Insights & Observations

Economic, Public Policy, and Fed Developments

- Three major themes emerged in June that we believe will be critical over the summer and fall; solidified improvement in inflation, growing evidence of a softening economy, and renewed political risk. We will address all three.

- Both CPI and PCE inflation releases were stellar in June. CPI beat by a tenth in both headline and core; the only source of inflation in May was shelter (which is a lagged calculation.) Core services ex-shelter turned negative and falling energy costs detracted almost exactly as much as shelter added at the headline. We do not expect energy improvements to be persistent, but negative core services ex-shelter is a welcome development for the Fed.

- CPI shifted market expectations enough that PCE was merely in-line, but nonetheless the release was excellent. Headline inflation was actually negative to full decimal precision, and while “supercore” was slightly positive, unlike in CPI, the +0.096% was the best reading we’ve seen in, August 2023 aside, nearly four years. The next few months will have tough comps, so the current +2.6% headline and core may rise slightly before year-end. But our belief that early 2024 inflation would prove to be an anomaly is being borne out by the data.

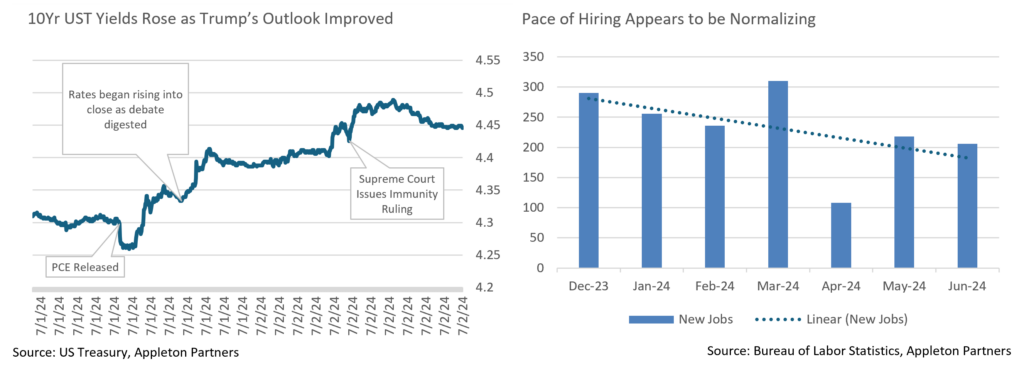

- Second, while we’d stress this is still consistent with a “soft landing,” the bulk of evidence now points to a slowing economy. The labor market has certainly cooled – May’s jobs report may have initially shown a robust 272k new jobs (exceeding the consensus 180k), but while the June release beat modestly at 206k vs. 190k, it also brought 111k in prior downward revisions, lowering May to a closer-to-consensus 218k. The unemployment rate ticked up to 4.1%, as well, and a perceptible cooling trend in hiring over the spring is evident.

- Cooling extended beyond the labor market. ISM Services and Manufacturing both modestly contracted, and durable goods orders were a little weak (although a widespread car dealer software hack at month end may have had an impact). The combination of slightly weaker than expected reports has begun to weigh on growth forecasts – the Atlanta Fed’s GDPNow nowcast fell from over +3% in mid-June to +1.5% as of July 3rd. This may ultimately have overshot a little, given some of the inventory effects from Q1, but in aggregate, it looks like the economy is probably no longer exceeding trendline growth.

- Finally, political turmoil came to the forefront in late June, after President Biden’s disastrous debate performance on the 27th threw his campaign into turmoil. Friday afternoon saw a run-up in rates and the 10Yr ultimately closed 15bps higher than the lows of the day. A number of research notes on Monday suggested it might be the markets pricing in the likelihood of a Trump win, and with it higher inflation from his proposed heavy tariffs, immigration constraints, and a more politically accommodative Fed; the immediate 6bps jump in Treasury yields on the news the Supreme Court ruled Trump may have some immunity from prosecution for “official acts” (a decision effectively closing the window to hear pending criminal cases against Trump before the election) gives credence to this theory.

- •Combined, we see the stage set for volatility in the second half of 2024. The progress against inflation and cooling labor market should, absent any surprises, give the Federal Reserve cover to begin cutting rates as early as September. However, growing Democratic calls for President Biden to step down make it very hard to predict the path of the election, and with it, future fiscal policy. Sudden developments could easily pull the equity and rates market well away from fundamental value in this highly charged environment.

Equity News and Notes

A Look At The Markets

- Equity markets followed up May’s strength with an equally impressive June. After posting gains of +4.8% in May, the S&P 500 was up +3.47% in June, marking the first time since 1997 that both months saw >3% returns. Nasdaq was the June performance leader at +5.96%, while the Dow rose +1.12%. Sector performance was mixed with 5 up and 6 down. Information Technology led the way at +9.3%, while Utilities and Materials trailed, posting -5.75% and -3.26% monthly returns, respectively.

- Market breadth remains unusually narrow with NVDA, AAPL, MSFT and AMZN accounting for over 60% of the S&P 500’s June gain. To this point, the equal-weighted S&P lost further ground versus it’s more widely followed market cap-weighted counterpart, underperforming by a whopping 4.37%. How long a small number of mega cap names can drive the market remains an open question.

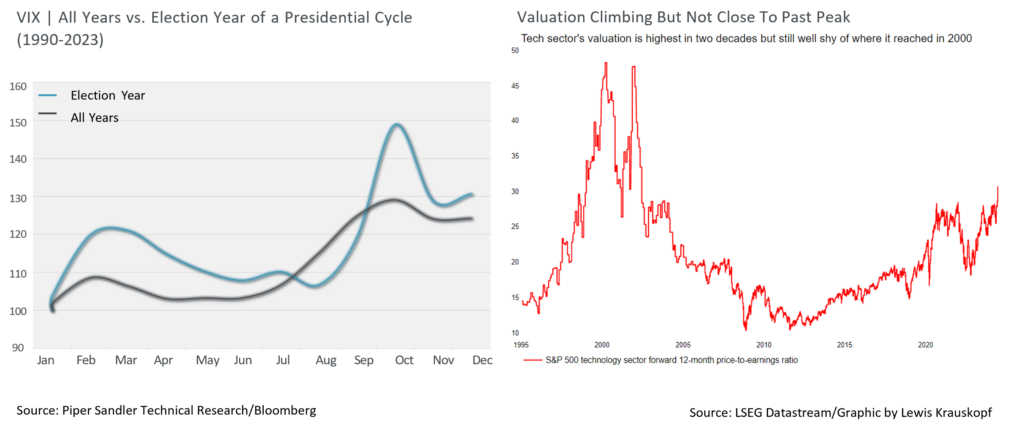

- Comparisons to the late 1990’s “dot com bubble” are off base though in our view. Unlike many of the surging names of that era, today’s technology giants are enormously profitable, highly entrenched economic stalwarts. As Bloomberg Chief Equity Strategist Gina Adams recently emphasized, despite today’s huge valuation difference between the most expensive S&P 500 technology stocks relative to the cheapest ones in that sector, the leaders’ median forward P/E multiple is only a third of the 1990’s peak. Furthermore, the annualized median net income growth rate in 1Q24 among today’s leading mega cap tech names was +18.7% vs. +5.3% for the entire S&P 500.

- Economic resilience, including the all-important consumer, has been under the microscope of late. May retail sales failed to hit expectations, although deceleration in spending has been modest and orderly. Other data pointing to a cooling economy included a May ISM manufacturing miss, flat core capital goods orders, and the lowest new home sales in six months. Inflation expectations fell slightly, which may have helped consumer confidence beat expectations.

- From an equity perspective, the data to us remains consistent with an economic “soft landing” and markets are now pricing in a 67% chance of a September Fed Funds rate hike. A slow growth economy remaining out of recession coupled with the beginning of even modestly more accommodative monetary policy would be a solid backdrop for Q4 and beyond.

- Seasonality is also worth referencing. While July is typically one of the stronger months of the year for the S&P 500 (averaging +1.34% over the last 25 years), August and September have historically been challenging periods prone to higher-than- average volatility. With the Republican (July 15-19) and Democratic conventions approaching (August 19-22), and a final Presidential debate (September 10) on the horizon, politics and other headline risk is in play and may add to short term volatility.

- Given this year’s impressive gains and the likelihood of volatility ahead, we would not be surprised to see modest consolidation in the equity markets. Should this occur, we will look to utilize downside volatility to add to preferred names ahead of what we anticipate may be a positive close to the year.

From the Trading Desk

Municipal Markets

- Municipal yields moved lower by 14 to 20bps during June, with smaller moves between 2029 and 2031 maturities and larger ones on the tails of our buying range. The curve remains inverted, as it has been for the entirety of 2024, with the spread between 2s to 10s at -21 bps. The persistency of curve inversion has enabled us to pick up incremental yield on shorter maturities while still maintaining duration targets by complementing this exposure farther out on the curve in a barbell structure.

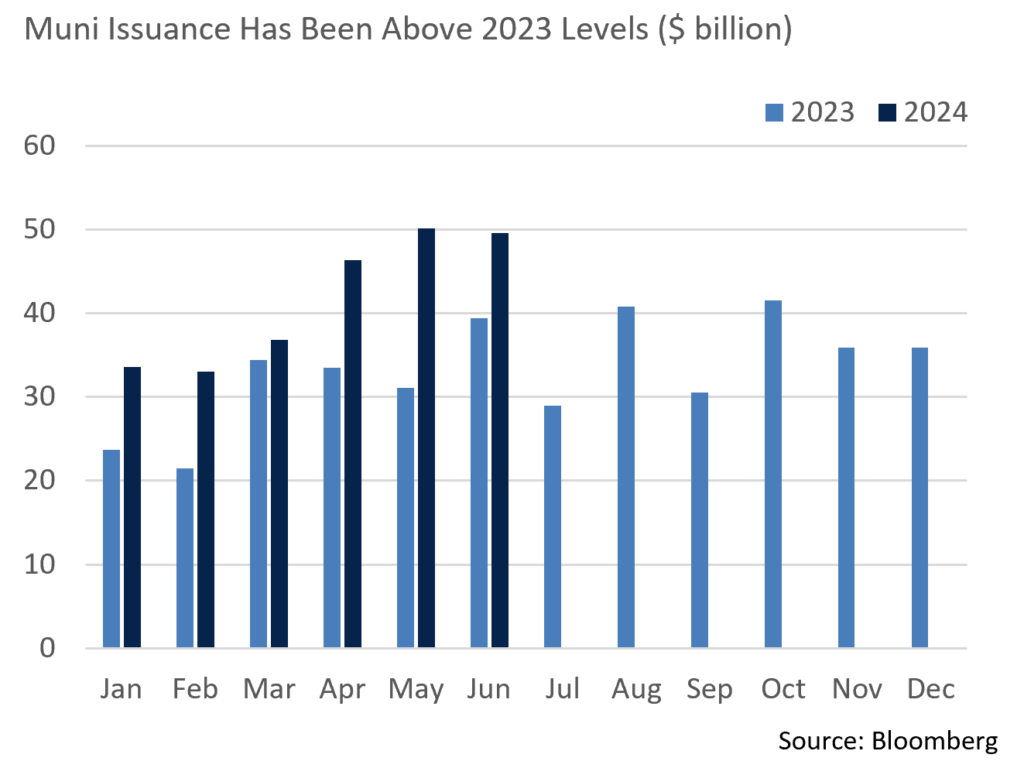

- New municipal supply remained strong through quarter-end with Bloomberg reporting total quarterly issuance of more than $146 billion, 40% higher than the same period last year. We believe this phenomenon reflects issuers trying to front run expected election related market volatility. Heightened issuance is likely to be sustained, particularly in September and October ahead of election day.

- A surge in issuance has been met with significant demand by tax-exempt investors. July and August are historically periods of strong technical support for municipals given the volume of bonds that are maturing or are being called and thus will need to be reinvested. According to Bloomberg, July net negative supply has reached $12.6 billion and is expected to increase as we progress through the month. The recent record for largest net negative supply in July was -$29 billion in 2020. While we do not anticipate exceeding that level, favorable technicals should keep municipal yields tight.

Corporate and Treasury Markets

- June’s Investment Grade Corporate new issuance guidance of $90 billion was easily exceeded by the $102 billion of new debt that ultimately came to market. The last week in June ended with $32 billion of issuance ahead of the July 4th holiday and a typical July slowdown due to Q2 earnings blackouts. Issuers paid higher concessions as the month ended, although demand remained solid with average order books 3.4x oversubscribed. Spread compression on deals was about 25bps as they started trading in the secondary market. Single A bonds represented 37% of monthly volume and 43% YTD. The Financial sector has been the largest issuer, accounting for 42% of YTD volume.

- On a YTD basis, $867 billion of Investment Grade Corporate bonds have been sold in the primary market, the second highest total since $1.2 trillion was offered during the COVID-influenced first half of 2020. Consensus for 2024 new supply remains in the $1.2 trillion range although we anticipate a slowdown as the presidential election approaches and given the potential for an initiation of FOMC short-term rate cuts. A slower primary market would put downward pressure on already relatively tight credit spreads in a market that is not lacking for demand.

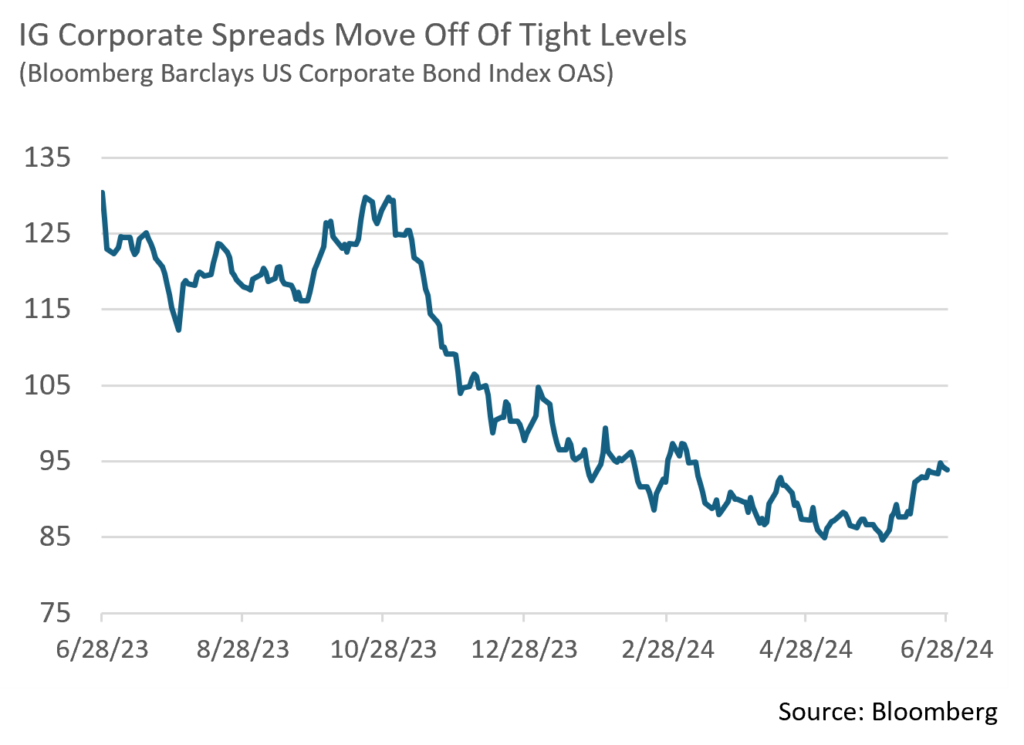

- For the third straight month, Investment Grade Corporate bonds had positive returns with a 0.64% gain on the Bloomberg US Corporate Bond Index raising YTD performance to -0.49%. Longer bonds continued to struggle to keep pace with the intermediate portion of the curve. We continue to favor intermediate duration and high-quality names as more signs of a slowing economy become evident.

- Investment Grade spreads moved higher in June as a risk-off tone took hold for the first time in several months. The 9bps of spread widening on the Index brought the OAS to 94bps, a level that hasn’t been seen since mid-March. We do not see this as a warning sign or particularly alarming in absolute terms or relative to historical norms. The market in our view is simply recalibrating at the margin as economic data and technical factors develop. June’s modest widening reinforces our belief that IG spreads are likely to remain locked in a relatively narrow range for the time being.

Financial Planning Perspectives

Home Ownership In High Interest Rate Environments

Home ownership is a significant milestone for many, symbolizing personal achievement, stability, and investment. However, the decision to purchase or rent involves weighing various pros and cons.

Buying a Home in a High Interest Rate Environment

High interest rates can significantly complicate matters. Despite potentially pushing down prices, it also means higher monthly mortgage payments, which can be challenging for first-time buyers. Rising rates may also reduce the type of home one can afford, potentially limiting choices. In today’s housing market, many homeowners are hesitant to sell, as there is reluctance to give up prevailing low mortgage rates. This dynamic tends to reduce the inventory of homes, making it harder for buyers to find properties at affordable prices.

Impact of Declining Interest Rates

As interest rates decline, the cost of borrowing decreases, making mortgage payments more affordable. This can stimulate demand as more buyers find it financially feasible to purchase homes. Lower interest rates also mean that existing homeowners can refinance their mortgages at better rates, reducing monthly payments and freeing up income. Moreover, declining rates may contribute to higher property values as increased demand pushes prices upward.

Pros of Buying a Home in a High Interest Rate Environment

Despite the above noted challenges, there are several potential advantages to buying a home in today’s environment, including the potential for long-term financial gains should property values increase.

- Decreased Demand: High interest rates often deter potential buyers from entering the market, leading to reduced competition. This can dampen demand and create pockets of buying opportunity, although pricing dynamics differ considerably by market.

- Bargaining Power: With fewer buyers, sellers may be more willing to negotiate price and other terms.

- Refinancing Opportunities: If interest rates eventually decrease, homeowners have the option to refinance their mortgages at a lower rate. This can significantly reduce monthly payments and interest expenses.

- Equity Accumulation: Regardless of interest rates, paying down a mortgage builds equity, a valuable financial asset.

- Market Appreciation: Real estate typically appreciates over time and getting into home ownership earlier rather than later may be beneficial.

- Tax Advantages: homeowners can deduct mortgage interest payments from taxable income in accordance with certain limitations, thereby creating a lower net after-tax cost to home ownership.

- Rental Opportunities: Homeowners may wish to rent out an investment or primary residential property to generate income.

Cons of Buying a Home in a High Interest Rate Environment

High interest rates also create significant financial challenges, including:

- Increased Mortgage Costs: High interest rates result in larger monthly and long-term mortgage payments. This is a factor that ought to be carefully considered.

- Reduced Affordability: Higher borrowing costs can limit the size and quality of homes that buyers can afford, forcing compromises on desired features or locations.

- Slower Equity Accumulation: Depending on mortgage structure, a higher financing cost may result in a larger portion of each payment going toward interest rather than principal.

- Stricter Qualification Requirements: Given risk considerations, lenders may impose more stringent criteria for mortgage approval in a high interest rate environment.

- Uncertainty of Future Rates: While refinancing can be beneficial when interest rates drop, there is no guarantee that rates will decrease in the future, thereby risking locking homeowners into their initial interest rates.

- Ongoing Expenses: Homeownership comes with responsibilities for maintenance, property taxes, insurance, and other costs. This too needs to be part of the financial analysis undertaken when considering a purchase.

Deciding whether to buy a home hinges on individual circumstances, goals, and risk tolerance. Prospective buyers must weigh the financial challenges against anticipated long-term gains and personal benefits of homeownership. When interest rates are relatively high, hurdles to home ownership may arise, although good opportunities to buy can still materialize. Careful evaluation and planning are important to making an informed decision and our Portfolio Managers are here to help you and your loved ones evaluate these decisions.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acum