Insights & Observations

Economic, Public Policy, and Fed Developments

- The incoming “Trump 2.0” Administration’s policy priorities remain in flux, and House Speaker Johnson’s near failure to be seated is a fresh reminder of the thin legislative path open to the GOP. With so much still unknown, major market impacts are likely to come from public policy, but for now we will focus on hard economic data.

- Consumers still appear to be spending. Retail sales were solid in November, with headline surprising a tenth to the upside at +0.7%, with a substantial contribution from auto sales. This supports the theory that the hurricanes in the fourth quarter led to a surge in replacement car purchasing. Ex-auto and gas was weaker, but the “control group” sales, which feeds into GDP calculations, was still solid at +0.4%. Consumers often cut back after big-ticket purchases like cars, so it will be important to see how durable this trend proves to be.

- This strength was mirrored in the final Q3 GDP revision, which unexpectedly increased from +2.8% to +3.1%. Much of the strength came from upward revisions to consumption, now +3.7%. Final sales to domestic purchasers and to private domestic purchasers continue to show exceptional demand as well, at +3.7% and +3.4%, respectively.

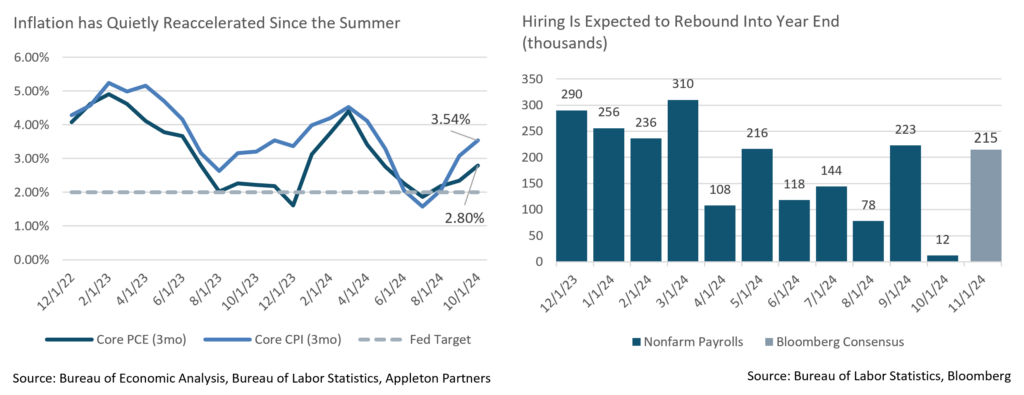

- Inflation remains a mixed bag. A fourth consecutive +0.3% Core CPI print didn’t deter the Fed from cutting rates a further 25bps in December. While January through March introduce high year ago comparisons that may allow the YoY rate to drop, the 3-month annualized rate now sits at nearly +3.7%, higher than the trailing 12 month’s +3.3%; base effects alone won’t return core inflation to the Fed’s 2% target.

- However, PPI and PCE were more encouraging. Headline PPI came in hot, but 80% of the increase was in food prices, thanks to a 56% increase in the cost of eggs due to avian flu. We expect policy makers to look through the headline to the better-than-expected ex-food, energy, and trade numbers. PCE was an unabashedly good report that exceeded solid expectations, beating headline and core by a tenth at +0.128% and +0.115% respectively, with “super-core” falling to +0.159% as services inflation cooled.

- Employment rebounded in December with growth of 227k jobs, slightly above expectations that had already been raised in the days before the release. Prior period revisions of +56k suggest the previous month wasn’t quite as bad as initially thought. However, the two-month average is still low, and with survey responses suggesting companies are still delaying investment decisions until they have greater fiscal clarity, the post-election rebound we expect is likely to take several months to play out. We continue to believe the labor market is in better shape than the weak consensus view.

- The pivotal moment in the December FOMC meeting came during the press conference, when Powell was asked how expected fiscal policy changes under the Trump Administration had been factored into the Fed’s dot plot. “Some people did take a very preliminary step and start to incorporate highly conditional forecasts of policy into their estimations, some did not, and some didn’t say,” Powell answered. Yields soared and stocks fell in response on the implication that the upward movement in December’s dot plot was likely only a precursor of moves higher in future meetings. After rising steadily into the meeting in expectation of a “hawkish cut,” the 10Yr UST broke through prior resistance at 4.50%, ultimately reaching an intra-day high of 4.64%. Since the meeting, 4.50% has held as a floor.

Equity News and Notes

A Look At The Markets

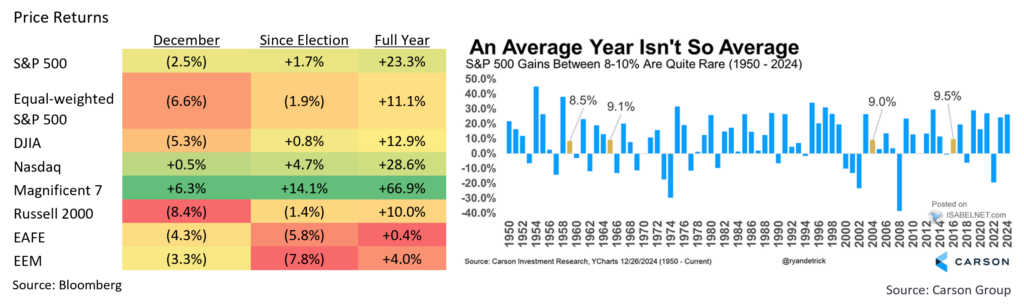

- Stocks were mostly lower in December as traditional seasonal tailwinds failed to materialize. The S&P 500 fell for only the third time in 2024, closing -2.5% lower. Both the DJIA (-5.3%) and Russell 2000 (-8.4%) fared worse, while the Nasdaq was the lone bright spot, gaining +0.5%, once again a product of large-cap technology names. Sector performance varied greatly with only 3 sectors higher, led by Communication Services (+3.5%), while 5 of 11 sectors closed lower by -8% or more. Style dispersion was also evident with large-cap growth stocks trouncing large-cap value by 785bps, increasing the YTD gap to just over 20%, an unusually high differential.

- Despite December’s weakness, stocks were notably higher in 2024, and the S&P 500 gained over 20% in back-to-back years for the first time since 1998. The index set 57 all-time highs over the course of the year, although the year ended -3.4% below the most recent high set on December 6th. The much-discussed Santa Claus rally failed to materialize as the S&P 500 shed -2.6% from Christmas through year-end, the worst holiday performance since at least 1952. Nonetheless, history suggests that January returns are more indicative of what might come over the balance of the year. A year ago, stocks were uncharacteristically sluggish during the Santa Claus period but rose in January (+1.6%) on the way to a +25% total return.

- Much of the enthusiasm for stocks following the election faded as narrow leadership returned. From November 5th through year-end (see chart below), the equal-weight S&P 500 lost nearly -2% while small caps stumbled and global equities ex-US were notable laggards. Remarkably, despite more S&P 500 stocks declining than advancing for 14 straight trading days at the beginning of the month, the index still reached a new all-time high on the back of some of the largest capitalization tech giants.

- The “Magnificent 7” are not going down without a fight as the breadth expansion of the late summer/early fall dissipated. Smaller companies are generally more sensitive to rate increases, and with 10Yr UST yields rising 40bps in December, investors once again bid up large cap tech stocks. The prospect of significant performance breadth that could lengthen the bull market may depend on the path of interest rates in 2025.

- The bull narrative that has carried stocks to record levels largely remains intact though. The US consumer has been resilient, propped up by a labor market that continues to be tight despite signs of slowing. The economy, buoyed by spending on services, is still growing above trend line. Corporate profits are expected to increase by +9.5% in 2024 paced by margin expansion, while analysts are calling for +14.5% in 2025. The ability of corporations to reach these hurdles will be critical in the year ahead given relatively high current equity valuations. Corporate balance sheets are also healthy, and credit spreads remain near historic tights. Further positive signs include enthusiasm about the AI revolution, and optimism concerning the incoming administration’s pro-growth/deregulatory policy agenda.

- However, the nearer term outlook is not without risks. What will the new administration’s tariff and immigration policies look like, and to what extent might they fuel inflation and corporate profit pressure? Will geopolitical tensions become too much for US investors to ignore? Will the Fed be able to successfully adjust monetary policy to avoid a recession? And lastly, how much of the bull narrative has been priced in, and will current valuations prove to be too rich?

- As is often the case, Wall Street analysts have recently raised their 2025 S&P 500 price targets after largely missing the 2024 rally. Most are in the 6,500-6,600 range, which would represent a gain of 10-12%. However, we caution against reading too much into prognostications, especially those calling for S&P 500 returns close to their long-term averages. Stocks rarely produce “average” performance, as volatility is a feature, not a bug, of the market. Instead, we focus on company specific fundamentals and look to the macro environment for context.

From the Trading Desk

Municipal Markets

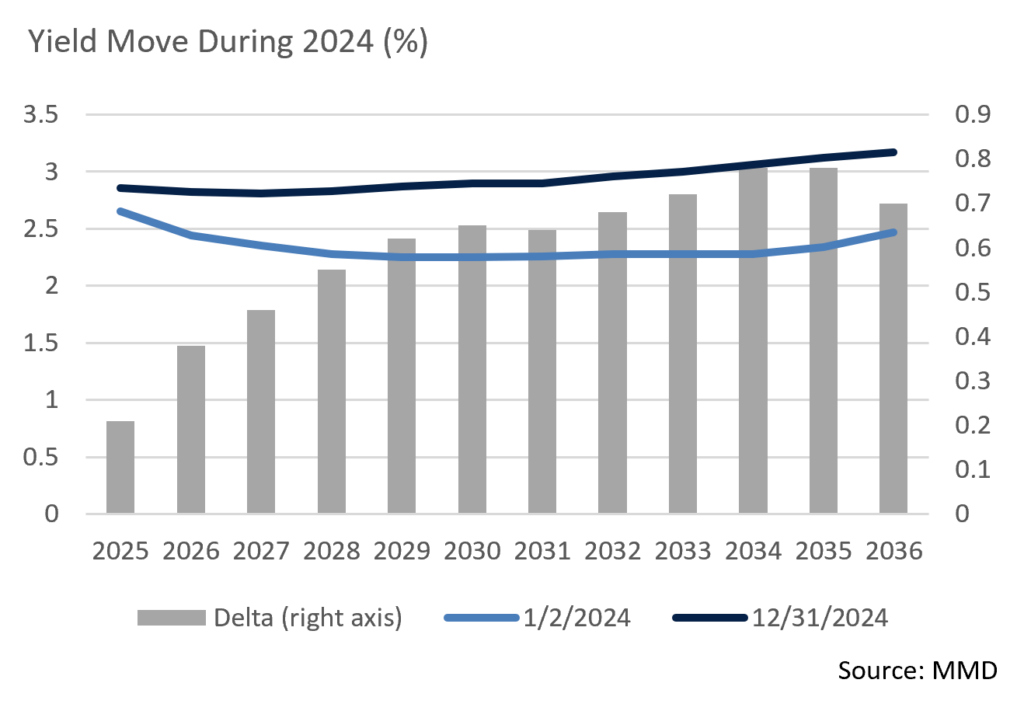

- December saw municipals selling off to the tune of 20 to 30bps across the curve. With tax efficiency a priority in many portfolios, trading was busy. The curve also steepened with the spread between 2s and 10s increasing from 19bps to 24bps, normalization that allows for yield pick-up from adding duration.

- The yield curve was higher and steeper over the course of the year. While the very front end of the municipal curve (<3 years) remains moderately inverted, the rest of the curve has steadily become upward sloping. Over the full year, 3-year yields rose 46bps, 5-years were up 62bps, and 10-years 78bps. While adding incremental duration now offers greater yield pick-up, 2024’s bear steepening trend produced short-term price pressure.

- Ratios were also higher as municipals underperformed USTs. The 10-year AAA/UST ratio began 2024 in the mid-50s, and this proved to be the richest point of the year. Ratios were somewhat volatile but ended 2024 at 66.5%.

- Issuance was heavy throughout 2024 and closed with a record of $507.6 billion, a 32% increase over 2023 (The Bond Buyer). The previous high-water mark of $484.6 billion occurred in pandemic-impacted 2020. This year’s elevated issuance was driven by a backlog of projects, recession fears, and an effort to get ahead of the November election. Inflation was also a factor as it contributed to an increase in jumbo-sized deals. The volume leaders in tax-exempt issuance among sectors were School Districts and Water & Sewer, as issuers funded building, infrastructure and related needs.

- California, Texas and New York remain the top state issuers. California brought over $71.6 billion to market, a sizeable 31.4% increase over last year. Texas was also a strong contributor to new bond supply, increasing issuance 15.3% YoY, while New York grew at a robust 38.8% rate.

Corporate Markets

- High grade corporate bond spreads traded within a 5bps range in December given sustained investor appetite for credit. Tight spreads persist with the Bloomberg US Investment Grade Index OAS closing the year at 80bps. Looking forward in 2025, we feel it is more likely that increased issuance will fail to meet the demands of eager investors than it is that spreads widen on supply growth.

- December, as is typically the case, was a slow month with only $41.2 billion coming to market. Issuers were all but done the week before the Christmas holiday. Nonetheless, Investment Grade issuance of $1.496 trillion in 2024 was the second largest total on record, trailing only the $1.75 trillion brought to market in 2020. Overall, deals were very well received with oversubscriptions common, nominal concessions, and tight secondary market trading spreads. We see this favorable backdrop continuing well into 2025.

- The Bloomberg US Investment Grade Corporate Index fell -1.94% in December as UST yields rose sharply. The performance drag was greatest at longer ends of the curve (-4.90% vs. -0.73% for intermediate bonds). For the full year, the index produced a +2.13% total return.

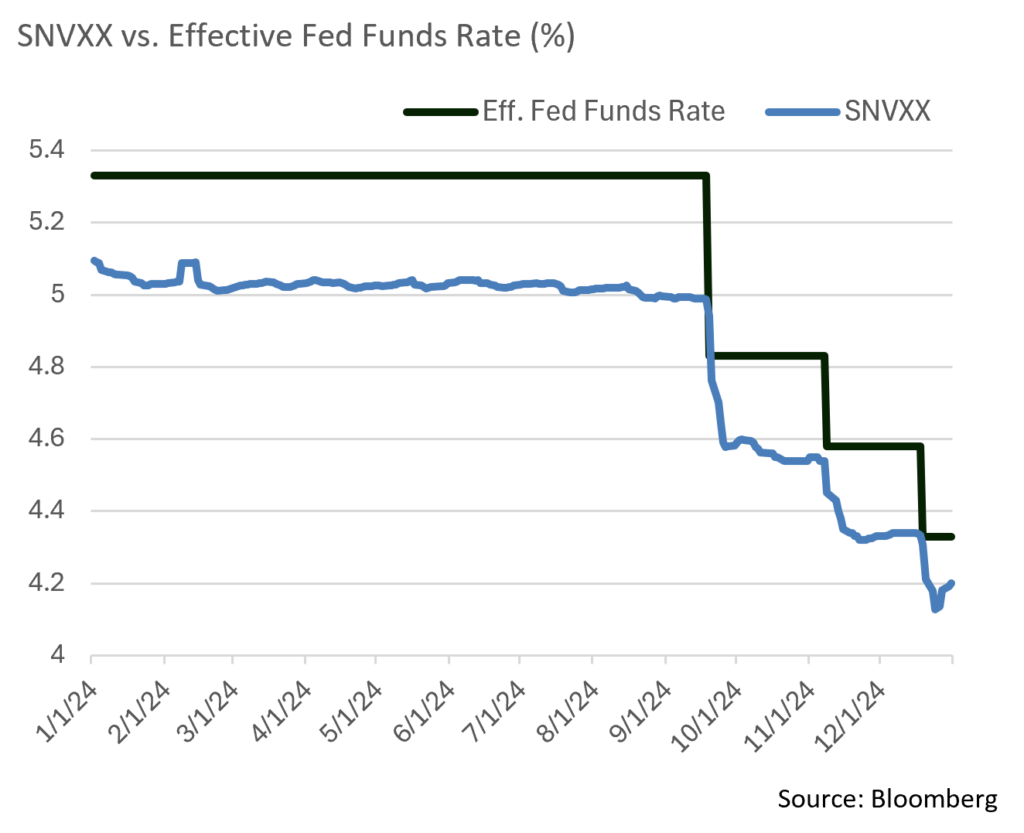

- Money market funds have attracted a tremendous amount of assets with yields remaining close to or above 5% for much of 2024. An effective Fed Funds Rate of 5.50% was the obvious contributing factor, although recent Fed Funds cuts have changed the dynamic. Money market yields are moving down in synch with Fed Funds and now more closely track longer-term bonds. Many investors are again revisiting the potential value of adding duration and locking in yields for a longer term. Current expectations call for 2 more rate cuts in 2025, a policy adjustment that would put further pressure on short-term yields.

Financial Planning Perspectives

A New Year Brings a New Name

As a follow up to our recent announcement, we are excited to ring in the New Year with a new name: Appleton Wealth Management. Our revised identity was chosen as it better reflects the depth of services we provide to individuals, families, and non-profit organizations. Wealth Management more optimally captures the extent to which portfolio management is complemented by a growing range of financial, estate, and philanthropic planning.

While our name is new, Appleton Partners has been assisting families navigate a complex web of asset allocation strategy, tax considerations, retirement solutions, charitable giving, and legacy planning for nearly 40 years. Your relationship with your Wealth Manager (formerly Portfolio Manager) and Wealth Management Associate (formerly Assistant Portfolio Manager) remains unchanged.

Update on the Corporate Transparency Act

The legal drama concerning the constitutionality of the Corporate Transparency Act (CTA) continues. Last February we published an overview of the CTA and its filing requirements. The Act, which was passed in 2021 as part of the larger National Defense Authorization Act, allowed Treasury to institute rules aimed at preventing money laundering and other illegal activities, principally through the disclosure of ownership interests of LLCs and partnerships.

The constitutionality of the legislation was challenged in the US District Court for the Eastern District of Texas, and as part of the suit, the Court, on December 3, 2024, issued a nationwide preliminary injunction of the January 1, 2025 filing deadline to disclose beneficial owners. As anticipated, the government appealed, and on December 23, 2024, the Fifth Circuit Court of Appeals stayed the lower court injunction and reinstated the CTA’s reporting requirements. As part of the Fifth Circuit’s decision, the filing deadline for Beneficial Ownership Information (BOI) reports was pushed back to January 13, 2025. Further adding to the confusion, the Fifth Circuit Court of Appeals reversed its earlier decision on December 26th, and as of this writing, BOI reports are not required to be filed, and the January 13th deadline is moot. We understand this impacts some of our Wealth Management clients and their legal entities and will update you on any new developments.

Can We Assist a Family Member, Friend, or Colleague?

At Appleton, we take great pride in the strength and durability of our private client relationships. Is there someone you care about who might benefit from working with us? If so, please let us know as we would be happy to see if we can help them reach their wealth management goals.

Please contact your Wealth Manager, or reach out to: Jim O’Neil, Managing Director

617-338-0700 x775 | [email protected] | www.appletonwealth.com

Upcoming Webinar

Women & Wealth Management: Moving Forward After Later-in-Life Divorce or Loss of a Spouse

January 29, 2025

This webinar led by Kelly McKernan, Senior Vice President, looks at the need for women to address a myriad of potential financial planning issues in the event of loss of a spouse or later-in-life divorce. She will discuss issues that may arise and how one might navigate such transitions. We invite you to join us and encourage sharing this invitation with a relative or friend who could also benefit.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.