy, and Fed Developments

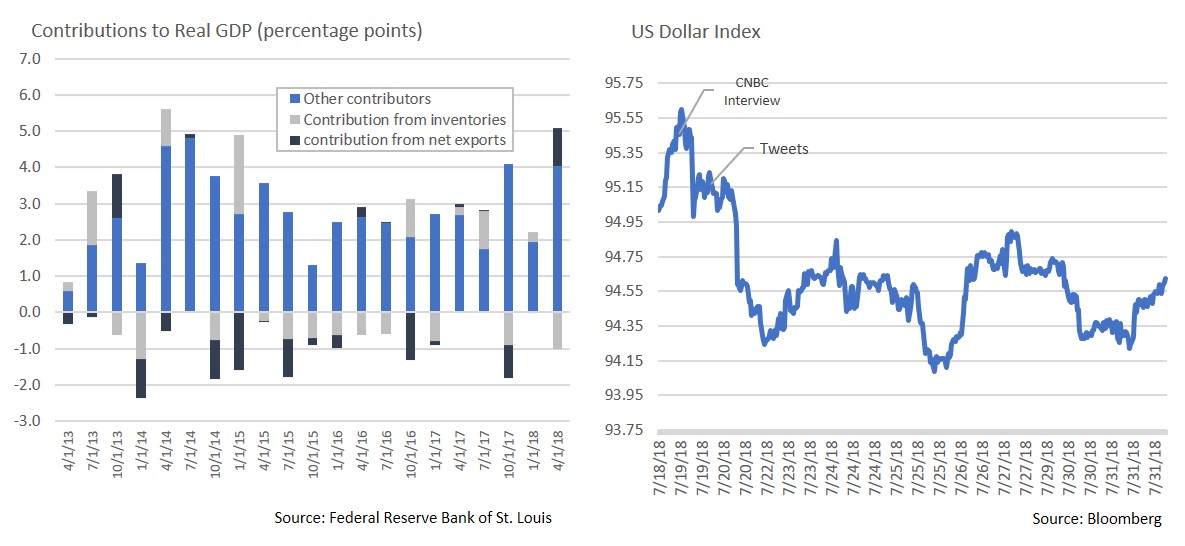

- While the Q2 GDP release came in slightly below expectations at 4.1%, it was a strong report and represented the highest quarterly growth rate since Q3 2014. Beneath the surface, there was both cause for optimism and caution. A surge in net exports contributed more than 1% to the growth rate, although this was largely a function of fast-tracked trade activity as firms tried to get ahead of retaliatory tariffs. Q3 GDP should slow as a result, with the net export contribution largely a wash over the two quarters. On the other hand, a decline in inventories subtracted roughly 1%, and solid final sales to domestic private purchasers of 4.3% point to sustained domestic demand. While the net trade impact was expected, this was not. We expect GDP growth to cool a bit in Q3, although the fall off should be less dramatic than previously feared.

- The inflation picture remains muddled, but likely still muted. While PMI released at the start of July was slightly lower than expectations at 0.2% for both headline and core (bringing year-over-year to 3.4 and 2.7% respectively), the Fed’s preferred measure, the PCE deflator, came in light at 0.1% (vs 0.2% expected). Encouragingly, personal income and consumption both rose 0.4%, and the savings rate was unchanged at 6.8%. This was a good report, as it confirmed healthy, modest inflation, along with solid spending and savings.

- The Trump Administration continues to send mixed messages on trade. At the start of the month President Trump directed his administration to prepare for $200B in additional 10% tariffs (a move China threatened to challenge in the WTO), before announcing another proposed $500B in tariffs. With roughly $130B in US goods shipped to China and $506B in Chinese goods exported to the US, we are approaching the point where further tariffs would be ineffective, making alternative forms of retaliation necessary. The Qualcomm and NXP merger being blocked by Chinese regulators may represent an example. Tensions moderated towards the end of the month with both sides committing to talks, only to see the US reiterate plans to move forward with $200B of tariffs, prompting Chinese ire. Meanwhile, in earlier meetings with European Commission President Juncker and Italian PM Conti, Trump soothed the market with assurances of continued trade negotiation. It remains difficult to get a clear read on where the Administration stands, although overall trade tensions seem to be escalating.

- Breaking from decades of White House tradition, President Trump guardedly criticized the Federal Reserve for raising interest rates in an interview with CNBC, before more openly attacking the Fed over Twitter the next day. The President argued that Fed policies are strengthening the dollar and taking away a US competitive advantage as the euro and yuan weaken. The dollar dropped sharply on the news, an indication of acute market sensitivity to today’s political news cycle, before recovering somewhat in subsequent days.

Equity News & Notes

Seeing the Fundamental Forest Through the Macro Trees

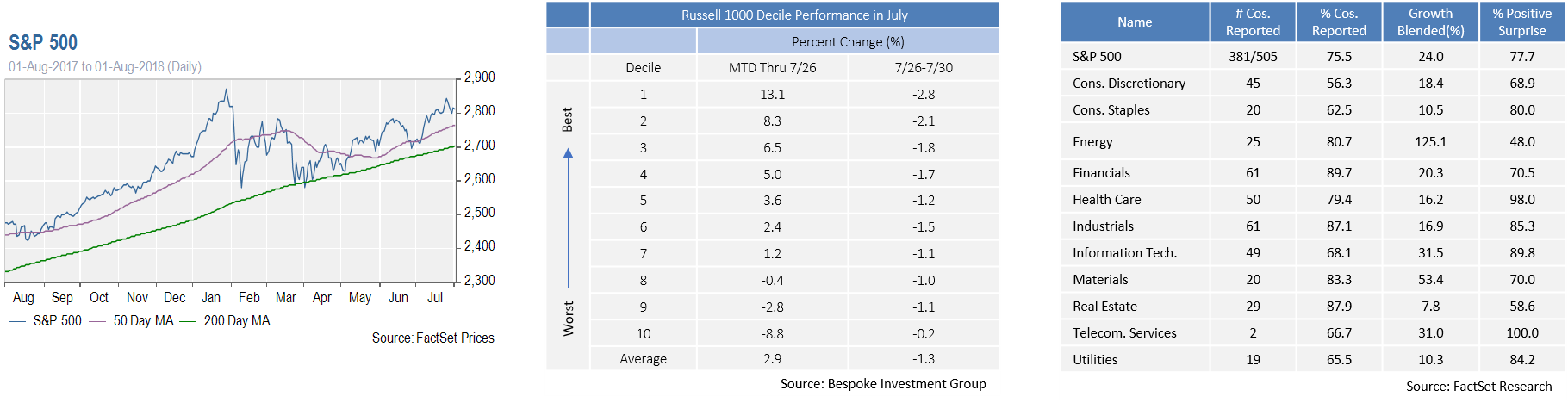

- Q2 earnings season isn’t over yet, but with 75% of S&P 500 companies reporting, results remain highly favorable. According to FactSet Research, blended quarterly earnings growth reached 24%, barely behind Q1’s very strong 25%. Top line sales growth has also been robust, with a 9.3% blended revenue growth rate. We’ve been monitoring rising input costs for businesses, but it is encouraging to see that net profit margins remain elevated, in part a function of the impact of reduced corporate taxes.

- How have investors been reacting to this earnings season given elevated expectations? Beats are being rewarded, a sign of sustained positive sentiment. According to Bank of America Merrill Lynch, companies that exceeded earnings expectations have risen an average of 1.5% after reporting, the largest gain since 2016. The outlook for the remainder of 2018 also looks good, with 20% forecasted earnings growth. Investors will have to contend with slowing growth rates in 2019, yet the current S&P 500 forward P/E of 15.8x remains quite reasonable.

- Despite the overall S&P 500 posting a solid gain in July, rotation under the surface sent ripples through the market. Shares of technology companies came under heavy selling pressure following Facebook’s drop after reporting disappointing results. During the 3-day selloff, many investors worried that Tech’s leadership role was coming to an end and that the “growth-over-value” trade was dead. To us, the selloff was not about fundamentals. Netflix and Facebook disappointed, but other stalwarts like Alphabet, Microsoft, Amazon, and Apple are still putting up exceptional results. These brief Tech selloffs have not been uncommon, despite the sector remaining the YTD top S&P performer. The accompanying chart from Bespoke Investment Group speaks to the influence of profit taking on recent sector rotation.

- Although investor immunity to each headline and tweet appears to be growing, trade remains the most visible threat to the equity markets. The S&P 500 was able to break above 2,800 in July, partially due to easing trade war fears following President Trump’s meeting with European Commission President, Jean-Claude Junker. There were also rumors that a deal on reworking NAFTA may be on the horizon. However, as referenced earlier in this publication, enthusiasm was short lived. Progress with European and North American allies can easily be undone by escalating tensions with China. For now, investors remain optimistic that we’ll be able to avoid a trade war, yet market skittishness reflects an unusual and disconcerting level of policy uncertainty.

From the Trading Desk

Municipal Markets

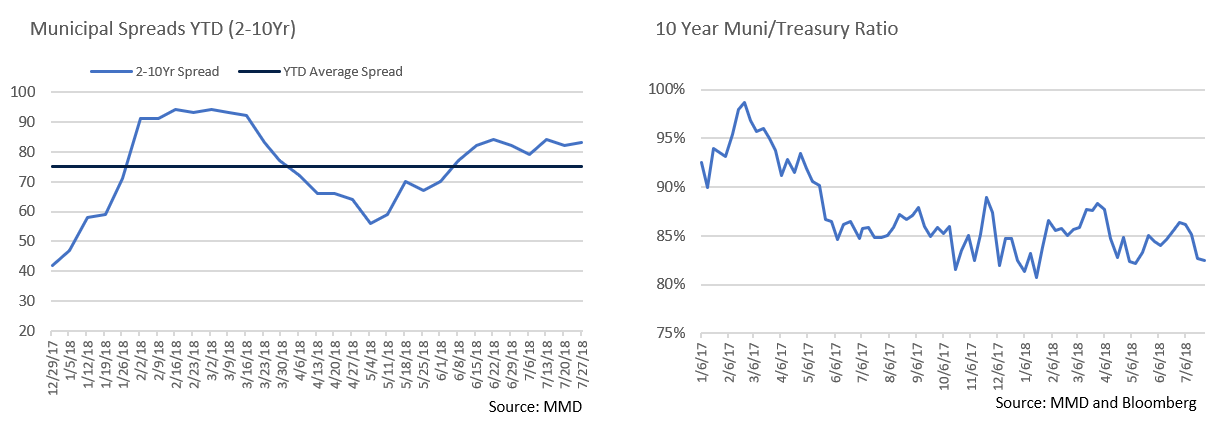

- At the end of July, the 2 to 10 year spread on the muni curve stood at 84 basis points, significantly steeper than the beginning of the year’s 42 basis point level, but consistent with the beginning of the month. The 2Yr yield increased to a high of 1.87% in the Spring, before prices rallied and drove yields down to 1.61% at the end of July. The 10Yr muni started the year at 1.98% before climbing to 2.45%, with most of the move occurring in Q1. While the financial media and many investors fret over the possibility of the Treasury curve inverting given a historic association with subsequent recession, the muni curve remains much steeper and has never inverted. We do not expect that to change and see healthy tax-exempt market conditions marked by strong investment grade credit quality.

- The ratio of 10Yr munis to Treasuries ended July at 82.8%, below the 52 week average of 84.9% and down more than 3% from the beginning of the month. The trend lower has been driven by strong muni demand coupled with limited supply. Federal tax reform has impacted both sides of the equation by limiting investors’ ability to deduct State and Local taxes, and removing issuers’ flexibility to issue advance refunding bonds. While munis and Treasuries often largely move in synch, favorable muni technicals have driven down the Muni/Treasury ratio to its current level. Nonetheless, we are finding tax-exempt investment grade value.

Taxable Markets

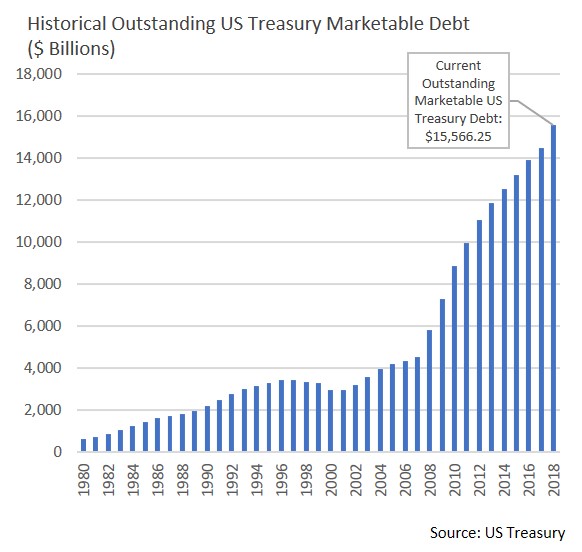

- A sea of red ink at the Federal level is exacerbating US Treasury yield curve fears. As we move into the second half of 2018, the level of outstanding marketable US Treasury debt has climbed to a record level of $15.566 trillion, more than $1 trillion greater than the Treasury had outstanding as recently as the end of 2017. The year-to-date 2018 increase is roughly equal to recession easing issuance during all of 2011. The additional debt is in part needed to offset revenue lost by the Trump tax cut package. An additional $500 billion is expected to be raised by the end of 2018.

- Treasury issuance has been focused on the shorter end of the curve, with the heaviest distribution out to five years. Funding the Treasury’s needs will continue to put pressure on rates at the front end of the yield curve, contributing to the flattening that has given market watchers so much consternation. This supply dynamic is compounded by the Fed’s ongoing efforts to normalize monetary policy, in part by steadily nudging up short-term rates. The market has long demonstrated a willingness and ability to accommodate US debt needs, although the longer term funding cost is something that must be closely watched.

Financial Planning Perspectives

Bridging the Generational Planning Gap

Intrafamily dynamics are as unique as individuals themselves, and there are no “off-the-shelf” solutions to complicated life situations. How wealthy families approach multi-generational financial planning is no exception. Nonetheless, for more than three decades, our clients have expressed a common goal – the desire to see future generations approach financial matters with security, confidence, and responsibility.

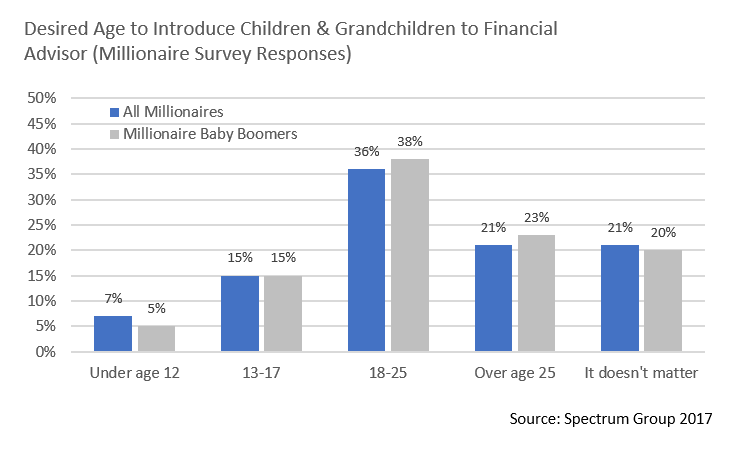

Effective multi-generational financial planning starts with relationships. Introducing your children and grandchildren to our portfolio managers in whatever manner best suits your personal style and circumstances represents an important first step. Doing so can create valuable familiarity and comfort not only with the people involved in your financial affairs, but the planning process itself. At what age this ought to take place is another matter. Families have widely different perspectives on that question, as a recent Spectrum Group survey of wealthy families revealed.

Introducing younger generations to your advisors need not involve them in the details of your investment portfolio or estate plans. The real value lies in establishing a connection to the people and process that can be built upon when the time comes for your family members to begin making financial decisions.

Financial literacy is also a widespread concern. In fact, according to the National Foundation for Credit Counseling’s 2016 Consumer Financial Literacy Survey, 45 percent of adults gave themselves grades of C, D or F regarding their personal finance knowledge.* Many wealthy families are understandably concerned that younger generations may not be equipped to handle wealth and related financial matters responsibly.

At Appleton Partners, we have always approached financial planning in a hands-on, customized manner. Unique solutions reflect unique circumstances, and we are happy to engage with your family members in whatever manner makes you most comfortable. Educational savings strategies, retirement planning, and asset allocation may be of more immediate interest to younger family members, while, in other cases, sharing details concerning your estate and legacy plans, healthcare proxies, or other sensitive matters may be appropriate.

Regardless of your needs and desires, relationships matter. Building an advisory bridge to the next generations can help provide your loved ones with the resources and advice they will need. We invite you to reach out and let us know how we can best support your planning objectives.

* Champlain College for Financial Literacy

For questions concerning our financial planning or wealth management services, please contact

Jim O’Neil, Managing Director, 617-338-0700 x775, [email protected]