Insights & Observations

Economic, Public Policy, and Fed Developments

- Even without an election, today’s macro environment would be interesting. Markets are focused on labor weakness and have broadly moved on from inflation concerns. What makes this fascinating , however, is that we think markets have it backward.

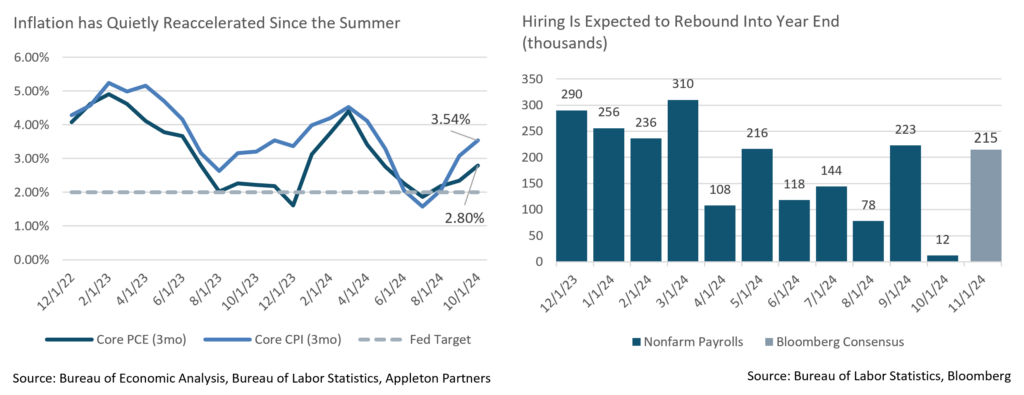

- Inflation has accelerated since the summer. October’s CPI was in line with consensus, but this was the third straight +0.3% Core CPI monthly print, and markets expect a fourth in December. On a three-month annualized basis, this equates to +3.5% Core inflation, too high for the Fed’s comfort. Core PCE bottomed out over the summer and has been running at +0.3% as well, with the three-month annualized rate a better, but still too high, +2.8%.

- Meanwhile, October’s abysmal jobs report, with only 12k new jobs, was impacted by two hurricanes, a major strike, and a lot of election-related deferred hiring. We expect a rebound in hiring in the coming months. Economists do, too, with the Bloomberg consensus for the report due out on the 6th calling for a robust 215k new jobs. Nonetheless, the market remains convinced hiring is worrisomely tepid.

- If we even get consensus employment and inflation reports in December, the case for the Fed to cut short term rates is less compelling, and we think a skip in December is more likely than the 75% probability implied by the futures markets. We’re also looking for a sizable upward revision in the 2026-27, and possibly long run, neutral rates in the December “dot plot,” with a median in the 3.5-4% range plausible; futures market pricing suggests the market wouldn’t be unduly startled by this large a move (the September dot plot had a 2.9% long run neutral).

- Turning to the election, former President Trump will return to Washington in January with narrow House and Senate majorities. As in 2016, there is considerable uncertainty as to which of his campaign talking points will become policy; however, here are some broad observations. With Congress reportedly already working on a budget including a ten-year extension of the Tax Cuts and Jobs Act, this will be an early legislative priority. Passage via reconciliation will be necessary given narrow majorities; and, thus, cuts will mostly be “funded” and will not substantially increase the deficit. Tax cuts should boost growth, although another four years of inaction on persistent deficits was a concern before the election, and this budget will likely do nothing to address this issue.

- Tariffs were another focal point of Trump’s campaign. The consensus is that they are a negotiating tool, which is probably true in the case of China. Nonetheless, Trump has argued his 10-20% tariff proposals on all imports are both good for growth (most economists disagree) and necessary to pay for tax cuts (probably true, as they will have to pass via reconciliation), so action here is very likely.

- Immigration policy is also an under-appreciated risk, as the roughly 3 million migrant workers who came to America in the last few years contributed to unexpectedly robust growth during a period of falling inflation and labor market normalization. While mass deportations would be difficult and expensive, though not impossible, a reduction in new immigration would tighten labor markets, and at the margin, both this and tariffs are likely to be inflationary.

- On the whole, we expect higher growth but also the potential for higher inflation. With this in mind, we are widening our fair value range for the 10Yr UST, raising the top end 25bps to 4.75% while leaving the bottom unchanged at 4.00%.

Equity News and Notes

A Look At The Markets

- Stocks were higher in November as the S&P 500 gained +5.7% to bring its YTD price return up to +26.5%, the best 11-month start to a year since 1997. That said, the S&P 500 actually trailed, as the Nasdaq rose +6.2%, the DJIA +7.5%, and the Russell 2000 +10.8%. Nonetheless, the S&P 500 has produced positive returns in 11 of the past 13 months and ended the month at an all-time high, its 54th this year. All 11 sectors were higher, led by Consumer Discretionary (TSLA +38.2%) and Cyclicals (Financials, Industrials, and Energy). Healthcare stocks were the laggard following the election and subsequent RFK Jr. nomination.

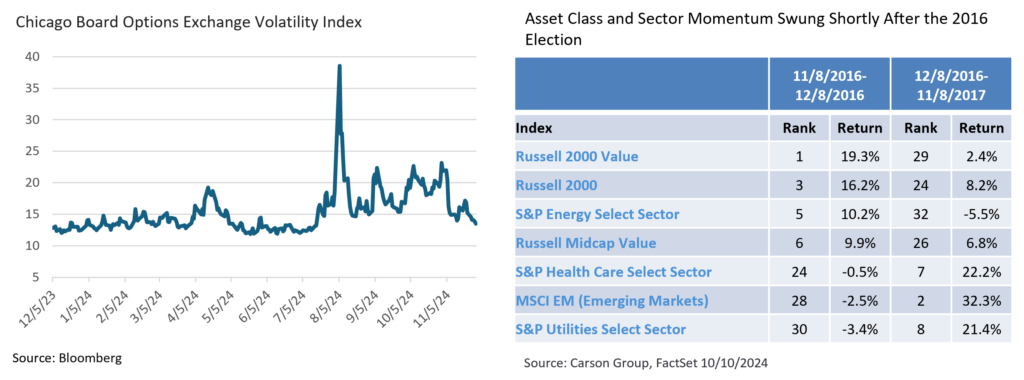

- The main driver of November’s strength was the swift and decisive election outcome as the market welcomed political clarity following months of uncertainty. As we noted last month, elevated volatility heading into November was largely about portfolio positioning and downside protection being sought by traders worried about a prolonged, contentious election and that we were likely to see this unwound. The collapse in the VIX, Wall St’s “fear gauge,” was immediate, with a 1-day drop from 23 to 15, among the largest daily declines since the onset of Covid. The drop in volatility was also seen in other asset classes with the MOVE Index, the bond market’s version of the VIX, falling from 136 to 95 by month’s end.

- Despite removing the election overhang, questions remain regarding the new administration and its policies. Tariffs are garnering headlines, but we don’t yet know the amounts, which goods are to be impacted, from which countries, the extent of retaliation, and the degree to which companies will pass these higher costs on to the consumer. The details of immigration policies are highly uncertain as are the associated impacts on the labor force and wage pressures. The Administration is likely to pursue corporate tax cuts, yet the prospects of passing reduction to 15% in a Congress in which the Republicans hold very narrow margins remains to be seen, as is the ultimate balance between an expected increase in corporate profits relative to the deficit impact of lost Treasury revenue. Will deregulation lead to an economic boom or elevated risk taking from companies? These are but a few of the many questions investors will have to grapple with in 2025 and beyond.

- As we seek answers, caution is warranted when extrapolating early post-election market moves. As the chart below shows, what investors initially believed the winners and losers to be after the 2016 election did not work out so well over the subsequent 11 months. As more clarity is gained concerning legislative and executive action policies, we will be better able to assess the fundamental impact on sectors and individual stocks. Until then, reading too much into the market’s day-to-day view on winners and losers is not advisable.

- Relative to market prospects, the underlying trends heading into the election are more impactful than the results. Said differently, the fundamental drivers in place over the months prior to November 4th are still in place today and should sustain upward momentum. A resilient consumer, a healthy jobs market, an economy growing above trend, easing monetary policy from global banks, healthy credit and liquidity, expected corporate profit growth of +12.5-15% next year, and getting past a divisive election are all favorable indicators. Tactically, positive seasonal trends, corporate buybacks, and the FOMO trade heading into year-end are also at play. Geopolitical flare-ups are a concern, but the biggest risk at this point may be excessive “animal spirits” taking hold as valuation metrics are stretched to the upside. An early December breather would be well-deserved, although the ingredients are present for a Santa Claus rally.

- Wishing you and your loved ones a happy, peaceful holiday season!

From the Trading Desk

Municipal Markets

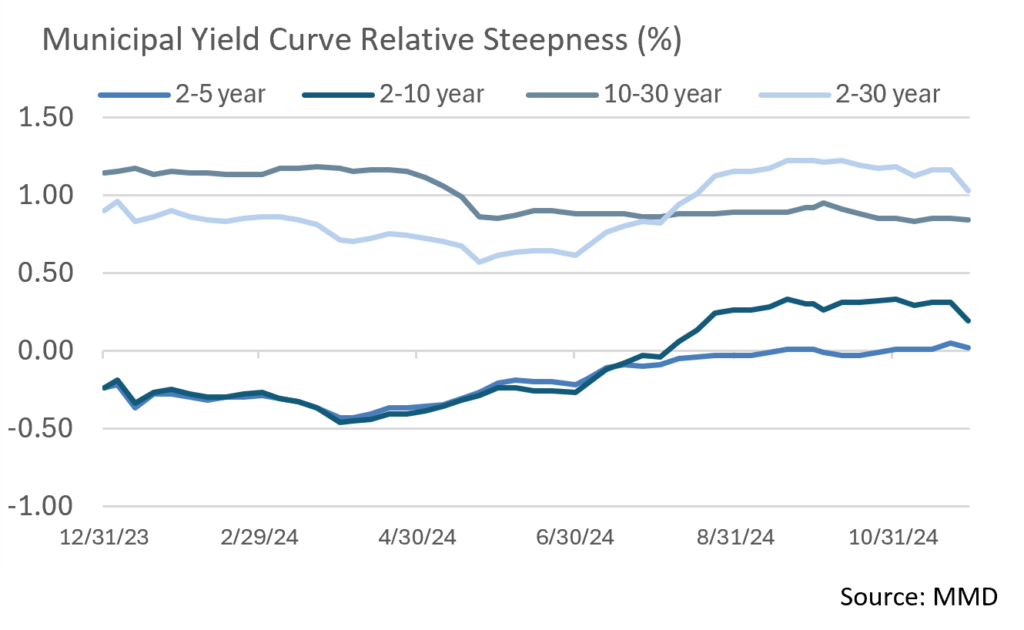

- The AAA municipal yield curve moved in a bull flattener last month, meaning that yields on the longer end of the curve pushed lower by more than shorter maturities. This type of market action favors longer exposure relative to shorter positioning and hinders the curve normalization that had begun following a historic inversion.

- According to MMD, the spread between 2s and 10s began November at 33bps before closing at 19bps. The front end of the municipal yield curve continues to mimic Treasuries and remains inverted, with 1 and 2-year AAAs still outyielding intermediate issues out to nine years on the municipal curve.

- Variable Rate Demand Notes (VRDNs) yields remain volatile and are subject to technical factors associated with new issuance volume and the level of demand for longer fixed coupon securities. Volatility is expected to continue into the New Year, with yields trending lower as buyers look to be fully invested in the face of limited new supply.

- The 10Yr Muni/UST ratio moved lower over November, beginning the month at almost 69% before finishing at 66.7% by month’s end. We expect ratios to stay in this range or slightly lower due to limited December municipal supply and high levels of demand.

- December issuance is expected to be modest even though YTD levels are running 35% above 2023. Bond Buyer’s 30-day visible supply expectation is now just over $14 billion, with the majority scheduled to come to market this week. The FOMC release on December 18th and the following holiday week will put a damper on new offerings. Accordingly, we are looking closely at this week’s deals and actively looking for value in the secondary market.

Corporate Markets

- The US Investment Grade Corporate Bond primary market remained robust in November, with $96.7 billion issued, beating consensus estimates of $70 billion. This was the 9th month this year where actual issuance has exceeded consensus by $25 billion or more, and full-year volume is 27% higher than last year.

- December, generally a quiet month, is expected to produce about $40 billion of new debt, most of which will come to market during the first two weeks. Financials are leading the way with $90 billion issued so far during Q4, new supply that compares to only $45 billion over the same period last year. As the year draws towards a close, conditions remain favorable for issuers with UST yields falling, tight credit spreads, and high investor demand.

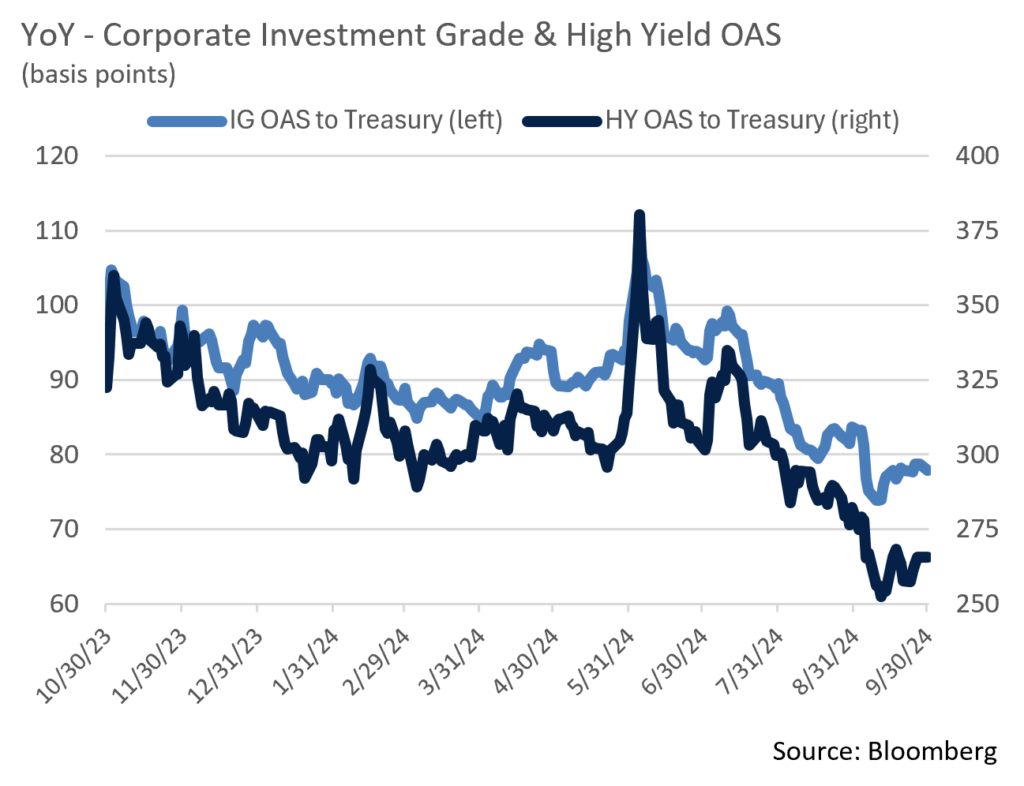

- Strong credit appetite is reflected in OAS on the Bloomberg US Corporate Index averaging only 90bps this year, with a low of 74bps set on November 11th and a high on August 5th of 111bps. Aside from the very short-lived high in August, credit spreads had fluctuated within a relatively tight 20bps range until a downward move began in mid-September that culminated in the 74bps low a week after the Presidential election. We do not anticipate spreads moving meaningfully in either direction over the remaining days of 2024 and expect investor demand for high quality bonds and overall sentiment to remain strong into the New Year.

- November’s +1.34% total return on the Bloomberg US Corporate Investment Grade Index marked the 7th month of positive returns in 2024. Falling UST yields accounted for most of that figure, although tighter credit spreads have produced positive excess returns over USTs (+0.49% in November and +2.52% YTD).

- With credit risk being rewarded, lower quality bonds fared best on the month, as did the Utility and Industrial sectors. US Corporate High Yield also continues to perform well as yield-hungry investors flock to that market. With spreads at near all-time lows, our focus remains on higher quality issues as we feel the risk-reward dynamic is more favorable than going down in credit.

Financial Planning Perspectives

Tax Cuts & Jobs Act

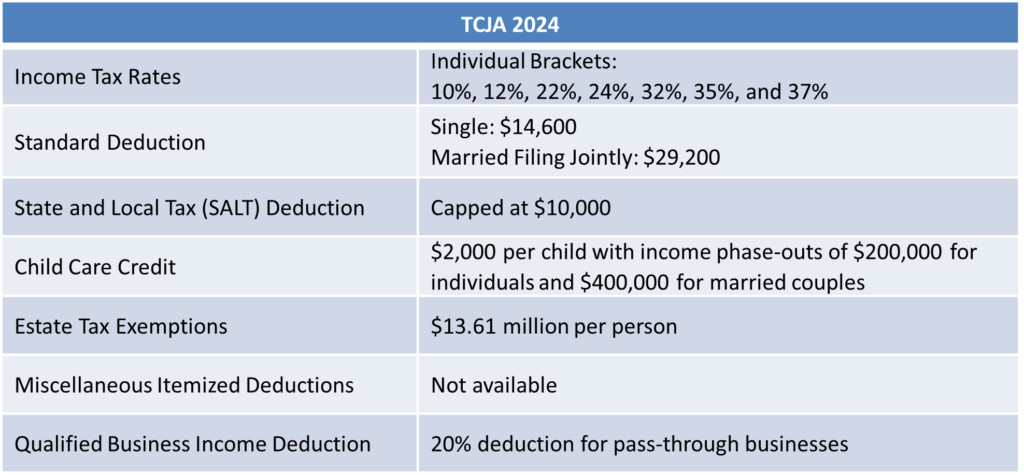

The Tax Cuts and Jobs Act (TCJA) introduced significant changes to the tax landscape when signed into law by President Trump in 2017. The TCJA was passed using the reconciliation process, an expedited process used by Congressional budget committees to ensure tax laws align with the spending and revenue targets of the federal budget and only requires a simple majority to be passed by the Senate. TCJA expires on December 31, 2025, which made the 2024 election pivotal in determining the fate of the largest tax code overhaul in three decades.

With a Republican Congressional sweep and Donald Trump returning to office, a new tax bill with significant ramifications is expected to be introduced in 2025, likely once again utilizing the reconciliation process. This legislation would either extend or alter the TCJA’s provisions. Below, we outline current provisions and identify areas of potential change that ought to be considered.

Prior to TCJA, approximately 5 million households were subject to Alternative Minimum Tax (AMT). Many high-income households had paid AMT due to high state and local tax (SALT) deductions in addition to multiple dependents. By virtue of TCJA limiting SALT deductions and higher income phase-out amounts for AMT, the number of households subject to this tax was reduced to only about 200,0001. The SALT deduction cap and AMT are integrally linked, and the former has been highly controversial, all of which makes the current tax debate particularly noteworthy.

How Congress will pay for potentially pending tax breaks is an open question. Donald Trump has suggested eliminating taxes on Social Security at a time when the system’s viability is already bleak, leading to the possibility that the full retirement age could be increased as high as 69. Whether or not that or other changes occur remains to be seen.

Another option would be to build on a Secure Act 2.0 provision, namely the mandatory ‘Rothification” of retirement funds for high earners. High earners are those earning at least $145,000 annually, are age 50 or older, and are eligible for after-tax catch-up contributions. Currently, these requirements only apply to 401k, 403b, or 457 plans, but these stipulations may be altered to accelerate tax revenue collection2.

Uncertainty concerning the ever-changing tax code abounds, although we expect to see a tax bill of some kind in 2025. As always, we will keep clients updated on notable changes and encourage you to reach out to your Portfolio Manager to discuss your personal situation.

- J. Manganaro, “7 Big Unknowns That Could Shake Up Retirement Planning”, November 26, 2024

- Michael Kitces, “Nerd’s Eye View”, Kitces.com, November 13, 2024.

UPCOMING WEBINAR

Women & Wealth Management:

Moving Forward After Later in Life Divorce or Loss of a Spouse

January 29, 2025

REGISTER HERE

This webinar led by Kelly McKernan, Senior Vice President, looks at the need for women to address a myriad of potential financial planning issues in the event of loss of a spouse or later in life divorce. She will discuss issues that may arise and how one might navigate such transitions. We invite you to join us and encourage sharing this invitation with a relative or friend who could also benefit.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.