Dedicated to Clients

Appleton Wealth Management serves a wide range of families, individuals, non-profits, and other institutions. In whatever capacity you work with us, we recognize it’s about you. Your needs drive goal-oriented action plans intended to create peace of mind, security, and comfort.

Unique Solutions, Not Off-the-Shelf Products

We’ve been doing this for quite some time and have worked with many different clients whose objectives span a wide spectrum of life circumstances. Whether you’re looking for trusted expertise that allows you to step away from managing your own assets, are seeking greater tax efficiency, or asset and liability planning guidance, we have the experience and know-how to help.

Supporting Your Goals

We offer the expertise and dedicated focus needed to support your goals. Our investment solutions emphasize alignment with personal or institutional objectives, as well as liability and cash flow demands.

A Purposeful Resource

Philanthropy is an important Appleton value, and our wealth management team prioritizes supporting non-profit organizations at the management, board, and investment committee levels.

Key Capabilities

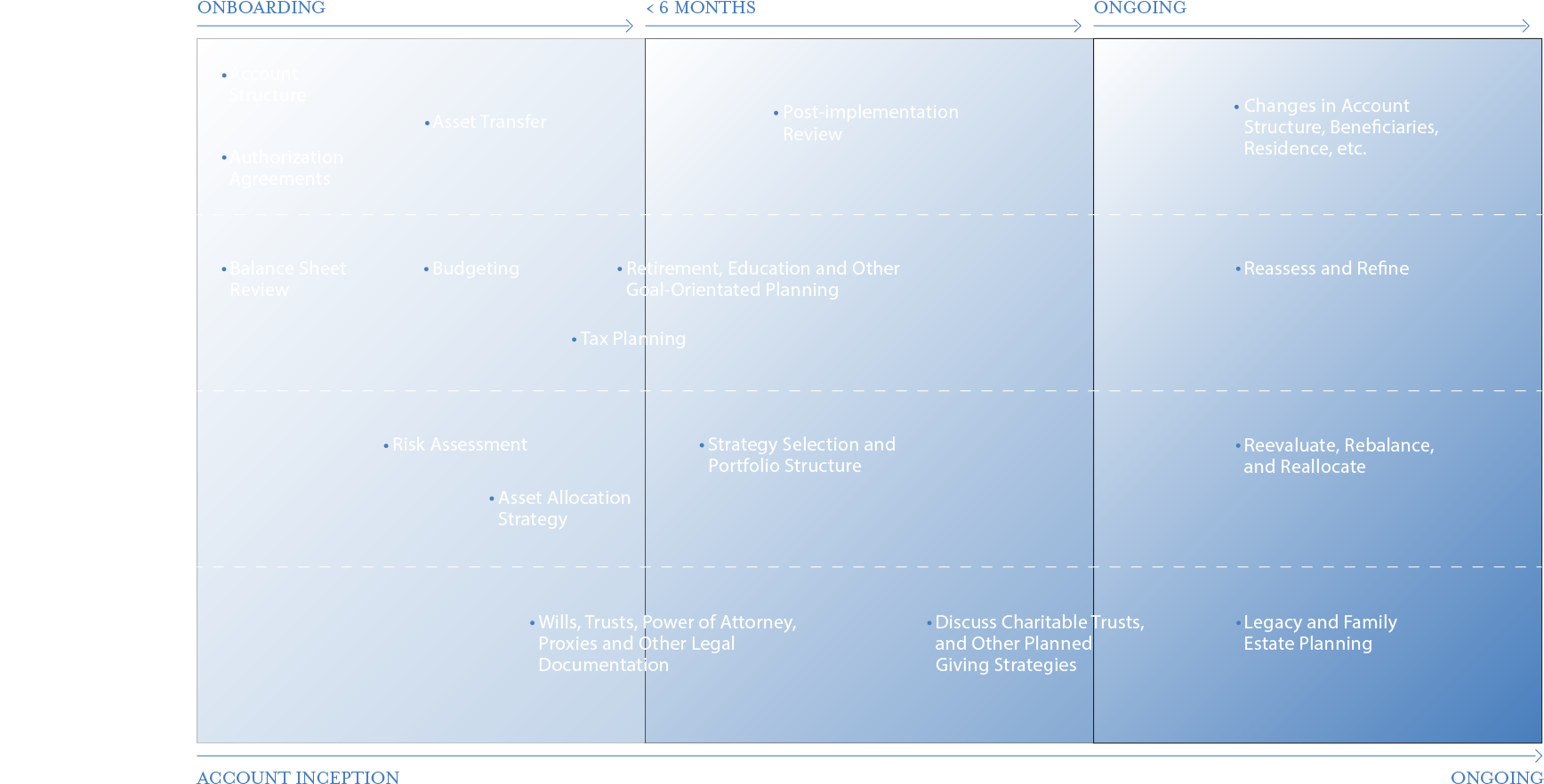

Life is anything but simple, but we’re here to lend a helping hand. Here are some of the ways we serve our clients:

- Discretionary money management

- Tax-advantaged income portfolios

- Risk-managed growth and balanced investment strategies

- Diverse financial planning

- Educational savings strategies

- Multi-generational family guidance

- Estate and legacy planning

Portfolio Optimization

Markets aren’t static, and neither are your circumstances. That’s why we closely monitor and actively manage your investment portfolios. Our investment process maintains the flexibility to react to changing dynamics, emphasizes time-tested buy-and-sell disciplines, and focuses on periodic rebalancing to defined asset allocation parameters.

Wealth Perspectives

These briefs highlight real-world situations we regularly work through with private clients. By sharing these insights, we hope to create awareness and encourage positive action.

More Wealth Perspectives

“

The ability to understand, translate, and act upon client needs is one of the most rewarding parts of our business. The care with which we deliver our client service is truly what sets us apart.

Kerry L. Needham, IACCP®

Senior Vice President,

Director of Client Services