Insights and Observations

Economic, Public Policy, and Fed Developments

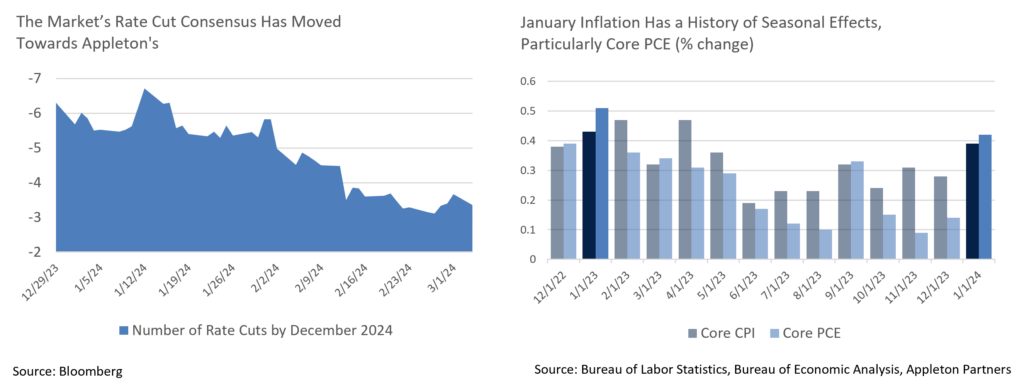

- February’s biggest story was a series of unexpectedly hot inflation reports sharply reducing market expectations for 2024 Fed rate cuts. Beneath the surface, the month was a Russian doll of nested contradictions, not the least of which being that while we welcome this repricing (the markets now closely align with our expectations for 2-3 cuts before year-end), fears of a reacceleration of inflation are probably misplaced, and certainly premature.

- First, despite the market reaction, none of the misses were especially large; Headline CPI was expected to have fallen a tenth from December and instead remained unchanged, while Core was expected to remain unchanged and instead increased a tenth. The pressure was mostly confined to one, admittedly large, component, owner’s equivalent rent (OER). The CPI surprise was neither broad nor sizable.

- Inflation reports were also hard to reconcile with slowing retail spending. Goods heavy retail sales contracted sharply, while the more services focused personal spending fell to a nearly flat rate. Ironically, we suggest looking through these spending releases due to probable weather impacts; construction materials showed the largest drop in the retail sales report, during a nationwide cold snap. Still, the fall in spending was real, if likely temporary, and it’s still hard to see inflation rising at a time when consumers aren’t spending.

- Seasonal factors may have also impacted the inflation readings. The Bureau of Labor Statistics noted an unexpected weight increase for “single family detached” housing being responsible for the jump in OER, which is a one-time impact. And, one of the reasons that year-over-year data still fell despite upside surprises was that the prior year report had also been unexpectedly hot, before the index settled back down the subsequent month. COVID-19 and unpredictable weather have made seasonal adjustments somewhat unstable, and January has been a noisy point in the calendar for a while now.

- Markets calmed with a warm but in-line PCE inflation number (though we note that CPI and PPI had likely shifted the consensus upwards); the fall in inflation was always expected to be lumpy, and without a few more data points there’s no reason to think the Fed’s inflation campaign has gone off track. One point does not make a trend.

- The second Q4 GDP estimate offered the market some good news – while the headline number fell a tenth to +3.2%, this was primarily driven by a fall in inventories, and consumer spending actually improved from +2.8% to +3.0% in the latest revision. This should be positive for Q1 growth as retailers will need to rebuild inventories – the Atlanta Fed GDPNow Q1 estimation is currently +2.5%, a deceleration from Q4 and early estimations, but still solid.

- Another encouraging development came in the House, where nearly half of the GOP joined with their Democratic colleagues to pass a “clean” continuing resolution (CR), averting a partial government shutdown for at least another week. While a week is not normally something to celebrate, this was a functional sign after the coup that brought down ex-Speaker McCarthy over a previous clean CR. Republican hardliners appear to have become more pragmatic about the concessions they can extract with their narrow House majority, which shrunk to three after George Santos’ former seat went Democratic in a January special election. While narrow majorities and a sharply divided caucus are a recipe for unpredictability, this is grounds for cautious optimism.

Equity News and Notes

A Look at the Markets

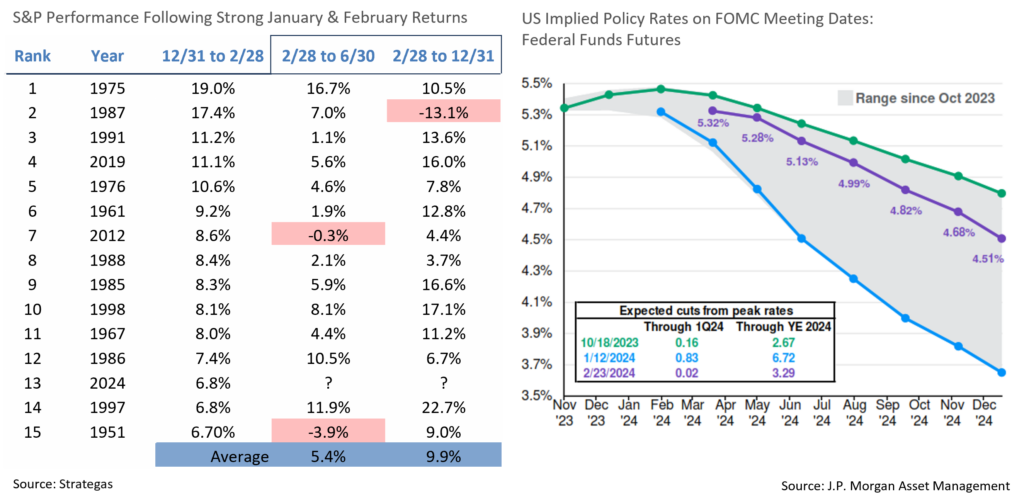

- Stocks were higher in February as the S&P 500 gained +5.2% to push its monthly winning streak to four. The index broke through 5,000 for the first time, setting several all-time closing highs along the way. The Nasdaq and Russell 2000 outpaced the S&P 500, gaining +6.1% and +5.5%, respectively, with the Nasdaq closing the month at its first all-time high since November of 2021. The DJIA also hit a record high late in the month but registered a more modest +2.2% gain. All eleven sectors were higher with a risk-on bias evident as the three “growth” sectors (Discretionary, Tech, and Comm. Services) outperformed and the “defensives” (Utilities and Staples) lagged.

- The S&P 500 is now off to its 13th best start to a year through two months since 1950. The index hasn’t pulled back -2% from a high since it bottomed out in October of last year and the primary volatility metric, VIX, is a very modest 13, both indications of market apathy. We are comforted by the fact that the bond market is signaling a similar degree of complacency with credit spreads at multi-year lows. March tends to be one of the relatively weaker performance months and a patch of volatility at this point would not be out of the norm. However, when looking at historical returns from similar conditions as today, the performance outlook for the remainder of the year looks promising.

- One of the main drivers of the recent stock rally has been a repricing of the Fed Funds Rate path. In mid-October 2023, the market was aligning with the Fed’s “higher for longer” message and pricing in only 3 cuts for 2024, with the first one in July. As inflation readings eased around the turn of the year, investors became much more dovish, pricing in nearly 7 cuts beginning in March. Many feared that the market was ahead of itself and that the divide between the Fed and investor expectations would bring asset prices down. With inflation proving to be stubborn, the market is again pricing in only ~3 cuts with an implied year-end rate of 4.4%, as compared to the Fed’s projection of 4.6%. We are hopeful that this divergence signals that the market will not simply trade on monetary policy expectations and instead turn to stock specific fundamentals.

- The Q4 earnings season is complete and better-than-expected results have bolstered equity returns despite the hawkish repricing mentioned above. Earnings grew +4.0% (vs. expectations of +1.5%), representing back-to-back positive quarterly growth. More importantly, expectations for double digit 2024 earnings growth have held. That number tends to drift lower as the year moves on, but absent a recession, positive earnings growth should prove to be a tailwind.

- With Super Tuesday behind us, election season is kicking into high gear. As the drama in DC plays out, we remind clients that there does not need to be drama in their approach to investing. As the accompanying chart demonstrates, stocks tend to do well regardless of politics, so it is best to ignore the noise.

From the Trading Desk

Municipal Markets

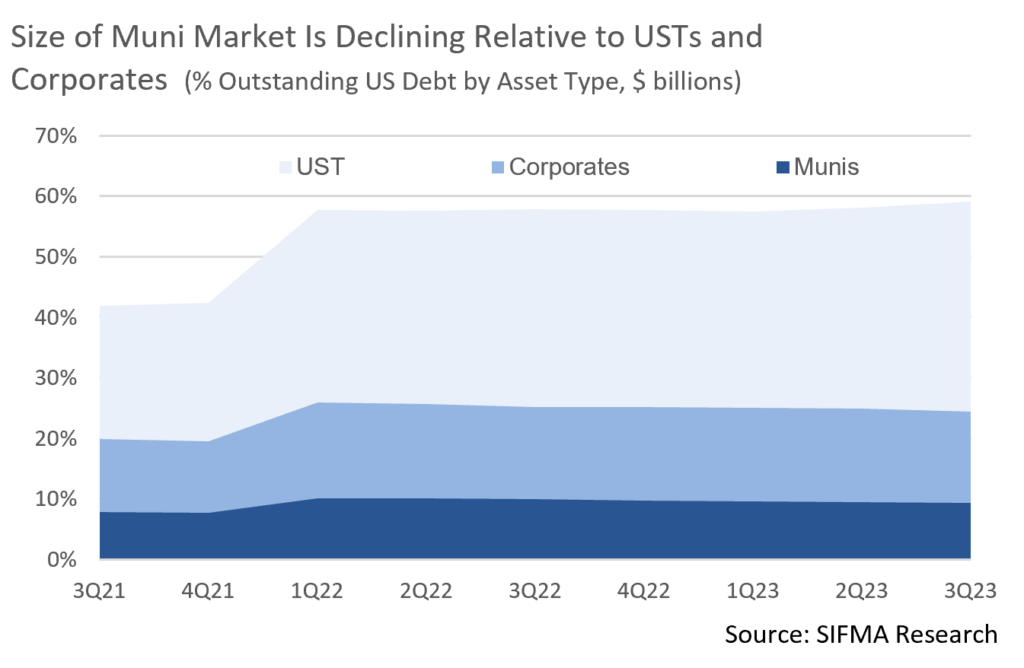

- Valuation remains stretched by historical standards with the 10-year AAA Muni/UST ratio ending the month at 58%, as compared to a 52-week average of 66% and 5-year averages of 80%. Looking more closely at these atypical ratios reveals several underlying factors that point to the likelihood of sustained favorable tax-exempt technicals.

- The size of the municipal market has only increased 4% since 2015 vs. 81% for USTs and 36% for corporates. Meanwhile, demand for municipals has been bolstered a combination of factors: an aging population and retirees seeking tax-exempt income, US wealth concentration among the top wealth cohorts, and the passage of a $10,000 cap on SALT deductions once enjoyed in high tax and highly populated states. All of these have fueled demand, while sluggish supply has been impacted by the elimination of advanced refundings.

- Municipals (Bloomberg Municipal Bond Index) were able to buck a negative seasonal February trend by producing positive returns (+0.13%) on the month. Tax-exempts outperformed USTs in February, a reversal from the prior month. Supply and demand was the story with the former falling $29 billion short of January, while demand remained strong.

- We anticipate new offerings to pick up with 30-day visible supply of $9.96 billion. March is also typically an active month for Local Government bond sales. At the same time, reinvestment cash coming back to investors is projected to be $10 billion lower in March than in February. Increased supply and less cash chasing new deals may create better value for investors in the weeks ahead should tax-exempt issuers need to come to market with higher yields to attract buyers.

Corporate Bond Markets

- For the second straight month the Investment Grade Corporate primary market delivered record setting issuance. A four-day, $53.1 billion frenzy to close out February brought the monthly tally to $198 billion, smashing the previous record of $150.9 billion set over the same period of 2023. M&A funding was a principal catalyst with non-cyclicals accounting for 36% of new bond supply, followed by Financials at 27%.

- While demand for debt remains robust, investor fatigue began to be evident as the month closed. New issue concessions rose from roughly 3 bps to nearly 15 bps over the last week in February and books were not as highly covered. March tends to be a seasonally strong issuance period, averaging $180 billion in recent years, although this year we expect lingering investor fatigue to limit new IG supply to about $130 billion. This should support favorable technicals given a backdrop of strong demand.

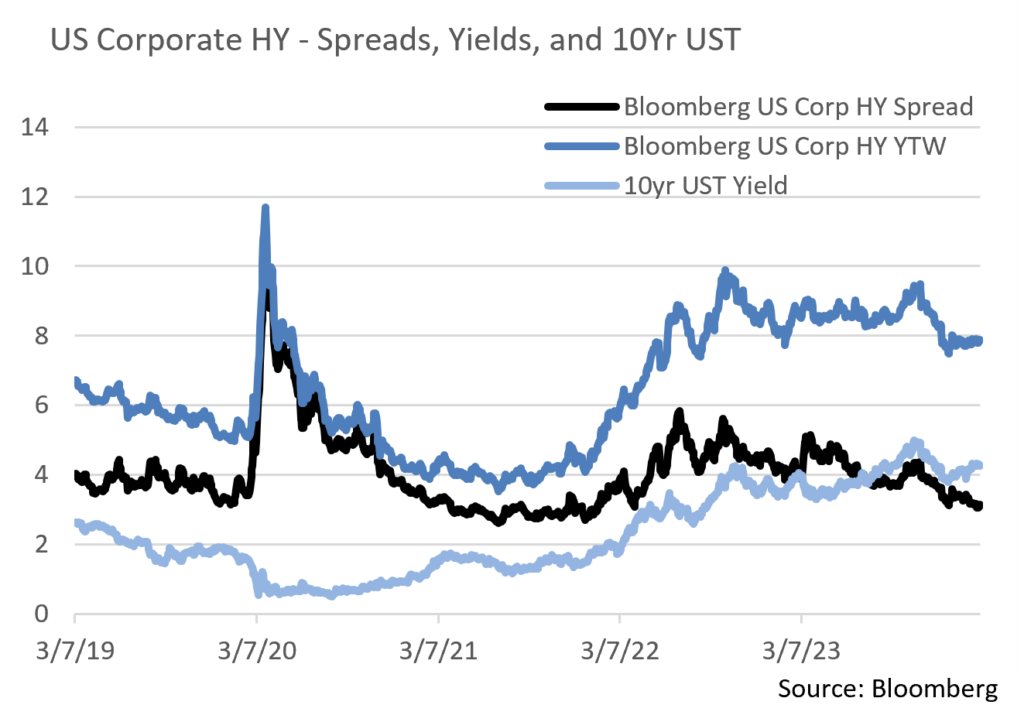

- Credit spreads are still close to two-year tights with risk appetite intact. The spread on the Markit IG 5-year CDX (credit default swap) Index dropped to a YTD low of 50.9 on 2/22 after hitting a high of 60.6 to open 2024. For perspective, the average over the past 12 months was 76.4 with a high of 91.8 reached on 3/13. On an OAS basis, spreads widened at the end of February yet are still well below average and close to 2-year lows. We feel spreads will remain range bound as demand for yield outweighs the potential impact of Fed Funds rate reductions.

- High yield sentiment is also positive given a more upbeat macroeconomic outlook. Spreads are historically tight, yet yields are still sufficient to attract risk-taking investors. Month-ending spreads of 305bps are the lowest since 4/4/22, the major distinction being that 10Yr USTs were 2.40% at that time vs. 4.25% as of 2/29/24.

- A similar supply surge has characterized the high yield markets with February delivering $27 billion of issuance, pushing the YTD total to $58 billion. This represents a 71% increase over the last 12 months, another indication of healthy market conditions.

Financial Planning Perspectives

529 to Roth Rollovers: An Opportunity To Fasttrack Retirement Savings

SECURE Act 2.0 passed in December of 2022 bringing significant change to the American retirement landscape. We highlighted this bill in January 2023 and again in October 2023, although we are now drilling down into a specific change that may be able to benefit young professionals. This new rule creates a pathway for 529 plans to be rolled over into a Roth IRA and is intended to address “overfunded” 529 plans, whether that results from more contributions being made than were necessary, the beneficiary receiving a scholarship, the individual not going to college, or any other reason.

By way of background, a 529 plan is a savings account that allows individuals to save for a beneficiary’s educational and related expenses. Generally speaking, 529 plans are state sponsored savings plans whereby income, dividends and capital gains are not taxed while invested and funds utilized for eligible educational expenses are also tax-free.

Should funds remain in the account after providing for the beneficiary’s educational expenses, the account holder would typically be faced with a choice of either shifting assets in the fund to a different beneficiary or withdrawing the funds for non-educational related purposes and subjecting withdrawals to ordinary income tax rates and a 10% penalty. This new rule allows for a new option to roll over funds in the 529 plan to a Roth IRA, although several restrictions must be understood to ensure a successful transfer from one vehicle to another.

•Most importantly, the Roth IRA account holder must match the beneficiary of the 529 plan.

•The 529 plan must have been maintained for at least 15 years.

•The contributions to the 529 plan must have been made at least 5 years prior before they can be rolled over.

•Over the course of the account holder’s lifetime, a maximum of $35,000 may be rolled from the 529 plan to a Roth IRA.

•The maximum rollover that can be made annually cannot exceed the maximum annual contribution limit for IRAs and Roth IRAs and cannot be made in addition to an annual contribution for IRAs and Roth IRAs.

•The Roth IRA account holder must have earned income in order to make any rollover.

Please note that these stipulations need to be adhered to avoid potentially significant tax consequences. If all the above are satisfied, even though such a rollover process would take several years, this new rule creates a compelling retirement savings opportunity for younger generations. Often, recent college graduates are dealing with many new expenses and retirement savings may not be top of mind. This legislation could help put young professionals in a better position to build their nest eggs. The accompanying chart presents the significant value of starting Roth contributions at relatively early ages. The opportunity for a 529 to Roth Rollover may offer an attractive means of doing so.

If you have additional questions or would like to discuss this subject in further detail, please speak with your Portfolio Manager.

Please note that this chart is for illustrative purposes only. This chart provides examples of what portfolios would look like assuming an annual rate of return of 7%. Actual returns may vary over time and may be lower than the assumed rate here.

Source: Fidelity, BusinessWire, Appleton Partners, Inc.

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.