Insights & Observations

Economic, Public Policy, and Fed Developments

- The biggest October economic news came on the first of November, when October’s jobs report showed a mere 12k jobs created that month. While abysmal on the surface, we recommend interpreting the jobs report with caution for three reasons.

- The easiest to quantify is the ongoing Boeing strike. While BLS did not name names, they noted strike activity was responsible for a detraction of -44k from “transportation equipment manufacturing.”

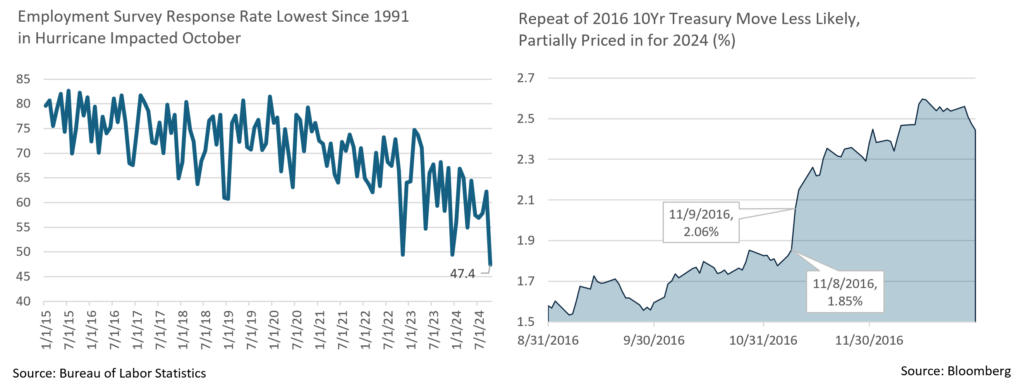

- Two hurricanes in rapid succession impacted the numbers as well, though this is harder to directly quantify; BLS notes that employment levels were impacted, though not the unemployment rate (which suggests the modest drop in labor participation was also storm related). Notably, the lowest response rate since 1991 implies this report’s accuracy has also been affected by a smaller sample size, setting up potential for larger revisions in the next two months.

- Finally, while BLS made no mention of a close presidential race, recent business surveys have indicated companies are deferring hiring and capital investment until after the election, when fiscal policy will be more certain. This undoubtedly depressed hiring as well.

- In all three cases, October weakness can reasonably be expected to reverse in coming months. The 112k in downward prior revisions are a more concrete sign of softness, but for the most part revised numbers aren’t worryingly weak, and in any event, a moderation in labor demand was the Fed’s intended outcome. We expect the FOMC to look through this report.

- The Q3 GDP report, while strong, was even stronger than it looked. Headline was a solid +2.8%, but with detractions from net trade and inventory drawdown, personal consumption was a whopping +3.7%. Final sales to domestic purchasers was +3.5%, and +3.2% ex-government. This was after excellent October retail sales data, and the biggest uptick in consumer confidence since May 2021. Most of the movement in the Confidence Survey was driven by the “current situation” sub-index, and confidence in job availability improving. Overall, growth looks robust at the start of Q4.

- Treasury indices posted their worst return in over two years in October as yields surged. Positive economic data may have been to blame, and the move aligns well with an upward move in Bloomberg’s estimation of the long run neutral interest rate to 3.6%, which we see as far more reasonable than the pre-FOMC meeting 2.9%. However, it also came at a time when betting markets saw an increased likelihood of a Trump win. The “Trump trade” this summer was higher yields as the Biden campaign faltered. In 2016, while the post-election equity pop is well-remembered, there was also a corresponding spike in Treasury yields; yields could rise further should Trump win; this possibility appears to be better priced in now than it was 8 years ago although post-election yield volatility is likely regardless.

- With both candidates likely to increase US deficits, in the long term we see the curve steepening regardless of the winner. One factor that could depress them in the medium term is, paradoxically, the US hitting the debt ceiling on January 2nd. Unable to issue new debt, the Treasury will spend out of their General Account, which since the beginning of QE is held at the Fed outside of the depository system. This technically represents an influx of fresh liquidity into the US banking system. With estimates of the start-of-year TGA balance nearly $700 billion, adequate to fund operations through August, this could be a tailwind in the first half of 2025.

Equity News and Notes

A Look At The Markets

- Stocks were lower in October as each of the major US equity averages closed with modest losses. Although the S&P 500 has been up in 10 of the prior 12 months, the index finished -1.0% lower last month to snap a 5-month winning streak. Despite the setback, a +19.6% YTD price return is the best election year performance through October since 1936. The Nasdaq outperformed but still closed lower (-0.5%), while the DJIA (-1.3%) and Russell 2000 (-1.5%) lagged. Sector performance was mixed with Financials, Communication Services, and Energy the only sectors to close higher. Underperformers included a mix of defensives and cyclicals as breadth narrowed with the equal-weighted S&P 500 trailing the market-cap weighted index by 0.61%.

- One of the stiffest headwinds for equities in October was a backup in yields as the 10Yr UST had its worst month since September 2022. The MOVE Index, the bond market’s version of the VIX Index, ended the month at a 52-week high. The rise in yields was attributed to the potential for a Republican victory and the likely subsequent deficit and tariff implications. There was also a hawkish repricing of Fed odds as the market viewed fewer rate cuts going forward given better-than-feared economic data. As we’ve noted in this space before, equities can deal with the absolute level of yields, it’s the speed of the move that causes angst.

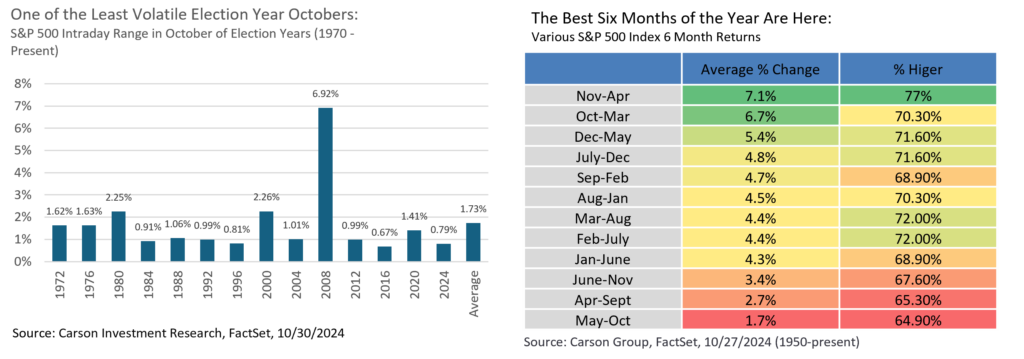

- Volatility has picked up as the election approaches, which isn’t surprising. The VIX currently sits well above its 2024 average of 15.5 at 22.1. A reading above 22 is high even for an election year, which have averaged pre-election day readings of 18.6 since 1990. But looking at the price movement of the S&P 500 tells a different story as the average daily range was only 0.79% in October, well below the 1.73% election year October average. In fact, this would be the second tightest trading range for the index for an October of an election year since 1950. If we look at credit spreads, they also do not show signs of stress. Taken together, this indicates that what we are seeing with the VIX is likely traders positioning portfolios using options rather than fundamental fears. Looking ahead, we would expect to see these trades unwind post-election.

- The Q3 earnings season is underway with 70% of S&P 500 companies having reported. Results have been mixed, but good enough overall to support the market. Beat rates for earnings (75%) and sales (60%) are both slightly below recent averages, as are the margins on those beats at 4.6% and 1.1%, respectively. However, we have still seen the blended earnings growth rate improve to +5.1% from a 9/30 estimate of +4.3%. Should this growth rate stand, it would mark the 5th straight quarter of YoY growth. A notable topic on recent earnings calls has been the election, specifically a slowdown or pause in activity given the uncertainty of the outcome. It stands to reason that we could see an acceleration in activity once the winner is known, regardless of party. The 2025 earnings growth rate currently stands at +15.1%, but history shows that initial estimates are often cut as the calendar turns. Given the market is trading at an elevated 21.3x forward P/E, 2025 estimates bear close scrutiny.

- November has historically begun a strong 6-month period for the S&P 500 and gains over the remainder of the year have also tended to be above average. Since 1990, the median gain over the final 2 months has been +3.3% with positive returns 25 out of 34 times. In election years, performance has tended to be even stronger with a median gain of +3.9% and gains six out of eight times.

- The bull case continues to lean on the consumer holding up well, no recession, sustained corporate earnings growth, easier monetary policy, AI optimism, ample liquidity, and benign credit conditions. Valuations are full so we’ll have to see how much of this is priced in, but we could see a resumption of the upward trend once the political overhang is removed.

From the Trading Desk

Municipal Markets

- The first week of November could be a roller coaster for municipal investors. All eyes will be on the Presidential election followed by the November Fed meeting on Wednesday and Thursday. The Fed meeting was adjusted from the typical Tuesday and Wednesday schedule due to the election. The Fed will release its Fed Funds rate decision on Thursday and CME FedWatch futures currently point to a near certainty of a 0.25% decrease.

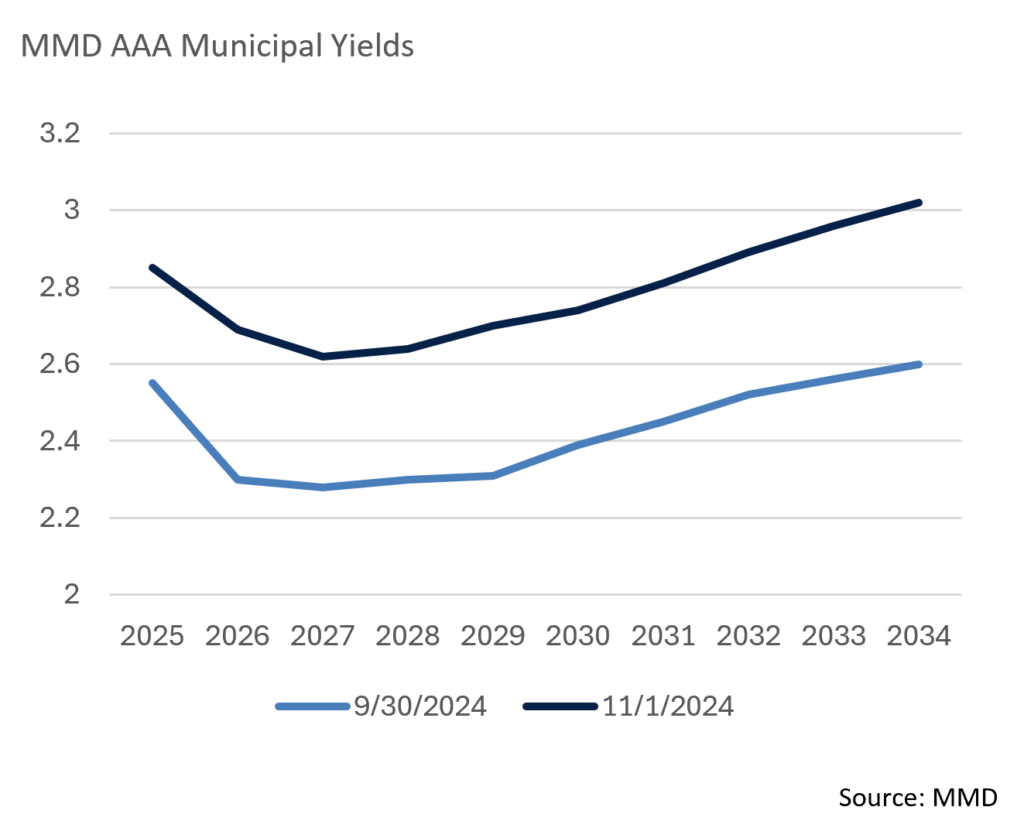

- Over the course of the month, municipal yields moved higher in close to a parallel shift. The 2-year AAA bond was up by 39 bps and 10-year yields increased by 42 bps. This felt like a buying opportunity for many investors looking for yield and demand has remained robust. Given that Treasury yields also moved higher in October, the 10-year AAA Muni/UST ratio remained stable on a month-to-month basis at about 69%. We expect ratios to remain in this range for the foreseeable future, despite it being below long-term averages.

- Supply continues to be robust, as it has been throughout the year. According to BofA Securities, YTD issuance is 38% above last year. Bloomberg data reports that October issuance was the highest of the year by a significant margin at $66.2 billion, a function in part of issuers getting ahead of potential election volatility. The Bond Buyer 30-Day Visible Supply indicator is at a near-term low of just $3.7 billion given that very limited new supply is forthcoming this week and next. Once the market digests the election results, as well as a likely Fed Funds rate cut, we expect issuance to return.

Corporate Markets

- US Treasury yields moved significantly higher in October and the shape of the curve flattened, erasing what had been a sizeable trough between very short maturities and the intermediate part of the yield curve. As the month began, the inversion between 1Yr and 10Yr USTs was -24bps, yet that same range closed October with a positive 1bp differential as short yields fell slightly, and intermediate yields moved higher on stronger economic data. The lowest yielding points along the curve this year have continuously been the 3Yr to 5Yr range and last month’s sell off drove up 5Yr UST yields 60bps to the highest level since July 2024.

- While UST yields rose, putting pressure on fixed income performance, Investment Grade credit spreads remained incredibly resilient. The 80bps OAS recorded on October 17th was the lowest so far this year and since August 2021. The lowest point in the last 10 years was a 53bps print back in March 1997. While we do not expect credit spreads to fall to those very tight levels anytime soon, we feel they will be range-bound over the near term with demand remaining exceptionally strong.

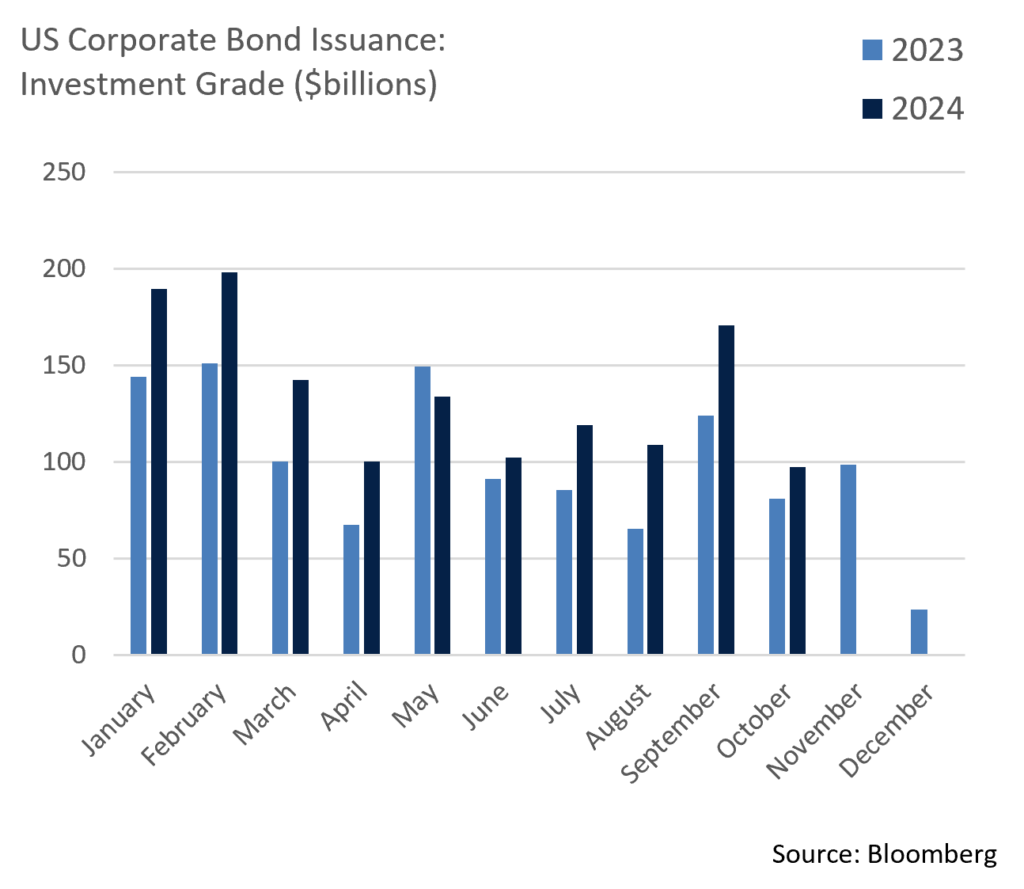

- The primary market continues to be supported by eager investors looking to lock in higher yields for longer. This month’s $97.5 billion of issuance beat the market consensus of $97 billion, although this was the first time this year that monthly issuance failed to exceed $100 billion. November issuance is also projected to be slower than usual due to the Presidential election and the Fed Funds rate announcement. Market consensus for November is roughly $70 billion, which doesn’t come close to filling the gap of an estimated $100 billion in monthly redemptions, a technical factor that should be supportive of IG credit. We expect sluggish new supply to continue over the balance of 2024.

Financial Planning Perspectives

Year-End Tax Planning Checklist

As the end of 2024 draws closer, we encourage clients to consider several tax planning strategies. Here are a few items that you may wish to discuss with your Portfolio Manager.

At Appleton, we take great pride in the wealth management and financial planning services provided to our clients. Is there someone you care about who might benefit from working with us, but you’re unsure how to make the introduction? If so, please let us know. We are happy to help.

Please contact your Portfolio Manager or reach out to: Jim O’Neil, Managing Director

617-338-0700 x775 | [email protected] | www.appletonpartners.com

This commentary reflects the opinions of Appleton Partners based on information that we believe to be reliable. It is intended for informational purposes only, and not to suggest any specific performance or results, nor should it be considered investment, financial, tax or other professional advice. It is not an offer or solicitation. Views regarding the economy, securities markets or other specialized areas, like all predictors of future events, cannot be guaranteed to be accurate and may result in economic loss to the investor. While the Adviser believes the outside data sources cited to be credible, it has not independently verified the correctness of any of their inputs or calculations and, therefore, does not warranty the accuracy of any third-party sources or information. Specific securities identified and described may or may not be held in portfolios managed by the Adviser and do not represent all of the securities purchased, sold, or recommended for advisory clients. The reader should not assume that investments in the securities identified and discussed are, were or will be profitable. Any securities identified were selected for illustrative purposes only, as a vehicle for demonstrating investment analysis and decision making. Investment process, strategies, philosophies, allocations, performance composition, target characteristics and other parameters are current as of the date indicated and are subject to change without prior notice. Registration with the SEC should not be construed as an endorsement or an indicator of investment skill acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal.