Insights and Observations

Economic, Public Policy, and Fed Developments

- The most important moment of the Federal Reserve meeting on January 31st was Powell’s response to the final question about the risks posed by economic strength. He indicated in no uncertain terms that the Fed was no longer very concerned about strong consumption or growth, since inflation had continued to fall the entire second half of the year despite a fast-growing economy. For a Fed that spent the past two years focused on demand destruction, this represents a critical paradigm shift on their part, and the clearest indication yet that the Fed’s planning for a “soft landing” may no longer be merely aspirational.

- It’s a good thing, too, because otherwise, the Fed might have had plenty to worry about; the meeting was bookended by extremely strong data releases. The week before had brought a robust Q4 GDP report, with growth of +3.3% a full percentage point above consensus. The details were excellent, too – strength was broad, and notably private sales to domestic purchasers (which strips out trade, inventory changes, and government contributions and is a great measure of underlying demand) came in at +2.6%, closer to consensus but still very robust. The quarter’s early shakiness proved fleeting.

- Then came Friday’s blowout jobs report, at 353k, nearly double the consensus estimate, plus 2023 annual revisions totaling an additional 359k jobs over the full year. This is roughly equal to a month and a half of job growth at the pre-revision 2023 monthly average and represented an exceptionally strong report.

- The market reaction was also encouraging. Powell had pressed back strongly against expectations of a March rate cut in his Q&A, but the futures market still considered a cut in March a tossup (we consider this wildly optimistic) and the 10Yr had started to drift below 4% and into the 3.80s. After the report, a March cut fell to a 1-in-5 probability, and the 10Yr popped back up just above 4%. The jobs report didn’t push the rates market in a new direction, so much as it shocked it back to its senses.

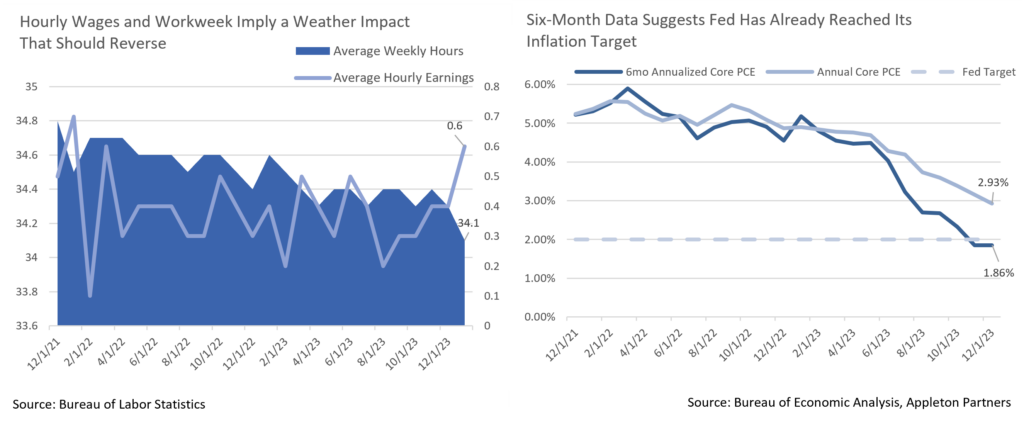

- Another aspect of the labor report that garnered attention was the sharp rise in hourly earnings, +0.6% on the month and +4.5% for the trailing year. This deserves some context. The increase came with a fall in the average workweek, dropping out of the tight range of 34.3 to 34.4 hours where it had spent essentially all of 2023, to 34.1, and in a month with a national cold snap and nearly double the monthly average of employees not working for weather-related reasons. This looks like weather-related composition shifts favoring higher paid job that will likely unwind next month.

- Otherwise, incoming data continues to look good. GDP reports now show two consecutive quarters of +2.0% PCE, despite above-trendline growth. ISM Services never weakened, and while ISM Manufacturing remains in contraction, it is in a strong upwards trend. Powell’s optimism is understandable. The risk here is no longer that the Fed cannot get on top of inflation; they have. Rather, the risk is now reacceleration if the Fed eases too quickly. And, with the Fed now committed to not reflexively tighten based on consumption alone without separate evidence of inflation, a major risk of policy error has been taken off the table.

Equity News and Notes

A Look at the Markets

- Despite month-end volatility, January was positive for stocks with the S&P 500, Nasdaq, and DJIA all logging gains of over +1%. Small-cap stocks once again trailed in a top-heavy market as the Russell 2000 pulled back -3.9%. The large cap S&P 500 and DJIA hit all-time highs with the former index now posting gains in twelve of the past thirteen weeks. Sector performance was mixed with six out of eleven closing lower. Communication Services and Technology were notable outperformers, while Real Estate and Materials trailed.

- Stocks opened the year on a relatively weak note before a string of favorable economic data bolstered equity returns. The “soft-landing” narrative gained traction following an in-line CPI, a negative PPI, Core PCE below 3%, strong retail sales, and a stronger-than-expected GDP reading of +3.3%. We caution that the data came amid pushback from Fed officials who threw cold water on the notion of a March rate cut, stating that the FOMC needed to see sustained progress on the inflation front. The market initially sold off on the news although expectations for about five cuts over the course of 2024 remain the consensus view.

- Despite performance momentum, the breadth expansion seen in December did not carry into January as mega cap technology names once again assumed leadership. Echoes of 2023 returned as the Large Growth style leadership bested Large Value by 2.5%. Even more telling was underperformance of the “average stock”; the equal-weighted S&P 500 lost -0.9% vs. a +1.6% gain for the better-known cap-weighted index. We expect greater performance breadth to materialize as interest rates recede.

- At the end of the month, investors were caught off guard when NY Community Bancorp (NYCB) reported a surprise loss attributable to credit deterioration and cut their dividend. The stock reacted poorly, trading down over -37% and handed the KBW Regional Banking Index its worst day since the collapse of Silicon Valley Bank nearly a year ago. NYCB has outsized exposure to multi-family housing in New York City, including a sizeable loan to a troubled co-op complex. The bank also had to take further loan loss provisions given it crossed a regulatory asset level threshold following the purchase of distressed assets from Signature Bank. Credit spreads showed little signs of stress and we feel this situation is isolated and not a systematic risk. Nonetheless, we are attuned to real estate and their potential impact on overall market risk appetite.

- Q4 earnings are nearly halfway complete with mixed results. After a shaky start from the big banks, more recent reports have helped lift the blended earnings growth rate back into positive territory (+1.6%). Notably, Wall St analysts have not cut their quarter ahead forecasts to the extent many expected, and the full-year 2024 growth estimate remains above +11%. Corporate earnings hinge on the economic outlook and we are tracking the labor market and consumer strength for signs of weakness.

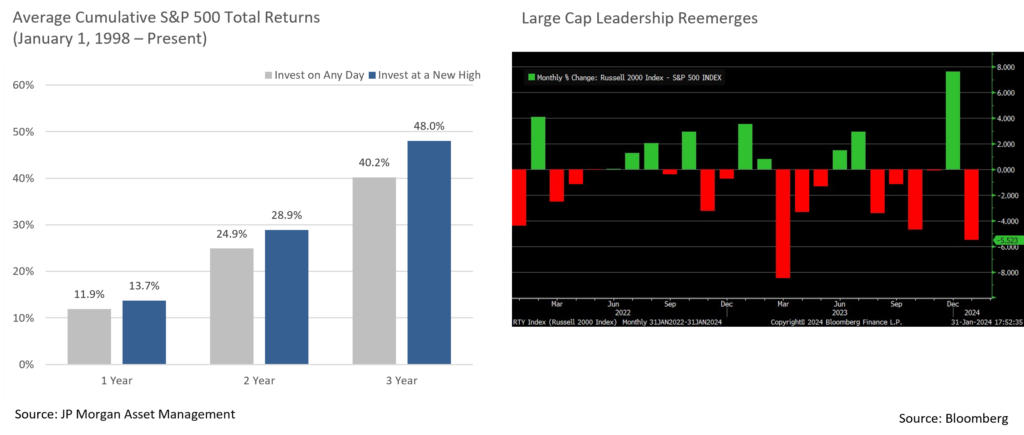

- An investing adage that bulls often cite is that “strength begets strength” and we are reminded of it as the major averages hit all-time highs. It is counterintuitive to see that historical performance has been more favorable when investing at highs than on an average day. January has also tended to be a good indicator of how the remainder of the year plays out. We expect volatility during this election year, particularly as the Fed begins to normalize monetary policy, yet our equity outlook is positive, and pullbacks should prove to be good buying opportunities.

From the Trading Desk

Municipal Markets

- January is typically a positive performance month for municipal strategies as demand often drives favorable technicals. This year was not the case though, as a Bloomberg Municipal Bond Index gain of +2.32% in December was followed by a -0.51% monthly return, the worst January since 2011. Municipals have been taking their cue from Treasuries, and their higher yields to start the year have impacted the tax-exempt markets.

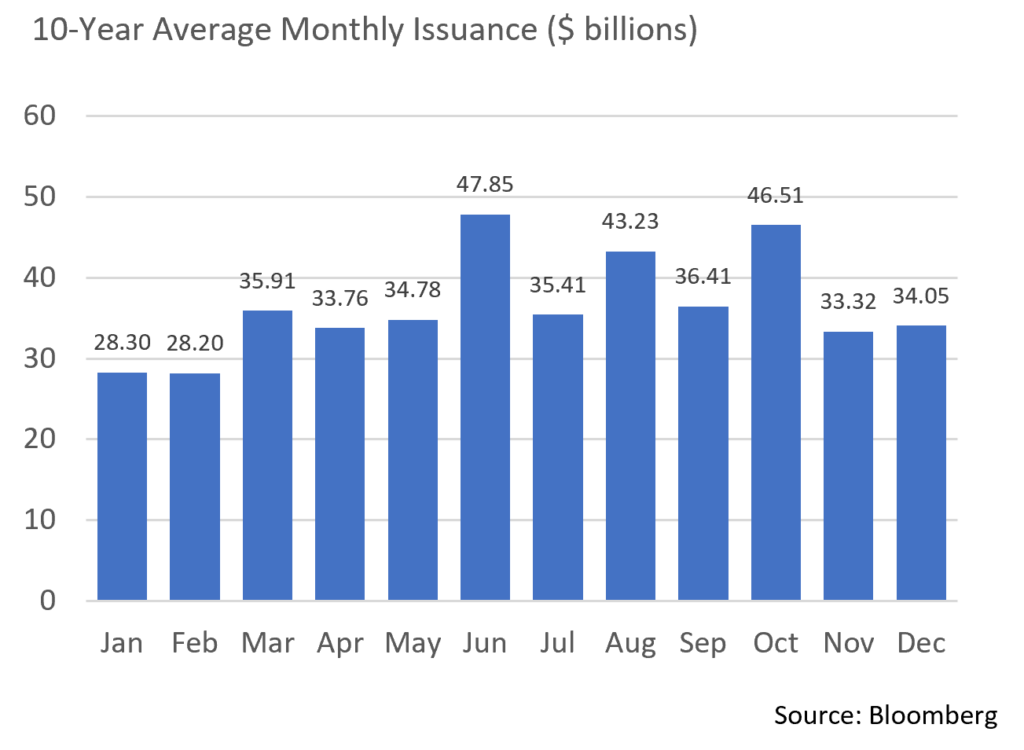

- New municipal issuance of $30 billion was up 25% from January 2023, marking the highest level since 2017. As has been the case with investment grade corporates, tax-exempt supply continues to be well received. Bloomberg’s 30-day visible supply is now estimated to be $7.8 billion. On the demand side, retail investors have warmed to municipals with net fund inflows of $1.5 billion over the last week of January alone. February is expected to produce almost $42 billion of coupon and principal payments, sources of cashflow for reinvestment that should fuel sustained demand.

- Relative to portfolio positioning, we are finding opportunities to sell shorter duration bonds and reinvest on the intermediate to longer ends of the curve. At present, the trough is in the 2029 to 2030 maturity range, beyond which relative steepness improves. Modestly higher yields allow us to buy income streams at cheaper levels, with market expectations for a Fed cut in March diminishing with May now far more likely.

Corporate Bond Markets

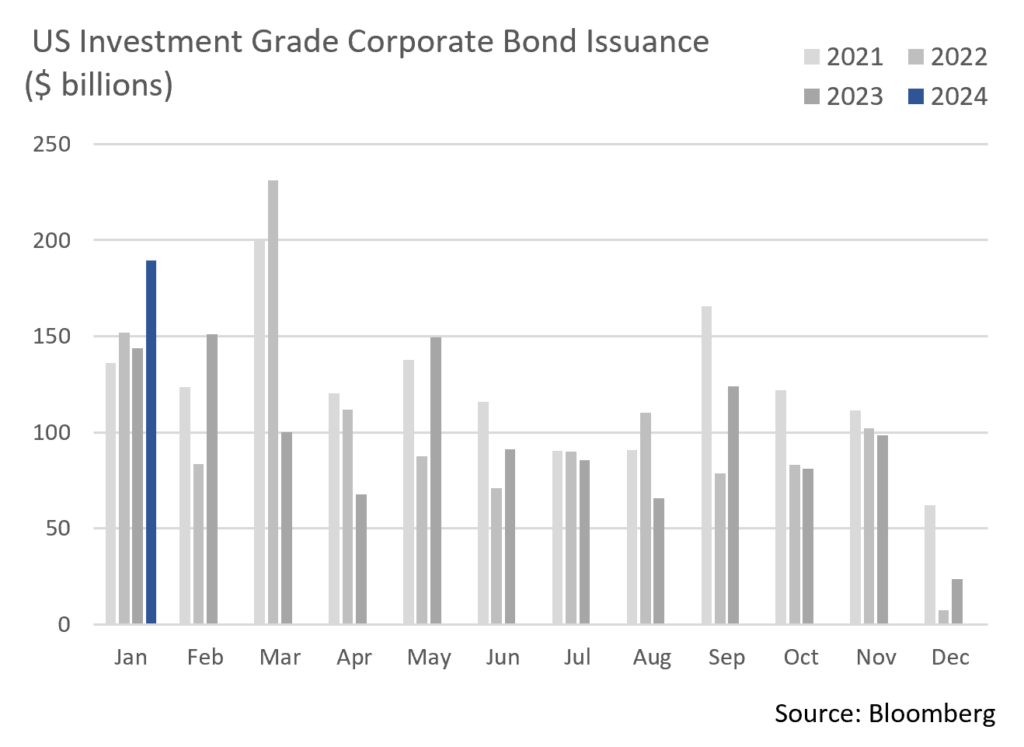

- Primary market action drove the Investment Grade storyline to begin 2024 as new issue volume topped $189 billion, shattering the previous January record of $175 billion set in 2017. The surge also beat market expectations of roughly $160 billion. This supply was met with robust demand as investors moved to get ahead of the potential for receding interest rates. New issue concessions fell to just 2.7 bps on the month reflecting the strength of new deals coming to market. A couple of notable deals even priced with negative concessions to the same issuers’ outstanding bonds.

- Market appetite for credit was also illustrated by January’s new offerings being oversubscribed by an average of nearly 4x, as well as by an average of 23 bps of spread compression on bonds as they broke into “free to trade” territory.

- The financial sector represented 59% of this month’s Investment Grade Corporate issuance, higher than is typically the case, although January is generally an active month for Financials as they emerge from earnings blackouts. Wall Street analysts are calling for about $150 billion of new issuance in February, a figure we find very plausible given positive market sentiment.

- Risk tone typically reacts to market “jolts” such as the NY Community Bank losses announced late in January. This development reflects ongoing pressure on commercial real estate although we feel risk is largely isolated. Our investment focus in this area remains with Globally Systematically Important Banks (GSIBs) given their more stringent capitalization requirements.

- Demand strength was reinforced when Lipper Inc. reported a massive $2.68 billion of net inflows into Investment Grade mutual funds over the week that ended 2/1, cash flow that followed $1.24 billion of net inflows the prior week. January’s net of $5.38 billion has been integral to absorbing new issuance and maintaining downward pressure on credit spreads.

- The OAS on the Bloomberg Barclays US Corporate Bond Index began the year close to a one-year low of 99 bps, and after quickly hitting 105 bps spreads fell back to 96 bps at month’s end. Initial selling pressure was prompted by a better-than-expected job market, although sustained demand pushed spreads back down. A widening breakout from here seems unlikely over the near term.

Financial Planning Perspectives

The Corporate Transparency Act Is Here. Are You Prepared?

Are you or a family member the operator or manager of a Limited Liability Corporation (“LLC”), or a general partner of a Limited Partnership (“LP”)? Have you ever created an LLC to hold real estate or other investment assets? If so, new, more stringent reporting requirements brought on by the Corporate Transparency Act warrant attention. The Act, passed in 2021 as part of the larger National Defense Authorization Act, authorized the Treasury Department to institute rules aimed at preventing money laundering. To this end, a great deal of attention has been placed on LLCs, smaller corporations, and LPs given that many shell companies were created for the purpose of tax avoidance and, in certain instances, in the furtherance of illicit activities.

New requirements became effective on January 1, 2024, and compel “reporting companies” to register the ownership interests of individuals that exercise substantial control, or own or control not less than 25% of the entity. This must be done by filing a Beneficial Ownership Information Report, or BOI Report, with the Financial Crimes Enforcement Network (“FinCEN”). FinCEN is a bureau of the U.S. Treasury Department whose mission it is “to safeguard the U.S. financial system from illicit use and combat money laundering and promote national security through the collection, analysis, and dissemination of financial intelligence and strategic use of financial authorities.”1 Failure to comply with the requirements of the Corporate Transparency Act may incur civil and criminal penalties, including penalties of up to $500 a day and up to two years imprisonment along with a $10,000 fine.

Entities Subject to the FinCEN BOI Reporting

The Corporate Transparency Act (“The Act”) defines “reporting companies” as a corporation, LLC or other legal entity created by the filing of a document with the Secretary of State of a given state or created under the laws of a foreign country and registered to do business in the U.S. It is estimated that the new law applies to over 32 million entities.

The Act does not apply to entities:

- With greater than 20 employees;

- A physical office in the U.S.; and

- Greater than $5 million in sales or gross receipts

There are also 23 different types of entities that are exempt from the requirements of the Corporate Transparency Act, mostly financial services institutions such as banks, credit unions, and broker dealers. (see: https://www.wolterskluwer.com/en/expert-insights/the-23-exemptions-from-the-corporate-transparency-act).

Information That Must Be Reported to FinCEN

Details to be provided include legal name, DOB, residential address, business street address, ID number of a non-expired passport or state issued ID, and a picture ID. While the reporting company does not need to file a BOI report annually, if there are any changes to the information on file, an updated BOI report must be filed within 30 days. Furthermore, the Act also requires reporting companies to disclose other information including legal/trade/DBA names, street address, state in which entity was created, as well as providing an incorporation instrument from the issuing state.

The Treasury Department has begun building a Beneficial Ownership Information database and recently Treasury Secretary Janet Yellen announced that over 100,000 entities have joined the BOI tracking system. Covered entities must file an online BOI report no later than January 1, 2025. After January 1, 2024, all newly created “reporting entities” will have to file an online BOI report within 90 days of formation. Beginning in 2025, all newly created “reporting entities” will have only 30 days to file their BOI report with FinCEN.

Please see: https://www.fincen.gov/boi

If you have any questions, please contact Jim O’Neil at (617) 303-0775.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.